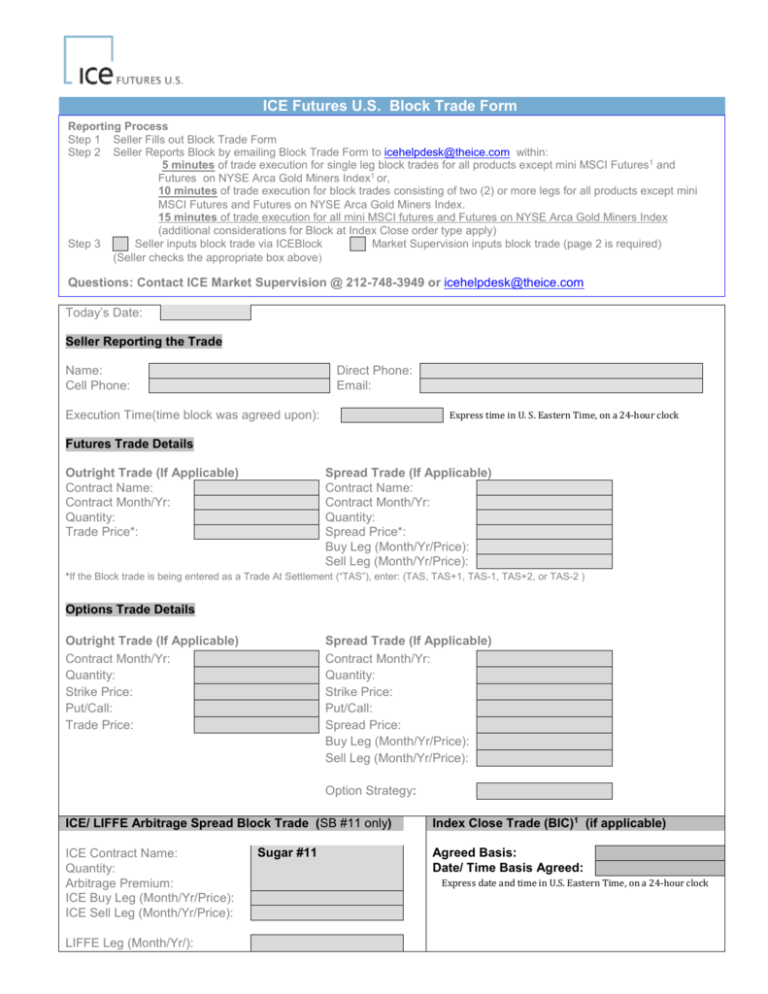

ICE Futures US Block Trade Form

advertisement

ICE Futures U.S. Block Trade Form Reporting Process Step 1 Seller Fills out Block Trade Form Step 2 Seller Reports Block by emailing Block Trade Form to icehelpdesk@theice.com within: 5 minutes of trade execution for single leg block trades for all products except mini MSCI Futures1 and Futures on NYSE Arca Gold Miners Index1 or, 10 minutes of trade execution for block trades consisting of two (2) or more legs for all products except mini MSCI Futures and Futures on NYSE Arca Gold Miners Index. 15 minutes of trade execution for all mini MSCI futures and Futures on NYSE Arca Gold Miners Index (additional considerations for Block at Index Close order type apply) Step 3 Seller inputs block trade via ICEBlock Market Supervision inputs block trade (page 2 is required) (Seller checks the appropriate box above) Questions: Contact ICE Market Supervision @ 212-748-3949 or icehelpdesk@theice.com Today’s Date: Seller Reporting the Trade Name: Cell Phone: Direct Phone: Email: Express time in U. S. Eastern Time, on a 24-hour clock Execution Time(time block was agreed upon): Futures Trade Details Outright Trade (If Applicable) Contract Name: Contract Month/Yr: Quantity: Trade Price*: Spread Trade (If Applicable) Contract Name: Contract Month/Yr: Quantity: Spread Price*: Buy Leg (Month/Yr/Price): Sell Leg (Month/Yr/Price): *If the Block trade is being entered as a Trade At Settlement (“TAS”), enter: (TAS, TAS+1, TAS-1, TAS+2, or TAS-2 ) Options Trade Details Outright Trade (If Applicable) Contract Month/Yr: Quantity: Strike Price: Put/Call: Trade Price: Spread Trade (If Applicable) Contract Month/Yr: Quantity: Strike Price: Put/Call: Spread Price: Buy Leg (Month/Yr/Price): Sell Leg (Month/Yr/Price): Option Strategy: ICE/ LIFFE Arbitrage Spread Block Trade (SB #11 only) ICE Contract Name: Quantity: Arbitrage Premium: ICE Buy Leg (Month/Yr/Price): ICE Sell Leg (Month/Yr/Price): LIFFE Leg (Month/Yr/): Sugar #11 Index Close Trade (BIC)1 (if applicable) Agreed Basis: Date/ Time Basis Agreed: Express date and time in U.S. Eastern Time, on a 24-hour clock 2 (*THIS INFORMATION IS NOT REQUIRED IF USER IS ENTERING BLOCK DIRECTLY TO ICEBLOCK) *Seller Details *Name of ICE Futures U.S. Clearing Firm: *Seller Account #: Put an "X" for Seller Classification at ICE US *Individual Member executing for himself (CTI1) *Individual Member executed by an authorized trader (CTI3) *If CTI2 or CTI 4, Specify if “House” or “Customer” Account: *Buyer Details *Name of ICE Futures U.S. Clearing Firm: *Buyer Account #: Put an "X" for Buyer Classification at ICE US *Individual Member executing for himself (CTI1) *Individual Member executed by an authorized trader (CTI3) *If CTI2 or CTI 4, Specify if “House” or “Customer” Account: *Clearing Firm # *Member Firm (CTI2) *Non-Member (CTI4) *Clearing Firm # *Member Firm (CTI2) *Non-Member (CTI4) Further Description of CTI Codes: 1 - Trade executed by an Individual Member for his own account, an account he controls or has an interest in. 2 - Trade executed for the house or proprietary account of a Clearing Member or NonClearing Member Firm. 3 - Trade executed by an authorized trader for the account of another individual member. 4 - Trade executed for any other account that is not a CTI 1, 2 or 3. Link to ICE Futures US block trade FAQ: https://www.theice.com/publicdocs/futures_us/exchange_notices/Block_Trade_FAQ.pdf Revised May 2014 1 NOTE: all information shown on this form for mini MSCI futures and futures on the NYSE Arca Gold Miners Index and all BIC information becomes effective with the listing of these futures contracts on IFUS on June 30, 2014.