Energy Efficiency in the Russian Federation (Umbrella Programme)

advertisement

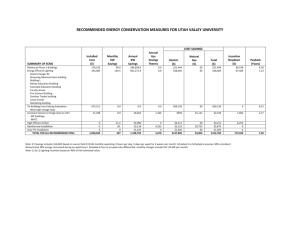

PROJECT IDENTIFICATION FORM (PIF) PROJECT TYPE: Full-sized Project THE GEF TRUST FUND S Submission Date: 21 January 2008 Resubmission Date: 22 February 2008 PART I: PROJECT IDENTIFICATION GEFSEC PROJECT ID1: 3653 GEF AGENCY PROJECT ID: COUNTRY(IES): Russia PROJECT TITLE: Energy Efficiency in the Russian Federation (Umbrella Programme) GEF AGENCY(IES): UNDP (coordinating agency), EBRD, UNIDO OTHER EXECUTING PARTNERS: GEF FOCAL AREAS: Climate Change GEF-4 STRATEGIC PROGRAM(S): CC-SP 1 and CC-SP 2 NAME OF PARENT PROGRAM/UMBRELLA PROJECT: INDICATIVE CALENDAR Milestones Expected Dates Work Program (for FSP) April 2008 CEO Endorsement/Approval December 2008 GEF Agency Approval January 2009 Implementation Start February 2009 Mid-term Review 2011 Implementation Completion 2014 A. PROJECT FRAMEWORK (Expand table as necessary) Project Objective: Facilitate market transformation towards more a more energy efficient economy through the promotion of efficient technologies and practices in key sectors. The project will improve energy efficiency in industry, buildings, and lighting through regulatory support, investment, and capacity development at the federal, regional, and local levels. In line with the GEF Climate Change strategy, this umbrella program will cover the entire spectrum of the building sector, including the building envelope, the energy-consuming systems and appliances used in buildings for heating, cooling, lighting, including appliances, as well as building operation and energy consumption during building operation. In industry, the project will promote the deployment and diffusion of energy-efficient technologies and practices in industrial production and manufacturing processes, focusing on GHG-intensive industries. Indicate whether Expected Project Components Investment, Outcomes TA or STA Improving Energy Efficiency in TA Enabling policy Buildings in Northwest Russia framework and enhanced institutional capacities for improving building energy efficiency at the provincial and local level GHG emissions reduced by 34-45% at pilot sites and 60% of pilot site buildings certified for energy efficiency performance Local energy efficient solutions and management models demonstrated Improving Energy Efficiency in Investment Urban Housing & TA Concepts of integrated municipal planning introduced and disseminated. Best practices in building code 1 Project ID number will be assigned initially by GEFSEC. Expected Outputs Provincial legal and regulatory framework. Indicative GEF Financing* ($) % Indicative Cofinancing* ($) % Total ($) 5,840,000 20 23,250,000 80 29,090,000 9,670,000 10 86,500,000 90 96,170,000 Energy efficiency curriculum, vocational training centre, distance learning programme Three demonstration projects: Model construction site in Vologda oblast, introduction of a methodology for certification of EE buildings in Vologda Oblast, and a municipal project management system for EE in construction and maintenance in Arkhangelsk Oblast. Development of municipal investment frameworks in participating municipalities. Guidance developed for 1 support introduced and disseminated. Credit for EE investments in housing increased; EE considerations “mainstreamed” into housing sector lending. Improving Energy Efficiency in Investment Public Buildings & TA Municipal EE projects identified, audits conducted, and project proposals prepared for financing. Support provided for tendering procedures and management of large-scale programs that may need additional dedicated resources. the Russian Municipal Housing Reform Fund (RMHRF) to phase in requirements for certified buildings. Line of credit and project preparation support for regional governments and/or residents undertaking housing reconstruction programs within the RMHRF that adequately address energy efficiency. Technical support for project identification, audits, project preparation, and tendering. 9,210,000 13 62,700,000 87 71,910,000 7,810,000 20 32,000,000 80 39,810,000 EBRD financing in the form of an a municipal energy efficiency loan Loans for EE investments to municipalities Forfaiting mechanism Energy savings of at least 30% in target buildings and facilities achieved. Introducing Energy Efficiency Standards and Labeling TA Innovative financial mechanism introduced— forfaiting—that will transfer credit risk and assets in energy efficiency investments to a third party. National legal, regulatory, and institutional mechanisms for a widespread energy efficiency S&L scheme in place Market penetration of energy efficient appliances increased Energy efficiency standards and labels for selected products S&L demonstration programme in selected regions Testing and labeling protocols; procurement models Strategic buyer Awareness among partnerships and produer targeting consumers agreements and market agents increased Awareness campaign 2 Transforming Markets for Energy Efficient Lighting TA Efficient lighting policies and standards introduced Capacity (and incentives for) of the supply chain to promote EE lighting enhanced EE office lighting marketed to all public and commercial buildings EE street lighting replicated Improving Energy Efficiency in TA & GHG-Intensive Industries Investment National platform and knowledge centre established 7,020,000 26 20,500,000 74 27,520,000 15,385,000 10 135,750,000 90 151,135,000 5 to 10 suppliers assisted in improving their production or imports of EE lighting equipment or components Health and educational buildings in City of Moscow switched to efficient lighting EE street lighting installed in Nizhny Novgorod City and Oblast CFL marketing campaign targeting the residential sector established by Moscow city government and manufacturers Target-setting agreements with industry signed CFLs installed in five demonstration apartment buildings in Moscow National energy management standards introduced Policies compatible with ISO energy management standard Market demand for EE goods and services increased Informational campaign, recognition program, targeted incentives through preferred suppliers Capacity of energy managers enhanced to optimize industrial systems and increase EE Expert-level training Agreements with 75 energy-intensive firms in 4 or more industrial sectors Dedicated financing Investments in EE mechanism for EE technologies and systems investments optimization projects established Total project costs 54,935,000 13 360,700,000 87 415,635,000 * List the $ by project components. The percentage is the share of GEF and Co-financing respectively to the total amount for the component. ** TA = Technical Assistance; STA = Scientific & technical analysis. 3 B. INDICATIVE FINANCING PLAN SUMMARY FOR THE PROJECT ($) GEF Grant Co-financing Project Preparation NW Buildings: 140,000 Public Buildings: 215,000 Residential Buildings: 165,000 Standards & Labeling (S+L): 150,000 Efficient lighting: 140,000 Industrial EE: 225,000 Subtotal: 1,035,000 NW Buildings: 200,000 Public Buildings: 200,000 Residential Buildings: 200,000 S+L: 250,000 Project NW Buildings: 5,840,000 Public Buildings: 9,210,000 Res. Buildings: 9,670,000 S+L: 7,810,000 Efficient lighting: 7,020,000 Industrial EE: 15,385,000 54,935,000 NW Buildings: 23,250,000 Public Buildings: 62,700,000 Res. Buildings: 86,500,000 S+L: 32,000,000 Agency Fee Total NW Buildings: NW Buildings: 589,000 6,578,000 Public Buildings: Public Buildings: 942,500 10,367,500 Res. Buildings: Res. Buildings: 983,500 10,818,500 S+L: S+L: 796,000 8,756,000 Efficient lighting: Efficient lighting: 716,000 7,876,000 Industrial EE: Industrial EE: 1,561,000 17,171,000 5,597,000 61,567,000 NW Buildings: 23,450,000 Public Buildings: 62,900,000 Res. Buildings: 86,700,000 S+L: 32,250,000 Efficient lighting: 600,000 Subtotal: 1,700,000 Efficient lighting 20,500,000 Industrial EE: 135,750,000 360,700,000 Efficient lighting 20,750,000 Industrial EE: 136,350,000 362,400,000 2,735,000 415,635,000 250,000 Industrial EE: Total 5,597,000 423,967,000 * Please include the previously approved PDFs and planned request for new PPG, if any. Indicate the amount already approved as footnote here and if the GEF funding is from GEF-3. C. INDICATIVE CO-FINANCING FOR THE PROJECT BY SOURCE ($), IF AVAILABLE UNDP Sources of Co-financing 1 Project Government Contribution (cash) Project Government Contribution (in-kind) Private Sector2 NGO3 Others4 Total co-financing for UNDP projects 1 NW Buildings S&L EE Lighting Total 6,979,750 8,100,000 14,050,000 29,129,750 1,055,250 1,400,000 14,565,00 850,000 16,000,000 1,400,000 5,350,000 32,250,000 23,450,000 2,455,250 6,700,000 20,750,000 37,265,000 2,250,000 5,350,000 76,450,000 In the NW Buildings project, the Government co-financing will come from matching federal and regional funds allocated in line with the national co-financing practices in the framework of the federal target programmes on housing. Regional funding will be allocated through the regional energy funds established in 2005 in support to the regional energy efficiency programmes. Since 2005, financing through the regional energy funds has been steadily increasing. In 2006 the level of funding in the pilot regions came to: in the Arkhangelsk region – $1.85 mln (50 mln roubles), in Vologda region - $3 mln (82 mln roubles), in Pskov region - $0.8 mln (22 mln roubles), mainly invested into district heating systems. In 2007 these allocations increased by 25% and included resources for energy auditing. In 2008-2010 regional financing to energy efficiency programmes will be doubled (including capital investments). 4 In the standards and labeling project, the government co-financing includes federal government budget and Regional government budget. The federal financing is planned under the ongoing federal program "Research and development of priority areas towards improvement of science and technology in Russia for 2007-2012 - total amount $7,895,000 $ (cash 6,495,000 and in kind $1,400,000). In addition, the government of Moscow is planning further budgets for energy efficiency programs. 2 In the NW Buildings Project, private sector co-financing to energy efficiency projects will come through public and residential construction projects and through the concessions on building maintenance (management). In the Standards and Labeling Project, these are estimated contributions by manufacturers and retailers of energy efficient products (increased marketing efforts etc) 3 In the NW Buildings project, NGO co-financing is sought from the North-West Association, Agency for development and investment promotion, regional funds for municipal development and others. Co-financing commitments will be leveraged during the PPG phase. 4 In the Standards and Labeling project, other co-financing comes from the following sources: Russian electricity company, Gasprom. Norilnikel, Lukoil, etc. The co-financing is planned under the energy efficient programs implemented in these companies and will be primarily used for the introduction of energy efficient procurement models. The total amount is estimated to $5,350,000. Sources of Co-financing for Type of Co-financing EBRD and UNIDO projects Project Government Contribution Unknown at this stage Project Government Contribution In Kind EBRD/UNIDO Industrial EE Amount Loans EBRD Credit lines EBRD Grants 300,000 EBRD Unknown at this stage 500,000 UNIDO Unknown at this stage 500,000 UNIDO Grants 300,000 120,000,000 62,000,000 34,000,000 50,000,000 Unknown at this stage 1,700,000 700,000 800,000 62,900,000 86,700,000 13,700,000 136,350,000 Total co-financing 200,000 EBRD Residential Buildings Amount 200,000 1,050,000 EBRD Private Sector EBRD Public Buildings Amount Financing in the Residential Buildings will be supplemented by parallel financing in the form of direct financial support for the construction of residential buildings through the Russian Municipal Housing Reform Fund. D. GEF RESOURCES REQUESTED BY FOCAL AREA(S), AGENCY (IES) SHARE AND COUNTRY(IES) (in $) GEF Agency Focal Area Country Name/ Global EBRD Climate Change Russia UNDP Climate Change Russia UNIDO Climate Change Russia Total GEF Resources Project Preparation 492,500 430,000 112,500 1,035,000 Project Agency Fee 26,226,250 2,671,875 20,670,000 2,110,000 8,038,750 815,125 54,935,000 5,597,000 Total 29,390,625 23,210,000 8,966,375 61,567,000 PART II: PROJECT JUSTIFICATION A. STATE THE ISSUE, HOW THE PROJECT SEEKS TO SOLVE IT, AND THE EXPECTED GLOBAL ENVIRONMENTAL BENEFITS TO BE DELIVERED: The Russian economy has been experiencing steady growth that is likely to continue and to bring with it a growing demand for energy. The latter trend is alarming, as the Russian economy remains among the most energy intensive in the world. The energy intensity of Russia’s economy is twice as high as the world average, it is three times higher than in Western Europe, 2.3 times higher than in the United States, and two times higher than that of China. Along with economic growth, the level of greenhouse gas emissions in Russia has been steadily increasing since 1999 (2,152.4 million tons of CO 2 equivalent in5 2004 alone2). The energy saving potential of Russian economy through increased energy efficiency is equally substantial. It is assessed at 35-40 percent, or 360-430 million tons of oil equivalent annually. The findings of a rapid assessment of Russia’s energy saving potential by sector are presented in the table below. As demonstrated in the table, the Russian building sector represents the highest energy saving potential. At the same time, this sector faces a series of deeply-rooted problems that hamper its reform and the inflow of private sector investments. The majority of existing industrial and building infrastructure was designed and constructed during the Soviet governance. The perception of low energy prices affected the design, construction and exploitation of buildings and the selection of industrial processes and technologies. In the residential and public buildings sector, complex and inefficient management and ownership frameworks create risks and barriers for private investments in energy efficiency projects. As a result this sector is dragging behind industrial sectors in applying energy efficiency practices and technologies. However, industrial sectors also hold significant untapped potential energy savings, both because efficiency measures are not identified by energy managers, and because energy efficiency considerations are not “mainstreamed” into the Russian commercial lending sector. These and other barriers to energy efficiency are described in Section C below. The scope and complexity of problems faced by the Russian economy are very extensive and cannot be addressed through a single GEF project. A broader programmatic multi-agency approach is required. This is why this Umbrella Programme is proposed as a coordinated intervention of key Russian sectoral agencies. Table: Energy Saving Potential in Russia3 Sector Unit of measure Electric power industry Heat supply systems Industry Buildings Residential million toe million toe million toe million toe Million GCal Billion kWh Million GCal Billion kWh Billion kWh million toe Public Street and indoor lighting Total: Baseline energy consumption 355 679.0 152.0 360.0 74.0 20.0 970 Technical potential of energy savings Savings of natural gas (bln m3) 68.3 87.4 89-106 360.0 95.0 166.0 19.0 6.0 370-390 Saving potential (%) 23-38 70.6 Share of the total energy saving potential (%) 18.4 23.5 23.9 34.2 25-30 31.0 18.0 18.0 3.6 53.0 62.5 46.1 25.7 16.3 8.7 7.5 1.7 172-177 38.3-40.1 100.0 In accordance with the GEF Climate Change strategy, the proposed umbrella program will cover the entire spectrum of the building sector, including the building envelope, the energy-consuming systems and appliances used in buildings for heating, cooling, lighting, including appliances, as well as building operation and energy consumption during building operation. In industry, the project will promote the deployment and diffusion of energy-efficient technologies and practices in industrial production and manufacturing processes, focusing on GHG-intensive industries. Priority threats/root causes and barriers to be addressed Energy efficiency of Russia’s building and appliances sector is hampered with a combination of barriers and perverse incentives, including policy and legal barriers, market and financial barriers, institutional, social and behavioral barriers. In industry, prospects for improving energy efficiency remain limited because only limited information is available on what improvements can be implemented. There is also little support or encouragement to management to help shift the emphasis away from increased production and more towards cost efficiency and sustainability. Detailed and specific barrier analysis is presented in the attached individual project PIFs. The following broader barrier categories can be identified: Policy and legal barriers: Key policy documents that will drive national energy efficiency investments are still under development. The regulatory framework that should operationalize new policies in the construction and communal housing sectors is inadequate. Specific examples include absence of compulsory energy efficiency labeling schemes or binding regulations for sectoral/agency procurement. Also, most of the Russian regions and municipalities are lacking long term energy efficiency programmes that hampers inflow of investments. The UNDP NW Buildings project, the EBRD Municipal Buildings Project, and the EBRD Residential Buildings project will all address these barriers. In addition, the UNDP S&L project will address the lack of a supportive regulatory and legal framework for setting standards and labeling energy-efficient appliances. 2 3 Russia’s Report on demonstrating progress under the Kyoto Protocol, 2006. Centre of Energy Efficiency (CENEf), 2006, Rapid assessment 6 The EBRD-UNIDO industrial energy efficiency project will address the lack of national industrial energy efficiency targets and specific policies designed to improve energy efficiency in industry. Institutional capacities: The barriers include insufficient coordination and lack of clear leadership among government agencies in implementation of energy efficiency policies related to market transformation and demand side management. There is a lack of viable institutional experience (both state and NGO) in introducing market incentives and labeling systems for appliances and other equipment used in the buildings sector. The UNDP S&L project will address this barrier, as will the EBRD-UNIDO project component on establishing market incentives for improving industrial energy efficiency.. In addition, management expertise and effective institutional networks are lacking at the regional and municipal level in both the standards sector and in the more general area of identifying and designing energy efficiency projects for existing and planned building stock. All proposed projects will address this barrier by working with regional and local partners. Market barriers: On the supply hand, the market of professional services (energy audits, business planning, energy management) is not well developed, and there are few local professional engineering companies that can offer energy-efficient construction. The UNDP NW Buildings project will address this barrier. The EBRD-UNIDO project will focus on strengthening the skills of energy managers to include the identification and implementation of energy-saving measures in GHG-intensive industries. On the demand side, barriers include a shortage of capital for investment and a lack of incentive to make up-front investments in energy-efficient construction and retrofitting and to undertake efficient maintenance practices. Barriers are rooted in relatively low energy prices, lack of attractive financing, and an artificial separation of energy efficiency from ongoing investments in housing, public facilities, home appliances, and building equipment. The EBRD Municipal Buildings Project, the EBRD Residential Buildings Project, the UNDP S&L project, and the EBRD-UNIDO project will address these barriers. Technical and knowledge barriers: Insufficient technical capacity and know-how in energy efficiency technologies, the design and introduction of energy performance standards, sustainable labeling schemes, and the design and certification of highlyefficient buildings. testing methods and effective consumer campaigns. These barriers inhibit scaling up successful initiatives and replicating innovative energy efficinecy technologies introduced in pilot projects. These barriers are adressed in all of the proposed projects. The strategy of the Russia Energy Efficiency Program that has driven the choice of individual projects is threefold: - Sector-specific barrier removal: Specific projects will analyze and address barriers to energy efficiency in the following sectors: construction of new buildings, residential housing, municipal buildings, appliances, lighting, energy-consuming building equipment, and industrial processes. Building on best regional practices and pilots, the project will also reduce institutional and information barriers for up-scaling and replicating innovative energy efficiency technologies. - Mainstreaming energy efficiency into government investment frameworks for buildings sector: The Russian Government has prioritized the reform in the housing sector and announced it among three national priority projects. Development of innovative technologies, including energy and construction sectors, is another priority pursued through the national investments. National financing is channeled through federal target programmes designed and managed by specific sectoral agencies, including the Ministry of Regional Development (federal programme on housing), Federal Agency for Science (priority innovation programmes), Ministry of Civil Defence and Emergencies (recovery of urban settlements), etc.. Besides federal investments, regional governments allocate financing for the modernization of housing sector through regional budgets. The GEF programme through individual projects will partner with the key sectoral and regional agencies to influence decision making and embed energy efficiency principles into these national investments. - Capacity building: As a result of administrative reform the management authority over the majority of housing stock has been transferred to regional and local governments. Given Russia’s vast geographic expansion, climatic diversity and decentralized governance, the role and involvement of provincial and local governments in promoting energy efficiency is very important. Acute capacity constrains at that levels (in particular at the local municipal level) and lack of professional expertise are major factors hampering promotion of energy efficiency. Development of long-term municipal energy efficiency programmes and establishment of regional energy efficiency centres in the most advanced provinces proved to be decisive factors for the success of pilot energy efficiency projects. The programme will build institutional and technical capacities of municipal and regional energy managers in both the public and the private sectors and facilitate access to local market of professional services in the field of building energy efficiency. The Goal of the Russia Energy Efficiency Program is to reduce greenhouse gas emissions from energy consumption in the Russian economy and the appliances and equipment used in a variety of facilities. The program objective is to promote energy-efficient technologies and practices in the buildings and appliance sectors. This objective will be achieved through 7 implementation of a series of energy efficiency projects in the Russian building sector that will work together to deliver the following Outcomes: 1. 2. 3. 4. 5. 6. 7. 8. Improved energy efficiency in construction sector and several GHG-intensive industrial sectors, including both new construction and retrofitting/process upgrades. Enhanced institutional capacities for long-term municipal energy planning and reduced energy consumption in municipal buildings. Enhanced institutional capacities for long-term commercial energy management and reduced energy consumption in GHG-intensive industries. Embedding energy efficiency practices and technologies into ongoing national investments in urban development, housing reform, and procurement. Reduced barriers to energy efficiency in the residential housing sector. Increased market penetration of energy-efficient technologies, products, and materials in the residential and commercial building markets through introduction of energy efficiency standards and labeling. Market transformation of public, commercial and household lighting. Market transformation of GHG-intensive industries. Project selection: Projects have been selected based on the following criteria: Geographic region: since the Russian Federation is the largest country in the world spanning 11 time zones it is necessary to select projects which are able to address both local needs, as well as provide the opportunity for significant cost effective replication throughout the country. Projects should address the broad scope of end-use sectors in energy efficiency in buildings, and address the particular barriers that these end-use sectors experience. The projects should fit together logically, so that each achieves necessary objectives but benefits from achievements from the other projects. They should not however be inextricably linked to each other which would increase project risks as a whole. The projects should play to the strengths, experience and comparative advantage of each GEF agency. The projects should maximize cost effectiveness. The following individual project proposals (PIFs) have been developed and are submitted along with the programme outline: 1. NW Buildings: Localizing solutions to improved building energy efficiency in the North West of Russia: capacity building and demonstrations, UNDP-GEF 2. Public Buildings: Improving Efficiency in Public Buildings in the Russian Federation, EBRD-GEF 3. Residential Buildings: Improving Urban Housing Efficiency in the Russian Federation, EBRD-GEF 4. Standards and Labeling (S&L): Standards and Labeling for Promoting Energy Efficiency in Russia, UNDP-GEF, PIMS 3550 5. Efficient Lighting: Transforming the market for Efficient Lighting, UNDP-GEF 6. Industrial EE: Market Transformation Programme on Energy Efficiency in GHG-intensive industries in Russia, EBRD-UNIDO Comparison by Selected Characteristics Geographic Region EBRD Municipal Buildings Project EBRD Urban Housing Project Municipalities to be determined during PPG Khanty-Mansi autonomous region, Siberia National scope for Housing Fund work UNDP NW Buildings Project Three oblasts in the NW Russian admin. territory UNDP Standards/Labels UNDP Efficient Lighting EBRD-UNIDO Industrial EE Regions to be determined. National scope with demonstration activities in Nizhny Novgorod and Moscow National, by industry and company National scope for labeling 8 End-Use Sector EBRD Municipal Buildings Project EBRD Urban Housing Project Public administration buildings New public and private urban residential buildings UNDP NW Buildings Project Buildings in all sectors UNDP Standards/Labels UNDP Efficient Lighting EBRD-UNIDO Industrial EE Household appliances Efficient lighting in all sectors GHG-intensive industries Federal EE programme Government cofinancing Government co-financing Product retailers CFL producers Private Sector (Designated Financing Mechanism) Absence of institutional arrangements for S&L and efficient procurement Will establish norms for appliances and equipment Local production and standards EE not reflected In facilities Management or investments Knowledge center, procurement, local production support Training, Targets, Preferred suppliers Public awareness campaign Public awareness and marketing Outreach to industry Other equipment Public facilities (educational and healthcare) Lighting Public lighting Co-financing Both new and existing buildings EUR 10-50 million in credit to municipalities Forfaiting mechanism for suppliers Key Barrier Addressed Finance gap for municipalities Activities to define and support “energyefficient” technologies Will develop criteria for prioritizing EE investments TA Mechanisms Support for project preparation USD 34 million in EBRD loans USD 50 million EBRD line of credit Russian Housing Municipal Reform Fund Under-representation of EE in municipal planning and housing policy Will establish criteria for “EE buildings” Federal target programmes on housing Regional EE funds “Policy-topractice” gap Will develop criteria for certification of EE buildings Will develop criteria for municipal EE norms Tendering Unit Guidance to state fund Support for municipal energy planning Three demonstration projects Curriculum Focus of Capacity Developmen t Efforts and Target Group Project ID and preparation (for municipalities and public facilities) Planning (for municipalities) Mainstreaming (for fed govt) Professional training Capacity to support EE buildings in policy and implementation (Oblast govts) Project prep (entities) Replication: Strategy and Scope Lessons learned shared with participating municipalities Federally through the Housing Fund; to other oblasts/okrugs through IA activity Forfaiting mechanism scaled up to additional municipalities Disseminate best practice for “highly efficient buildings and in municipal energy planning Training (professionals; trainers) Lesson from demos in 3 oblasts shared at the territorial (okrug) and federal level Professional training Demonstration of implementation Education (households, buyers, sellers) Institutional mechanisms (federal govt) Policy at federal level, and then Trials at oblast level Professional training Producers Energy managers Commercial buyers Policy-makers City and regional procurement Commercial lenders Building of national capacity for local ownership Agreements with key sectors and firms Demonstration in Moscow and Nizhny Novgorod 9 B. DESCRIBE THE CONSISTENCY OF THE PROJECT WITH NATIONAL PRIORITIES/PLANS: The project is highly relevant to the major priorities of the 2003 Energy Strategy of the Russian Federation for the period up to 2010. The significant potential for both energy and budgetary savings in public building energy efficiency (The Russian Federal, Regional, and Local Governments spent approximately USD 10 billion on energy in 2005, with an estimated potential saving of 30-40%) and in households, means that efficiency in this sector is important. This strategy includes: The reduction of specific costs for generation and use of energy resources be means of rational use, application of energy saving technologies and equipment, losses reduction; The improvement of financial sustainability and efficiency of the use of a energy sector potential, increase of the labour productivity. Maximally efficient use of natural fuel-energy resources and energy sector potential for economic growth and improvement of the quality of living of citizens. C. DESCRIBE THE CONSISTENCY OF THE PROJECT WITH GEF STRATEGIES AND STRATEGIC PROGRAMMES: The Russian Energy Efficiency Program is submitted under the GEF Focal Area Climate Change-Mitigation, Strategic Programme 1 “Promoting Energy Efficiency in Residential and Commercial Buildings”. The Program fully fits with the GEF-4 Focal Area strategy paper and contributes to the achievement of GEF CC mitigation objectives. In compliance with the GEF-4 strategic programming outline, the program will reduce institutional and capacity barriers to energy efficiency in Russia and promote increased market penetration of energy-efficient technologies, practices, products, and materials in the residential, commercial, and industrial sectors. Fit with national priorities: Improved energy efficiency is one of the key priorities for the national economy for the coming 510 years and is clearly outlined in national policies, including the Federal Law on Energy Saving (1996) and a number of regional (provincial) laws and programmes. The government has set a goal of reducing energy intensity of the economy in 2007 by 26-28% compared with 2000 partly through structural changes in the economy and partly through improved energy efficiency and institutional measures. In addition, the government is in the process of developing a federal target program, “Energy efficient economy for the period until 2015,” and a new edition of the Energy Strategy for the period until 2020. D. OUTLINE THE COORDINATION WITH OTHER RELATED INITIATIVES: The projects under the Russia Energy Efficiency Program will build on initiatives of other GEF projects including the UNDPGEF “Energy Efficiency in the Russian Education Sector”, and the UNDP-GEF project “Capacity Building to Reduce Key Barriers to Energy Efficiency in Russian Residential Buildings and Heat Supply.” As the co-ordinating agency, UNDP will be responsible for overall communications, including those with other GEF initiatives in Russia, such as the GEF projects led by the World Bank (IFC) and UNEP (regional initiative in financing). The program will also build on the experiences of other funders including the World Bank, NEFCO (Norway), and the European Commission’s TACIS programme. Co-ordination with the USAID activities in Federal Energy Management (efficient federal energy buildings), regulations and institutional support to enhance efficiency in budget-funded buildings including pilot projects will also be ensured. The efficient lighting project will cooperate closely with and aim to learn from the GEF-UNEP-UNDP initiative “Global Market Transformation for Efficient Lighting”. This co-development will benefit the development of the national project, which can take account of global strategies and the interaction with international industries that take place there, whilst the global project can learn from the practical implementation issues that emerge during the national project design stage, and take these into account for its project development. Further co-ordination of the proposed projects with ongoing initiatives will be explored as part of project preparation activities of the individual projects. E. DISCUSS THE VALUE-ADDED OF GEF INVOLVEMENT IN THE PROJECT DEMONSTRATED THROUGH INCREMENTAL REASONING: While it is difficult to calculate specific emission reductions during the initial design phase of the proposed projects, it is expected that investments made in energy-efficient construction will generate savings of at least 30% over current building stock and operations & maintenance practices. In industry, Initial estimates from an EBRD market demand study and model for Russia indicate that a dedicated financing facility of 120 million USD, assuming 80% debt financing for projects, could generate energy savings of 5600 GW per annum and emission reductions of up to 1.35 million tonnes CO2e per annum. Over a 10-year equipment lifetime this would result in 13.5 million tonnes, and a carbon cost per tonne of 9 USD / tCO 2eq. In addition to the direct outcomes of the individual projects, the Russia Energy Efficiency Program should provide additional global environmental benefits because it will increase the dissemination of successful practices across the projects and broaden 1 0 the information and financing options available to municipalities, regions, and businesses participating in individual projects. F. INDICATE RISKS, INCLUDING CLIMATE CHANGE RISKS, THAT MIGHT PREVENT THE PROJECT OBJECTIVE(S) FROM BEING ACHIEVED, AND IF POSSIBLE INCLUDING RISK MEASURES THAT WILL BE TAKEN: The Programme is being developed in partnership with the key Russian sectoral agencies and builds upon national investments into energy efficiency, construction and development sectors. The Programme is supported by a constituency of stakeholders and national expert networks. These factors will mitigate the risks to the effectiveness and sustainability of the programme. A broad description of potential risks and a mitigation strategy are presented below. A more detailed description of risks is presented in the individual project PIFs attached herewith. Risk description A complex multi-agency programme structure. Rating L Opposition from national producers to the introduction of international energy efficiency practices and standards as they will require additional investments into modernization If energy prices remain low, some of the energy efficiency products and technologies will not be cost-effective. L Insufficient capacities at the municipal management level. M L Mitigation A coordination committee will be established to monitor and coordinate implementation of the Umbrella Programme. Each individual project included in the programme will be governed by a sectoral national executing agency represented in the Programme Coordination Committee. He choice of national executing agencies will be made based on technical expertise and responsibilities over the management of national sectoral investments. This structure will ensure that any duplication and inter-agency tensions are avoided. This risk might affect plans for introducing energy efficiency standards and labeling schemes and procurement standards. It will be mitigated through the involvement of the Russian union of entrepreneurs and chamber of commerce to develop “adaptation schemes” for the national producers. In addition to that, the project strategy will utilize a strong government commitment towards reduction of energy intensity of Russian industries to create effective policy environment for the change. The prices for energy resources on the local market has been gradually growing over the last years. Energy bills are becoming a noticeable component in the family budgets. The labeling project will assess cost effectiveness of various technologies and will focus its pilot phase on the equipment/technologies that generate biggest savings. Large consumers (municipalities and companies) are motivated to reduce energy use even at the current level of energy prices. Capacity building will be included in all individual project proposals. In particular, capacity building for municipal energy managers will be a core element of the EBRD Municipal Buildings project, the EBRD Residential Buildings project, and the UNDP NW Buildings project. For each individual project a set of criteria for the choice of pilot regions and projects will be developed that would include political and financial commitment of the regional and municipal authorities and presence of professional agents/engineering companies or energy efficiency centres. 1 1 G. DESCRIBE, IF POSSIBLE, THE EXPECTED COST-EFFECTIVENESS OF THE PROJECT (e.g. $/ton of CO2 abated). IF COST-EFFECTIVENESS IS NOT PRESENTED, OUTLINE THE STEPS THAT PROJECT PREPARATION WOULD UNDERTAKE TO PRESENT COST-EFFECTIVENESS AT CEO ENDORSEMENT: Sector Estimated cost effectiveness Buildings in NW Russia With the total funding of $29 mln, this suggests high cost-effectiveness of GHG abatement measures of approximately $5.8/tCO2. Additional impact is expected through the replication of project solutions to other regions through out the Russian Federation. Public Buildings Experience shows that investments in buildings energy bills have been reduced by around 40%. Details of cost effectiveness (and emission reductions per USD spent) will we determined during PPG execution. Urban Housing Energy savings and avoided emissions can be substantial in an urban housing efficiency project. For example, as result of a shift to a more rigorous, performance-based code in 1999, the city of Moscow realized estimated energy savings of 0.7 TWh, with equivalent emission offsets of 120,000 tons in two years (Matrosov, 2004). Based on current operating conditions and the proposed performance of the buildings in the project, EBRD estimates that the refurbishment of housing stock within the context of the project will generate a emission reduction of 30% relative to the situation at the start of the project. Standards and Labeling The project is projected to realize energy savings of 15-20 TWh/year (10-15 MtCO2/year) by the end of the project, and 30-35 TWh/year (25-30 MtCO2/year) by the end of the impact period. The total GEF requested contribution is USD 7.96 million, leading to a cost-effectiveness of USD 0.08/ton CO2, which is extremely cost-effective in comparison to most other GEF CC projects. Efficient lighting Total savings amount to approximately 62 Mton cumulatively for this project, against a requested GEF-allocation of USD 7.5 million, resulting in an estimated cost-effectiveness of $ 0.12 per ton CO2. Industrial Energy Efficiency Initial estimates from an EBRD market demand study and model for Russia indicate that a dedicated financing facility of 120 million USD, assuming 80% debt financing for projects, could generate energy savings of 5600 GW per annum and emission reductions of up to 1.35 million tonnes CO2e per annum. Over a 10-year equipment lifetime this would result in 13.5 million tonnes, and a carbon cost per tonne of 9 USD / tCO 2eq. For the GEF grant of 15.6 million USD this would represent a highly cost effective direct impact of about 1.2 USD / tCO2eq. The project would also generate additional savings through the standards and agreements components. H. JUSTIFY THE GEF AGENCY COMPARATIVE ADVANTAGE (LEAVE BLANK IF GEF AGENCY IS WITHIN THE COMPARATIVE ADVANTAGE MATRIX) The role of UNDP as the coordinating agency for the Russia Energy Efficiency Program fits well with its emphasis on capacity development and technical assistance. The proposed interventions are in line with UNDP comparative advantages as presented in GEF comparative advantage matrix. The project is focused on local capacity building and transferring energy efficiency know-how and tools to the local level decision-makers and professionals. Capacity building at the local and provincial levels is seen as a prerequisite to market transformation and effective energy demand management. The EBRD has a long-term experience in working with public bodies in Russia, and significant regional experience in Municipal Finance and the Construction sector. EBRD has mainstreamed energy efficiency activities across all investment operations, and it has a substantial private sector portfolio in Russia in key industrial sectors. Energy efficiency is the cornerstone of the EBRD’s Sustainable Energy Initiative, launched in 2006. It aims to double EBRD investments in sustainable energy to €1.5 billion in the period 2006-2008. Both EBRD and UNIDO have been recognized as having comparative advantages for industrial energy efficiency by the GEF Secretariat. EBRD would complement UNIDO’s industrial energy efficiency capacity and expertise with its experience with energy efficiency project financing mechanisms. 1 2