ii. asian conglomerates & korean conglomerates

advertisement

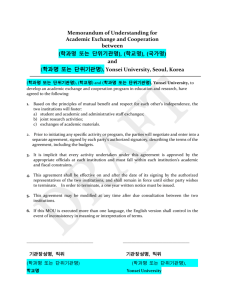

HGCY Asian Corporate Governance Case Studies Series (Korea): Practice & Perspective Anatomy of an Asian Conglomerate: The Rise and Fall of Daewoo and the Formation of Modern Corporate Governance June 2005 Joongi Kim Graduate School of International Studies Yonsei University, Seoul, Korea This working paper was financed by the World Bank and produced through support by the Hills Governance Center at Yonsei University. This may not be commercially reproduced without the publisher’s permission. Hills Governance Center at Yonsei University 134 Sinchondong, Seodaemun-gu, Seoul 120-949, Korea Contents I. INTRODUCTION .................................................................................... 1 II. ASIAN CONGLOMERATES & KOREAN CONGLOMERATES .... 2 1. BUSINESS AND GOVERNMENT RELATIONS ................................ 2 2. OWNERSHIP STRUCTURE .................................................................. 5 3. RELATED-PARTY TRANSACTIONS AND SELF-DEALING ......... 9 4. ACCOUNTING FRAUD AND LOAN FRAUD .................................. 12 5. FINANCIAL STRUCTURE .................................................................. 15 III. CONCENTRATED DECISION-MAKING AND THE FAILURE OF OVERSIGHT .................................................................................................. 18 1. CONCENTRATED DECISION-MAKING ......................................... 18 2. INADEQUATE OVERSIGHT BY REPRESENTATIVE DIRECTORS, BOARDS OF DIRECTORS AND STATUTORY AUDITORS ............................................................................................. 21 3. SHAREHOLDERS AND STAKEHOLDERS ..................................... 24 IV. CONCLUSIONS ..................................................................................... 27 134 Sinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr I. INTRODUCTION1 Many Asian companies collapsed during the financial crisis in 1997 and 1998, but none compared to the demise of the Daewoo Group, imploding under the weight of 22.9 trillion won in accounting fraud. The Daewoo saga provides an understanding of the state of corporate governance in a major Asian conglomerate. As later discovered, weak corporate governance of conglomerates and their vast network of companies had a devastating effect when the 1997 financial crisis hit. Corporate governance reforms since then have mainly focused on the large listed companies of these conglomerates and have proved vital to the restructuring efforts of Asian economies. Daewoo shared many common features with other Asian conglomerates in terms of its corporate governance. Generous government concessions, substandard regulatory oversight, weak bank supervision, ineffective boards of directors, and complicated ownership structures represented some of the more prominent common elements. Daewoo’s total domination by its controlling shareholder and chairman who served as its patriarch remained a central problem. A key focus of this case study will be to trace the development of this type of structurally weak corporate governance system, and try to place it in the context of other Asian companies. This case study will first review the background of Daewoo’s corporate governance, particularly from the perspective of Asian conglomerates. The paper will next analyze how key players of the Daewoo conglomerate, including the board of directors, creditors, accounting firms, officers, shareholders and employees, failed to act as active monitors. This study will then explore the structural and functional corporate governance problems that plagued Daewoo. In the end, this paper will provide a comprehensive review of the institutional corporate governance failures in a large Korean conglomerate in the hope that it can provide valuable policy lessons for other emerging markets in Asia. 1 The author would like to thank Jisoo Lee, Heejung Kim, Suyoune Lee, Jeonghoon Seo and Mihwa Park for their assistance in preparing this case study. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 1 II. ASIAN CONGLOMERATES & KOREAN CONGLOMERATES This chapter will review the basic characteristics of large conglomerates in Asia. Within this framework, it will then provide a history of Daewoo leading up to the financial crisis. First, a description of the general characteristics of the relations between the government and conglomerates will be provided. Second, a general account of the ownership structure of Daewoo will be analyzed. Third, the chapter will offer a review of the fundamental governance problems such as related-party transaction and self-dealing. Fourth, Daewoo’s vulnerable financial structure will be discussed, particularly in comparison with its ownership arrangement. Finally, Daewoo’s historic accounting fraud during the financial crisis will be described. 1. Business and Government Relations From an economic perspective, large conglomerates played a dominant role in the development of Asian economies, particularly Korea’s.2 Asian conglomerates tended to possess many common attributes. Nurtured under the government’s industrial policy, Korean conglomerates, in particular, often shared comparable ownership structures, management styles, financial structures, business models, and business cultures. Economic policy makers played the leading role in guiding business decisions, and ultimately shaping how corporate governance functioned. Founded in 1967, Daewoo, or “Great Universe,” started out as a small textile company.3 In less than three decades, based upon foreign assets, Daewoo became the largest transnational company among developing countries. Daewoo specialized in buying distressed companies from the government, extracting concessions in the process and then successfully restructuring and turning around these entities. Daewoo rapidly expanded into a conglomerate through this mode of acquisition as most of its major companies were procured in this manner under Korea’s industrial policy during the 1960s and 1970s. In these early years, Daewoo apparently benefited from the personal relationship between its Chairman, Woo Choong Kim, and President Chung Hee Park. Largely through these connections, Kim obtained critical incentives from the government when 2 3 OECD White Paper on Asian Corporate Governance, p. 18. The two Chinese characters of Daewoo mean “great universe.” 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 2 taking over troubled companies. In 1976, for example, when Daewoo acquired Hankook Machinery, a manufacturer of industrial machinery, rolling stock and diesel engines that had not shown a profit for most of its history, the government provided generous financing and debt forgiveness to make the deal attractive. Under the new name, Daewoo Heavy Industries, Daewoo returned the company to profitability in its first year. Again, in 1978, when Daewoo acquired Okpo Shipping Company, another troubled company, government concessions allowed Daewoo to restructure the shipyard so that it started to generate positive earnings soon thereafter.4 Other distressed companies that the conglomerate acquired included Daewoo Motor, and parts of Daewoo Electronics and Daewoo Securities. During these transitions, requirements or conditions concerning corporate governance did not enter the dialogue. Daewoo, therefore, largely succeeded in turning around these troubled companies through their rent-seeking ability. Chairman Kim would continue to rely upon his political acumen to extract these generous incentives from the government and to steer Daewoo out of difficulties. In 1988, for example, Daewoo faced its first serious crisis when Daewoo Shipbuilding and Heavy Machinery underwent a severe liquidity emergency due to suddenly deteriorating market conditions. The company employed over 14,000 workers and thousands more when suppliers and other downstream and upstream industries were included. The political economy consequences of allowing the company to collapse were enormous. The government thus reluctantly decided to bail out the company through an 840 billion won rescue plan despite heavy criticism that it should have been dissolved. The government’s inability to deal decisively at the time convinced many that major conglomerates such as Daewoo had indeed become too big to fail. Everyone involved with large conglomerates such as Daewoo became more and more dependent upon this governmentguaranteed social safety net, contributing to a dangerous moral hazard. Banks, investors, creditors, accounting firms and other stakeholders blindly followed this myth that the “Daewoos” in Korea would not be allowed to collapse. When the financial crisis hit, everyone naturally presumed that the government bureaucracy and Kim’s political clout would rescue the conglomerate. Operationally, Asian conglomerates tended to follow the dictates of strong central 4 Daewoo Shipping merged into Daewoo Heavy Industries to form Daewoo Shipbuilding and Heavy Machinery. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 3 management that revolved around the controlling shareholder. Controlling shareholders in turn managed their conglomerates like personal kingdoms. While providing a certain degree of efficiency, this highly centralized decision-making structure in the end became the source of most of corporate governance ills in Asian conglomerates. Accountability and transparency received secondary priorities. The legal framework failed to provide effective board of directors, corporate officers and statutory auditors that acted independently according to their fiduciary duties. These internal stakeholders did not act as active monitors overseeing the conduct of the dominant controlling shareholder. At best, government technocrats used the state’s control and industrial policy to control the excesses of businesses. Large conglomerates such as Daewoo designed their business plans according to the government’s policies and credit control. The potential incentives included preferential financing, subsidies, tax benefits, tariff protection and even bailouts if serious trouble arose. Disincentives included targeted administrative fines, tax audits, criminal investigations and prosecutions.5 Daewoo therefore closely followed the government industrial policy concerning export-led growth to develop the economy. Through policy loans, export guarantees, export insurance, tariff protections, subsidies and other financial incentives, Daewoo became one of the leading conglomerates in the development of new trading markets around the world. By 1979, Daewoo became Korea’s largest exporter. Starting from 1993, to further its overseas commitment, Daewoo launched its Global Management Strategy. By 1998, the Daewoo Empire consisted of over 590 subsidiaries and over 250,000 employees worldwide across all the major continents. While becoming a global conglomerate many latent problems emerged. Throughout the industrialization process, conglomerates with close government ties reaped enormous windfalls. In the worst cases, government and business collusion, led to clientelism, cronyism and corruption. Bureaucratic and political interests engaged in predation vis-à-vis their relationship with large conglomerates. The notorious slush funds scandal in the 1990s revealed that two former Korean Presidents solicited a combined total of over 39 billion won ($ 50 million) from 5 OECD White Paper on Corporate Governance, p. 24. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 4 Daewoo alone. In the end, dozens of government officials and politicians were convicted for receiving bribes from Daewoo in return for their support. State-oriented corporate governance remained a defining feature of conglomerates such as Daewoo. The government controlled the primary modes of financing, regulatory landscape, and determined the major business direction. The government in turn acted as the primary monitor with regards to the operations of the board and potential excesses of the controlling shareholders. With the privatization of financial institutions, the expansion of equity markets and the decline of the state influence, however, the state’s ability to act as a monitor weakened. This left a vacuum in terms of the checks and balances and general oversight of the controlling shareholder and the board of directors. 2. Ownership Structure As with other Asian conglomerates, Korean conglomerates generally shared similar ownership structures based upon family-control.6 From generation to generation, family-control has been a defining characteristic among Korean conglomerates. Initially maintaining high ownership concentration, as common in most Asian countries, families secured control through a vast web of, interlocking share ownership between affiliates.7 The ownership structure of Korean conglomerates gradually began to differ from other Asian conglomerates starting in the early 1970s. In the 1970s, the government decided to compel conglomerates to list their companies on the stock exchange. Policymakers intended for conglomerates to disperse their ownership as a means to return their earnings back to society since they were the primary beneficiaries of industrial policy. The fledgling securities market also desperately needed the liquidity that public offerings from these large conglomerates could offer. Controlling families in turn feared that such dispersion could threaten their controlling interests and invite excessive scrutiny. Furthermore, given the generous indirect financing from state-controlled banks, they believed that their companies did not 6 Stijn Claessens & Joseph Fan, Corporate Governance in Asia: A Survey, 3 International Review of Finance 71, 74 (2002). 7 OECD White Paper on Corporate Governance, p. 32, 43-44. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 5 need to tap into capital markets for additional equity financing. To persuade these controlling families to list their company’s shares, therefore, the government designed the legal and regulatory system to protect their interests. Any potential threats to their ownership control and potential “interference” were thus thwarted. Institutional investors had to shadow vote their shares, unfriendly mergers and acquisitions were curbed, disclosure standards remained minimal, and minority shareholder rights such as shareholder proposals, inspection rights and derivative litigation faced high ownership requirements. Boards of directors, statutory auditors, external auditors, officers, shareholders, employees, and other stakeholders all were relegated to weak positions through formal and informal restraints in exercising their rights. This protection from outside scrutiny and challenges to corporate control had the negative side effect of weakening market discipline and oversight. Controlling shareholders gradually lowered their ownership stakes and remitted their shares because they were satisfied that they could withstand threats of control. While helping the development of Korea’s capital markets, this ownership dispersion policy led to a gradual misalignment between the interests of controlling shareholders and other minority shareholders. Korean controlling families developed much higher disparities between cash flow rights and controls rights than their counterparts in other Asian conglomerates. Furthermore, unlike in many common law countries, the dispersed weak ownership was not matched with correspondingly stronger shareholder protections. This created an anomalous situation that left conglomerates increasingly vulnerable to expropriation because weak controlling shareholder ruled in an environment of weak minority shareholder rights. Daewoo’s controlling shareholders, Woo Choong Kim and his family, followed this ownership structure and they controlled the group through a severely distorted ownership pattern. They did not hold a high cash-flow position of any of the Daewoo companies they controlled. As of 1998, for instance, Woo Choong Kim and his family members owned non-negligible stakes in only 4 companies. Among the 10 largest companies, they owned on average only 0.7 % of the total shares (Table 1).8 In fact, one reason that Daewoo did not seek equity financing when the financial crisis struck was due to concerns that Kim’s weak ownership position would be further diluted. 8 Unlike in many Asian countries, other than privatizing former state-owned entities, the government does not own significant stakes in large conglomerates in Korea. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 6 Daewoo-affiliated companies, of course, owned another 33.87% of each other and treasury shares accounted for 0.93%. Combined together, this created a 41.02% block of ownership for Kim to control the Daewoo companies. Daewoo’s low stock prices also reflected not only its lack of profitability, but also its complicated and unaccountable ownership structure (Diagram 1). As the market feared, in the end, this interlocking ownership structure forced stronger companies such as Daewoo Corp. to subsidize struggling affiliates such as Daewoo Motor. It also allowed Kim to dominate all decision-making without any appropriate oversight. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 7 (1997, unit:%) <Table 1> Daewoo Group Intraconglomerate Ownership 7.6 0.1 0.41 2.3 2.3 6.1 11.1 1.55 1.7 30.0 Daewoo Elect. Com 8.5 8.04 0.13 1.73 0.47 4.61 2.08 7.79 3.6 2.81 0.53 1.1 1.15 2.66 1.39 1.00 4.75 49.50 0.84 0.9 45.0 14.67 25.76 24.7 4.1 Daewoo Prec. 39.0 1.10 0.01 19.1 Daewoo Deve. 46.79 2.85 0.01 Daewoo Auto Sales Daewoo Fin. Total 0.2 0.4 Daewoo Indust Kim Family 6.9 Orion Electric 4.7 6.87 68.50 5.7 4.7 ESOP 4.34 2.0 Keang Nam En Treas. shares 0.4 0.18 8.5 Daewoo Electr Daewoo Tele. Daewoo Securities 0.8 Daewoo Elect. Comp. 0.04 Daewoo Shipbldg. Daewoo Develop. 2.30 1.8 23.0 3.1 Daewoo Securit Daewoo Auto Sales 37.0 Daewoo Precisions 1.1 Daewoo Motor 1.1 0.4 Daewoo Corp. Daewoo Motor Orion Electric 5.3 Daewoo Telecom 29.1 Daewoo Heavy Daewoo Heavy Daewoo Electron. Investee Daewoo Corp. Investor 19.94 3.34 11.75 25.0 19.2 Average 0.51 0.08 1.02 0.76 20.09 100 39.00 28.29 1.50 31.27 (27.99)* Source: Chaebol Information Center, Inha University (*: average stake of affiliates) 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 7 <Diagram 1> Daewoo Group’s Ownership Structure in 1997 (Unit: %; companies larger than 1 billion won) DW Corp 1.8 8.5 Kim Family DW Telecom. 29.1 6.87 37 45 DW Finance DW Motor 25 23 30 DW Heavy 24.7 39 11.1 6.9 5.3 6.1 3.1 DW Securities 1.39 DW Industries 7.6 DW Develop. 1 Orion Elect. 1.7 DW Auto Sales 4.1 19.1 1.55 8.5 DW Elect. Com 19.2 DW Precision 2.3 3.6 11.75 Keang Nam Ent. 4.7 DW Shipbuilding 0.41 DW Electronics 2 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr ` 8 3. Related-Party Transactions and Self-Dealing This vulnerable ownership structure of Korean conglomerates where weak owners acted without adequate monitoring, inevitably led to various forms of expropriation. Related-party transactions among conglomerate affiliates, for instance, when improperly done was a common practice that represented a prime example of failed corporate governance. The central problem occurred when related-party transactions proceeded on non-market conditions and did not receive proper scrutiny by the board of directors. Until 1993, in fact, the regulatory agencies tacitly allowed this practice and did not seek to sanction improper support of weaker affiliates by stronger affiliates. In 1998, the Fair Trade Commission (FTC) finally issued its first regulatory sanctions against such illegal subsidization. The FTC has since continued to attempt to scrutinize the largest chaebols for these types of abuses. <Table 2> Improper Internal trading and Subsequent FTC Subcharge by Group> (Unit: No. of; 100 million won) Group Provider companies Supported companies Amt of transactions Amount of support Subcharge Daewoo 6 7 4,229 - 89 Average* 18.5 7 9,009 - 133.3 Daewoo 11 3 415 - 44.6 Average* 5.5 4.5 3,628 - 41.2 Daewoo 7 10 54,301 858 135 Average* 11.5 7 17,257 410.5 164.8 June 1998 July 1998 July 1999 Source: FTC; *: Average of other top 4 conglomerates (Hyundai, Samsung, LG and SK); The FTC launched its first investigation in 1993 and at the request of the FTC SK Corp. received criminal fines of 100 million won and its president 50 million won in 1995. Historically, in Korea’s early stages of development when credit and financing was scarce, the government promoted these types of related-party transactions among affiliates. Conglomerates could only enter new markets through initial financing and support from their sister companies. Korea’s most successful companies, for example, including Samsung Electronics and Hyundai 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 9 Motors, can trace their origins to this type of subsidization. Many conglomerates in fact engaged in a package approach to business. Conglomerates boasted that they could provide a diversified range of goods and services for a large single client. Daewoo in particular would engage in country projects in which the entire conglomerate would participate. This would include the entire range of business of the conglomerate including construction, sales, marketing, financing and others. The construction company, for instance, would build a hotel, the financial companies would obtain financing for it, others would grant guarantees, another affiliate would provide management training for the hotel staff, and another would promote the hotel. Individually affiliated companies, therefore, became predisposed to the wishes of the controlling shareholder concerning the overall direction of the conglomerate. Healthier affiliates supported risky new ventures or struggling companies. Commercial banks and government-owned banks routinely required payment guarantees from stronger affiliates for loans made to weaker companies. As with other Asian conglomerates, affiliated companies provided problematic support through interlocking debt guarantees.9 Whether it was a bond offering or a bank loan, companies within the same group routinely granted payment guarantees to each other on non-market terms. Sister companies likewise gave guarantees for all forms of debt instruments. As of December 1997, cross-guarantees among Daewoo affiliates were estimated to total 8.5 trillion won, the highest among all the major Korean chaebols. The problem was that under this structure a weaker affiliate’s default could start a chain reaction of payment demands and collapses that could ultimately threaten the entire network of companies within a conglomerate. This feature exacerbated the too-big-to-fail mentality because forcing one chaebol affiliate to default on a loan could thus threaten the entire group. This also evolved into a moral hazard under which companies engaged in riskier ventures and in the worse case more improper acts. Undoubtedly, large conglomerates engaged in various forms of earnings management and questionable accounting practices. Conglomerates, in particular, could easily inflate balance sheets through related-party transactions among sister companies. Without consolidated or combined accounting, a single asset, for instance, could be sold through a chain of companies, generating sales for all of the companies involved. To support ailing sister companies, affiliated companies engaged 9 OECD White Paper on Asian Corporate Governance, p. 43. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 10 in transfer pricing to improve their accounting statements. In the later stages, the British Finance Corporation (BFC) acted as the conduit through which a substantial amount of the improper subsidization occurred. In the worst case, controlling families or senior managers engaged in outright self-dealing for their own personal benefit. A common practice would be to establish a wholly-owned non-listed company and direct all lucrative outsourcing business to this new entity at exorbitant rates. More benign forms of self-dealing consisted of appointing less qualified relatives as directors or CEOs. Despite these obvious concerns, the government relied less upon legal protections under the corporate or securities law and more on administrative guidance or such regulation as provided under the fair trade, tax or inheritance laws. Softer social or cultural pressures were also employed to try to tame these problems. As with all other conglomerates, Daewoo followed the same practice of supporting affiliates. In 1978, Daewoo began its tragic association with the automobile industry when it acquired a 50 percent stake of Saehan Motors in a joint venture with GM Korea to form Daewoo Motor. Combined with its over-ambitious expansion, Daewoo Motor eventually brought down the entire conglomerate as all resources were devoted to try to sustain the company. The initial plan was to expand its capacity through exports and turn around the troubled automobile company. In 1991, they eventually bought out GM’s 50 percent stake and thereafter commenced a series of disastrous acquisitions in various foreign automobile markets. In January 1998, during the height of the financial crisis, for example, Daewoo Motor even acquired Ssangyong Motor and its more than 1.7 trillion won in debt. A string of acquisitions occurred with the help of Daewoo affiliates. Daewoo Corp. and Daewoo Heavy Industries ended up assuming most of the burden. Similarly, all employees in the Daewoo group were pressured to purchase Daewoo automobiles financed through generous financing provided by affiliates. Between 1993 and 1997, Daewoo Motor, Ssangyong Motor, Daewoo Corp. and Daewoo Heavy’s accounted for close to 82.7% of the entire conglomerates net debt among its non-financial companies. Overall, most accounts indicate that Kim and senior managers did not engage in direct selfdealing for their own personal benefit. As with the accounting fraud, Daewoo executives claim that 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 11 all decisions were carried out on behalf of the company and not for their own personal gains. Unlike many other conglomerates that failed during the financial crisis, regulators, prosecutors, creditors and investors have only uncovered selective amounts of evidence of direct personal enrichment. Allegedly some executives used secretive BFC funds to acquire Daewoo affiliates at discounts, and over $700 million from the fund cannot be traced. In another questionable example, the KDIC announced that Kim used Daewoo funds to make $2.5 million in donations to Harvard University, attended by one of his sons, and 19 billion won to another Korean university. No indication exists that these donations were made with board approval. In the criminal trials, however, the courts did find that the senior executive’s participation in the accounting fraud and loan fraud did amount to another form of self-dealing. While they might not have financially benefited in a direct sense, the courts held that their desire to cling to their jobs instead of preventing the fraud against Kim’s command amounted to self-dealing for their own benefit. 4. Accounting Fraud and Loan Fraud Daewoo’s accounting problems represent the most serious part of its breakdown in corporate governance. Large conglomerates throughout Asia utilized their vast networks of companies to shift losses and gains, particularly because combined financial statements were not required.10 In Korea, historically, the government tacitly held a generous attitude with regard to accounting opacity. Given the lack of credit, exaggeration of financial figures was necessary to attract precious foreign capital. Deceptive accounting became a standardized practice for many companies that relied upon debt financing from banks. State-controlled banks in turn obliged by basing their lending decisions on the size of revenues, sales volume and assets instead of the amount profits and cash flow. This emphasis on size in particular allowed conglomerates to obtain international financing. Companies would overstate their financial figures to obtain as much commercial loans as needed. Meanwhile, the banks themselves followed weak corporate governance, and lending decisions were complicated because they were in turn susceptible to political pressure. 10 OECD White Paper on Asian Corporate Governance, p. 37. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 12 When the financial crisis hit, Daewoo could no longer sustain its accounting and loan fraud. But instead of engaging in painful restructuring by reducing their business plans or downsizing their work force, Daewoo chose to overcome its financial difficulties through expansion. This bold choice could only be supported by even more daring and purposeful deceit. The overseas BFC accounts were employed to manipulate financial figures and conceal losses. Internal and external corporate governance failed to detect or prevent any of this fraud. According to the government’s final report, Daewoo inflated its financials by a total of 22.9 trillion won. In 1997 and 1998, to conceal 21 trillion won in impaired capital, for example, Daewoo Corp. overstated its assets by 10.9 trillion won, deflated its debt by 38.3 trillion won and overstated its capital by 26.9 trillion won.11 The most serious part of the accounting and loan fraud was committed over this two-year period. At the same time, the conglomerate was hemorrhaging under operating debt of 11.8 trillion won in 1997 and 12.1 trillion won in 1998. <Table 3> Accounting Fraud (unit: trillion won) Capital (99.8) Companies Initial FSC Report Final Gov’t Report Company Figures Due Diligence Daewoo Corp. 2.6 -17.4 20.0 14.6 Daewoo Motor 5.1 -6.1 11.2 3.2 Daewoo Heavy 3.1 1.0 2.1 2.1 Daewoo Electron. 0.7 -3.0 3.7 2.0 Daewoo Telecom 0.3 -0.9 1.2 0.6 Subtotal 7 Other Daewoo Affiliates 11.8 -26.4 38.2 22.5 2.5 -2.2 4.7 0.4 Total 14.3 -28.6 42.9 22.9 Source: Government Final Report, Sept. 15, 2000 Daewoo committed the accounting fraud in several ways. Most of the misinformation 11 Judgment of July 24, 2001, Seoul District Court, Criminal Affairs 21st Division, 2001 Gohab 171. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 13 involved the use of affiliates and overseas accounts to reduce debts and manipulate export returns. The regulators ultimately discovered 15 trillion won in off-balance sheet liabilities, 4 trillion won in non-performing loans, 3 trillion won in false inventories and 1 trillion won in false research and development expenses. Financial accounting fraud involved asset swaps between sister companies at excessively discounted or inflated values. To provide funds to support a weaker company, for example, stronger affiliates would purchase the assets of the weaker company at above-market prices. These transactions would then be concealed because of the lack of consolidated accounting statements. In a similar fashion, Daewoo used international financial institutions in various schemes. Overseas financial institutions, for example, would technically acquire newly issued stocks of Daewoo affiliates with weak credit standing that Daewoo would then record as equity investments.12 These investments had guarantees or put options by Daewoo affiliates that in effect made them concealed loans that should have been treated as debt. Investigations later revealed that the BFC in London functioned as the center for the group’s accounting fraud. First opened in 1982, Daewoo used close to a dozen of different accounts to avoid the reporting requirements in the foreign exchange laws. Daewoo’s foreign operations, for instance, would transfer funds to the BFC that they received in payment for goods or services or that they borrowed from foreign banks. By 1996, annual borrowings from the BFC accounts apparently totaled between $6~7 billion. Reportedly, the accounts held over $7.5 billion by the end of August 1999. When the financial crisis hit, account receivables and payments for exported goods that should have been credited to domestic accounts in Korea were diverted to the BFC accounts to settle interest payments demands and maturing debt of troubled overseas operations. In its desperation, Daewoo focused on repaying its foreign obligations over its domestic ones, particularly since it held more clout over Korean creditors. During this period, Daewoo exhausted most of the capital in the BFC accounts to meet these interest payments. In 1999, for instance, interest payments to foreign financial institutions amounted to $2.49 billion. Daewoo also used BFC related paper companies to obtain fraudulent commercial invoices, bills of lading, and packing lists to defraud domestic banks with discounting bills of exchange when it could no longer sustain its foreign 12 Judgment of Nov. 29, 2002, Seoul High Court, 2001 No 2063. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 14 obligations. Daewoo deceptively mixed an enormous amount of real bills of exchanges that were discounted with fraudulent ones to deceive bank loan managers. Daewoo contravened various laws through the operation of the BFC accounts. Korean law prohibits the hiding of certain property overseas without appropriate disclosure.13 None of the BFC account’s activities was appropriately disclosed. The operation of the BFC accounts similarly violated Korea’ strict foreign currency laws and regulations that applied at the time.14 The Ministry of Finance and Economy (MOFE) did not grant permission for the transfer of funds out of the country to cover the debts of the BFC accounts. Daewoo instead fabricated documents to make these payment transfers appear as if they were in return for purchasing goods from an overseas company. Ultimately, from 1996 to 1999, Daewoo used the BFC to conceal approximately 5 to 8 trillion won a year of off-balance sheet liabilities that should have been recorded in Daewoo’s books in Korea. Overall, Daewoo’s breakdown in corporate governance system allowed it to perpetrate this vast accounting fraud and loan fraud, undetected and undeterred. 5. Financial Structure From the start, Korean conglomerates grew under heavy state-supported debt financing. They operated under debt to equity ratios that exceeded 450 percent for the top four conglomerates in Korea at the time of the crisis in December 1997. Historically, state-controlled commercial banks provided policy loans at special interest rates to conglomerates as part of the country’s economic development strategy. The government believed that if they maintained control over financing, they could control these conglomerates, monitor any malfeasance, and could overcome any lack in corporate governance in the process. They believed they knew what was best for these conglomerates and that they were better monitors than any board of directors, accountants, investors or stakeholders. As a conglomerate, Daewoo’s financial structure had several distinguishing features. First, Daewoo had a long history of over-relying on debt gearing. In 1988, Daewoo already was among 13 14 Special Economic Crimes Aggravated Punishment Act. Foreign Currency Management Act. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 15 the most heavily indebted conglomerates in Korea with over $11.2 billion in borrowings. Daewoo, for instance, operated under an exceptionally high degree of debt financing, even when compared to other conglomerates. While the other top three conglomerates decreased their debt to equity ratios to 355 percent and 266 percent by December 1998 and June 1999, respectively, Daewoo’s instead increased to 527 percent and 588 percent respectively. Unlike other conglomerates, the holding company of the group, the Daewoo Corp., was not the main profit center. Daewoo Corp. acted as a trading company for the exports of Korean products. In difficult times, Daewoo Corp. could not provide sufficient financial support to sustain weaker affiliates. Instead, Daewoo Corp. became the center where overseas subsidiaries were used to create finance schemes that supported the enormous accounting fraud and loan fraud. <Table 4> Debt/Equity Ratio of Top Four Chaebols (unit: %) Group Dec 1995 Dec 1996 Dec 1997 Dec 1998 June 1999 Dec 1999 Hyundai 376.4 436.7 572 449 341 181 Daewoo 336.5 337.5 470 527 588 n/a Samsung 205.8 267.2 366 276 193 166.3 LG 312.8 346.5 508 341 247 184.2 Source: Donald N. Sull, Choelsoon Park and Seonchoon Kim, 2004, ‘Samsung and Daewoo: Two Tales of One City,’ Harvard Business School Case Study No. 9-804-055 (June 2, 2004) Under the pressure of the financial crisis, the Daewoo Group could not sustain its delicate financial balancing act. When the exchange rate collapsed from 700~800 won to the U.S. dollar to 2000 won and then stabilized at around 1400 won, the conglomerate’s total foreign debt alone jumped from 26.3 trillion won to over 49 trillion won. Daewoo had $5.1 billion in foreign currency loans and $1.9 billion in foreign currency loans to various convertible bond owners. The sudden spike in interest rates that was mandated by the International Monetary Fund to stem capital flight also paralyzed the company. Daewoo’s financing costs jumped from 3 trillion won to 6 trillion won over the span of several months. Even with operating profits remaining similar, Daewoo’s net profits collapsed. In 1998, Daewoo issued a staggering 19.7 trillion won in corporate bonds and commercial paper at interest rates that averaged 15 percent and reached as high as 25 percent to try to meet its financing needs. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 16 <Table 5> Daewoo Group’s Domestic Borrowings (unit: billion won) Dec 1997 Dec 1998 Jun 1999 Total Borrowings 28,712 43,907 43,389 Commercial banks Non-bank financial institutions Corporate notes Commercial papers 8,614 8,115 8,414 3,569 8,231 3,989 19,702 11,985 8,609 4,022 22,039 8,719 Source: The Current Status and Future Plans of Financial and Corporate Restructuring, Korea Financial Supervisory Commission, Aug. 24, 1999. In July 1999, the end came for Daewoo when over 19.2 trillion won in commercial paper came due. In return for 1.3 trillion won in Woo Choong Kim’s equity holdings in Daewoo companies, on July 26, 1999, the financial regulators approved the rollover of 6 trillion won of short-term commercial paper for six months and 4 trillion won in additional funding. Daewoo thus received over 10 trillion won in support, in a final effort to rescue the group. These funds were woefully inadequate and, instead of being injected into new business activities, Daewoo allegedly used them to compensate unpaid wages. For over a year since the government began its close supervision of the group to curtail its crisis, Daewoo had already issued 19.7 trillion won in bonds and commercial paper. Then, on August 26, 1999, only a month later, the conglomerate folded when 12 of Daewoo’s primary companies proceeded into court receivership workout procedures. As a conglomerate, Daewoo’s corporate governance shared many common vulnerabilities with other Asian conglomerates. In particular, the weaknesses in its monitoring system, internal controls, ownership structure, accounting transparency and financial structure were fully exposed when the financial crisis hit. With all corporate governance systems in an inoperative state, it is not surprising that the accounting fraud and loan remained undetected until the end. The sheer scale of the accounting fraud serves as an indicator of how weak Daewoo’s internal and external corporate governance structures were at that time. Interestingly, after the conglomerate collapsed in 1999, most former Daewoo affiliates have regained their financial strength. Unshackled from the burdens of having to support weaker affiliates such as Daewoo Motor, these Daewoo affiliates have had little 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 17 difficulties in restructuring themselves back to profitability. Many of these Daewoo companies have the same senior management with the major difference being their independence from the conglomerate. Effective corporate governance based upon checks and balances, transparency and accountability of each company proved to be of critical difference. III. CONCENTRATED DECISION-MAKING AND THE FAILURE OF OVERSIGHT As with many Korean conglomerates, Daewoo’s corporate governance did not operate effectively. The controlling shareholder dominated all decision-making without the necessary checks and balances. The representative directors, directors, statutory auditors, shareholders, employees and other gatekeepers all failed to function as provided under the legal and regulatory framework. In the end, this led to Daewoo’s controlling shareholder single-handedly driving the conglomerate into entering highly risky business decisions and, more significantly, committing staggering amounts of accounting and loan fraud. 1. Concentrated Decision-Making Daewoo’s fate remains inextricably linked with its founder Woo Choong Kim. Kim deserves the most credit for the conglomerate’s initial success and responsibility for its ultimate failure. As Daewoo’s Chairman, he was recognized as one of the world’s most successful businessmen. In 1984, he received the International Chamber of Commerce’s coveted International Business Award that was conferred by Sweden’s King Carl Gustaf XVI. He wrote a best-selling autobiographical book, “Every Street is Paved with Gold,” that was published in 21 languages and sold more than 2 million copies. In 1999, he was elected president of the Federation of Korean Industries, Korea’s official organization of business leaders. He not only had a gift as a corporate turn-around expert, but Kim also made sure that Daewoo’s business model focused on developing new international markets. From the beginning, he maintained a pioneering, global perspective. Despite Daewoo’s initial achievements, the financial crisis fully exposed the weakness of its concentrated governance structure. The concentration in decision-making power proved fatal 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 18 when the conglomerate faced a crisis and Kim’s business acumen, ethics and principles faltered. Returning to its roots, Kim viewed the crisis as an opportunity for Daewoo to expand, not retrench, by acquiring distressed companies and turning them around. This led Kim to recklessly drive the conglomerate into bankruptcy and perpetrate one of the largest accounting and loan frauds in world history. As with many Asian conglomerates, as the controlling shareholder Kim maintained total control of over the conglomerate. In addition to being controlling shareholder, more importantly, he served as the Chairman of the entire conglomerate. All major decision-making of the entire conglomerate of dozens of companies were formulated through the Chairman’s Office. Key personnel in the Chairmen’s Office oversaw the operation of the BFC and all of Daewoo’s international financing decisions. With a staff of over 100 persons, the Chairman’s Office oversaw all personnel decisions, financing decisions, business strategies and inter-company relations. In particular, control over overseas operations and their financing schemes remained within Kim’s exclusive domain. Through this office, he ultimately controlled the appointment of all CEOs and board members for all Daewoo affiliates and subsidiaries.15 Thus, as the courts later found, he had “absolute influence over the careers of the defendants” and gave “authoritative orders” that could not be contravened.16 Leading Daewoo executives testified that the corporate culture required unconditional deference to Kim’s wishes. During the financial crisis, therefore, he was able to unilaterally force directors and managers to commit the accounting and loan fraud. Kim’s autocratic control further centralized and decision-making suffered as a result of a generation change of his closest advisors. Until the mid-1990s, the key executives that surrounded Kim consisted of those that had been with him since Daewoo’s establishment. Kim had personally recruited many of these senior executives and they had grown together with the conglomerate’s expansion. They were similar in age with Kim and many were even alumni of the same prestigious high school that Kim attended. They could be straightforward and could act as an informal check and balance against his decision-making. In the early 1990s, however, many of these original 15 OECD White Paper on Asian Corporate Governance, p. 19. 2001 Gohab 171; 2001 No 2063; Judgment of Jan. 11, 2002, High Court, 2001 No 2062; Judgment of Aug. 30, 2001, High Court, 2001 No. 1022. 16 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 19 executives gradually retired and were replaced by younger managers. As career Daewoo men, who rose through the rigid corporate hierarchy, these new executives were unable to challenge the chairman’s decisions in a similar fashion.17 Notwithstanding the corporate governance troubles associated with the concentrated decision making structure, Woo Choong Kim did make many exemplary decisions. He declared from the beginning when he first established Daewoo that he would never transfer control of the conglomerate to his family members. He believed that his successor had to be a professional manager unrelated to him. Kim even went so far as to exclude his relatives from major executive positions in the group. This management succession philosophy distinguished him from other conglomerate heads. Controlling shareholders in Asian usually consider their companies as their personal possessions. In the case of Korea, families claimed hereditary entitlement to become successors even though the controlling shareholder and family personally held only a minimal amount of stock. The interest of shareholders to appoint the most competent CEO to enhance corporate value according to corporate governance principles or the possibility that the family successor might be less than capable to lead the company were secondary matters. Kim’s professional approach to management succession was therefore a true novelty among Asian companies. Unfortunately, due to Daewoo’s collapse, Kim did not have the chance to fulfill this pledge that would have had a tremendous influence upon other companies in the region. Another interesting fact is that, in 1978, Kim donated all of his personal holdings in Daewoo Corp. to the Daewoo Foundation. Of the total 20 billion won in donations, 17.5 billion won consisted of his own Daewoo stock. Kim declared that he established the foundation with philanthropic intentions to repatriate his wealth back to society. The foundation sought to engage in public interest activities, primarily through social welfare programs. It established various hospitals, supported museums, constructed low-income housing projects and funded academic research. Skeptics nevertheless believe that these donations were a clever ploy to serve ulterior purposes. First, it allowed Kim to preempt a political crackdown against the conglomerate by the authoritarian government in power at the time. Second, the foundation acted as a shelter to minimize his personal 17 A similar strong deference to superiors is prevalent in many Asian countries. OECD White Paper on Asian Corporate Governance, p. 53. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 20 inheritance taxes.18 Third, by serving as a de facto holding company, the foundation helped Kim maintain control of Daewoo. Kim could shield his involvement by using the façade of a non-profit organization. In October 1993, for example, among the many foundations established by the top 30 chaebol, the Daewoo Foundation owned the most shares in affiliates of the conglomerate. Finally, the foundation operated not solely through Kim’s personal donations, but also through substantial contributions received from Daewoo affiliates. By enlisting support from Daewoo affiliates to this personal cause, this diluted the philanthropic nature of Kim’s donations. All in all, Daewoo’s controlling shareholder, Woo Choong Kim, dominated all decisionmaking of the conglomerate without sufficient checks and balances or internal controls. This type of unmonitored control might have helped Daewoo in its early years when Kim successfully managed the company and maintained his integrity. Yet, this structure of absolute allegiance to the controlling shareholder and lack of internal controls later played a critical role in the shocking accounting and loan fraud that followed 2. Inadequate Oversight by Representative Directors, Boards of Directors and Statutory Auditors As with many Asian conglomerates, the representative directors, boards of directors and statutory auditors of Korean conglomerates failed to fulfill their role as fiduciaries working on behalf of the interests of shareholders at large. They did not prevent controlling shareholders from taking advantage of non-controlling shareholders and other stakeholders as a result. Furthermore, despite the common law origins of its corporate law, Korea did not legally distinguish between directors and officers, and these were roles combined into one position. Non-executive outside directors did not exist until they were required in 1998. This weakened potential checks and balances against the controlling shareholder. 18 Several other chaebols employed this type of tax scheme until this loophole was later closed. After amendments to the tax laws to prevent controlling shareholders of conglomerates from evading inheritance taxes, the Daewoo Foundation reduced its stake in Daewoo Corp from over 10 percent to 5.81% in August 1993. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 21 Daewoo’s representative directors, boards of directors and statutory auditors did not fulfill their functions according to the mandates of corporate law. They failed as institutions to counterbalance the domineering authority of the controlling shareholder and unilateral chairman. Daewoo might have weathered the financial crisis had it begun to downsize and restructure in early 1998. The board failed to persuade Woo Choong Kim to pursue a more contraction-oriented policy when he chose to revert to his instincts and adopt an aggressive growth strategy. Daewoo expanded into the automobile industry and implemented its Global Management Strategy just when the financial contagion swept across Asia in late 1997. Kim’s choice of timing could not have been worse for Daewoo. As with all Korean conglomerates, boards of directors did not function for practical purposes. Companies did not even hold formal board meetings as prescribed by law. Fictitious board minutes would be recorded based upon the instructions of the Chairman’s office. The office of planning often wrote up the minutes and approved them with the personal seals of all directors that they kept under their care as though a meeting was held. Korean companies did not have outside directors. Daewoo first elected non-executive outside directors to its boards in March 1998. Even with 25 percent of its board consisting of outside directors, the board failed to detect or prevent the worst of the accounting and loan fraud that occurred in 1998. In particular, Daewoo’s representative directors, directors and statutory auditors remained ineffective because they were not held accountable to anyone other than the controlling shareholder. Other than criminal prosecution or regulatory sanction, other forms of accountability such as civil liability did not exist. In Korea, shareholder derivative litigation itself did not occur until 1997.19 As evidence of the unlikelihood of directors being held accountable, director and officer liability insurance, for instance, could not be found in Korea (Table 6). This lack of accountability had the effect of further weakening the position of directors. Without the potential of personal civil liability, other than their conscience, they had little reason to defy the wishes of the controlling shareholder, especially when it conflicted with the interests of minority shareholders. Until Daewoo’s collapse, 19 In 2004, Korea became one of the first Asian countries to adopt securities-related class action litigation although application of the law has been suspended until 2007. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 22 public enforcement in the form of criminal liability or administrative sanctions also remained ineffective. Furthermore, directors had no labor market flexibility and remained captive to their conglomerates. On the other hand, loyal directors were rewarded in a variety of ways. After they retired they would be subsequently hired as consultants, provided transitional support or could obtain outsourcing contracts as suppliers. Having devoted an average of 20 years of their lives to rise to the level of director, they had little incentive to be less than faithful to their conglomerates. <Table 6> Director and Officers Liability Insurance Polices in Korea Year Total No. of Policies 1996 1 1997 5 1998 105 1999 320 2000 101 2001 264 2002 386 2003 372 2004(est.) 500 Source: Bernard S. Black, Brian R. Cheffins, and Michael D. Klausner,, "Shareholder Suits and Outside Director Liability: The Case of Korea," CORPORATE GOVERNANCE AND THE CAPITAL MARKET IN KOREA, Youngjae Lim, ed., 2005 Only after the collapse have representative directors, directors and statutory auditors of Daewoo and other leading conglomerates faced civil and criminal liability. Daewoo executives presently face over dozens of legal cases for civil liability, many of which are currently pending. Domestic and international shareholders, banks, suppliers, and other creditors are the leading plaintiffs seeking compensation for the failure of these directors. In terms of criminal liability, in April 2005, the Supreme Court upheld prison sentences ranging from eighteen months to seven years against seven of the most senior Daewoo executives. Equally significant and unprecedented in scale, confiscatory fines ranging from 1.47 trillion won to 23.03 trillion won were levied as well. The criminal violations included accounting 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 23 fraud, foreign currency violations, and hiding assets overseas. 20 The courts dismissed the defendants’ claims that they had to passively follow Kim’s orders, and that they did not intend to defraud others. They similarly rejected the claims that the accounting fraud was committed to try to repay reoccurring debts. In finding them guilty, the courts held that the defendants had violated their duty to enhance corporate transparency and to legally engage in business operations while restructuring the company. Daewoo’s representative directors, directors and statutory auditors failed in their role as monitors to provide the necessary oversight. They did not fulfill their duty to protect minority shareholders from the controlling shareholder’s malfeasance. As with many other Korean conglomerates, they disregarded their roles as fiduciaries and succumbed to the dictates of the controlling shareholder. Therefore, they failed to act as independent, front-line monitors to prevent Kim’s strategy of expanding Daewoo out of its problems through massive accounting fraud. 3. Shareholders and Stakeholders As found in all jurisdictions around the world, shareholders and stakeholders such as employees played a passive role in terms of monitoring management in Asia. Daewoo shareholders and stakeholders differed little from others in other Korean companies. They did not monitor, question or challenge management, or seek information or attempt to get representation on the board. Shareholder rights and stakeholder rights from a corporate governance perspective were difficult to exercise due to various obstacles. As with most Asian countries, shareholder litigation in Korea against the company or senior executives remained rare events. Daewoo’s shareholders failed to take any action even after some of Daewoo’s most egregious corporate governance failures. Board accountability was left to regulatory proceedings such as tax audits or FTC actions or occasional criminal prosecution. The notorious slush funds scandal in the early 1990s, for example, exposed that 25 billion won and 15 billion won of Daewoo funds were respectively used as bribes to two former Korean Presidents. Yet, 20 Woo Choong Kim’s criminal case is currently proceeding after his sudden return to Korea in June 2005. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 24 shareholders did not take any action against management for this misuse of corporate funds. Shareholders brought the first series of civil actions only after corporate collapses following the Asian financial crisis. Many factors contributed to this chronic passivity. First, without a class action vehicle, the 5 percent minimum holding requirement to bring a shareholder derivative action that existed at the time was a prohibitively high barrier for collective action. Similar minimum holding requirements made exercising shareholder rights such as seeking an inspection of financial and accounting records difficult or making a shareholder proposal. Second, institutional investors, in the past, could not exercise their votes and were confined to shadow voting. Third, equity investment also occurred on a short-term basis with Korea’s trading turnovers ranking among the highest in the world. When companies committed wrongdoing, investors accepted the consequences and sold their positions at a loss. Fourth, plaintiff shareholders had difficulties in obtaining information concerning managerial wrongdoing. In addition to weak disclosures standards, as a civil law country Korea lacked such legal procedures as discovery and shareholders had to resort to using the information that they could obtain through regulatory actions such as those brought by the Fair Trade Commission or criminal judgments reached by the courts. Fifth, as with many Asian countries, for example, Korean companies also colluded to hold shareholder meetings on the same day to impede shareholder from attending. 21 Until the crisis, shareholder meetings, in fact, when convened, proceeded perfunctorily without discussion and lasted no more than ten minutes. Approval of accounting statements and election of directors and auditors were the only serious agenda items. Daewoo was no exception. Even when compared with other jurisdictions, Korean shareholders lacked any incentive to act as active monitors. In the case of Daewoo, only after its collapse and various legal reforms, have over 40 legal actions seeking a total of 600 billion won in damages been brought. Together with banks, creditors, suppliers and former employees, investors have brought actions against former Daewoo companies and their managers, largely based upon information obtained through regulatory and criminal actions. Daewoo executives have been found repeatedly liable for astronomical sums of 21 OECD White Paper on Asian Corporate Governance, p. 21. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 25 compensation. Stakeholders such as Daewoo’s employees, as a group, also failed to provide checks and balances that could have mitigated corporate governance failures and ultimately the accounting and loan fraud. Even though they had incentives to act as internal monitors, employees did not function as an internal control against any of the wrongdoing. They were ineffective even though Daewoo’s management and labor relations remained contentious for most of Daewoo’s history. Given its growth through acquisition that required restructuring efforts, laborers from the acquired company feared that the new Daewoo acquirers would inevitably seek to downsize their workforce. Daewoo thus suffered bitter, prolonged strikes for many years. According to Ministry of Labor statistics, Daewoo had 16 labor strikes from 1995 to 1998, second only to Hyundai. This management and labor tension, however, did not serve to act as restraint or monitoring force over the controlling shareholder. Labor unfortunately did not focus on obtaining concessions focused on corporate governance. Despite their aggressive negotiating demands, corporate governance unfortunately was not a fundamental priority. Furthermore, as with most Korean companies, Daewoo’s employment stock ownership plans (ESOP) similarly did not act to serve as a monitoring force. In Korea, ESOPs traditionally remained captive to the interests of insider managers because, under the regulatory structure, employees had to exercise their votes individually or by delegation. When combined with the small portion of the ESOPs, this led to collective action problems that similarly existed for other small investors. The average holding of ESOPs in Daewoo companies, for instance, averaged only 1.6% at the end of 1997. As a result, voting rights were therefore rarely exercised and the potential oversight they could provide did not occur. Finally, employees did not have sufficient access to information. As witnessed with the operation of the BFC, employees did not have inkling as to the seriousness of the conglomerates problems or the depths of its financial fraud. Even if they did harbor suspicions concerning the accounting or loan fraud, under the hierarchical decision making structure, they had little incentive to question superiors. The strong sense of group loyalty deterred many from raising issues. Similarly, 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 26 a strong corporate culture against whistleblowers also persisted.22 Employees therefore rarely challenged questionable decision-making or even contemplate engaging in exposing wrongdoing. Even after the dismantlement of the conglomerate, former Daewoo employees have not offered any comprehensive statements on what led to the collapse. Hence, Daewoo’s shareholders and stakeholders did not serve as active monitors over the controlling shareholder, board or directors, executives or statutory auditor. Their passivity contributed to an environment that promoted opaque decision-making and allowed questionable accounting practices to continue unabated. They failed to protect their own financial interests and did not contribute to any meaningful corporate governance oversight. IV. CONCLUSIONS Weak corporate governance plagued most companies in Asia. This case study in particular traced the corporate governance anatomy of Daewoo, once a leading conglomerate in the region. It described Daewoo’s business and government relations, its ownership structure, its financial structure, and its history of related-party transactions particularly in the context of other Asian conglomerates. Structurally dominated by its controlling shareholder, the company failed to maintain proper accounting, internal controls, and financial discipline. Meanwhile ineffective private and public enforcement also led to the lack of corporate governance discipline. Corporate governance remained a secondary priority behind growth and expansion. In the end, Daewoo’s boards of directors, officers, auditors, shareholders or stakeholders alike did not act as diligent monitors that provided oversight over the controlling shareholder. All of these factors contributed to Daewoo’s corporate governance failures. The onset of the financial crisis then fully exposed Daewoo’s vulnerabilities as a conglomerate. Ineffective corporate governance led to poor business decisions and eventually malfeasance during the crisis. The lack of proper checks and balances against the controlling shareholder in particular led to the unprecedented accounting and loan fraud. Therefore, the controlling shareholder, Woo Choong Kim, ultimately deserves the most responsibility for Daewoo’s failure. 22 Legal whistleblower protections have only been in effect since January 2002. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 27 Korea has henceforth undergone an unprecedented degree of corporate governance reforms. It has moved to strengthen oversight through checks and balances at all level of the corporate structure. General public awareness of the significance of proper corporate governance has substantially improved. Nevertheless, concerns persist that many of Korea’s leading companies still remain vulnerable to the excessive concentration of power of controlling shareholders and their families. Korea must continue to persevere to enhance transparency and accountability if it wants to prevent another debacle such as Daewoo and join the ranks of advanced capital markets. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 28 REFERENCES Aguilar, Francis J., Harvard Business School Case Study 9-885-510, Apr. 10, 1985 Aguilar, Francis J. & Cho, Dong Sung, Daewoo Group, Harvard Business School Case Study No. 9385-014 (July 23, 2984). Black, Bernard S., Cheffins, Brian R. and Klausner, Michael D., "Shareholder Suits and Outside Director Liability: The Case of Korea," CORPORATE GOVERNANCE AND THE CAPITAL MARKET IN KOREA, Youngjae Lim, ed., 2005 Chung, Chae-Shick & Kim, Se-Jik, “New Evidence On High Interest Rate Policy During The Korean Financial Crisis,” KOREAN CRISIS AND RECOVERY Claessens, Stijn & Fan, Joseph, Corporate Governance In Asia: A Survey, 3 International Review of Finance 71 (2002). Clifford, Mark, Breaking Up Is Hard To Do, Far East Economic Review, May 11, 1989, at 63. Clifford, Mark, The Daewoo Comrade: South Korean Firm Blazes Northern Trail, Far East Econ. Review, Feb. 20, 1992, at 47. Coffee, John C., Gatekeeper Failure And Reform: The Challenge Of Fashioning Relevant Reforms, 84 Boston University Law Review 301 (2004). Cordingley, Peter & Nakarmi, Laxmi, In Search Of Daewoo's Kim; What He Knows Could Embarrass, Asiaweek, Feb. 16, 2001, at 1. Enright, Michael J. Et Al., Daewoo And The Korean Chaebol (University Of Hong Kong, HKU143, Aug. 15, 2001) Fletcher, Matthew & Nakarmi, Laxmi, Driving To The World, Asiaweek, Mar 21, 1997 French, Howard W., With Daewoo, A Twilight Of Korean Conglomerates; Dismantling Of Yesterday's Economic Engines, New York Times, Sept. 3, 1999, at C1 Friedman, Eric, Simon Johnson & Todd Mitton, Corporate Governance And Corporate Debt In Asian Crisis Countries, In Korean Crisis And Recovery (David T. Coe & Se-Jik Kim Eds., International Monetary Fund And Korea Institute for International Economic Policy 2002) Hansmann, Henry & Kraakman, Reinier, The End Of History For Corporate Law, 89 Georgetown Law Journal 439 (2001) Healy, Tim & Nakarmi, Laxmi, Wrong Man For The Job? Kim Woo Choong Got Daewoo Into Its Mess. Now He's Supposed To Turn Things Around, Asiaweek, Aug. 13, 1999, at 1 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 29 Fair Trade Commission, Bu-Dang-Han Ji-Won-Haeng-Wi-Ui Sim-Sa-Ji-Chim (Nae-Bu-Ji-Chim) [Improper Supporting Acts Evaluation Guide (Internal Guide)] (1997) (S. Korea) Johnson, Simon et al., Corporate Governance In The Asian Financial Crisis, 58 Journal of Financial Economics (2000) Kim, Dong-Jae, Geul-ro-beol-deu-rim-eul sil-hyeon-ha-neun sin-gyeong-yeong-jeon-nyak [New Business Management Strategy to Fulfill a Global Dream], in Se-gye-ga yeol-rin-da mi-raega bo-in-da [The World is Opening and You Can See the Future] (Jae-Myeong Seo ed., HaeNaem 1998) Kim, Seon-Gu et al., Seoul National University Institute of Economic Research, Chul-ja-chong-aekje-han-je-do-ui ba-ram-jik-han gae-seon-bang-hyang[Appropriate Way to Improve the Total Investment Limitation System] 12-13 (2003) Kim, Sun-Woong, The Limitations of Seeking Accountability Against De Facto Directors as Demonstrated in the Shareholder Derivative Action Against Daewoo Corp., Center for Global Change & Governance Issue Report, Nov. 23, 2004 Kim, Chong-Tae, Desperate measures might be too little, too late, Business Korea, Aug. 1, 1999. Kirk, Don, Former Daewoo Executive Charged, New York Times, March 7, 2001 Kim, Jinbang, Ownership Structure, in Han-guk-ui 5-dae-jae-beol-baek-seo [White Paper on Top 5 Korean Chaebol] (PSPD Participatory Society Research Centre ed., Nanam Publishing 1999),available at http://chaebol.inha.ac.kr. Kim, Joongi, Recent Amendments to the Korean Commercial Code and Their Effects on International Competitions, 21 University of Pennsylvania Journal of International Economic Law 273 (2000) Kim, Kon Sik & Kim, Joongi, Revamping Fiduciary Duties in Korea: Does Law Matter in Corporate Governance?, in Global Markets, Domestic Institutions: Corporate Law and Governance in a New Era of Cross-Border Deals 373, 389 (Curtis J. Milhaupt ed., 2003) Lee, Dong Gull, “The Restructuring of Daewoo,” Economic Crisis And Corporate Restructuring in Korea 153 (Stephen Haggard et al. eds., Cambridge University Press 2003) Lewis, Michael, The World's Biggest Going-Out-of-Business Sale, New York Times, May 31, 1998, § 6 (Magazine) at 34 Milhaupt, Curtis, Nonprofit Organizations as Investor Protection: Economic Theory and Evidence from East Asia, 29 Yale Journal of International Law 169 (2005) 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 30 Nakarmi, Laxmi, Globalization: Good Intentions, Asiaweek, Feb 18, 2000, at 1 Kirk, Don, For Daewoo's Founder, Pride Before the Fall, New York Times, Feb. 23, 2001, at W1 OECD White Paper on Corporate Governance in Asia 5 (2003) Park, Seong-Chan, Sin-u-ri-sa-ju-je-do-ui ju-yo nae-yong-gwa hyang-hu gae-seon yeon-gu sa-hang [Central Aspects of the New ESOP System and Future Research Issues Toward Its Improvement], 4 Good Corporate Governance Review 2 (2002) Pistor, Katharina et al, The Evolution Of Corporate Law: A Cross-Country Comparison, 23 University of Pennsylvania Journal of International Economic Law 791, 849 (2002) Quelch, John A. & Park, Chanhi, Daewoo’s Globalization: Uz-Daewoo Auto Project, Harvard Business School Case Study No. 9-598-065 (Mar. 23, 1998) Sull Donald et al., Samsung and Daewoo: Two Tales of One City, Harvard Business School Case Study No. 9-804-055 (June 2, 2004) Upton, David & Kim, Bowon, Daewoo Shipbuilding and Heavy Machinery, Harvard Business School Case Study No. 9-695-001 (Oct. 1, 1994) Yu, In-Hak, Han-guk-jae-beol-ui hae-bu [A Dissection of Korea’s Chaebol] 207 (Pul-bit Publishers 1991) Judgment of July 24, 2001, Seoul District Court, Criminal Affairs 21st Division, 2001 Gohab 171. Judgment of Aug. 30, 2001, Seoul High Court, 2001 No. 1022 Judgment of Jan. 11, 2002, Seoul High Court 2001 No 2063 Judgment of Jan. 11, 2002, Seoul High Court, 2001 No 2062 Judgment of Dec. 18, 2003, Constitutional Court, en banc, 2002 Heonga 23 Panryejip [Court Decisions] 15-2, 393-405. Judgment of May 28, 2004, Seoul District Court, Civil Affairs 22nd Division, 2000 Gahap 78865. 134 Shinchon-dong, Seodaemun-gu, Seoul, Korea 120-749 Tel: (82-2) 2123-6295 Fax: (82-2) 362-1915 (e) hills@yonsei.ac.kr (w) hills.yonsei.ac.kr 31