Problems:

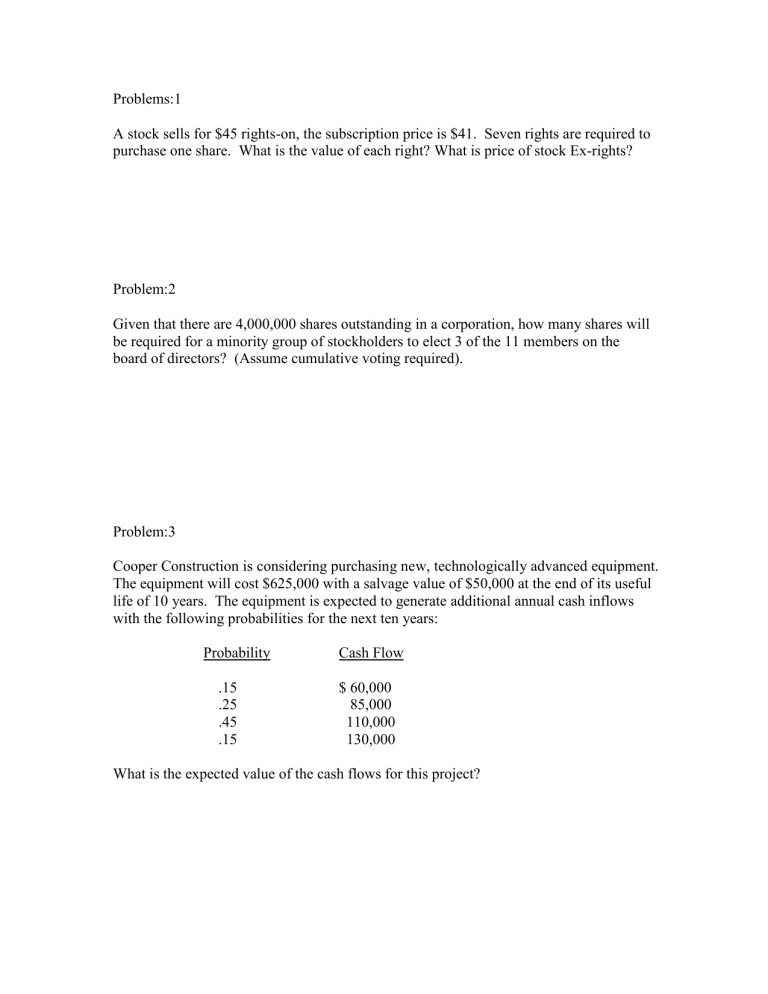

Problems:1

A stock sells for $45 rights-on, the subscription price is $41. Seven rights are required to purchase one share. What is the value of each right? What is price of stock Ex-rights?

Problem:2

Given that there are 4,000,000 shares outstanding in a corporation, how many shares will be required for a minority group of stockholders to elect 3 of the 11 members on the board of directors? (Assume cumulative voting required).

Problem:3

Cooper Construction is considering purchasing new, technologically advanced equipment.

The equipment will cost $625,000 with a salvage value of $50,000 at the end of its useful life of 10 years. The equipment is expected to generate additional annual cash inflows with the following probabilities for the next ten years:

Probability Cash Flow

.15

.25

.45

.15

$ 60,000

85,000

110,000

130,000

What is the expected value of the cash flows for this project?

Problem: 4

Bill Broodiest, star quarterback for the Spring Bay Smashers, would like to invest a small portion of his earnings in the stock of one of a few firms. His estimates of dividends and the probabilities of their occurrence follow:

Galaxy Communications

Probability Dividend

Breathiest Electronics

Probability Dividend

.2

.4

.4

.2

$ 0

700

800 .4

900

.1

.2

.2

.1

$ 500

700

900

1,100

1,200

Put answers below; provide work on next page.

A) : What is the expected value for each investment?

B) : What is the standard deviation and coefficient of variation for each?

C) : If a third investment, with an expected value of $930 and a standard deviation of $200.25 existed, which of the THREE investments should Broodiest choose?

Problem:5

A investor must choose between two bonds, assume Par=1000

Bond A pays 80 annual dividend and has market value of 800, it has 10 years to maturity

Bond B pays 85 annual dividend and has market value of 900, it has 2 years to maturity

A, What is current yield on both bonds

B, Which bond should you select according to answer A

C, What is Yield to Maturity on Both bonds

D, Based on C, which bond would you select?

Problem 6.

Suppose a French Franc is selling for $.1286 and a Maltese Lira is selling for $2.1372,

What is exchange rate(cross rate) of the French Franc to the Maltese Lira. That is, how many French Francs are equal to a Maltese Lira?.

Problem 1. answer= .50, Price Ex-rights=44.50

Problem 2. Answer= 1,000,001 shares

Problem 3. Answer =99,250

Problem 4. Answer A=Galaxy 780, Breathiest 890

Answer B=Galaxy .46, Breathiest .23

Answer C=Third Inv CV=.2153 (Galaxy CV=.46, Breathiest CV=.23, and option 3

CV=.2153)

Problem 5A, Bond A 10% current yield, Bond B 9.44% current yield

Part B, choose A

Part C, Bond A approx Yield 11.36%, Bond B approx Yield 14.36%

Part D choose bond B

Problem 6, Answer 16.62

Extra Credit Lease

Lease Problems

Problem 1

United Airlines is leasing a 10,000,000 plane from Boeing. The lease is 10 years paid annually with a residual of 50%. Boeing is will to give UAL a special lease rate of 3% if it’s an open lease, but if UAL wants a closed end lease the rate is 5%. What is the residual and payments on both the open end and closed end lease.

Problem 2

You’re considering a new car lease. The cap cost is 20,000, the residual is 70%, the rate is a special 3% for a 36 month(3year) lease. What is the residual and payment.

Problem 3

A corporation is considering leasing new equipment, the cap cost is 1,000,000, and the lease would be 7 years paid monthly, with a residual of 10% and interest rate of 6%.

What is the residual value and payments.

Why would a corporation prefer a lease to a purchase??

Answer Problem 1, Residual=5million, Payment open end=719,080.71, payment closed end=866,688.58

Answer Problem 2, Residual=14,000, Payment=209.05

Answer Problem 3, Residual=100,000, Payments=13582.29

Answer problem 4, refer to your notes and chapter 16, page 485