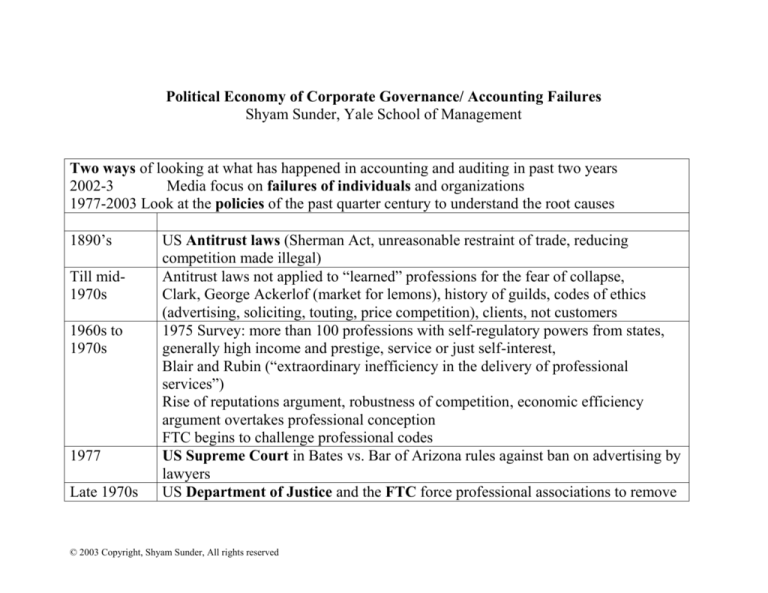

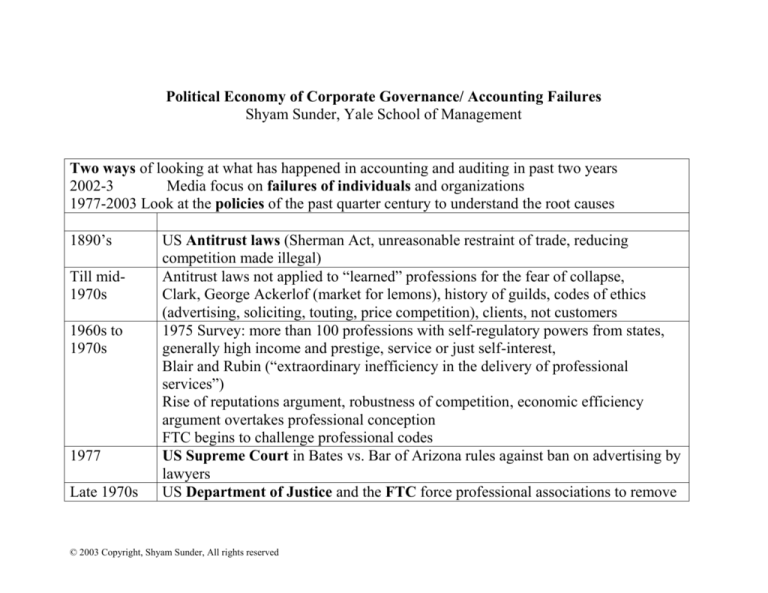

Political Economy of Corporate Governance/ Accounting Failures

Shyam Sunder, Yale School of Management

Two ways of looking at what has happened in accounting and auditing in past two years

2002-3

Media focus on failures of individuals and organizations

1977-2003 Look at the policies of the past quarter century to understand the root causes

1890’s

Till mid1970s

1960s to

1970s

1977

Late 1970s

US Antitrust laws (Sherman Act, unreasonable restraint of trade, reducing

competition made illegal)

Antitrust laws not applied to “learned” professions for the fear of collapse,

Clark, George Ackerlof (market for lemons), history of guilds, codes of ethics

(advertising, soliciting, touting, price competition), clients, not customers

1975 Survey: more than 100 professions with self-regulatory powers from states,

generally high income and prestige, service or just self-interest,

Blair and Rubin (“extraordinary inefficiency in the delivery of professional

services”)

Rise of reputations argument, robustness of competition, economic efficiency

argument overtakes professional conception

FTC begins to challenge professional codes

US Supreme Court in Bates vs. Bar of Arizona rules against ban on advertising by

lawyers

US Department of Justice and the FTC force professional associations to remove

© 2003 Copyright, Shyam Sunder, All rights reserved

anticompetitive provisions from their “codes of ethics”

1979

AICPA’s new Code of Ethics: allows advertising, solicitation of competitors’

clients and employees

Early 1980s Sharp drop in the price of audit services due to competitions, disappearing profits in

audit firms

Special problems of observing the quality of audit service

Early 1980s New business model of audit firms to maintain profitability:

New production function: shift from substantive to analytical tests

New product Mix: Use audit relationships to sell more consulting (consulting as a

consequence, not cause, of the collapse)

New internal compensation: Transfer between audit/consulting partners

New labor market policy: Cut wages of new hires

Early 1980s Growth of university accounting majors and CPA candidates stops

Mid-1980s

Many business and audit failures and law suits (S&Ls), auditors pay hundreds of

millions in settlements, worries about profitability resume

Later-1980s Goal to change the legal environment of auditors

Federal: Switch from joint-and-several to proportionate liability

State: Switch to Limited Liability Partnerships, 150 hour (five-year) qualification

for CPAs to reduce supply

1988-90-92- Large scale organized contributions to elections from auditors

94

1993

FASB’s attempt to write a standard for executive option accounting is beaten back

by business and Congress (role of CT senator)

© 2003 Copyright, Shyam Sunder, All rights reserved

1994

1995

1999

2001-3

US Supreme Court (Central Bank vs. First Interstate Bank of Denver) rules that

corporate advisors cannot be held liable to third parties for aiding and abetting

fraud

Private Securities Litigation Reform Act gives proportionate liability to auditors

plus a gift under pressure from the Silicon Valley: safe harbor for forward looking

(speculative) information

SEC misdiagnoses audit problems (consulting as the cause); attempts to have

auditors divest consulting; is beaten back with support from Congress, settles for

disclosure of fees

Accounting and audit failures surface in the wake of economic slow down and

stock market drop

© 2003 Copyright, Shyam Sunder, All rights reserved

© 2003 Copyright, Shyam Sunder, All rights reserved

© 2003 Copyright, Shyam Sunder, All rights reserved

Number of Settlements of Claims Against Auditors

Frequency by Time Period

300

250

200

150

100

50

0

1960-1964 1965-1969

1970-1974

1975-1979

1980-1984

Time Period

© 2003 Copyright, Shyam Sunder, All rights reserved

1985-1989

1990-1995

Unknown

Amounts of Settlements Against Auditors

500,000,000

400,000,000

300,000,000

Total

200,000,000

100,000,000

0

19

67

19

72

19

75

19

78

19

81

19

84

19

87

19

90

19

93

19

96

Amount of Settlements

Total Amount of Settlements

Year

© 2003 Copyright, Shyam Sunder, All rights reserved

Accountants’ Contributions to Political Campaigns

© 2003 Copyright, Shyam Sunder, All rights reserved

Accountants’ Contributions to Political Campaigns

© 2003 Copyright, Shyam Sunder, All rights reserved

© 2003 Copyright, Shyam Sunder, All rights reserved

Why Accounting/Auditing Collapsed? A Policy Story

Shyam Sunder, Yale School of Management

June 2003

Two ways of looking at what has happened in accounting and auditing in past two years

2002-3

Media focus on failures of individuals and organizations

1977-2003

Look at the policies of the past quarter century to understand the root causes

1890’s

US Antitrust laws passed

Till midAntitrust laws not applied to professions for the fear of collapse, “market for

1970s

lemons”

1960s to

Rise of reputations argument, robustness of competition

1970s

1977

US Supreme Court in Bates vs. Bar of Arizona rules against ban on advertising by

lawyers

Late 1970s

US Department of Justice and the FTC force professional associations to remove

anticompetitive provisions from their “codes of ethics”

1979

AICPA’s new Code of Ethics: allows advertising, solicitation of competitors’ clients

and employees

Early 1980s Sharpe drop in the price of audit services due to competitions, disappearing profits in

audit firms

Early 1980s New business model of audit firms to maintain profitability:

Production: shift from substantive to analytical tests

Product Mix: Use audit relationships to sell more consulting

Compensation: Transfer between audit/consulting partners

Labor Market: Cut wages of new hires

© 2003 Copyright, Shyam Sunder, All rights reserved

Early 1980s

Mid-1980s

Growth of university accounting majors and CPA candidates stops

Many business and audit failures and law suits (S&Ls), auditors pay hundreds of

millions in settlements, again worries about profitability

Later-1980s Goal to change the legal environment of auditors

Federal: Switch from joint-and-several to proportionate liability

State: Switch to Limited Liability Partnerships

1988-90-92- Large scale organized contributions to elections from auditors

94

1993

FASB’s attempt to write a standard for executive option accounting is beaten back

by business and Congress

1994

US Supreme Court (Central Bank vs. First Interstate Bank of Denver) rules that

corporate advisors cannot be held liable to third parties for aiding and abetting fraud

1995

Private Securities Litigation Reform Act gives proportionate liability to auditors

plus a gift under pressure from the Silicon Valley: safe harbor for forward looking

(speculative) information

1999

SEC misdiagnoses audit problems (consulting as the cause); attempts to have

auditors divest consulting; is beaten back with support from Congress, settles for

disclosure of fees

2001-3

Accounting and audit failures surface in the wake of economic slow down and stock

market drop

© 2003 Copyright, Shyam Sunder, All rights reserved