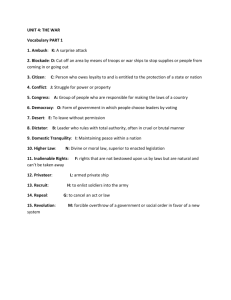

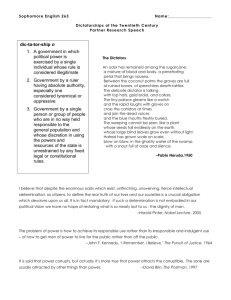

EnlightenedRuleandTy..

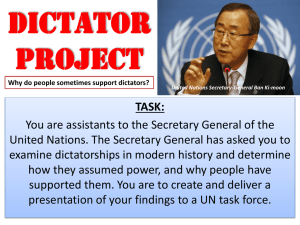

advertisement