140KB - Treasury

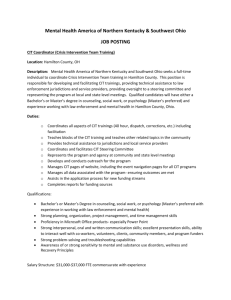

CIT SOLUTIONS PTY LTD

Objectives

CIT Solutions Pty Ltd is a commercial Registered Training Organisation (RTO) focussed on providing customised training, education and consultancy services in the ACT, Australia and internationally since 1988. With experience and depth of knowledge to help organisations find the right solutions for both employees and employers, CIT Solutions draws on the expertise of the academic staff of CIT, as well as carefully selected contractors and consultants from industry and academia.

CIT Solutions delivers training locally, nationally, overseas and via the Internet. Training facilities in Canberra include traditional classrooms, specialised laboratories and workshops.

Where appropriate, multimedia and computer-based techniques are used in both local and distance learning packages.

CIT Solutions offers training programmes in more than 80 discipline areas and aims to:

provide nationally accredited qualifications, short accredited programmes, and personal development and leisure programmes on a commercial basis;

provide customised solutions sensitive to client needs at competitive prices;

provide consultancy services to clients in Australia and overseas;

be an international education provider of choice; and

extend and multiply CIT’s capability to respond to the individual needs of industry, commerce, Government and the community.

2003-04 Highlights

Strategic and operational issues to be pursued in 2003-04 include:

expanding the company’s product base and program delivery;

introducing new, comprehensive and auditable management systems;

expanding management training capability;

accessing additional student accommodation for domestic and international students;

improving quality assurance processes, policies and procedures; and

achieving targeted project outcomes and profit margins.

2003-04 Budget Paper No.4 461 CIT Solutions

CIT Solutions

Statement of Financial Performance

2002-03

Budget

$'000

Revenue

6 681 User Charges - Non ACT

Government

1 411 User Charges - ACT

Government

46 Interest

8 138 Total Ordinary Revenue

2002-03 2003-04

Est.Outcome Budget Var

2004-05

Estimate

2005-06

Estimate

2006-07

Estimate

$'000 $'000 % $'000 $'000 $'000

6 386 6 646 4 6 809 6 977 7 149

1 733

48

8 167

1 776

75

8 497

2

56

4

1 821

93

8 723

1 866

118

8 961

1 913

133

9 195

Expenses

3 146 Employee Expenses

323 Superannuation Expenses

4 041 Supplies and Services

179 Depreciation and Amortisation

192 Other Expenses

7 881 Total Ordinary Expenses

257 Operating Result

3 129

442

3 952

178

222

7 923

244

3 369

455

4 051

182

228

8 285

212

8

3

3

2

3

5

-13

3 446

467

4 152

170

234

8 469

254

3 526

478

4 256

174

240

8 674

287

3 608

488

4 362

178

246

8 882

313

1 602 Total Equity From Start of

Period

-213 Dividend Declared

1 646 Total Equity At The End of

Period

1 708

-400

1 552

1 552

-218

1 546

-9

46

..

1 546

-218

1 582

1 582

-218

1 651

1 651

-218

1 746

2003-04 Budget Paper No.4 462 CIT Solutions

Budget as at 30/6/03

$'000

Current Assets

608 Cash

1 204 Receivables

360 Investments

92 Other

2 264 Total Current Assets

CIT Solutions

Statement of Financial Position

Est.Outcome Planned Planned Planned Planned as at 30/6/03 as at 30/6/04 Var as at 30/6/05 as at 30/6/06 as at 30/6/07

$'000 $'000 % $'000 $'000 $'000

83

1 468

956

50

2 557

120

1 468

1 037

50

2 675

45

-

8

-

5

183

1 468

1 124

50

2 825

190

1 468

1 305

50

3 013

327

1 468

1 386

50

3 231

445

53

498

3 055

359

38

397

3 072

-19

-28

-20

1

285

23

308

3 133

207

8

215

3 228

118

0

118

3 349

Non Current Assets

388 Property, Plant and Equipment

52 Intangibles

440 Total Non Current Assets

2 704 TOTAL ASSETS

Current Liabilities

316 Payables

245 Employee Benefits

311 Other

872 Total Current Liabilities

Non Current Liabilities

186 Employee Benefits

186 Total Non Current Liabilities

1 058 TOTAL LIABILITIES

1 646 NET ASSETS

REPRESENTED BY FUNDS

EMPLOYED

1 626 Accumulated Funds

20 Reserves

1 646 TOTAL FUNDS

EMPLOYED

188

393

868

1 449

54

54

1 503

1 552

1 532

20

1 552

188

393

868

1 449

77

77

1 526

1 546

1 526

20

1 546

-

-

-

-

43

43

2

..

..

-

..

188

393

868

1 449

102

102

1 551

1 582

1 562

20

1 582

188

393

868

1 449

128

128

1 577

1 651

1 631

20

1 651

188

393

868

1 449

154

154

1 603

1 746

1 726

20

1 746

2003-04 Budget Paper No.4 463 CIT Solutions

CIT Solutions

Statement of Cashflows

2002-03

Budget

$'000

CASH FLOWS FROM

OPERATING ACTIVITIES

2002-03 2003-04

Est.Outcome Budget Var

2004-05

Estimate

2005-06

Estimate

2006-07

Estimate

$'000 $'000 % $'000 $'000 $'000

Receipts

8 092 User Charges

46 Interest Received

8 138 Operating Receipts

8 119

48

8 167

8 422

75

8 497

4

56

4

8 630

93

8 723

8 843

118

8 961

9 062

133

9 195

Payments

3 447 Related to Employees

4 041 Related to Supplies and

Services

192 Other

7 680 Operating Payments

458 NET CASH

INFLOW/(OUTFLOW)

FROM OPERATING

ACTIVITIES

CASH FLOWS FROM

INVESTING ACTIVITIES

Receipts

0 Proceeds from Sale/Maturities of Investments

0 Investing Receipts

Payments

121 Purchase of Property, Plant and Equipment

50 Purchase of Investments

171 Investing Payments

-171 NET CASH

INFLOW/(OUTFLOW)

FROM INVESTING

ACTIVITIES

CASH FLOWS FROM

FINANCING ACTIVITIES

Payments

213 Dividends to Government

213 Financing Payments

-213 NET CASH

INFLOW/(OUTFLOW)

FROM FINANCING

ACTIVITIES

74 NET

INCREASE/(DECREASE)

IN CASH HELD

534 CASH AT BEGINNING OF

REPORTING PERIOD

608 CASH AT THE END OF

THE REPORTING

PERIOD

3 549

3 952

222

7 723

444

300

300

121

943

1 064

-764

400

400

-400

-720

803

83

3 801

4 051

228

8 080

417

194

194

81

275

356

-162

218

218

-218

37

83

120

-35

-35

-33

-71

-67

79

-46

-46

46

3

5

-6

7

3

105

-90

45

3 888

4 152

234

8 274

449

194

194

81

281

362

-168

218

218

-218

63

120

183

3 978

4 256

240

8 474

487

194

194

81

375

456

-262

218

218

-218

7

183

190

4 070

4 362

246

8 678

517

218

218

-218

137

190

327

294

294

81

375

456

-162

2003-04 Budget Paper No.4 464 CIT Solutions

Notes to the Budget Statements

Significant variations are as follows:

Statement of Financial Performance

user charges - non ACT Government: the decrease of $0.295m in the 2002-03 estimated outcome from the original budget is due to a larger than expected concentration of work performed for other ACT Government agencies rather than external clients. The increase of $0.260m in the 2003-04 Budget from the 2002-03 estimated outcome is mainly due to an expected increase in the level of contracts;

user charges – ACT Government: the increase of $0.322m in the 2002-03 estimated outcome from the original budget is primarily due to increased training courses for ACT

Government agencies;

employee and superannuation expenses: the increase of $0.102m in the 2002-03 estimated outcome from the original budget is due to wage increases. The estimated outcome also reflects a correction to the estimates moving $0.119m from employee expenses to superannuation expenses. The increase of $0.253m in the 2003-04 Budget from the 2002-03 estimated outcome is also due to wage increases; and

dividend declared: the increase of $0.187m in the 2002-03 estimated outcome from the original budget is due to the increase in the dividend declared by CIT Solutions Pty Ltd based on the operating result for the 2002 calendar year. Since then, the wage increases have had an offsetting impact on the 2002-03 estimated outcome.

Statement of Financial Position

total assets: the increase of $0.351m in the 2002-03 estimated outcome from the original budget is mainly due to large invoices expected to be raised towards the end of the financial year; and

total liabilities: the increase of $0.445m in the 2002-03 estimated outcome from the original budget is due to increased revenue received in advance for certain projects commencing early in 2003-04, offset by a decease in the level of creditors held at year end, reflecting the company policy of clearing debts within agreed payment periods.

2003-04 Budget Paper No.4 465 CIT Solutions