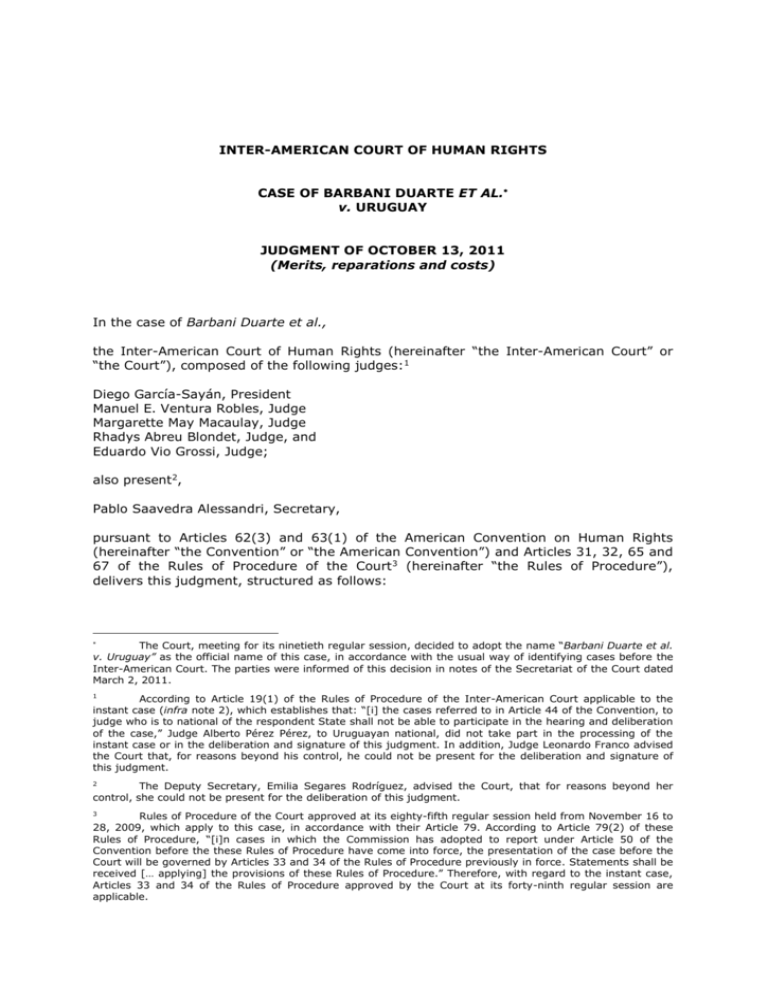

Proyecto de Sentencia Caso Barbani Duarte y otros vs. Uruguay

advertisement