Unit 1

advertisement

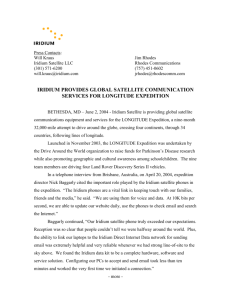

Unit 1 Problem Set Solutions Question: Describe the key differences between Iridium and Globalstar focusing on the system architecture and technology on the one hand and on the business model on the other hand. Answer: Iridium is a lower altitude higher capacity system. Iridium possesses intersatellite links (ISL) that allows it to route calls using multiple nodes. Globalstar is essentially a “bent-pipe” architecture. Iridium was conceived as an end-to-end service provider, where the ground stations (gateways) were to be owned and operated by Iridium (in conjunction with regional partners). Globalstar on the other hand would not own individual ground stations, but rather have local providers according to a “franchise” model. Unit1_solution The November 1999 edition of Bloomberg magazine contained an article entitled “The Milking of Iridium”. This article stated in part: There are many reasons Iridium failed economically. The company had bulky telephones that weighed as much as one pound, cost as much as $3,000 and didn’t work well in buildings or cars. Iridium’s target market were international travelers who wanted to communicate with people in other countries from cars, airports and other open areas. Anywhere meant any location on the globe, not anywhere on the globe from inside a building. What was unanticipated was that international business travelers would simply buy two or three $100-class terrestrial cellular phones and pull out the appropriate one when emerging from the airport in Paris, Tokyo or New York – a much cheaper proposition than an expensive and relatively bulky $3,000 phone.. Cellular phones had become a commodity, to be replaced and tossed away every 12-18 months. This was wholly unanticipated in 1991, when Motorola first committed to the project. Testing phase insufficient. Software had twenty million lines of code. What may have doomed Iridium, however, where the multiple, and often conflicting, roles played by Motorola. July 1, 2000 post-mortem analysis in Marketing Management December 12,2000 AP – sale of Iridium Most revealing is perhaps the following statement of an unnamed high level Iridium employee in Research, Planning and Market Strategy: “Iridium’s original market research was conducted before wireless technology was widely available. By the time Iridium launched its commercial service, the customer base from its original research had significantly decreased because wireless communications were now widely available in populated areas.” At the time Iridium was conceived, cellular or mobile phones were of limited use when users crossed international borders. Europe, for example, had many different mobile standards, which meant a German phone would usually not work in France or Italy. Motorola’s management saw immense opportunity in creating a global wireless service with a single protocol and predicted a market of 12 million satellite phone users by 2002 and a 40% market share for Iridium. The company also predicted 100 million cellular terrestrial cellular phone users by 2000. While Iridium had an 18 month lead over its closest mobile satellite service (MSS) competitors such as Globalstar, Teledesic and ICO Global Communications this was not a major competitive advantage. The main problem was that the marketplace had been transformed by ground-based mobile networks that were rapidly exploiting new technologies and building scale throughout the 1990’s. Here was a major advantage of terrestrial networks compared to Iridium and its competitors: “staged deployment”. Terrestrial networks started offering limited coverage at first in urban, high-density and revenue generating areas as well as along major highways and traffic arteries. Rural areas were often not covered in the early to mid-1990’s but this did not seem to bother terrestrial cellular subscribers whose lives and needs were focused on large urban centers and the surrounding suburbs. Once significant revenues started to flow into the terrestrial cellular systems, a part of the proceeds were used to gradually expand coverage, robustify service and increase capacity on an “as-needed, as-afforded” basis. A key factor in the growth of wireless phones was the adoption of a single standard, known as GSM, in Europe and parts of Asia. By January 2000 there were more than 450 million cellular subscribers worldwide (including GSM). According to some observers, the rapid evolution to a single European standard took Motorola by surprise, even though Iridium incorporated a GSM-based dual use mode as an afterthought. The satellite constellations, on the other hand, did not have this luxury and were prefaced on an “all-or-nothing” approach. A partial coverage Iridium was never envisioned and would have been of even less value. Unit 4 discusses this aspect in more detail and presents ways in which market uncertainty and staged deployment might have been considered while architecting Iridium. The future: Satellite service providers such as Iridium entered the market as rivals and competitors to ground-based services. A new understand is emerging that satellite services are complementary to ground based networks. Focus on specialized markets such as oil rigs, fishing fleets, shipping, INMARSAT has an estimated customer base of 108,000 subscribers. From: DISCOVER Vol. 21 No. 10 (October 2000) Table of Contents Twenty of the Greatest Blunders in Science in the Last Twenty Years What were they thinking? By Judith Newman Earth to Iridium The award for "Most Expensive Piece of Immediately Obsolete Technology" goes to Iridium, a communications company that 10 years ago promised crystal-clear cellular phone service anywhere on the planet. Sixty-six satellites were launched at a cost of $5 billion. "The phones were bulky. They cost $3,000. A call cost several dollars per minute, and the system didn't work indoors," says Richard Kadrey, a founder of Dead Media Project, a Web-site collection of failed media and technology. "Most people simply don't need to call Dakar at a moment's notice. In fact, the number of people who do is so small that it is probably dwarfed by the number of people who really need to talk to aliens." In 1999, Iridium took its place among the 20 largest bankruptcies in history. Competition: Success of terrestrial networks – price of communications too high compared to terrestrial cellular service ? Fundamental problem is large time delay between conception and launch. This is true for many other systems as well. One way to deal with this is embedding flexibility into the system design, see Module 4. Handset: Too expensive and heavy Usability: Can’t use indoors System Introduction: Not sufficient testing, Availability of handsets, Marketing not set up for onslaught of inquiries Economic Instability: Asian crisis Marketing: No clear differentiation, target population unclear Why is there some success after September 11, 2002? Need for decentralized systems Clear niche customer markets are emerging: Journalists in Afghanistan, Military users in the field, emergency relief (police…)