DOC - Europa

advertisement

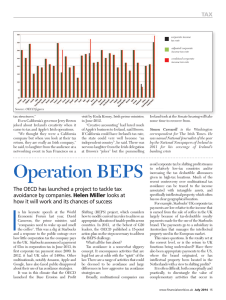

EUROPEAN COMMISSION PRESS RELEASE Brussels, 21 September 2014 Commissioner Šemeta welcomes G20 Finance Ministers' agreement on new measures to combat corporate tax avoidance EU Tax Commissioner Algirdas Šemeta has welcomed the package of measures to tackle international corporate tax avoidance, which was endorsed today by the G20 Finance Ministers in Cairns, Australia. The Ministers agreed on a first set of recommendations to address key areas in the OECD's Action Plan on Base Erosion and Profit Shifting (BEPS) which, once implemented, should ensure fairer taxation and fairer competition globally. The EU has been actively involved in the OECD's work on the BEPS Action Plan, while also pushing forward its own ambitious measures to fight tax avoidance in Europe. "The initiatives agreed at the G20 today are an important advance in creating a fairer, more appropriate corporate tax environment worldwide. They will thwart many of the aggressive tax practices that companies engage in today, and ensure a more level playing-field for businesses internationally. They will ensure that countries work together to protect tax bases, rather than tug against each other to the benefit of corporate tax dodgers." Commissioner Šemeta said. "However, today's commitments are just a first step – albeit an important one. There are many other important issues to be addressed before we have delivered upon the BEPS Action Plan. I would urge our international partners, together with the OECD, to keep their eye on the goal so that we meet the 2015 deadline foreseen. For our part, the EU will continue to be an active and constructive partner in the BEPS project, and will push for its swift and successful completion. The EU has always been the flag-bearer in the fight against tax avoidance, and we will continue to lead by example, in Europe and worldwide." Background The reports and recommendations agreed by G20 Finance Ministers today present a number of important solutions to the problem of international tax avoidance. These include measures against particular forms of aggressive tax planning (hybrid mismatch arrangements), steps to prevent tax treaty abuses and necessary revisions to international transfer pricing rules. Other crucial issues, such as tackling harmful tax practices linked to Intellectual Property regimes (e.g. Patent Boxes) and tax rulings, will be developed over the coming year. Answers to the challenges of taxing the digital economy also need to be found. At EU level, major steps have been taken to clamp down on corporate tax avoidance, which are both consistent with, and set the pace for, the international work in this area. Over the past year alone, measures have included: - Revising EU corporate tax rules: The revision of the Parent-Subsidiary Directive (see IP/13/1149) will prevent companies using mismatches in national tax regimes to evade IP/14/1024 taxes. Member States agreed on the measures to counter certain abusive tax practices (hybrid mismatches) in July 2014, and should agree on the anti-abuse provisions (to ensure taxation is based on actual economic activity) before the end of the year. - Addressing Digital Taxation: The Commission established an independent High Level Expert Group to examine the challenges and solutions to taxing the digital economy. The Group's report, presented in May 2014, will help guide future initiatives in this area at EU level (see IP/14/604). - Tackling harmful tax regimes: Whether through competition investigations into tax rulings (see IP/14/663) or scrutiny of Patent Boxes under the Code of Conduct on Harmful Business Taxation, the Commission has used every tool at its disposal to counter harmful tax regimes in Member States. Useful links For the fight against tax fraud and tax evasion at EU level, see: http://ec.europa.eu/taxation_customs/taxation/tax_fraud_evasion/index_en.htm Homepage of Commissioner Šemeta: http://ec.europa.eu/commission_2010-2014/semeta/index_en.htm Follow Commissioner Šemeta on Twitter: @ASemetaEU Contacts : Emer Traynor (+32 2 292 15 48) Franck Arrii (+32 2 297 22 21) For the public: Europe Direct by phone 00 800 6 7 8 9 10 11 or by e-mail 2