One Afternoon at the United States International

advertisement

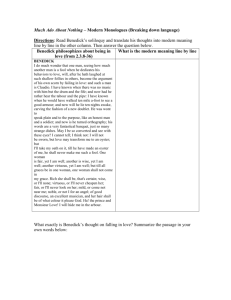

One Afternoon at the United States International Trade Commission SOURCE: Excerpts from the Official Transcript Proceedings before the U.S. International Trade Commission, meeting of the commission, June 12, 1985, Washington, DC. C hairwoman Stern: We turn now to investigation TA-201-55 regarding nonrubber footwear. Staff has assembled. Are there any questions? Vice Chairman Liebeler has a question. Please proceed. Vice Chairman Liebeler: My questions are for the Office of Economics, Mr. Benedick. Do foreign countries have a comparative advantage in producing footwear? Mr. Benedick: Yes, foreign producers generally have a comparative advantage vis-à-vis the domestic producers in producing footwear. Footwear production generally involves labor-intensive processes which favor the low-wage countries such as Taiwan, Korea, and Brazil, which are the three largest foreign suppliers by volume. For instance, the hourly rate for foreign footwear workers in these countries ranges from about one-twelfth to one-fourth of the rate for U.S. footwear workers. Vice Chairman Liebeler: Is it likely that this comparative advantage will shift in favor of the domestic industries over the next several years? Mr. Benedick: It is not very likely. There seems to be little evidence that supports this. The domestic industry’s generally poor productivity performance over the last several years, which includes the period 1977 to 1981, roughly corresponding to the period of OMAs (Orderly Marketing Arrangements) for Taiwan and Korea, suggests that U.S. producers must significantly increase their modernization efforts to reduce the competitive advantage of the imported footwear. Vice Chairman Liebeler: Have you calculated the benefits and costs of import relief using various assumptions about the responsiveness of supply and demand to changes in price? Mr. Benedick: Yes. On the benefit side, we estimated benefits of import restrictions to U.S. producers, which included both increased domestic production and higher domestic prices. We also estimated the terms of trade benefits resulting from import restrictions. These latter benefits result from an appreciation of the U.S. dollar as a result of the import restrictions. On the cost side, we estimated cost to consumers of the increase in average prices on total footwear purchases under the import restrictions and the consumer costs associated with the drop in total consumption due to the higher prices. Vice Chairman Liebeler: In your work, did you take into account any retaliation by our trading partners? Mr. Benedick: No. Vice Chairman Liebeler: What was the 1984 level of imports? Mr. Benedick: In 1984, imports of nonrubber footwear were approximately 726 million pairs. Vice Chairman Liebeler: If a six-hundred-million-pair quota were imposed, what would the effect on price of domestic and foreign shoes be, and what would the market share of imports be? Mr. Benedick: At your request, the Office of Economics estimated the effects of the six-hundredmillion-pair quota. We estimate that prices of domestic footwear would increase by about 11 percent and prices of imported footwear would increase by about 19 percent. The import share, however, would drop to about 59 percent of the market in the first year of the quota. Vice Chairman Liebeler: What would aggregate cost to consumers be of that kind of quota? Mr. Benedick: Total consumer cost would approach $1.3 billion in each year of such a quota. Vice Chairman Liebeler: What would be the benefit to the domestic industry of this quota? Mr. Benedick: Domestic footwear production would increase from about 299 million pairs for 1984 to about 367 million pairs, or by about 23 percent. Domestic sales would increase from about $3.8 billion to about $5.2 billion, an increase of about 37 percent. Vice Chairman Liebeler: How many jobs would be saved? Mr. Benedick: As a result of this quota, domestic employment would rise by about 26,000 workers over the 1984 level. Vice Chairman Liebeler: What is the average paid to those workers? Mr. Benedick: Based on questionnaire responses, each worker would earn approximately $11,900 per year in wages and another $2,100 in fringe benefits, for a total of about $14,000 per year Vice Chairman Liebeler: So what then would be the cost to consumers of each of these $14,000-a-year jobs? Mr. Benedick: It would cost consumers approximately $49,800 annually for each of these jobs. Vice Chairman Liebeler: Thank you very much, Mr. Benedick. Commissioner Eckes: I have a question for the General Counsel’s Representative. I heard an interesting phrase a few moments ago, “comparative advantage.” I don’t recall seeing that phrase in Section 201. Could you tell me whether it is there and whether it is defined? Ms. Jacobs: It is not. Chairwoman Stern: I would like to ask about cost/ benefit analysis. Perhaps the General Counsel’s Office again might be the best place to direct this question. It is my understanding that the purpose of Section 201 is to determine whether a domestic industry is being injured, the requisite level for requisite reasons, imports being at least as important a cause of the serious injury as any other cause, and then to recommend a remedy which we are given kind of a short menu to select from to remedy the industry’s serious injury. Are we to take into account the impact on the consumer? Are we to do a cost/benefit analysis when coming up with the remedy which best relieves the domestic industry’s serious injury? Ms. Jacobs: As the law currently stands, it is the responsibility of the commission to determine that relief which is a duty or import restriction which is necessary to prevent or remedy the injury that the commission has determined to exist. The president is to weigh such considerations as consumer impact, etc. The commission is not necessarily responsible for doing that. Of course, the commission may want to realize that, knowing the president is going to consider those factors, they might want to also consider them, but in fact, that is not the responsibility of the commission. It is the responsibility of the commission only to determine that relief which is necessary to remedy the injury they have found. Chairwoman Stern: I can understand our reporting to the president other materials which aren’t part of our consideration but nevertheless necessary for the president in his consideration, but having that information and providing it to the president is different from its being part of the commission’s consideration in its recommendations. Ms. Jacobs: That’s right. Your roles are quite different in that respect. Vice Chairman Liebeler: Nations will and should specialize in production of those commodities in which they have a comparative advantage. Fortunately, our country has a large capital stock which tends to provide labor with many productive employments. Our comparative advantage is in the production of goods that use a high ratio of capital to labor. Shoes, however, are produced with a low ratio of capital to labor. Therefore, American footwear cannot be produced as cheaply as foreign footwear. The availability of inexpensive imports permits consumers to purchase less expensive shoes and it allows the valuable capital and labor used in this footwear industry to shift to more productive pursuits. This situation is not unique to the footwear industry. The classic example is agriculture, where the share of the labor force engaged in farming declined from 50 percent to 3 percent over the last 100 years. This shift did not produce a 47 percent unemployment rate. It freed that labor to produce cars, housing, and computers. The decline of the American footwear industry is part of this dynamic process. This process is sometimes very painful. Congress, by only providing for temporary relief, has recognized that our continued prosperity depends on our willingness to accept such adjustments. The industry has sought this so-called temporary import relief before. The ITC has conducted approximately 170 investigations relating to this industry. This is the fourth footwear case under Section 201, and so far the industry has gotten relief twice. The 1975 petition resulted in adjustment assistance. The 1976 case resulted in orderly marketing agreements with Taiwan and Korea. In spite of the efforts of the domestic industry to suppress imports, the industry has been shrinking. Between 1981 and 1984, 207 plants closed; 94 of these closings occurred just last year. The closing of unprofitable plants is a necessary adjustment. Import relief at this stage will retard this process and encourage entry into a dying industry. Because there is no temporary trade restriction that would facilitate the industry’s adjustment to foreign competition, I cannot recommend any import barrier. Chairwoman Stern: The intent of the General Import Relief law is to allow a seriously injured industry to adjust to global competition. The commission must devise a remedy which corresponds to the industry and the market forces it must face. No other manufacturing sector of our economy faces stiffer competition from abroad than the U.S. shoe industry. Imports have captured three-fourths of our market. No relief program can change the basic conditions of competition that this industry must ultimately face on its own. The best that we as a commission can do—and under Section 201 that the president can do—is to give the industry a short, predictable period of relief to allow both large and small firms to adjust, coexist, and hopefully prosper. I am proposing to the president an overall quota on imports of 474 million pairs of shoes in the first year. Shoes with a customs value below $2.50 would not be subject to this quota. The relief would extend for a full five years. Commissioner Lodwick: Section 201 is designed to afford the domestic industry a temporary respite in order to assist it making an orderly adjustment to import competition. The fact that the law limits import relief to an initial period of up to five years, to be phased down after three years to the extent feasible, indicates that Congress did not intend domestic producers to find permanent shelter from import competition under the statute. Accordingly, I intend to recommend to the president a five-year quota plan which affords the domestic nonrubber footwear industry ample opportunity to implement feasible adjustment plans which will facilitate, as the case may be, either the orderly transfer of resources to alternative uses or adjustments to new conditions of competition. Commissioner Rohr: In making my recommendation, I emphasize the two responsibilities which are placed on the commission by statute. First, it must provide a remedy which it believes will effectively remedy the injury which is found to exist. Secondly, Congress has stated that we, as commissioners, should attempt, to the extent possible, to develop a remedy that can be recommended to the president by a majority of the commission. I have taken seriously my obligation to attempt to fashion a remedy with which at least a majority of my colleagues can agree. Such remedy is a compromise. I am concurring in the remedy proposal which is being presented today by a majority of the commission. This majority recommendation provides for an overall limit on imports of 474 million pairs; an exclusion from such limitation of shoes entering the United States with a value of less than $2.50 per pair; a growth in such limitation over a five-year period of 0 percent, 3 percent, and 9 percent; and the sale of import licenses through an auctioning system. Commissioner Eckes: It is my understanding that a majority of the commission has agreed on these points. I subscribe to that and will provide a complete description of my views in my report to the president. QUESTIONS FOR DISCUSSION 1. What are your views of the ITC recommendation? 2. Should the principle of comparative advantage always dictate trade flows? 3. Why are the consumer costs of quotas so often neglected? 4. Discuss alternative solutions to the problem. 5. How would you structure a “temporary relief program”? job displacement