Volatile equity markets and diminishing economic prospects have

advertisement

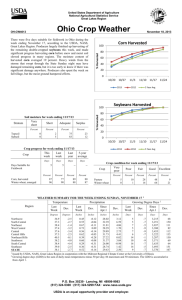

Volatile equity markets and diminishing economic prospects have dragged the grain markets along for a wild ride. Debate continues as to the extent that a slowing economy will cut into demand. Should the world enter another recession, people will still need to eat, ethanol use will still be mandated, and weather will still impact crop sizes around the world. Much of the rise in grain prices over the years can be attributed to a weakening US dollar and the rise of emerging markets whose populations have been moving up the food chain. The spillover of red ink from equity to grain markets stems from the fear that a global economic slowdown could reverse these trends. With an unfavourable growing season experienced in the US thus far, could these equity-related grain sell offs be the buying opportunity that livestock feeders have been looking for? Unfortunately I don’t have the answer. Yet. Corn Too much heat and not enough moisture throughout the US Midwest have sent corn production forecasts lower. Since the middle of July, private forecasters have been cuting their US national corn production estimates and maintain further bias to the downside. The USDA has had to play catch-up, acknowledging the impact of July’s hot and dry weather by lowering its yield forecast from 158.7 bushels per acre to 153. August thus far has not brought needed moisture relief to the key growing states of Iowa and Illinois, and private analysts are suggesting that further cuts to production are expected. Yield is not the sole production factor that is in doubt. The release of prevented plant acreage data on August 16th by the USDA’s Farm Services Agency (FSA) has raised concerns about the validity of the USDA’s corn acreage estimate. To qualify for government support programs, US producers are required to submit an annual report on all cropland use to the FSA. The acres reported by US producers for this purpose suggests that planted corn acreage could be 1 million acres lower than the USDA’s current estimate of 92.3 million. The USDA has already trimmed production by more than 500 million bushels; a very significant cut considering that carryout for the 2012 crop is only projected to be a touch higher than 700 million bushels. With further production cuts likely to come, continued demand rationing should be necessary. Chicago futures prices have climbed higher, but not nearly to the extent that could be expected given such bullish news. There is not much corn around in the country and the new crop outlook is weakening, but what is the propensity to own corn at over $7.00/bu? Could it be that high Chicago futures are now high enough to ration demand and to offset bullish production estimates? At first glance, the surprise increase in old crop ending stocks suggests that corn demand could indeed be softening in response to high prices. Livestock and poultry producers are scaling back production and feeding as much wheat as possible. Export demand is not torrid, but there appear to be no indications of cancelled sales or of any dramatic slowing in global demand. Ethanol production has slowed in recent weeks, but so to have ethanol stocks. This would suggest that demand for ethanol is remaining steady, which makes sense because blend rates are still mandated in the US and ethanol exports remain strong. It is possible that demand destruction at this time is more of a fear than reality, and that slowing demand is simply a symptom of users delaying purchases in the hopes that prices will fall. Old crop corn basis is softening as the market is now pretty well bought up. The feed processers may actually be overbought now that wheat is replacing a large percentage of corn. With time winding down until harvest, old crop premiums are beginning to erode. Producers with corn left in their bins should consider the fact that time is no longer on their side and that carrying inventory into new crop can be a costly affair. New crop corn basis is still strong relative to past years; however there is lots of concern about this year’s crop potential. Some corn in western Ontario had not tasseled by the middle of August, so quality and quantity will be questionable in pockets. Basis levels are too strong at this time to warrant exports, but because Ontario’s domestic consumption will outstrip production, imports will still be needed at some point in the marketing year. Soybeans The soybean market is playing the part of a rope in a tug-of-war match. On one side of the rope, strong corn prices and diminishing US yield prospects are trying to pull the market higher. On the other side, an uncertain economic picture and poor export prospects are pulling the market lower. Soybeans have been playing second fiddle to the corn market with the ratio of corn prices to soybean prices greatly biased in favour of corn. While it’s too late for US producers to make adjustments to their rotations at this time, South American producers will soon be looking to the market for direction as they ponder their planting options for the upcoming growing season. As such, soybeans cannot afford to lose too much ground to the corn market. Recent US yield forecasts have been supportive of the market. The market had a hard time believing that national yield would be as low as the 41.4 bushels per acre recently predicted by the USDA, but recent dryness has increased confidence in that estimate. As with corn, the FAS survey also suggested that further cuts to acreage be forthcoming. The strength of export demand for US soybeans is in question. There is talk that the Chinese are planning to sell a significant amount of soybeans from their reserve. These reserve stocks have had several birthdays, so the theory is that they need to be moved before they completely go out of condition. The market is trying to figure out whether or not Chinese authorities will look to replace these stocks because not doing so could have a dramatic effect on their import needs in the upcoming marketing season. US exporters are also facing the unusual prospect of having to compete with South American exports during harvest. Dynamic would be the word that best describes local old crop soybean basis levels. Old crop supplies are running very tight but the end users are carefully managing their inventory and crush levels to get to harvest. Crushers are still willing to pay premiums for old crop coverage, but they certainly do not want to own expensive inventory when new crop supplies become available. Producers should be aware of the cost of losing out on these premiums by holding inventory into harvest. A wildly fluctuating Loonie only adds to the basis volatility. Timely rains with good coverage throughout the province have helped yield prospects. Hot and dry weather during July undoubtedly limited yield prospects in some areas; however August weather has stabilized conditions. Despite the increased confidence in yield prospects, Ontario’s new crop basis levels remain stable. Producer selling remains light as many producers have already sold large portions of their crop. Wheat At face value, the fundamentals of world wheat supply and demand would be considered market negative. Were it not for the strength in the corn market, Chicago wheat futures prices would likely be lower. North American wheat stocks are plentiful yet still too expensive relative to Russian alternatives. Corn prices are strong enough that wheat is able to find its way into feed rations. As such, the wheat market is looking to the corn market for direction. Winter wheat harvest has pretty much wrapped up. Yields were mostly disappointing in the Southwest, but improved dramatically as harvest worked its way towards the Northern and Eastern regions. The spring wheat harvest is just getting underway as of this writing, and so far quality problems do not appear to be an issue. How long has it been since I was last able to make a comment like that? Considering that our Canadian dollar is still stubbornly above par to the US, local wheat basis levels are strong for this time of year. Interest from the feed markets is the primary reason for support. Ontario’s strong basis levels during harvest kept exports to a minimal. Other than export business conducted prior to harvest, most of the province’s wheat is still sitting in storage bins throughout the countryside.