BOARD OF EDUCATION - Butte School District # 1

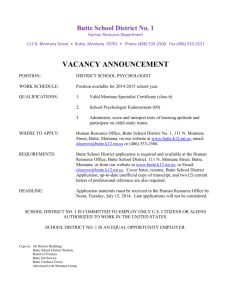

advertisement

2312 BOARD OF EDUCATION SPECIAL MEETING AUGUST 19, 2013 The Board of Trustees held a Special Meeting on Monday, August 19, 2013 at 4:15 p.m. at the School Administration Building with Chairwoman Ann Boston presiding. Trustees present: Patti Hepola, Vikki O’Brien, John Ries, and Debbie Shea. Absent: Scott Ferguson, Linda Sorini Granger, and Carol Wold. Also present were: Judy Jonart, Superintendent; J.R. Richardson, Business Manager, and Therese McClafferty, Director of Human Resources. CALL TO ORDER AND PLEDGE OF ALLEGIANCE Item 1 – PUBLIC HEARING – FINAL BUDGET for 2013-2014 A) Staff Report – J.R. Richardson Business Manager, J.R. Richardson stated that the Butte School District #1 is pleased to announce that for the 9th consecutive year, the District will be reducing the number of mills levied on local taxpayers. There has been a reduction of 53.09 mills over the past nine years, which is a 20.07% reduction. While this tax reduction will impact taxpayers differently, depending upon their property values and taxing jurisdiction, it does represent a significant overall county-wide tax reduction for School District No. l purposes. Mr. Richardson stated that both general fund budgets are at the maximum level – Elementary is $18,722,578.04 and High School $10,608,859.89. Mr. Richardson shared that the budget being presented tonight includes the 3.1% increase for staff. Staffing and utilities are 92-94% of the District budget. Trustee Ries shared that there are still union groups that have not settled their contracts and asked whether this could send the District into using Metal Mines money. Mr. Richardson stated “yes”; but reminded the Board that two years ago, Superintendent Reksten presented a budget that was not in balance and requested usage of $170,000.00 from the Metal Mines monies; which the Board approved the request. The District did not use these monies; but instead used monies from the Flexibility Funds. These funds were used to add a nurse position; and 4-5 elementary teacher positions. Trustee O’Brien asked if Metal Mines monies could be used for one-time spending. Mr. Richardson responded “School District’s have complete discretion of how to spend Metal Mines money. These monies cannot transfer to another fund; but the District can transfer expenses that were charged to general fund.” Mr. Richardson stated that both general funds are in balance; but there are three areas of concern that will be monitored closely: Substitute Costs; Utilities and Workers Compensation; and Data processing funds, treated just like Indian Education Funds. The Butte School District will continue to work through the budgetary parameters imposed by the State of Montana and remain cognizant of the tax burden placed on our local taxpayers during these challenging times. The District appreciates the support local taxpayers have afforded it through the passage of mill levies and will continue to strive to maintain their support. 2313 Trustee Hepola extended appreciation to JR Richardson and his staff for the phenomenal job they have done for the District over the last nine years. JR stated that the credit is also shared with the School District Board of Trustees, Administration and staff, who have all made every effort to contain expenditure increases and reduce property tax reliance. TAX IMPACT OF .1.17 MILL LEVY REDUCTION Tax. Value Mills Est. School Tax Decrease $ 736.40 -1.17 $ (0.86) $ 100,000.00 $ 150,000.00 $ 1,472.80 $ 2,209.20 -1.17 -1.17 $ $ (1.72) (2.58) $ 200,000.00 $ 2,945.60 -1.17 $ (3.45) MARKET VALUE $ 50,000.00 B) Proponents - None C) Opponents - None CLOSE PUBLIC HEARING APPROVAL OF ADOPTION OF THE FINAL BUDGET FOR 2013-2014 AND THE FIXING OF TAX LEVIES Trustee Ries motioned for approval of the Final Budget for 2013-2014 and the fixing of the tax levies, second by Trustee Shea, motion carried unanimously. Item 2 – COUNTY ATTORNEY OPINION ON NON-LEVIED BUILDING RESERVE FUND FOR 2013-2014 – J.R. Richardson July 26, 2013 Ann M. Boston, Chairperson Butte School District #1 Board of Trustees 111 North Montana Street Butte, MT 59701 Dear Ms. Boston and Board of Trustees, You have requested my opinion concerning a question that I have rephrased as follows: May Butte School District #1 collect taxes through 2018-2019 to satisfy a building reserve mill levy in the amount of $7,000,000 ($700,000 per year for ten years) approved by the voters at an election held on May 6,2008? Your question arises as a result of the realization that the tax levy assessment for 20122013 inadvertently did not include this building reserve levy. Accordingly, ButteSchool District #1 will not receive $700,000.00 for the 2012-2013 tax year. In order to collect this $700,000, Butte School District #1 has asked whether the law would preclude deferring the collection of this $700,000 until the year 2018-2019. In answering this inquiry, I have reviewed the relevant Montana statute setting forth the requirements that must be met in order to allow the trustees of a school district to establish a building reserve fund, together with the March 19, 2008 Resolution passed by the Board of Trustees for Butte School District #1 establishing a building reserve 2314 High School District. I also reviewed the form of the ballot considered by the voters at the May 6, 2008 school district election on this issue. Specifically, Section 20-9-502 MCA provides in relevant part: 20-9-502. Purpose and authorization of building reserve fund by election — levy for school transition costs. (1) The trustees of any district, with the approval of the qualified electors of the district, may establish a building reserve for the purpose of raising money for the future construction, equipping, or enlarging of school buildings, for the purpose of purchasing land needed for school purposes in the district, or for the purpose of funding school transition costs as provided in subsections (5) and (6). In order to submit to the qualified electors of the district a building reserve proposition for the establishment of or addition to a building reserve, the trustees shall pass a resolution that specifies: (a) the purpose or purposes for which the new or addition to the building reserve will be used; (b) the duration of time over which the new or addition to the building reserve will be raised in annual, equal installments; (c) the total amount of money that will be raised during the duration of time specified in subsection (l)(b); and (d) any other requirements under 15-10-425 and 20-20-201 for the calling of an election. (2) Except as provided in subsections (5)(b) and (6), a building reserve tax authorization may not be for more than 20 years. (3) The election must be conducted in accordance with the school election laws of this title, and the electors qualified to vote in the election must be qualified under the provisions of 20-20-301. The ballot for a building reserve proposition must be substantially in compliance with 15-10-425. (4) The building reserve proposition is approved if a majority of those electors voting at the election approve the establishment of or addition to the building reserve. The annual budgeting and taxation authority of the trustees for a building reserve is computed by dividing the total authorized amount by the specified number of years ... Based upon my review of the March 19, 2008 Resolution passed by the Board of Trustees of Butte School District #1 and the format of the ballot submitted to the voters at the May 6,2008 election, the requirements set forth in the above statute were met. Butte School District #1 has properly established a building reserve levy detailing the total amount of money that will be raised ($7,000,000.00) and the duration of time (10 years) the money will be raised in annual equal installments ($700,000.00). I have further concluded that the requirements of this statute do not preclude deferring the $700,000.00 tax levy, mistakenly not levied for the 2012-2013 tax year, until 2018-2019. Specifically, the deferment of the $700,000.00 building reserve tax assessment levy not collected in 2012-2013 until 2018-2019 will still result in this tax assessment being collected in ten (10) equal annual installments, the duration of time the electors approved. The analysis of the Montana Supreme Court in the case of Schmiedeskamp. et.al v. Board of Trustees of School District No. 24. 124 Mont. 493, 278 P.2d 584 (1954) further supports this conclusion. In that matter, the Court was asked to determine whether an elector could restrain the Billings School District from issuing bonds for the purpose of funding the construction of an elementary school building after a duly authorized election approved such bond issue. In denying the injunctive relief, the Court stated, We find no provision of the written law of this state that accords to the electors of a school district the right to petition either the school board or e courts to set aside or rescind a valid bond election simply because some of the electors may desire another election to vote on the question already favorable voted upon and carried, especially where, as here, no fraud is either alleged or shown in the conduct of the election already held, (emphasis added). Similarly, with the issue at hand, there is no fraud alleged in the method in which the building reserve levy was approved or in the inadvertence in assessing this levy in the 2012-2013 tax year. Additionally, deferring the 2012-2013 building reserve tax levy until 2018-2019 comports with the intent of the voters to provide $7,000,000.00 for this purpose and still complies with the law by collecting this levy in ten separate years through ten equal annual installments. 2315 Based upon all of the above, it is my opinion that Butte School District #1 may collect taxes through 2018-2019 to satisfy a building reserve mill levy in the amount of $7,000,000 ($700,000 per year for ten years) approved by the voters at an election held on May 6,2008. Eileen Joyce County Attorney for City-County of Butte-Silver Bow, Montana cc: Judy Jonart J. R. Richardson Matt Vincent Jeff Amerman Cathy Maloney J.R. Richardson stated that OPI took the position that it was not their error or nor the error of Butte School District #1 and they will not change forms or anything; but documented that Butte-Silver Bow County will have to levy the mills in 2018-2019. Trustee Shea asked if there is assurance that these steps will be taken. Mr. Richardson shared that he would send a letter to the County to explain that it will be up to them to follow through in 2018-2019 and also request a letter of assurance to the Board. Item 3 – DEPARTMENT OF REVENUE LETTER REGARDING HANDLING OF RAMSAY TIFID REMITTANCE – J.R. Richardson July 25, 2013 J.R. Richardson 111 N. Montana St. Butte, Montana 59701 RE: Ramsey TIF District It was nice to speak with you the other day. We appreciate your clarification of statements published in the Butte Standard and based on our understanding of the information you provided, we agree that the school district's handling of the remittance from the Ramsey TIF district appears to be in accordance with Montana law. By allocating the remittance funds to the district's various levy funded accounts to reduce your taxpayers' 2013 property taxes, the school district's actions conform to both the letter and the spirit of Montana's TIF laws. As you correctly pointed out, if this tax increment finance district did not exist, property tax levies within the school district would be lower than they currently are because the levies required to fund the school district's budget would not be limited to the base value of the property, but would be assessed against the actual value of that property. The school district's application of the remittance revenues avoids double taxation of those living within the school district, and reduces each individual's tax burden while acknowledging the important role that tax increment financing plays in local government finance. 2316 Your service to the taxpayers of Butte is admirable, and you are a role model for public servants in Montana. Sincerely, MICHELE R. CREPEAU Special Assistant Attorney General Montana Department of Revenue PO Box 7701 Helena, Montana 59604-7701 c: Madalyn Quinlan, OPI Butte-Silver Bow School Superintendent Alan Peura, Deputy Director, Montana Department of Revenue J.R. Richardson stated that the letter sent from the Montana Department of Revenue stated that the Butte School District is handling the funds appropriately. These funds go back into cash and are distributed back to tax payers. Item 4 – Public Comment On Any Public Matter Not On Agenda None Adjournment There being no further business to come before the Board, Trustee Shea moved to adjourn, second by Trustee Ries, motion carried. Chairwoman Boston adjourned the meeting at 5:00 p.m. _______________________________ Chairwoman of the Board of Trustees Attest: __________________________ District Clerk pj