background

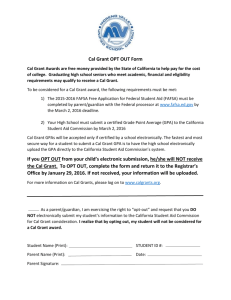

advertisement