Decoding the Domestic IT Market

Opportunity

Mid sized IT companies have played an important role in the development of the domestic IT industry

that is estimated to be around INR 1200 Bn as of FY10. However the Indian market has its own evolution

path in terms of key services, customer segments, competition and operating model. Mid sized service

providers must take cognizance of these differences and make appropriate adjustments to their business

model to continue to profitably address the domestic opportunity, say Kaustav Ganguli & K. Raman

(Practice Head – Infocomm, Media & Education) of Tata Strategic Management Group.

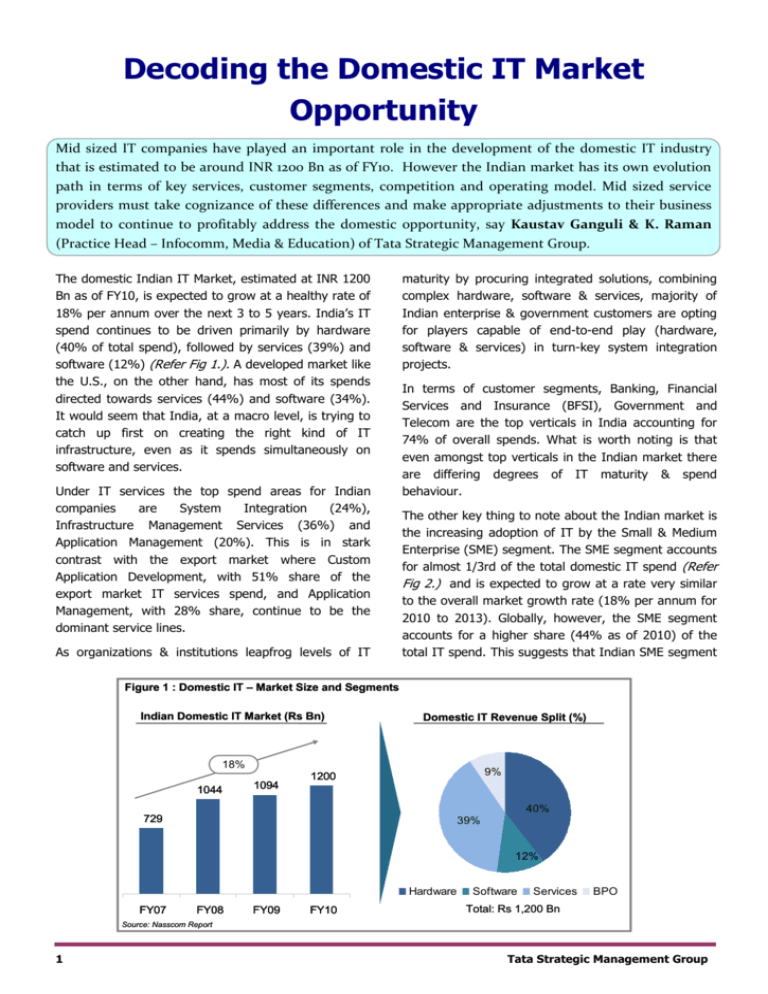

The domestic Indian IT Market, estimated at INR 1200

Bn as of FY10, is expected to grow at a healthy rate of

18% per annum over the next 3 to 5 years. India’s IT

spend continues to be driven primarily by hardware

(40% of total spend), followed by services (39%) and

software (12%) (Refer Fig 1.). A developed market like

the U.S., on the other hand, has most of its spends

directed towards services (44%) and software (34%).

It would seem that India, at a macro level, is trying to

catch up first on creating the right kind of IT

infrastructure, even as it spends simultaneously on

software and services.

Under IT services the top spend areas for Indian

companies

are

System

Integration

(24%),

Infrastructure Management Services (36%) and

Application Management (20%). This is in stark

contrast with the export market where Custom

Application Development, with 51% share of the

export market IT services spend, and Application

Management, with 28% share, continue to be the

dominant service lines.

As organizations & institutions leapfrog levels of IT

maturity by procuring integrated solutions, combining

complex hardware, software & services, majority of

Indian enterprise & government customers are opting

for players capable of end-to-end play (hardware,

software & services) in turn-key system integration

projects.

In terms of customer segments, Banking, Financial

Services and Insurance (BFSI), Government and

Telecom are the top verticals in India accounting for

74% of overall spends. What is worth noting is that

even amongst top verticals in the Indian market there

are differing degrees of IT maturity & spend

behaviour.

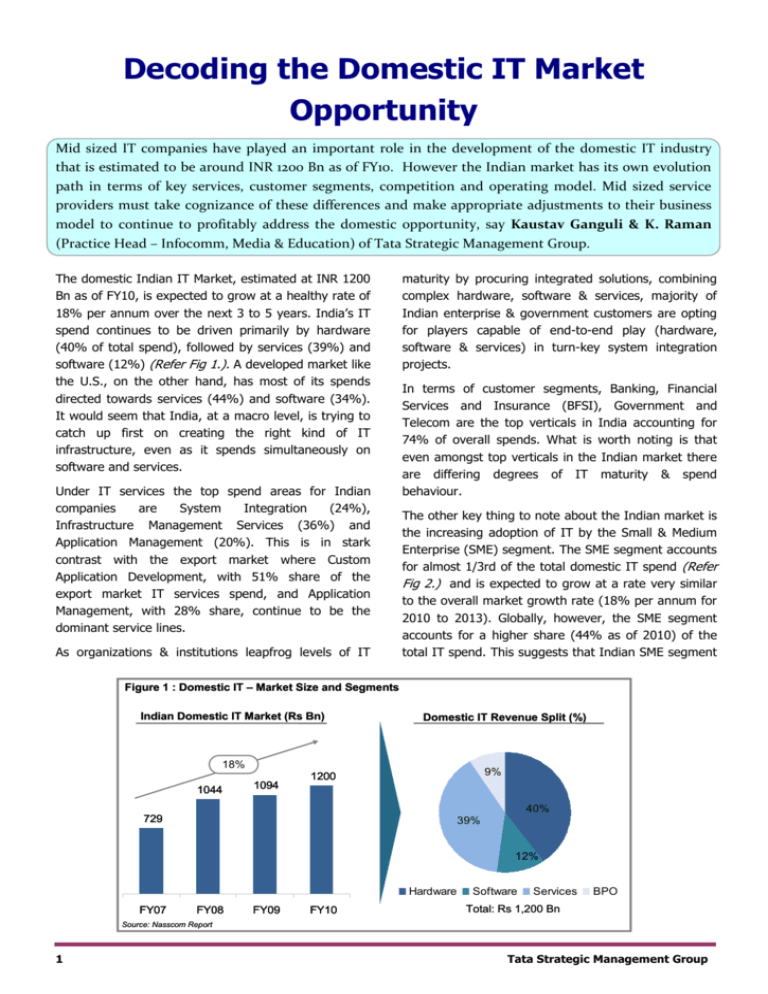

The other key thing to note about the Indian market is

the increasing adoption of IT by the Small & Medium

Enterprise (SME) segment. The SME segment accounts

for almost 1/3rd of the total domestic IT spend (Refer

Fig 2.) and is expected to grow at a rate very similar

to the overall market growth rate (18% per annum for

2010 to 2013). Globally, however, the SME segment

accounts for a higher share (44% as of 2010) of the

total IT spend. This suggests that Indian SME segment

Figure 1 : Domestic IT – Market Size and Segments

Indian Domestic IT Market (Rs Bn)

Domestic IT Revenue Split (%)

18%

1044

1094

9%

1200

40%

729

39%

12%

Hardware

FY07

FY08

FY09

FY10

Software

Services

BPO

Total: Rs 1,200 Bn

Source: Nasscom Report

1

Tata Strategic Management Group

Figure 2 : Domestic IT Spend By Company Size

Share of Domestic IT Spend by company size

Total: Rs 1,200 Bn (2010)

Share of Domestic IT Spend (Rs Bn)

2010

755

445

19%

44%

SMB

37%

14%

8%

66%

48%

Large

63%

Large

Hardware

Software

SMB

Services

Source: Zinnov, Nasscom

spends on IT, while increasing at a fast clip, may still

have significant potential for further growth.

To sum up, the Indian market demands end to end

capabilities across various verticals and for different

levels of IT maturity. This offers a structural advantage

to large sized IT companies as they would typically

possess the breadth and depth of services to cater to

the different need types of verticals having differential

IT maturity.

However the Indian IT Market has traditionally not

been the focus of large Indian IT players. The top ten

listed IT players from India (in terms of annual

turnover) who account for 62% of industry’s exports

from India command only 23% of the domestic IT

market share. While the largest Indian IT companies

continue to focus on opportunities in foreign markets

the domestic market, at least in the immediate term,

offers an attractive opportunity to the small and midsized IT companies.

In order to address the opportunity effectively mid

sized companies need to develop capabilities to

address the unique needs of the Indian market.

Focus on Select Customer Segments

To get a higher return on resources deployed mid

sized companies need to have a sharp focus on the

customer segments they would like to cater to. The

customer segmentation may have to go beyond

traditional industry verticals and focus on specific subverticals or organization sizes (by employees or by

annual turnover) within such sub-verticals. This is

because different verticals and different sizes of

companies within such verticals are in different stages

of IT evolution and would have different needs to be

catered to. For example if a company wants to focus

on the government sector it may need to go further

and also make decisions on the type of projects, the

2

states it wants to focus on, the target agencies &

entities in the government and also the offerings for

the sector.

Alliance Strategy for Missing Capabilities

As majority organizations in the domestic market

prefer end-to-end solutions, mid sized companies in

the short term will need to create effective

partnerships to take care of missing capabilities. These

companies would also need to acknowledge and

accept that their roles could be varied depending on

the opportunity. For example, the mid sized companies

could play the role of service providers to other IT

companies in some cases and address the needs of the

end customer in others. Such complex relationships

would mean that companies must have a clear idea of

the alliance & partnership strategy they need to adopt.

Innovations on Delivery

In order to protect margins and ensure profitability

companies will need to innovate on delivery models.

The innovations need to ensure that common process,

platform, human resources and infrastructure are

leveraged for multiple customers. One of the best

examples of delivery innovation in Indian IT has been

in the Managed Services space. Here, companies have

leveraged their expertise in Remote Infrastructure

Management (RIM) to drive down delivery costs and

boost margins. The model banks on greater sweating

of centralized technology and human resources in a

shared services model for multiple customers. Given

the lower price points in the domestic market, service

providers will have to work on such innovative delivery

models for higher profitability.

Talent Management Strategy

The other factor that would decide the relative success

of companies in the domestic market is in the realms

Tata Strategic Management Group

of talent acquisition, management and retention. IT

companies are fast realizing the fact that value in

customer engagements get driven by employees

engaging with customers and not in back-offices.

Hence there is an increasing focus on developing a

holistic strategy towards attracting high-quality talent,

engaging & motivating them, and ensuring higher

returns on investment in such talent by retaining them.

Innovations on Pricing Models

In more cases than not, Indian Enterprise Customers,

especially those amongst SMEs, find it difficult to make

significant one-time investments in upgrading their IT

infrastructure or applications portfolio. Our analysis

shows that an average medium sized Indian enterprise

with an employee size of ~300 has an annual IT

budget in the vicinity of Rs. ~42 Lakhs – this obviously

places constraints on the extent of one time capital

investments that such a company can make towards

IT upgrades. This underlines the need for opex-based

or ‘pay per use’ pricing model in the Indian market.

Needless to say – such migrations in pricing models

need to go hand-in-hand with changes in the delivery

architecture as well. The other emerging trend in

pricing models is with regards to increasing usage of

performance-based or outcome-based pricing –

especially in the area of IT services. Service providers

need to be alive to such new customer requirements

with respect to pricing and effect appropriate changes

in offerings & delivery.

Learnings from Successful Companies

The success stories of the largest Indian IT companies

focused primarily on international markets are wellchronicled. However, in the domestic market we also

find examples of medium or small sized companies

that have grown successfully by making strategic

choices in some of the aforementioned factors. Apart

from clearly identifying and implementing a go-tomarket approach for select customer segments, many

of these companies have relied on effective

partnerships, innovations on delivery & pricing, and a

holistic talent management strategy for their growth.

For example, Allied Digital and Glodyne are two

examples of companies who have derived majority

(94%: Allied; 75%: Glodyne as of 2009) of their

revenues from the domestic market. One thing that

clearly marks out these companies is how they

effectively leveraged implementation partnerships with

other IT majors for initial entry and ramp-up in their

identified customer segments. As far as innovation in

delivery model is concerned, one of the most

3

successful examples is found in the Managed Services

space where leading service providers like HCL &

others like Allied Digital and Glodyne pioneered the

concept of Remote Infrastructure Management (RIM)

to cut down delivery costs and boost margins. The

other noteworthy example of delivery model innovation

is unfolding in the SME space in the domestic market.

Here, some mid sized companies like Ramco Systems

are offering cloud based services on a ‘pay per use’

model to its customers and others have started

offering services in cloud consulting & integration.

Though most IT companies in India are yet to adopt a

comprehensive talent management strategy, the seeds

of change in this area had perhaps been sown by HCL

in 2005 when it announced its ‘Employees First,

Customers Second’ (EFCS) policy. The EFCS is based

on the five pillars of employee empowerment,

transformation, recognition, knowledge & support and

endeavours to drive a unique employee organization

thriving on a value-driven culture.

Strategic Imperatives for Domestic Market Play

It is clearly evident that the domestic market has very

unique characteristics in its IT needs and spend

behaviour. Companies which are looking to serve this

fast-growing and attractive market have to make

strategic choices primarily in two aspects. These two

aspects are:

1. Where to compete: This would involve decisions on

offerings & market segments (verticals / subverticals, enterprise sizes, geographies, MNC /

Indian, public / private etc.)

2. How to compete: This would mean identifying

innovations in delivery & pricing models, entering

into effective partnerships, and adopting long-term

initiatives to ensure higher returns on talent.

Companies need to conduct critical analyses of the

strategic options under each of these two aspects and

institute an implementation program for the identified

strategic choices to maximize their chances of

sustainable growth in the domestic market. Firms that

do this quickly can seize the advantage and emerge as

the next generation of success stories in the Indian IT

sector.

© Tata Strategic Management Group. All rights reserved

Tata Strategic Management Group

About Tata Strategic:

Tata Strategic Management Group is the largest Indian Owned Management Consulting Firm. Set up in

1991, Tata Strategic has completed over 500 engagements with more than 100 Clients across countries

and industry sectors, addressing the business concerns of the top management. Today more than half

the revenue of Tata Strategic Management Group comes from working with companies outside the Tata

Group. We enhance client value by providing creative strategy advice, developing innovative solutions

and partnering effective implementation.

Our Offerings

Strategy

Set Direction

•

•

•

•

Organization Effectiveness

Drive Strategic

Initiatives

Support

Implementation

•

•

•

•

India Entry

Alliance & Acquisition Planning

Strategic due diligence

Scenario Planning

Marketing

Operations

Vision

Market insights : B2B, Urban, Rural

Competitive Strategy

Growth/Business Plans

• Organization Structure

Roles & Decision rules

• Workforce Productivity

• Performance Management

& Rewards

• Capability Assessment

• Talent Management

• Governance for family

businesses

• Delegation & MIS

•

•

•

•

•

•

Cust. Segmentation

Product Innovation

Market Share

Route-to-Market

Brand Strategy

Structured Sales &

Distribution

• Marketing Upgradation

•

•

•

•

•

•

•

Manufacturing Strategy

Service levels

Managing Complexity

Logistics & Supply Chain

Throughput enhancement

Capital Productivity

Strategic sourcing

• Program Management

• Refinements/Course Corrections

About the Author:

K. Raman is the Practice Head of the Infocomm, Media & Education Practice at Tata Strategic Management

Group. He has worked with various organizations in sectors undergoing rapid transformation like IT, Telecom

and Education, helping them identify key shifts in markets and dimensioning the impact of such changes. In

the IT sector he is involved with various mid-sized companies advising them on business model changes

required for sustaining and accelerating growth.

Kaustav Ganguli is the Engagement Manager with Tata Strategic Management Group’s Infocomm, Media &

Education practice. He has significant experience in providing advisory services on strategic issues to

organizations both in India and abroad. He has had functional and consulting experience in IT / ITeS sectors

and has provided strategic advice on issues related to growth, business model & profitability to several

organizations in the Indian IT & ITeS sectors.

Nirmal, 18th Floor, Nariman Point, Mumbai 400021, India

Tel 91-22-66376712 Fax 91-22-66376600

url: www.tsmg.com email: raman.kalyanakrishnan@tsmg.com