Financial Markets Essay Topics (Final) - Cal State LA

advertisement

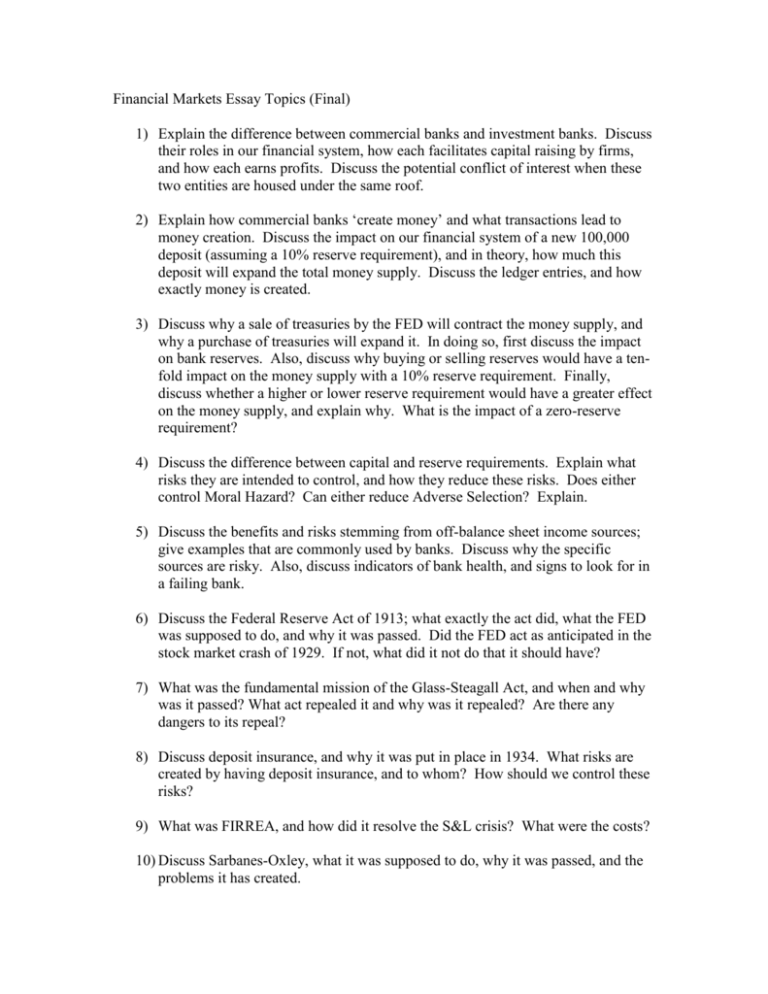

Financial Markets Essay Topics (Final) 1) Explain the difference between commercial banks and investment banks. Discuss their roles in our financial system, how each facilitates capital raising by firms, and how each earns profits. Discuss the potential conflict of interest when these two entities are housed under the same roof. 2) Explain how commercial banks ‘create money’ and what transactions lead to money creation. Discuss the impact on our financial system of a new 100,000 deposit (assuming a 10% reserve requirement), and in theory, how much this deposit will expand the total money supply. Discuss the ledger entries, and how exactly money is created. 3) Discuss why a sale of treasuries by the FED will contract the money supply, and why a purchase of treasuries will expand it. In doing so, first discuss the impact on bank reserves. Also, discuss why buying or selling reserves would have a tenfold impact on the money supply with a 10% reserve requirement. Finally, discuss whether a higher or lower reserve requirement would have a greater effect on the money supply, and explain why. What is the impact of a zero-reserve requirement? 4) Discuss the difference between capital and reserve requirements. Explain what risks they are intended to control, and how they reduce these risks. Does either control Moral Hazard? Can either reduce Adverse Selection? Explain. 5) Discuss the benefits and risks stemming from off-balance sheet income sources; give examples that are commonly used by banks. Discuss why the specific sources are risky. Also, discuss indicators of bank health, and signs to look for in a failing bank. 6) Discuss the Federal Reserve Act of 1913; what exactly the act did, what the FED was supposed to do, and why it was passed. Did the FED act as anticipated in the stock market crash of 1929. If not, what did it not do that it should have? 7) What was the fundamental mission of the Glass-Steagall Act, and when and why was it passed? What act repealed it and why was it repealed? Are there any dangers to its repeal? 8) Discuss deposit insurance, and why it was put in place in 1934. What risks are created by having deposit insurance, and to whom? How should we control these risks? 9) What was FIRREA, and how did it resolve the S&L crisis? What were the costs? 10) Discuss Sarbanes-Oxley, what it was supposed to do, why it was passed, and the problems it has created. 11) Discuss how banks are currently regulated, and identify the regulatory authorities. If different banks are regulated by different authorities, summarize who regulates what. 12) What is Universal Banking? 13) Discuss the differences between Mutual Banks, Credit Unions, and Savings and Loans, and how they differ from commercial banks. Discuss any special protections they have, why they exist, and how their health is measured. 14) Discuss how investment banks operate, how they function in our financial system, and how they earn money. Discuss I-banks add to the financial system in terms of services that they uniquely provide, and the importance of bank’s reputation to its survival. 15) Discuss the underwriting process, and the difference between negotiated and competitive sales. Under which type of sale is a financial advisor mandatory, and in that case, what is its role? Explain syndication, and why banks will form a syndicate. Also explain why banks prefer underwriting to financial advisory. 16) Explain what a prospectus is, what an offering memorandum is, and the information contained in the two documents. What is a red-herring? 17) Who are the major participants (players) in underwriting a financial issue, and what are their roles? How are they paid? 18) Discuss the major components of an I-bank, what operations are conducted in each, what services each component provides to our financial system, and how each earns fees. Discuss who works in each of these components. Discuss the difference between the underwriting and capital markets groups (both are crucial to the underwriting process, and divide under-writer fees). 19) Discuss what a mutual fund is and how it is structured. Discuss its role in our financial system, and who it primarily employs. Discuss what these people do. 20) Discuss what a hedge fund is, and how it earns profits. Explain what a marketneutral strategy is, and how it would be employed using two treasury bonds with a 120 month and 121 month maturities. 21) Explain how a venture capital firm operates, earns profits, and why an investment bank cannot replace it in our financial system. Explain why it is able to control Moral Hazard better than many other types of firms. How do these firms control for Adverse Selection? 22) Explain how finance companies operate, and how investment banks can conduct similar operations (structured product groups in I-banks effectively create the same product, and in-fact, are responsible for many of the CMO’s that have created problems). 23) Explain how insurance companies make money, why they are primary market participants, and how they control Moral Hazard and Adverse Selection. Explain what insurance is, the difference between “whole life” and “term”, and who regulates them. 24) Explain what a pension fund is, how it is similar to a mutual fund, the advantages it has over a mutual fund, and what an under-funded pension is. Explain the differences of under-funding pensions. Discuss the difference between a defined contribution and defined benefit. What will happen to pensions if GMAC and Ford go bankrupt? 25) Discuss the problems with Social Security, and potential corrections? 26) Discuss the Great Depression, the causes, and why it led to a collapse of our banking system. Explain what the FED did or did not do, and what it should have done. Explain how it destroyed our economy, and what we did to ensure it never would happen again. 27) What caused the S&L crisis in the 1980’s, and why were S&L’s going bankrupt? What did congress do that increased the severity of the crisis, and what action should congress have taken? 28) Discuss the Long Term Capital fiasco: how they were making money, what changed that led to the failure, and why their strategy failed. Explain the systemic risk created by LTC, why the FED intervened, and how the problem was solved. Discuss the similarity to the Orange County Investment Pool bankruptcy, four years earlier. Discuss what Too Big To Fail means. 29) Discuss the financial accounting scandals at ENRON, World Com, and Tyco. How did they differ, and how were they similar. Fundamentally, what did each scheme attempt to do (all had the same basic objectives)? How did we respond? 30) Discuss the difference between forwards, futures, and options. Which contract(s) fix the price of an asset in the future, and how is it done. Discuss exactly how each of these contracts works. How are futures and forwards quite similar? Which contract is most like an insurance policy, why? 31) Discuss the greatest danger to hedging with futures, and how firms have gone bankrupt using futures hedges. 32) Discuss what causes option premia to increase or decrease? Discuss how the strike affects the price of an option. If you’re hedging the value of your retirement portfolio, when would you be most likely to use options vice futures?