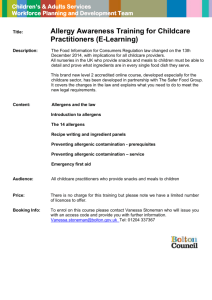

Imagine Co-operative Childcare – Childcare Vouchers

advertisement

IMAGINE CHILDCARE VOUCHER & SALARY SACRIFICE SCHEME for THE UNIVERSITY OF STIRLING Imagine Co-operative Childcare – Childcare Vouchers We are very keen to help all of our working parents with their childcare requirements and due to new government legislation, we have implemented a childcare vouchers salary sacrifice scheme so that you can benefit financially from the income tax and National Insurance Contribution exemptions available from the 6th April 2005. These exemptions will allow you to save up to £1,066 per year on the cost of your childcare (depending on the level of income tax and National Insurance Contributions you currently pay). You will have the opportunity to swap or “sacrifice” some of your gross income for childcare credit in a special childcare account held with our chosen provider, Imagine Co-operative Childcare. Because this credit is coming from your gross pay, essentially you are using some of your income tax and National Insurance Contributions to meet some of your childcare costs – this is where you make the savings. You can opt to sacrifice up to a maximum of £56 per week (£243 per month or £2,600 per year) for the whole year. Should you decide to take the maximum, you will save up to £1066 annually on the cost of your childcare. The scheme is very easy to operate. You are able to access your Imagine... account 24/7 via the Internet or telephone and authorise Imagine... to make a direct payment to your childcare provider’s bank account. Queries with the scheme should initially be addressed to Imagine. What is Salary Sacrifice? Salary Sacrifice is a fixed arrangement between you and us, as your employer, whereby you agree to “sacrifice”, or exchange, part of your income for a nominated benefit – In this case, credit in your own Imagine... childcare account. The amount that you receive through this sacrifice should stay constant unless you experience a significant “lifestyle change” – This is defined as any significant changes in your employment situation or your childcare requirements that would mean that you either need to change the benefit amount you receive or come out of the scheme altogether. Any such changes will need to be agreed between you and us in writing in order to comply with government legislation. In line with the new government legislation, you will be able to sacrifice up to £56 per week (£243 per month) from your gross income and in exchange will receive up to £56 per week (£243 per month) in Imagine... childcare credit. There is no charge to either you or your chosen carer(s) for participating in the scheme. We, as your employer, save our Employer’s National Insurance Contributions on whatever you decide to “sacrifice”. These savings allow us to pay Imagine… for administering the scheme, so there is no real cost to us as the employer. http://www.hmrc.gov.uk/manuals/eimanual/EIM42774.htm How does the Imagine... system work? Once you have completed the relevant forms and submitted them to the University, we place an order with Imagine on your behalf. They will use the information you have provided to ensure that your chosen childcare provider is registered or approved, and therefore eligible to receive your childcare payments. Imagine… will not pay any carer who is not registered or approved as this contravenes Inland Revenue legislation. If you are accepted for the scheme, you will receive all of the relevant system instructions through the post in order to access your Imagine… account – this information will include your unique account number and PIN. Your first deduction will take place in the month of your submission of the application form, provided that you submit the form to Anne Anderson by the 15th of the month or the last working day before. You will receive your benefit amount in your Imagine… account on the 28th of the month or the last working day before - Imagine… will credit your account with the full order amount. It is then up to you. You can use as little or as much of the credit as you like. You can access the account via the Internet or via free-phone telephone 24/7. To make a payment to your carer, you enter the amount you wish to pay (not more than is in your account), select your carer and authorise Imagine… to make a direct payment to your carer. Imagine… will initiate a bank transfer directly to your childcare providers bank account. There is also the facility within the Imagine… system to set up standing orders, so that if you have a regular payment to a childcare provider on a weekly or monthly cycle, you can automate the whole process. Stirling/Q&A 1 Instructions for Joining the Imagine… Scheme Once you have read all of the relevant information contained in this document and you wish to proceed with joining the scheme, you will be required to sign an amendment to your terms and conditions of employment. This makes your “sacrifice” legal from an Inland Revenue perspective and is essential in order for you to qualify for Income Tax and National Insurance Contributions exemptions. Before signing this document, speak with your carer(s) to ensure that they are happy to be paid by Imagine… Remember, there is no charge to them and the money goes directly into their bank account, in the same way that a direct debit from your bank account would. This application form is available in this pack. On the form you will be required to give full details of your monthly requirement in Childcare Vouchers (Maximum £243 per month/£56 per week). You will also need to give contact details for your nominated carer(s) so that Imagine… may contact them to provide further information on the system and register them to receive your payments. Once you have fully completed the form, you should return the signed form to Anne Anderson. Anne will use the information on the form to add you to the scheme and will provide Imagine with the necessary information to register your carer(s) for payment. Your gross salary will be reduced by the Childcare Vouchers amount you have asked for and you will receive the specified voucher amount from Imagine… in your Imagine… account Imagine… will immediately send you your access details, including your “User ID” and “PIN” and full instructions for accessing and using your Imagine… Childcare Vouchers account, both via the Internet and free-phone telephone. Your carer will also receive introductory information for the scheme. How much can I save? The amount that an individual can save is directly linked to their level of income, their rates of income tax and rate of National Insurance Contributions. Each employee is entitled to “sacrifice” up to £56 per week, provided that after their salary has been reduced, the level of salary is still above minimum wage. This is essential in order that you do not lose your entitlement to certain state benefits and is a prerequisite of joining the scheme. Should you decide to take the maximum value of £56 per week (£2,600 per year) as a “sacrifice” for this scheme, you will save up to £1,066 on the cost of your childcare. What’s the maximum value of Imagine... credit I can opt to receive? You are eligible to receive up to £56 per week (£243 per month) in the form of Imagine... childcare account credit. However, you must be in receipt of at least National Minimum Wage when the value of the credit has been taken from your original salary. Please refer to the savings calculator. This will enable you to work out what your savings will be through joining the schem e and also how much you are able to take, which is dependant on your level of earnings. National Minimum Wage is currently set at £5.05 per hour from 1 October 2005. You must earn at least this amount after the value of your Imagine… Childcare Vouchers amount has been deducted. Stirling/Q&A 2 Qualifying childcare provision in Scotland In Scotland, childcare vouchers attract tax and NI exemption (up to £56 per week), provided that the type of childcare used is registered. If the childcare is provided away from the child’s home, then it must be registered in Scotland for children up to and including 16 years. A registered childminder, nursery or childcare scheme is one that is registered in Scotland by the Scottish Commission for the Regulation for Care. Registered or approved childcare can include: Registered childminders, nurseries and play schemes Out-of-hours clubs on school premises run by a school or local authority Childcare schemes run by approved providers, for example, an out-of-hours scheme or a provider approved under a Ministry of Defence accreditation scheme Any childcare, including out-of-school care, regulated by the Care Commission Childcare given in the child’s own home by (or introduced through) childcare agencies including sitter services and nanny agencies, which must be registered (not a relative) Approved foster carers (the care must be for a child who is not the foster carer’s foster child) Qualifying childcare provision in England In England, childcare vouchers attract tax and NI exemption (up to £56 per week), provided that the type of childcare used is either registered or approved. If the childcare is provided away from the child’s home, then it must be registered in England for children up to and including 7 years. A registered childminder, nursery or childcare scheme is one that is registered in England by OFSTED or the Social Care Inspection Commission. Approved childcare in England is childcare approved by a body acting under the authority of the Secretary of State. Childcare providers who are eligible to apply for approval in England include: childminders who are not required to register, nannies or aupairs. Registered or approved childcare can include: Registered childminders, nurseries and play schemes Out-of-hours clubs on school premises run by a school or local authority Childcare schemes run by approved providers, for example, an out-of-hours scheme or a provider approved under a Ministry of Defence accreditation scheme Childcare given in the child’s own home by a person (not a relative even if approved or registered) approved to care for the child or children Childcare given away from the child’s own home by a person approved to care for the child or children aged 8 or over (If the carer is a relative, then they must also care for unrelated children to qualify) Childcare given in the child’s own home by a domiciliary worker or nurse from a registered agency who cares for the child or children (not a relative) Approved foster carers (the care must be for a child who is not the foster carer’s foster child) Qualifying ages for children in Scotland & England In Scotland and England, the child for whom the childcare voucher is provided must be a child of the employee or a child who lives with the employee and for whom he or she has parental responsibility. A child qualifies up to 1st September following their 15th birthday or the 1st September following their 16th birthday if he or she is disabled. The childcare used must be registered as specified. Stirling/Q&A 3 I don’t have fulltime childcare requirements; do I still qualify for this scheme? Yes, however, you will still be required to take a fixed sacrifice from your salary each pay period. These sacrificed earnings will build up in your Imagine... childcare account until such time as you need to pay your childcare provider. For example, you may use a summer holiday play scheme – A small deduction would come from your salary each pay period and would be credited to your Imagine... childcare account. When you need to pay for the play scheme, you simply access your Imagine... childcare account and authorise them to pay an amount that you choose to the provider of your choice. Imagine... will then, on your behalf, make a direct payment to your care provider’s bank account. This can be a very useful way to budget for your childcare as well as gaining a significant financial benefit through income tax and National Insurance Contributions savings. How does my carer get paid? You access your Imagine... childcare account via the Internet or telephone and authorise Imagine... to make a direct payment directly to your nominated childcare provider via bank transfer. When you initially join the scheme, you will be able to enter all of your carer’s details so that Imagine… are able to check that they are registered or approved as required and so that they can subsequently make payments to them upon your request. There is no charge to you or your carer for each transaction. You are able to set up new carers on the Imagine… system as and when you childcare provider changes. Can I pay more than one carer through the Imagine... system? Yes. Providing that all of the forms of childcare you employ qualify as registered or approved under the legislation for your country, then you can use as many childcare providers as you wish. This gives you the flexibility you need as the child/children get older and you have different childcare requirements. It can also be a useful way to budget for your childcare costs throughout the year. For example, if you only require childcare during holiday periods, you can set aside an amount of childcare credit from your salary and save up until you need to pay your childcare provider. You then simply access your account at this stage and authorise Imagine... to pay your childcare provider directly. Could my partner also enter into this scheme and make savings? Yes, the salary sacrifice scheme applies to individual earners, so if your partner works for the same organisation or another that offers a salary sacrifice scheme, then they can also save up to £1,066 per annum on the cost of your childcare – potentially doubling your savings. If your partner’s employer does not currently have a scheme like this in place and you would be interested in Imagine Co-operative Childcare approaching them directly, please contact Imagine... on the details below and they will be pleased to offer any assistance they can; Telephone: 0800 458 7929 Email: vouchers@imagine.coop Can I recover the outstanding balance in my Imagine …account should my childcare requirements cease? Yes, however, vouchers are valid for up to 5 years and can be used for a very wide range of approved childcare (viz. Approved nursery, crèche, after-school club, breakfast club, childminder and holiday play schemes.) The refund of any monies in your account will also be subject to Income Tax, National Insurance Contributions and a service charge made by Imagine (currently 4.7% of the balance). Therefore all refunds will need to come through payroll at which point all relevant charges will be collected. Imagine Co-operative Childcare cannot refund you directly. If you are leaving the University and have an outstanding balance in your Imagine…account, you can either retain your account until all of your funds have been used up paying for child care or you can request for a refund through payroll in the basis outlined above. You must apply for this refund prior to leaving the University in order that your P45 details are correct. Stirling/Q&A 4 I receive tax credits - What’s the effect on these if I decide to join the scheme? Tax credits will be affected in most cases should you decide to participate in a salary sacrifice scheme. However, it is difficult to give you a clear picture as to the precise affects that may occur, as tax credits are very different for each individual’s circumstances. The tax credit office are currently developing a calculator which will enable you to work out if you would be better off staying with your current tax credits or joining the salary sacrifice scheme for Imagine... childcare credit. As soon as this is made available, we will provide the necessary link so that you are able to check for your own personal circumstances. Until the calculator is created, what we are safely able to advise is that if your current childcare costs meet, or exceed, £2,600 per year, and you are currently in receipt of less than £800 in tax credit assistance annually, then you would receive greater fi nancial benefits by joining this salary sacrifice scheme. Should your tax credit assistance exceed £800 per year, we would advise that you contact the tax credit office and request that they perform some comparative calculations, so that you can see clearly which route will be most beneficial for your own circumstances. Tax Credits Help Line: 0845 300 3900 (Great Britain)/0845 603 2000 (Northern Ireland) http://www.inlandrevenue.gov.uk/specialist/salary_sacrifice.htm https://www.taxcredits.inlandrevenue.gov.uk/Qualify/WhatAreTaxCredits.aspx Will my other benefits (e.g. overtime, pension, share options, bonuses etc.) be affected if I decide to join the Imagine... scheme? All of your University benefits (Pension, Occupational Maternity Pay, overtime, bonuses etc.) will be based on your pre-sacrifice salary, so there will be no negative impact on these should you decide to join the Childcare Vouchers Scheme. Statutory Redundancy Pay (SRP), Sick Pay (SSP), Maternity Pay (SMP), Paternity Pay and Adoption Pay (SAP), State Pension All of these statutory payments apart from Paternity Pay can be slightly reduced by participating in a salary sacrifice scheme as they are calculated using your actual cash earnings. The effect, however is extremely minimal and the cash benefits you receive by participating in the scheme should far outweigh any effects on these state related benefits that you may receive in the future To avoid any negative impact on your SMP/SAP, you should come out of the salary sacrifice scheme 23 weeks prior to the expected week of childbirth/adoption. This is because your maternity/adoption pay is calculated over the 8 week period prior to the 15 week period before the expected week of childbirth/adoption. The effects should not be great, but it is worth reviewing if you become pregnant to see what is the best option for you. The State Pension consists of two pension elements. The first is the Basic Element. By entering into a salary sacrifice scheme for Childcare Vouchers, you must earn at least minimum wage in cash earnings to participate. This automatically preserves your entitlement to the Basic Element of the State Pension. The Second element of the State Pension is an adjusted amount depending on what you earn above minimum wage, known as the Additional State Pension or the State Second Pension. By entering into a salary sacrifice for Childcare Vouchers, your contributions towards the State Second Pension will be decreased for the duration of the time that you participate in the salary sacrifice due to the fact that your salary is seen to reduce for this period. Childcare Vouchers are not treated as a pension-able element of salary for the State Pension. You can get a pensions forecast by clicking on the link below. The effect on you State Second Pension pay out will be miniscule. If you are contracted out of the State Pension (i.e. in the University Pension scheme), then there will be no negative impact by entering into a salary sacrifice for Childcare Vouchers. For further information on other state benefits, you may find the links below useful. http://www.dwp.gov.uk/ http://www.dti.gov.uk/er/redundancy/payments-pl808.htm http://www.dwp.gov.uk/lifeevent/benefits/statutory_sick_pay.asp Stirling/Q&A 5 http://www.dwp.gov.uk/lifeevent/benefits/statutory_maternity_pay.asp http://www.dti.gov.uk/er/individual/adopt-pl515.htm http://www.dti.gov.uk/er/individual/paternity-pl514.htm http://www.thepensionservice.gov.uk/ http://www.thepensionservice.gov.uk/resource_centre/statepensionforecast.asp http://www.thepensionservice.gov.uk/pdf/pm/pm2apr04.pdf Further Information (Scotland) To find out if your child carer is registered contact: The Care Commission By phoning 01382 207 200 All childcare in Scotland listed under www.childcarelink.gov.uk is registered care. Further Information (England) To find out if your child carer is registered or approved contact: Office for Standards in Education (OfSted) By phoning 0845 601 4771 Or on the Internet at www.ofsted.gov.uk - quoting the Unique Reference (URN) for registered childcare. This number will appear on your child carer’s last registration certificate. Nestor Primecare Services Limited (responsible for approved childcare) By phoning 0845 7678 111 Stirling/Q&A 6