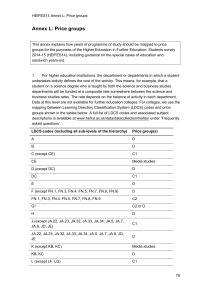

Multiple choice questions

advertisement