- Allama Iqbal Open University

advertisement

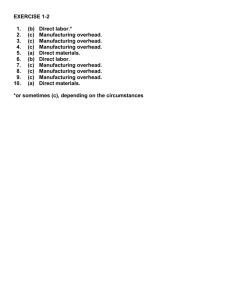

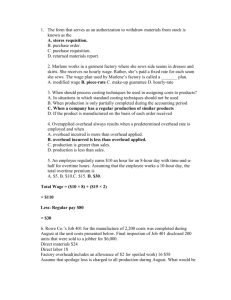

Final: 29-8-2015 ALLAMA IQBAL OPEN UNIVERSITY, ISLAMABAD (Department of Commerce) COST ACCOUNTING (5410) CHECKLIST SEMESTER: AUTUMN 2015 This packet comprises the following material: 1. Text Book (One) 2. Assignment No. 1, 2 3. Assignment Forms ( 2 sets ) In this packet, if you find anything missing out of the above mentioned material, please contact at the address given below: The Mailing Officer Allama Iqbal Open University H-8, Islamabad Ph: 051-9057611-12 Dr. Syed Muhammad Amir Shah (Course Coordinator) ALLAMA IQBAL OPEN UNIVERSITY, ISLAMABAD (Department of Commerce) [ WARNING 1. 2. PLAGIARISM OR HIRING OF GHOST WRITER(S) FOR SOLVING THE ASSIGNMENT(S) WILL DEBAR THE STUDENT FROM AWARD OF DEGREE/CERTIFICATE, IF FOUND AT ANY STAGE. SUBMITTING ASSIGNMENT(S) BORROWED OR STOLEN FROM OTHER(S) AS ONE’S OWN WILL BE PENALIZED AS DEFINED IN “AIOU PLAGIARISM POLICY”. Course: Cost Accounting (5410) Level: Associate Degree in Commerce ASSIGNMENT No. 1 Semester: Autumn 2015 Total Marks: 100 Pass Marks: 50 (Units: 1–4) Note: You are required to solve all questions if you are unable to understand any question of assignment, do seek help from your concerned tutor. But keep in mind that tutors are not supposed to solve the assignment questions for you. Q. 1 (a) Define the Cost Accounting and describe the characteristics which an ideal costing system should possess. (20) (b) Distinguish between: (i) Direct Cost and Indirect Cost (ii) Product Costs and Period Costs (iii) Capital Costs and Revenue Costs (vi) Prime Costs and Conversion Costs (v) Sunk Cost and Opportunity Cost. Q. 2 (a) (b) Explain the nature of spoiled goods and describe the various methods of accounting for them. (20) Hammad manufacturer has a usage of 500,000 automobile tyres of a certain size during the next year. The incremental cost of placing an order is Rs. 8. The cost of storing one tyre for one year is Rs. 2. Lead time on an order is five days, and the company is going to keep reserve supply of two days usage; usage is assumed to be constant over a 250 workday year. Required: (i) Calculate the re-order point. (ii) Calculate the EOQ (iii) No of order need per year (iv) Give proof of EOQ as in requirement Q. 3 Babar Manufacturer has two production departments M and N and two services departments R and S. Department factory overhead costs after primary apportionment are as follows: (20) M = Rs. 13,536 N = Rs. 15,678 R = Rs. 10,980 S = Rs. 8,406 Service departments render services in the following proportion: M N R S Service dept. R 30% 55% — 15% Service dept. S 40% 50% 10% — 2 Required: Calculate total factory overheads of production departments by preparing factory overhead distribution sheet. Q. 4 (a) (b) What are Piece Rates? What advantages and disadvantages are attributed to their use? What principles govern the determination of piece rates? (20) Best’s Manufacturing’s standard production for assembly operation X-15 is 20 units per hour. For the first week in May, a worker’s record shows the following: Units Hours 140 8 Monday 160 8 Tuesday 175 8 Wednesday 180 8 Thursday 200 8 Friday Required: Compute the employee’s earnings under each of the following conditions. Carry all computation to three decimal places. i. An incentive plan is used with a guaranteed rate of Rs. 12 per hour and a premium of 70% of the time saved on production in excess of standard for each day. ii. A 100-percent bonus plan is used with a base rate of Rs.12 per hour. The bonus is computed based on total production for the week. Q. 5 The assistant controller of the firm provided the following data, you are required to prepare an income statement: (20) Gross Profit rate on net sales 20%; rate of marketing expenses to net sales 5%; inventory turnover six times per year; 5% Bonds Payable represent 37.5% of the total liabilities of Rs. 20,00,000; net income for the year Rs. 12,00,000; net profit rate on net sales 10%. ASSIGNMENT No. 2 (Units 5–9) Total Marks: 100 Pass Marks: 50 Q. 1 Sheikh Corporation uses a general ledger and factory ledger. The following transactions took place on May 2014: (20) May 2 Purchased raw materials for the factory Rs.20,000 4 Requisitions of Rs.4,000 of direct materials and Rs.2,000 of indirect materials were filled from the stockroom 8 Factory payroll of Rs.2,000 for the week was made up at the home office; Rs.1,730 in cash was sent to the factory. Excise duty was Rs.90 and income taxes were Rs. 180 (Rs.1,880 direct labour and Rs.120 factory repair) 3 14 Depreciation of Rs. 200 for factory equipment was recorded. (Assets accounts kept on the general office books) 18 A Job was completed in the factory with Rs.960 direct labour and Rs.450 of materials being previously charged to the job. FOH is to be applied at % of the direct labour. 22 Miscellaneous factory overhead amounting to Rs.800 was vouched and paid by the home office 25 The completed Job was shipped to the ABC Company on instructions from the home office. Customer was billed for Rs.2,300. You are required to pass journal entries on the factory books and the general office books. Q. 2 During the month of October 2015 the following costs were incurred in Department B of Shah Ltd: (20) Material Costs Rs.140,000 Conversion Costs Rs.108,000 During the month 30,000 units with a total cost of Rs.360,000 had been transferred into the department from department A of these, 25,000 units were completed & transferred to department C and 4,000 units were in process. On 30th April being ¾ completed as to Material, ½ complete as Conversion Cost. Required: Prepare a cost of production report of Department B for April. Q. 3 What is a master budget? Briefly describe its contents and illustrate your answer with suitable example. (20) Q. 4 (a) (b) The Fixed Factory overhead of the Gulzar Company is estimated at Rs. 20,000 per month and variable overhead is budgeted at Rs.2.20 per unit. Normal volume is 10,000 units per month. Actual overhead for March was Rs. 23,000 and output was 12,000 units. (20) Calculate: i. Applied Overhead Rate ii. Over or Under-applied FOH iii. Idle Capacity Variance iv. Spending Variance Name five based used for applying factory overheads. Which factors must be considered in selecting a particular basis? Q. 5 Awais Company produces a component used in farm machinery. The firm’s fixed costs are Rs.1,600,000 per year. The variable cost of each component is Rs.1,500 and the components are sold for Rs.2,500 each. The company sold 8,000 components during the prior year. (20) Required: i. Compute the company’s break-even point in units. ii. What is the contribution-margin ratio? iii. Compute the break-even sales revenue. iv. How many units must the company sell to earn a target net profit of Rs.2,000,000? 4 5