Paper #4 - New England Complex Systems Institute

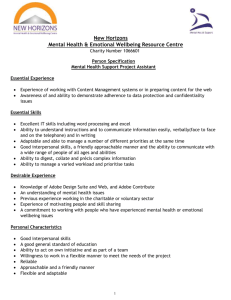

advertisement