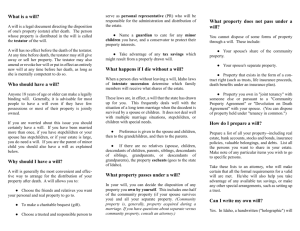

Variation of Wills

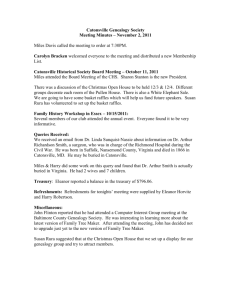

advertisement