Examples of Incidental Fees that Align with the

advertisement

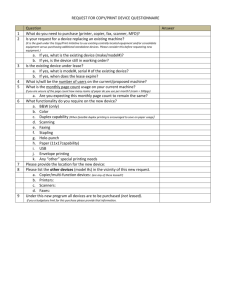

F10172 Examples of Incidental Student Fees and Charges that align with University Policy Cross Departmental/Faculty Issues: 1. Lecture Notes, Workbooks, Manuals Lecture notes/workbooks/manuals can be provided at a cost to students, in accordance with the Policy, on condition that: (i) At no time does the style and delivery of the lecture assume or depend on students having, in their possession, a copy of the printed lecture notes/workbook/manual in order to comprehend the lecture. (ii) Any detailed information contained in the lecture notes/workbook/manual (eg. diagrams, data sets, formulae, etc.) must either be: Provided as an overhead at the time, and for the duration, that it is required. Provided in hard copy, free of charge, at the time it is required. Provided by way of textbook reference, if research after the lecture is appropriate. Students should be made aware of these conditions and encouraged to provide feedback to the lecturers by way of SPOT, faculty curriculum meetings, etc. In addition, these principles should be applied to other relevant documentation. 2. Print Quotas - Provision of Free Printing Facilities (i) If a school/faculty requires students to provide their work in a printed format, then adequate free printing facilities must be made available. (ii) The cost of paper should be borne by students. Paper costs related to a thesis that will be retained by the University or an examiner should however, be borne by the faculty/school. (iii) This requirement is applicable to all students - undergraduate, honours, masters and PhD. 3. Thesis Printing and Binding Where printing and binding is a requirement of the University, any associated costs (paper, printing and binding) must be borne by the school/faculty. This applies to copies of theses of both a temporary or permanent nature for PhD, Masters by Research, Honours, etc. Paper and binding costs for a copy of a thesis, which will become the property of the student, is a cost borne by the student. More detailed information with regard to http://www.postgraduate.uwa.edu.au/page/41502 thesis production Source: Ancillary/Incidental Student Fees and Charges Regulating Committee Updated: November 2012 costs is available at: Page 1 F10172 4. Open Book Exams (i) If any exam instructs students to have a document (eg. book, statute, etc) available during the course of an exam, then the school/faculty must supply sufficient copies so that each student has one. (ii) If an exam permits students to have a document during the course of an exam, then the student is responsible for supplying, if they so wish, such documents. (iii) Deans are responsible for ensuring that each open book exam within their faculty is categorised as instructive or permissive and that such a decision is based on good teaching practices and equity for students. The above principles should also be applied to equipment required or permitted in an exam, the provision of which is not the responsibility of the student as deemed under the Policy. 5. Photocopying and Printing Costs The following principles with regard to photocopying and printing costs have been agreed: Establishment of a maximum rate for photocopying and printing is annually confirmed by the Incidental Student Fees and Charges Regulating Committee that can be levied on students by faculties, schools, libraries and other sections. Additional costs, levied by a non-academic unit (e.g. UniPrint, University Bookshop) in support of producing and selling the documents, are an acceptable cost that can be levied on students. Such additional costs might include or be affected by: the type of binding colour pages multi-coloured covers colour section dividers weight of dividers weight of paper for text size of print run cost of on-selling mark-up to cover wastage Charges which should not be costed into the final charge and thereby levied on students, but should be borne by the faculty/school include: scanning cleanup costs penalty photocopying rates for late submission of course readers photocopying costs for pages incorporated in the documents that ought to be provided free of charge (essential items), for example information on assessment, unit outlines, etc. 6. Textbooks The purchase of textbooks is an acceptable cost borne by students given that the purchase is optional as University practice requires that copies of the textbooks are available in the Library. Faculties and schools should be aware however that if the textbook is required at a certain time and place (for example computer laboratory), and the class cannot be understood without reference to the textbook, then the free option of reading the textbook in the Library is not valid. The purchase of the textbook then becomes an essential component of the course and either the textbook or the relevant sections will need to be provided by the faculty/school. Source: Ancillary/Incidental Student Fees and Charges Regulating Committee Updated: November 2012 Page 2 F10172 7. Provision of Calculators in Examinations Refer to University Policy on calculators approved for use in examinations (UP07/119) which deals with the type of calculators which can be used in examination venues. 8. Study Tours/Study Abroad Faculties/schools may charge students for goods or services which are a component of a course if students have the choice of acquiring the goods or services from suppliers other than the institution. Within this category, travel, food and accommodation associated with study tours and study abroad are accepted. However, it is also a requirement that faculties and schools keep these costs to a minimum wherever possible. 9. Accreditation/Registration Accreditation/Registration (provisional or not) fees are allowable if they continue or change into full registration upon graduation as they are viewed as necessary precursors that do go on to have value in use after graduation. When considering accreditation/registration charges, it is not necessary to take into account whether there exists a career pathway that doesn’t require the graduate to continue registration, thus making the initial, provisional registration of no value in use after graduation as the ultimate career choice of graduates is not a matter which can be taken into account for the purpose of levying this fee whilst students undertake placements in the course of their studies. 10. Third Party Fees Fees levied by a third party such as first aid certificates, criminal record checks, immunisation costs are acceptable charges. The third party fee does not need to demonstrate value in use after graduation and it can be ‘consumed’ during the course of study. Source: Ancillary/Incidental Student Fees and Charges Regulating Committee Updated: November 2012 Page 3