10.1 An Introduction to Capital Budgeting

advertisement

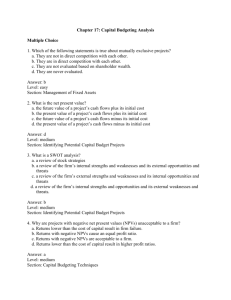

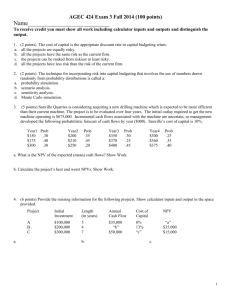

CHAPTER 10 The Fundamentals of Capital Budgeting Learning Objectives 1. Discuss why capital budgeting decisions are the most important decisions made by a firm’s management. 2. Explain the benefits of using the net present value (NPV) method to analyze capital expenditure decisions, and be able to calculate the NPV for a capital project. 3. Describe the strengths and weaknesses of the payback period as a capital expenditure decision-making tool, and be able to compute the payback period for a capital project. 4. Explain why the accounting rate of return (ARR) is not recommended for use as a capital expenditure decision-making tool. 5. Be able to compute the internal rate of return (IRR) for a capital project, and discuss the conditions under which the IRR technique and the NPV technique produce different results. 6. Explain the benefits of a postaudit review of a capital project. I. Chapter Outline 10.1 An Introduction to Capital Budgeting A. The Importance of Capital Budgeting Capital budgeting decisions are the most important investment decisions made by management. Prepared by Jim Keys 1 The goal of these decisions is to select capital projects that will increase the value of the firm. Capital investments are important because they involve substantial cash outlays and, once made, are not easily reversed. Capital budgeting techniques help management to systematically analyze potential business opportunities in order to decide which are worth undertaking. Imagine you were to start your own business. No matter what type you started, you would have to answer the following three questions in some form or another: 1. What long-term investments should you take on? That is, what lines of business will you be in and what sorts of buildings, machinery, and equipment will you need? 2. Where will you get the long-term financing to pay for your investment? Will you bring in other owners or will you borrow the money? 3. How will you manage your everyday financial activities such as collecting from customers and paying suppliers? Capital Budgeting The first question concerns the firm's long-term investments. The process of planning and managing a firm's long-term investments is called capital budgeting. In capital budgeting, the financial manager tries to identify investment opportunities that are worth more to the firm than they cost to acquire. Loosely speaking, this means that the value of the cash flow generated by an asset exceeds the cost of that asset. Regardless of the specific investment under consideration, financial managers must be concerned with how much cash they expect to receive, when they expect to receive it, and how likely they are to receive it. Evaluating the size, timing, and risk of future cash flows is the essence of capital budgeting. In fact, whenever we evaluate a business decision, the size, timing, and risk of the cash flows will be, by far, the most important things we will consider. B. Sources of Information Most of the information needed to make capital budgeting decisions is generated internally, beginning likely with the sales force. Then the production team is involved, followed by the accountants. All this information is then reviewed by the financial managers, who evaluate the feasibility of the project. Prepared by Jim Keys 2 C. Classification of Investment Projects Capital budgeting projects can be broadly classified into three types: (1) independent projects; (2) mutually exclusive projects; and (3) contingent projects. 1. Independent Projects Projects are independent when their cash flows are unrelated. If two projects are independent, accepting or rejecting one project has no bearing on the decision on the other. Prepared by Jim Keys 3 2. Mutually Exclusive Projects When two projects are mutually exclusive, accepting one automatically precludes the other. Mutually exclusive projects typically perform the same function. 3. Contingent Projects Contingent projects are those in which the acceptance of one project is dependent on another project. D. There are two types of contingency situations: Projects that are mandatory Projects that are optional Basic Capital Budgeting Terms The cost of capital is the minimum return that a capital budgeting project must earn for it to be accepted. It is an opportunity cost since it reflects the rate of return investors can earn on financial assets of similar risk. Capital rationing implies that a firm does not have the resources necessary to fund all of the available projects. It implies that funding needs exceed funding resources. Thus, the available capital will be allocated to the set of projects that will benefit the firm and its shareholders the most. Prepared by Jim Keys 4 Capital budgeting criteria checklist Does the method account for the time value of money (TVM)? Are all cash flows included? Can we adjust for differential project risk? Is there a decision rule? Can we measure the effect on the value of the firm? 10.2 Net Present Value It is a capital budgeting technique that is consistent with the goal of maximizing shareholder wealth. The method estimates the amount by which the benefits or cash flows from a project exceeds the cost of the project in present value terms. A. Valuation of Real Assets Valuing real assets calls for the same steps as valuing financial assets. Estimate future cash flows. Determine the investor’s cost of capital or required rate of return. Calculate the present value of the future cash flows. However, there are some practical difficulties in following the process for real assets. First, cash flow estimates have to be prepared in-house and are not readily available as they are for financial assets in legal contracts. Second, estimates of required rates of return are more difficult than it is for financial assets because no market data is available for real assets. Prepared by Jim Keys 5 B. NPV—The Basic Concept The present value of a project is the difference between the present value of the expected future cash flows and the initial cost of the project. Accepting a positive NPV project leads to an increase in shareholder wealth, while accepting a negative NPV project leads to a decline in shareholder wealth. Projects that have an NPV equal to zero imply that management will be indifferent between accepting and rejecting the project. The Basic Idea – The NPV measures the increase in firm value, which is also the increase in the value of what the shareholders own. Thus, making decisions with the NPV rule facilitates the achievement of our goal – making decisions that will maximize shareholder wealth. Estimating Net Present Value: Discounted cash flow (DCF) valuation – finding the market value of assets or their benefits by taking the present value of future cash flows by estimating what the future cash flows would trade for in today’s dollars. C. The cost of the project must be determined. Cash flows from the project are estimated. The riskiness of the projected cash flows is determined, so the appropriate rate of return is used to discount the cash flows. Cash flows are discounted to their present value to obtain an estimate of the asset’s value to the firm. The present value of the future expected cash flows is compared with the required outlay, or cost. If the asset’s value exceeds its cost, the project should be accepted; otherwise, it should be rejected. Alternatively, the project’s expected rate of return is compared with the rate of return considered appropriate for the project. If a firm identifies an investment opportunity with a present value greater than its cost, the firm’s value will increase. There is a very direct link between capital budgeting and stock values. The more effective the firm’s capital budgeting procedures, the higher the price of its stock. Framework for Calculating NPV The NPV technique uses the discounted cash flow technique. Prepared by Jim Keys 6 Our goal is to compute the net cash flow (NCF) for each time period t, where NCFt = (Cash inflows – Cash outflows) for the period t. A five-step approach can be utilized to compute the NPV. 1. Determine the cost of the project. Identify and add up all expenses related to the cost of the project. While we are mostly looking at projects whose entire cost occurs at the start of the project, we need to recognize that some projects may have costs occurring beyond the first year also. The cash flow in year 0 (NCF0) is negative, indicating a cost. 2. Estimate the project’s future cash flows over its expected life. Both cash inflows (CIF) and cash outflows are likely in each year of the project. Estimate the net cash flow (NCFt) = CIFt – COFt for each year of the project. Remember to recognize any salvage value from the project in its terminal year. 3. Determine the riskiness of the project and the appropriate cost of capital. The cost of capital is the discount rate used in determining the present value of the future expected cash flows. The riskier the project, the higher the cost of capital for the project. 4. Compute the project’s NPV. Determine the difference between the present value of the expected cash flows from the project and the cost of the project. 5. Make a decision. Accept the project if it produces a positive NPV or reject the project if NPV is negative. Prepared by Jim Keys 7 n NPV t 0 NCFt , (1 k) t where: NCFt = Net cash flow cash inflows – cash outflows) in period t, where t = 1, 2, 3,…, n k = The cost of capital n = The project’s estimated life Example - Compute the Net Present Value (NPV) given a required return of 12% and the following net cash flows: Year NCFt 0 ($20,000) 1 $6,000 2 $7,000 3 $8,000 4 $5,000 5 $4,000 NPV 20,000 6,000 7,000 8,000 5,000 4,000 0 1 2 3 4 (1.12) (1.12) (1.12) (1.12) (1.12) (1.12)5 NPV $20,000 $5,357.14 $5,580.36 $5,694.24 $3,177.59 $2,269.71 NPV $20,000 $22,079.04 $2,079.04 (Since the NPV>0, the project should be accepted). Excel Solution (in class) (note on Excel NPV function) Calculator Solution (in class) What is the NPV if the required return is 17%? NPV 20,000 6,000 7,000 8,000 5,000 4,000 0 1 2 3 4 (1.17) (1.17) (1.17) (1.17) (1.17) (1.17)5 NPV $20,000 $5,128.21 $5,113.59 $4,994.96 $2,668.25 $1,824.44 NPV $20,000 $19,729.45 $270.55 (Since the NPV<0, the project should be rejected). Prepared by Jim Keys 8 Note: It is not the rather mechanical process of discounting the cash flows that is important. Once we have the cash flows and the appropriate discount rate, the required calculations are fairly straightforward. The task of coming up with the cash flows and the discount rate in the first place is much more challenging. NPV is superior to the other methods of analysis presented in the text because it has no serious flaws. The method unambiguously ranks mutually exclusive projects, and can differentiate between projects of different scale and time horizon. The only drawback to NPV is that it relies on cash flow and discount rate values that are often estimates and not certain, but this is a problem shared by the other performance criteria as well. Suppose the firm uses the NPV decision rule. At a required return of 11 percent, should the firm accept this project? What if the required return was 16 percent? What if the required return was 27 percent? The NPV of a project is the PV of the outflows minus by the PV of the inflows. The equation for the NPV of this project at an 11 percent required return is: NPV = – $130,000 + $68,000/(1.11)1 + $71,000/(1.11)2 + $54,000/(1.11)3 NPV = $28,730.79 At an 11 percent required return, the NPV is positive, so we would accept the project. The equation for the NPV of the project at a 16 percent required return is: NPV = – $130,000 + $68,000/(1.16)1 + $71,000/(1.16)2 + $54,000/(1.16)3 NPV = $15,980.77 At a 16 percent required return, the NPV is positive, so we would accept the project. The equation for the NPV of the project at a 27 percent required return is: NPV = – $130,000 + $68,000/(1.27)1 + $71,000/(1.27)2 + $54,000/(1.27)3 NPV = – $6,074.35 At a 27 percent required return, the NPV is negative, so we would reject the project. Prepared by Jim Keys 9 D. Concluding Comments on NPV Beware of optimistic estimates of future cash flows. Recognize that the estimates going into calculating NPV are estimates and not market data. Estimates based on informed judgments are considered acceptable. The NPV method of determining project viability is the recommended approach for making capital investment decisions. The NPV decision criteria can be summed up as follows: Summary of Net Present Value (NPV) Method Decision Rule: NPV > 0: Accept the project. NPV < 0: Reject the project. Key Advantages Key Disadvantages 1. Uses the discounted cash flow 1. Difficult to understand without an valuation technique. accounting and finance background. 2. Provides a direct measure of how much a capital project will increase the value of the firm. 3. Consistent with the goal of maximizing shareholder wealth. 10.3 The Payback Period It is one of the most widely used tools for evaluating capital projects. The payback period represents the number of years it takes for the cash flows from a project to recover the project’s initial investment. A project is accepted if its payback period is below some prespecified threshold. Prepared by Jim Keys 10 This technique can serve as a risk indicator—the more quickly you recover the cash, the less risky is the project. A. Computing the Payback Period To compute the payback period, we need to know the project’s cost and to estimate its future net cash flows. Equation 10.2 shows how to compute the payback period. PB Years before cost recovery Remaining cost to recover Cash flow during the year Example: Compute the Payback Period (PB) given a required return of 12% and the following net cash flows: Year NCFt Cumulative NCF 0 ($20,000) 1 $6,000 $6,000 2 $7,000 $13,000 3 $8,000 $21,000 4 $5,000 5 $4,000 Therefore, payback occurs between two and three years: $20,000 - $13,000 $7,000 PB 2 2 2.875 years $8,000 $8,000 Excel Solution (in class) Note: The PB period when the cash flows are in the form of an annuity is calculated as: PB NCF0 NCFn Year NCFt 0 ($5,000) 1 $2,000 2 $2,000 3 $2,000 4 $2,000 PB NCF0 $5,000 2.50 years NCFn $2,000 Prepared by Jim Keys 11 There is no economic rationale that links the payback method to shareholder wealth maximization. If a firm has a number of projects that are mutually exclusive, the projects are selected in order of their payback rank: projects with the lowest payback period are selected first. B. How the Payback Period Performs The payback period analysis can lead to erroneous decisions because the rule does not consider cash flows after the payback period. A rapid payback does not necessarily mean a good investment. See Exhibit 10.6— Projects D and E. C. The Discounted Payback Period One weakness of the ordinary payback period is that it does not take into account the time value of money. The discounted payback period calculation calls for the future cash flows to be discounted by the firm’s cost of capital. The major advantage of the discounted payback is that it tells management how long it takes a project to reach a positive NPV. However, this method still ignores all cash flows after the arbitrary cutoff period, which is a major flaw. Prepared by Jim Keys 12 Example - Compute the Discounted Payback Period (DPB) given a required return of 12% and the following net cash flows: Year NCFt PVNCFt @12% Cumulative NCF 0 ($20,000) 1 $6,000 $5,357.14 $5,357.14 2 $7,000 $5,580.36 $10,937.50 3 $8,000 $5,694.24 $16,631.74 4 $5,000 $3,177.59 $19,809.33 5 $4,000 $2,269.71 $22,079.04 DPB 4 D. $20,000 - $19,809.33 $190.67 4 4.084 years $2,269.71 $2,269.71 Evaluating the Payback Rule The standard payback period is widely used in business. It provides a simple measure of an investment’s liquidity risk. The greatest advantage of the payback period is its simplicity. It ignores the time value of money. It does not adjust or account for differences in the overall, or total, risk for a project, which could include operating, financing, and foreign exchange risk. The biggest weakness of either the standard or discounted payback methods is their failure to consider cash flows after the payback. The following table summarizes this capital budgeting technique. While the payback period is widely used in practice, it is rarely the primary decision criterion. As William Baumol pointed out in the early 1960s, the payback rule serves as a crude “risk screening” device – the longer cash is tied up, the greater the likelihood that it will not be returned. The payback period may be helpful when comparing mutually exclusive projects. Given two similar projects with different paybacks, the project with the shorter payback is often, but not always, the better project. Redeeming Qualities of the Rule Despite its shortcomings, the payback period rule is often used by large and sophisticated companies when they are making relatively minor decisions. There are several reasons for this. The primary reason is that many decisions simply do not warrant detailed analysis because the cost of the analysis would Prepared by Jim Keys 13 exceed the possible loss from a mistake. As a practical matter, an investment that pays back rapidly and has benefits extending beyond the cutoff period probably has a positive NPV. In addition to its simplicity, the payback rule has two other positive features. First, because it is biased towards short-term projects, it is biased towards liquidity. In other words, a payback rule tends to favor investments that free up cash for other uses more quickly. This could be very important for a small business; it would be less so for a large corporation. Second, the cash flows that are expected to occur later in a project's life are probably more uncertain. Arguably, a payback period rule adjusts for the extra riskiness of later cash flows, but it does so in a rather draconian fashion—by ignoring them altogether. Summary of Payback Method Decision Rule: Payback period ≤ Payback cutoff point Accept the project. Payback period > Payback cutoff point Reject the project. Key Advantages Key Disadvantages 1. Easy to calculate and understand for people without strong finance 1. Most common version does not account for time value of money. backgrounds. 2. Does not consider cash flows past the 2. A simple measure of a project’s payback period liquidity. 3. Bias against long-term projects such as research and development and new product launches. 4. Arbitrary cutoff point. 10.4 The Accounting Rate of Return It is sometimes called the book rate of return. This method computes the return on a capital project using accounting numbers—the project’s net income (NI) and book value (BV) rather than cash flow data. Prepared by Jim Keys 14 The most common definition is the one given in Equation 10.3: ARR Average NI Average BV Average net income = [$100,000 + 150,000 + 50,000 + 0 + (−50,000)]/5= $50,000 It has a number of major flaws as a tool for evaluating capital expenditure decisions. First, the ARR is not a true rate of return. ARR simply gives us a number based on average figures from the income statement and balance sheet. Since it involves accounting figures rather than cash flows, it is not comparable to returns in capital markets. It ignores the time value of money. There is no economic rationale that links a particular acceptance criterion to the goal of maximizing shareholders’ wealth. Prepared by Jim Keys 15 10.5 Internal Rate of Return The IRR is an important and legitimate alternative to the NPV method. The NPV and IRR techniques are similar in that both depend on discounting the cash flows from a project. When we use the IRR, we are looking for the rate of return associated with a project so we can determine whether this rate is higher or lower than the firm’s cost of capital. The IRR is the discount rate that makes the NPV to equal zero. n NPV t 0 A. NCFt 0, (1 IRR) t Calculating the IRR The IRR is an expected rate of return, much like the yield to maturity calculation that was made on bonds. We will need to apply the same trial-and-error method to compute the IRR. Example - Compute the Internal Rate of Return (IRR) given a required return of 12% and the following cash flows: Year CFt 0 ($20,000) 1 $6,000 2 $7,000 3 $8,000 4 $5,000 5 $4,000 o Set the NPV equation equal to zero and solve for the IRR: NPV 0 20,000 6,000 7,000 8,000 5,000 4,000 0 1 2 3 4 (1 IRR) (1 IRR) (1 IRR) (1 IRR) (1 IRR) (1 IRR) 5 Prepared by Jim Keys 16 o At this point, unless you are using a financial calculator or spreadsheet, solving for the IRR is a trial and error process. That is, we would “plug” in different estimates for the IRR, work through the calculations, and determine if we have found the rate that causes NPV to equal $0. We have already computed the NPV of this project at a 12% discount rate and found the NPV to be positive. In addition, we computed the NPV of the project at a discount rate of 17% and found NPV to be negative. Therefore, we know that the IRR lies somewhere between 12% and 17% (in fact, we can see that the IRR is much closer to 17%). o Using a financial calculator, we find the IRR = 16.3757%. o Since the IRR > k (16.38% > 12%), the project should be accepted. Excel Solution (in class) Calculator Solution (in class) Note: The calculation of the project’s IRR does not depend upon the required rate of return. The IRR is compared to the required rate of return to determine whether to accept or reject the project. Also, if a project’s NPV is positive, its IRR will exceed the required rate of return. If a project’s NPV is negative, its IRR will be below the required rate of return. Prepared by Jim Keys 17 Special cases (IRR) NCFn “Lump Sum” case: IRR NCF0 (1/n) 1 Year NCFt 0 ($750,000) 1 0 2 0 3 0 4 $1,350,000 $1,350,000 IRR $750,000 (1/4) 1 1.80 (.25) 1 .15829 15.83% “Annuity” case: Use the PVIFA tables to estimate the IRR Year NCFt 0 ($32,000) 1 $14,000 2 $14,000 3 $14,000 4 $14,000 NPV = 0 = $14,000(PVIFA 4, IRR) - $32,000 (PVIFA 4, IRR) = $32,000 / $14,000 = 2.285714 Looking down the period column to four periods, we then move to the right to find the interest rate that corresponds to the PVIFA of 2.285714. This occurs somewhere between 24% and 28%. With a financial calculator, we find the exact IRR to be 26.86%. . B. When the IRR and NPV Methods Agree The two methods will always agree when the projects are independent and the projects’ cash flows are conventional. After the initial investment is made (cash outflow), all the cash flows in each future year are positive (inflows). Prepared by Jim Keys 18 Net Present Value Profile Graphical representation of the relationship between a project’s NPVs and various discount rates: Discount Rate NPV 0% 5% 10% 13% 14% 15% 20% $20.00 $11.56 $4.13 $0.09 -$1.20 -$2.46 -$8.33 Prepared by Jim Keys 19 The point at which the project’s NPV profile intersects with the x-axis is by definition the project’s IRR, since the NPV at this point is equal to $0. C. When the IRR and NPV Methods Disagree The IRR and NPV methods can produce different accept/reject decisions if a project either has unconventional cash flows or the projects are mutually exclusive. 1. Unconventional Cash Flows Unconventional cash flows could follow several different patterns. A positive initial cash flow followed by negative future cash flows. Future cash flows from a project could include both positive and negative cash flows. A cash flow stream that looks similar to a conventional cash flow stream except for a final negative cash flow. In these circumstances, the IRR technique can provide more than one solution. This makes the result unreliable and should not be used in deciding about accepting or rejecting a project. Prepared by Jim Keys 20 2. Mutually Exclusive Projects When you are comparing two mutually exclusive projects, the NPVs of the two projects will equal each other at a certain discount rate. This point at which the NPVs intersect is called the crossover point. Depending on whether the required rate of return is above or below this crossover point, the ranking of the projects will be different. While it is easy to identify the superior project based on the NPV, one cannot do so based on the IRR. Thus, ranking conflicts can arise. Prepared by Jim Keys 21 A second situation arises when you compare projects with different costs. While IRR gives you a return based on the dollar invested, it does not recognize the difference in the size of the investments. NPV does! Prepared by Jim Keys 22 Example - Calculation of crossover point: Expected aftertax net cash flows (NCFt) Cash flow Year (t) 0 1 2 3 4 IRR = Project S ($100) 50 40 30 30 Project L ($100) 20 30 50 65 Crossover rate = differential 0 30 10 (20) (35) 14.2978% Mutually Exclusive Investments Even if there is a single IRR, another problem can arise concerning mutually exclusive investment decisions, a If two investments, X and Y, are mutually exclusive, then taking one of them means that we cannot take the other. Given two or more mutually exclusive investments, which one is the best? Investment A B C NPV $10,000 $11,000 $8,000 IRR 22% 20% 24% PB 2.50 years 7.00 years 3.00 years . D. Modified Internal Rate of Return (MIRR) A major weakness of the IRR compared to the NPV method is the reinvestment rate assumption. IRR assumes that the cash flows from the project are reinvested at the IRR, while the NPV assumes that they are invested at the firm’s cost of capital. This optimistic assumption in the IRR method leads to some projects being accepted when they should not be. An alternative technique is the modified internal rate of return (MIRR). Here, each operating cash flow is reinvested at the firm’s cost of capital. Prepared by Jim Keys 23 The compounded values are summed up to get the project’s terminal value. The MIRR is the interest rate that equates the project’s cost to the terminal value at the end of the project. Equation 10.5 shows how to calculate the MIRR. Modified Internal Rate of Return 1) Using the required rate of return as the compounding rate, find the terminal value (future value) of all of the net cash inflows (positive net cash flows) at the end of the project life. 2) Using the required rate of return as the discounting rate, find the present value at t = 0 of all of the net cash outflows (negative net cash flows). 3) Compute the MIRR. TV inflows MIRR PVoutflows (1/n) 1 , Where n is equal to the life of the project. Example - Compute the Modified Internal Rate of Return (MIRR) given a required return of 12% and the following net cash flows: Year NCFt 0 ($20,000) 1 $6,000 2 $7,000 3 $8,000 4 $5,000 5 $4,000 1) TVinflows = $6,000(1.12)4 + $7,000(1.12)3 + $8,000(1.12)2 + $5,000(1.12)1 + $4,000(1.12)0 TVinflows = $9,441.12 + $9,834.50 + $10,035.20 + $5,600.00 + $4,000.00 = $38,910.82 2) PVoutflows = $20,000 TV inflows 3) MIRR PVoutflows (1/n) $38,910.82 1 $20,000 (1/5) 1 1.945541 Prepared by Jim Keys (.20) 1 .14238 14.24% 24 Excel Solution (in class) MIRR example with positive and negative cash flows: Safeway estimates that its required rate of return is 6 percent. The company is considering two mutually exclusive projects whose after-tax cash flows are as follows: Year 0 1 2 3 4 Project S ($1,255) 625 905 930 (245) Project L ($1,060) (470) 905 780 920 For Project S: TVinflows = $625(1.06)3 + $905(1.06)2 + $930(1.06)1 = $744.39 + $1,016.86 + $985.80 = $2,747.05 PVoutflows = $1,255 + $245(1.06)-4 = $1,255 + $194.06 = $1,449.06 MIRRS = ($2,747.05 / $1,449.06)1/4 – 1.0 = 17.34% For Project L: TVinflows = $905(1.06)2 + $780(1.06)1 + $920(1.06)0 = $1,016.86 + $826.80 + $920 = $2,763.66 PVoutflows = $1,060 + $470(1.06)-1 = $1,060 + $443.40 = $1,503.40 MIRRL = ($2,763.66 / $1,503.40)1/4 – 1.0 = 16.44% Since these projects are mutually exclusive, we would choose Project S. E. IRR versus NPV: A Final Comment Prepared by Jim Keys 25 While the IRR has an intuitive appeal to managers because the output is in the form of a return, the technique has some critical problems. On the other hand, decisions made based on the project’s NPV are consistent with the goal of shareholder wealth maximization. In addition, the result shows management the dollar amount by which each project is expected to increase the value of the firm. For these reasons, the NPV method should be used to make capital budgeting decisions. The following table summarizes the IRR decision-making criteria. Review of Internal Rate of Return (IRR) Decision Rule: IRR > Cost of capital Accept the project. IRR < Cost of capital Reject the project. Key Advantages Key Disadvantages 1. Intuitively easy to understand. 1. With nonconventional cash flows, IRR 2. Based on the discounted cash flow technique. approach can yield no or multiple answers. 2. A lower IRR can be better if a cash inflow is followed by cash outflows. 3. With mutually exclusive projects, IRR can lead to incorrect investment decisions. The Profitability Index - present value of the future cash flows divided by the initial investment (both Prepared by Jim Keys 26 numerator and denominator are positive). This definition assumes no negative cash flows after year zero. Technically, PI = PV of inflows / PV of outflows, thus a nonconventional project’s PI will have a PV in the numerator and the denominator. PVinflows PI PVoutflows Decision rule An investment should be accepted if the PI > 1.0 and rejected if the PI < 1.0. Example - Compute the Profitability Index (PI) given a required return of 12% and the following net cash flows: Year CFt 0 ($20,000) 1 $6,000 2 $7,000 3 $8,000 4 $5,000 5 $4,000 PVinflows 6,000 7,000 8,000 5,000 4,000 $22,079.04 1 2 3 4 (1.12) (1.12) (1.12) (1.12) (1.12) 5 PVoutflows $20,000 $22,079.04 PI 1.104 $20,000 Therefore, the project should be accepted since the PI > 1.0. 10.6 Capital Budgeting in Practice Prepared by Jim Keys 27 Practitioners’ Methods of Choice A. Exhibit 10.12 summarizes surveys of practitioners on the capital budgeting methods of choice. In the late 1950s, less than 20 percent of managers used the NPV or IRR methods. By 1981, over 65 percent of financial managers surveyed used the IRR, but only 16.5 percent of managers used the NPV. In a recent study of Fortune 1000 managers, 85 percent of managers used the NPV while 77 percent used the IRR. Surprisingly, over 50 percent of managers used the payback method. B. Ongoing and Postaudit Reviews Management should systematically review the status of all ongoing capital projects and perform postaudits on all completed capital projects. Prepared by Jim Keys 28 In a postaudit review, management compares the actual results of a project with what was projected in the capital budgeting proposal. A postaudit examination would determine why the project failed to achieve its expected financial goals. Managers should also conduct ongoing reviews of capital projects in progress. The review should challenge the business plan, including the cash flow projections and the operating cost assumptions. Management must also evaluate people responsible for implementing a capital project. Prepared by Jim Keys 29 Chapter 10 Sample Problems Multiple Choice Identify the choice that best completes the statement or answers the question. 1. Net present value: Cortez Art Gallery is adding to its existing buildings at a cost of $2 million. The gallery expects to bring in additional cash flows of $520,000, $700,000, and $1,000,000 over the next three years. Given a required rate of return of 10 percent, what is the NPV of this project? a. b. c. d. $1,802,554 $197,446 -$1,802,554 -$197,446 2. Net present value: Gao Enterprises plans to build a new plant at a cost of $3,250,000. The plant is expected to generate annual cash flows of $1,225,000 for the next five years. If the firm's required rate of return is 18 percent, what is the NPV of this project? a. b. c. d. $2,875,000 $3,830,785 $580,785 $2,1225,875 3. Payback: Binder Corp. has invested in new machinery at a cost of $1,450,000. This investment is expected to produce cash flows of $640,000, $715,250, $823,330, and $907,125 over the next four years. What is the payback period for this project? a. b. c. d. 2.12 years 1.88 years 4.00 years 3.00 years. 4. Discounted payback: Roswell Energy Company is installing new equipment at a cost of $10 million. Expected cash flows from this project over the next five years will be $1,045,000, $2,550,000, $4,125,000, $6,326,750, and $7,000,000. The company's discount rate for such projects is 14 percent. What is the project's discounted payback period? a. b. c. d. 4.2 years 4.4 years 4.8 years 5.0 years 5. Internal rate of return: Modern Federal Bank is setting up a brand new branch. The cost of the project will be $1.2 million. The branch will create additional cash flows of $235,000, $412,300, $665,000 and $875,000 over the next four years. The firm's cost of capital is 12 percent. What is the internal rate of return on this branch expansion? (Round to the nearest percent.) Prepared by Jim Keys 30 a. b. c. d. 20% 23% 25% 27% 6. Internal rate of return: Casa Del Sol Property Development Company is refurbishing a 200-unit condominium complex at a cost of $1,875,000. It expects that this will lead to expected annual cash flows of $415,350 for the next seven years. What internal rate of return can the firm earn from this project? (Round to the nearest percent.) a. b. c. d. 10% 12% 14% 16% 7. Modified internal rate of return: Jamaica Corp. is adding a new assembly line at a cost of $8.5 million. The firm expects the project to generate cash flows of $2 million, $3 million, $4 million, and $5 million over the next four years. Its cost of capital is 16 percent. What is the MIRR on this project? a. b. c. d. 18.6% 19.8% 20.2% 21.4% Prepared by Jim Keys 31 Chapter 10 Sample Problems Answer Section MULTIPLE CHOICE 1. ANS: D Learning Objective: LO 2 Level of Difficulty: Medium Feedback: Initial investment = $2,000,000 Length of project = n = 3 years Required rate of return = k = 10% Net present value = NPV 2. ANS: C Learning Objective: LO 2 Level of Difficulty: Medium Feedback: Initial investment = $3,250,000 Annual cash flows = $1,225,000 Length of project = n = 5 years Required rate of return = k = 18% Net present value = NPV 3. ANS: A Learning Objective: LO 3 Level of Difficulty: Medium Feedback: Year 0 1 2 3 4 Binder Corp. CF Cumulative CF $(1,450,000) $(1,450,000) 640,000 (810,000) 715,250 (94,750) 823,330 728,580 907,125 1,635,705 PB = Years before cost recovery + (Remaining cost to recover/ Cash flow during the year = 2 + ($94,750 / $823,330) = 2.12 years Prepared by Jim Keys 32 4. ANS: A Learning Objective: LO 3 Level of Difficulty: Medium Feedback: Roswell Energy i = 14% Cumulative PVCF Year 0 1 2 3 4 5 CF $(10,000,000) 1,045,000 2,550,000 4,125,000 6,326,750 7,000,000 PVCF $(10,000,000) 916,667 1,962,142 2,784,258 3,745,944 3,635,581 $(10,000,000 (9,083,333) (7,121,191) (4,336,934) (590,990) 3,044,591 PB = Years before cost recovery + (Remaining cost to recover/ Cash flow during the year = 4 + ($590,990/ $3,635,581) = 4.16 years 5. ANS: B Learning Objective: LO 5 Level of Difficulty: Medium Feedback: Initial investment = $1,200,000 Length of project = n = 4 years To determine the IRR, the trial-and-error approach can be used. Set NPV = 0. Try IRR =23.1%. The IRR of the project is 23.1 percent. Using a financial calculator, we find that the IRR is 23.119 percent. 6. ANS: B Learning Objective: LO 5 Level of Difficulty: Medium Feedback: Initial investment = $1,875,000 Annual cash flows = $415,350 Length of investment = n = 7 years To determine the IRR, the trial-and-error approach can be used. Set NPV = 0. Try IRR =12.3%. Prepared by Jim Keys 33 The IRR of the project is 12.3 percent. Using a financial calculator, we find that the IRR is 12.345 percent. 7. ANS: B Refer To: Ref 10-3 Learning Objective: LO 5 Level of Difficulty: Medium Feedback: Initial investment = $8,500,000 Length of investment = n = 4 years Cost of capital = k = 16% Prepared by Jim Keys 34