FINANCIAL ANALYSIS & MANAGEMENT

advertisement

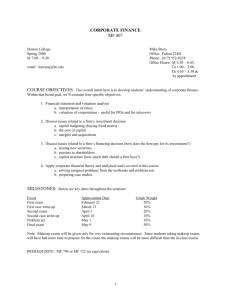

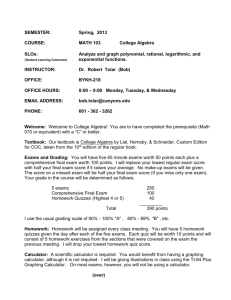

CORPORATE FINANCE MF 127 Boston College Spring 2000 Tu, Th 9:00 – 10:15; 3:00 – 4:15 Mike Barry Office: Fulton 224D Phone: (617) 552-0238 Office Hours: M 5:30 – 6:45, Tu 1:00 – 2:00, Th 4:30 – 5:30 & by appointment email: barrymj@bc.edu COURSE OBJECTIVES: The overall intent here is to develop students’ understanding of corporate finance. Within that broad goal, we’ll examine four specific objectives: 1. Financial statement analysis a. interpretation of ratios b. generating cash budgets c. preparing pro forma financial statements 2. Discuss issues related to a firm’s investment decision a. capital budgeting (buying fixed assets) b. the cost of capital c. mergers and acquisitions 3. Discuss issues related to a firm’s financing decision (how does the firm pay for its investments?) a. issuing new securities b. payouts to shareholders c. capital structure (how much debt should a firm have?) 4. Apply corporate financial theory and analytical tools covered in this course a. solving assigned problems from the textbooks and problem sets b. preparing case studies MILESTONES: Below are key dates throughout the semester: Event First Case write-up First exam Second Case write-up Second exam Problem set Final exam* Approximate Date Grade Weight February 17 10% February 29 20% March 23 10% April 13 20% April 27 10% May 6 (9:00 section; exam at 9:00) 30% May 10 (3:00 section; exam at 12:30) Notes: There will be a number of suggested problems drawn from the textbooks. While these won’t be graded, understanding how to solve the problems will be necessary to complete the case analyses and do well on the exams. If you can’t make it to an exam, you MUST provide me with either a note from the infirmary informing me you were too ill to take the exam or a similar note from the Dean in order to take a make-up exam. Note that make-up exams will likely be more difficult than the in-class exams. * You MUST take the final exam at the scheduled time. Please note this when making end of semester flight plans. PREREQUISITE: MF021 (Basic Finance) 1 Textbooks: 1. Ross, S.A, Westerfield, R.W. and J.F. Jaffe , Corporate Finance, 5th edition (Irwin/McGraw-Hill 1999). 2. Course pack of handouts available in the bookstore. Calculator: You will definitely need a calculator for this course. The calculator must be able to calculate the answer to yx such as (1.10434)1.222 . It also must be able to compute internal rates of return (IRR). It will make life easier if you buy a financial calculator. Many students in the past have bought the Sharp EL-733A. It costs about $30 at the BC bookstore or at Staples (or Service Merchandise). I’ve used the Hewlett-Packard (HP) 12-C since 1990. The HP 17BII is good, but more sophisticated than I (or likely you) need and is quite expensive. Whichever calculator you buy, IT’S YOUR RESPONSIBILITY TO LEARN HOW TO USE IT. Miscellaneous: 1. 2. While I don’t take attendance, you’ll probably find it helpful to make it to class. I don’t teach this course by following the textbooks verbatim. If you can’t make it to class, please be sure to get the notes from a classmate or from me. Caution: my lectures often contain explanations not spelled out explicitly in my notes. Your classmates probably have more written down than I have. 2 MF 127 COURSE OUTLINE Note: these dates are approximate. For exams, I’ll make it explicit what you are responsible for in class. Week of Topics and Assignments January 17 Ratio Analysis, Cash Budgeting Readings Chapter 2, Appendices 2A & 2B Jan. 24 and Jan. 31 Cash Budgeting (concluded), Pro Forma Statements Problems Supplementary Problems 4 – 6 Feb. 7 and Feb. 14 Capital Budgeting Case 1 Due February 17 Readings Problems Chapters 6 - 8 Supplementary Problems 7 – 16 Chapter 7, #s 6, 7, 9, 20, 27 Chapter 8, #s 13 and 14 February 21 Valuation February 28 Efficient Market Hypothesis Exam 1 February 29 Reading Chapter 13 March 6 No Class – Spring Break March 13 Security Issues Readings Problems March 20 Leasing Case 2 Due March 24 Reading Problems March 27 Chapter 24 Chapter 24, #s 3 and 9 Mergers and Acquisitions Reading Problems April 3 Chapters 14, 19 – 20 Chapter 19, #s 10 and 11 Chapter 30 Spreadsheet problem, parts (a) and (b) only (follows M&A lecture notes in course pack) Chapter 30, #s 8, 9, 11 Mergers and Acquisitions (concluded) 3 MF 127 COURSE OUTLINE (concluded) Week of Topics and Assignments April 10 Payouts to Shareholders Exam 2 April 13 Reading Chapter 18 April 17 and April 24 Payouts to Shareholders (concluded) Capital Structure and Cost of Capital No Class April 20 (Easter Break) Problem Set Due April 27 Readings Problems Chapters 15 – 17 Supplementary Problems 17 and 18 Chapter 15, #s 4, 7, 16, 20 Chapter 16, # 12 Chapter 17, #s 1, 5, 13 May 1 Class held on Tuesday, May 2 only. Final exam review. May 6 May 10 Final Exam (9:00 section at 9:00 a.m.) Final Exam (3:00 section at 12:30 p.m.) 4