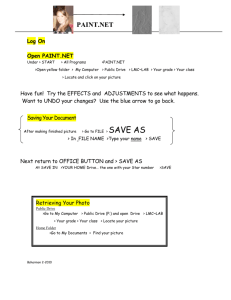

FINAL Paint Infrastructure Report

advertisement