terms contract - Consumer Affairs Victoria

advertisement

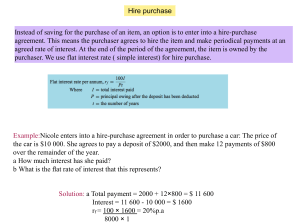

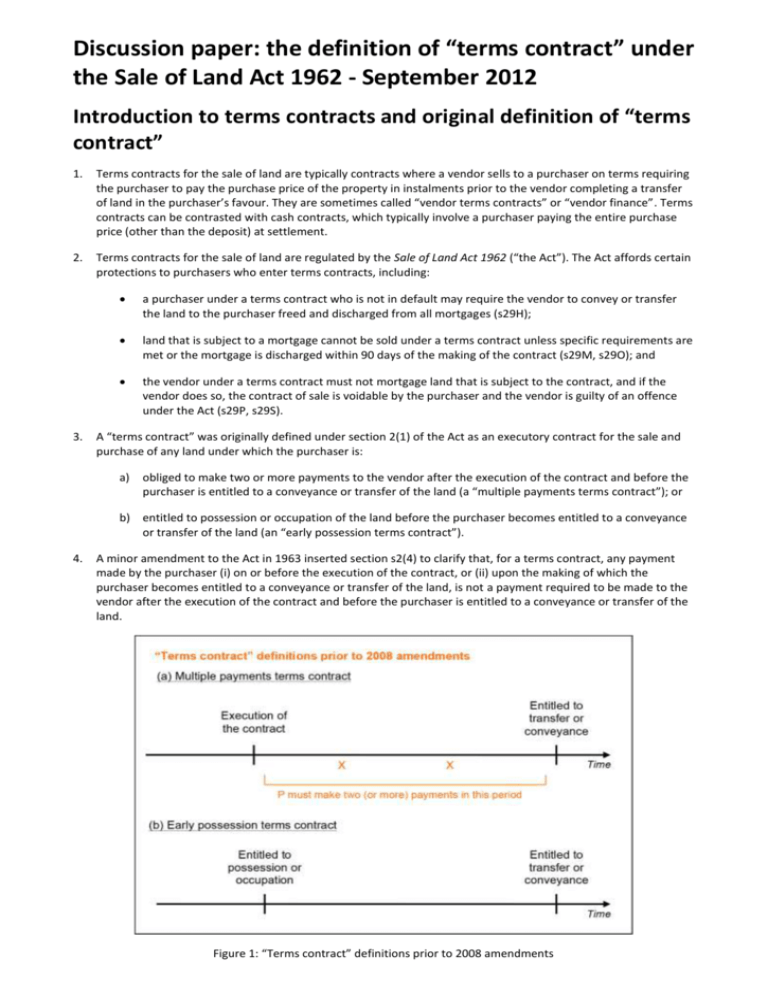

Discussion paper: the definition of “terms contract” under the Sale of Land Act 1962 - September 2012 Introduction to terms contracts and original definition of “terms contract” 1. Terms contracts for the sale of land are typically contracts where a vendor sells to a purchaser on terms requiring the purchaser to pay the purchase price of the property in instalments prior to the vendor completing a transfer of land in the purchaser’s favour. They are sometimes called “vendor terms contracts” or “vendor finance”. Terms contracts can be contrasted with cash contracts, which typically involve a purchaser paying the entire purchase price (other than the deposit) at settlement. 2. Terms contracts for the sale of land are regulated by the Sale of Land Act 1962 (“the Act”). The Act affords certain protections to purchasers who enter terms contracts, including: 3. a purchaser under a terms contract who is not in default may require the vendor to convey or transfer the land to the purchaser freed and discharged from all mortgages (s29H); land that is subject to a mortgage cannot be sold under a terms contract unless specific requirements are met or the mortgage is discharged within 90 days of the making of the contract (s29M, s29O); and the vendor under a terms contract must not mortgage land that is subject to the contract, and if the vendor does so, the contract of sale is voidable by the purchaser and the vendor is guilty of an offence under the Act (s29P, s29S). A “terms contract” was originally defined under section 2(1) of the Act as an executory contract for the sale and purchase of any land under which the purchaser is: a) obliged to make two or more payments to the vendor after the execution of the contract and before the purchaser is entitled to a conveyance or transfer of the land (a “multiple payments terms contract”); or b) entitled to possession or occupation of the land before the purchaser becomes entitled to a conveyance or transfer of the land (an “early possession terms contract”). 4. A minor amendment to the Act in 1963 inserted section s2(4) to clarify that, for a terms contract, any payment made by the purchaser (i) on or before the execution of the contract, or (ii) upon the making of which the purchaser becomes entitled to a conveyance or transfer of the land, is not a payment required to be made to the vendor after the execution of the contract and before the purchaser is entitled to a conveyance or transfer of the land. Figure 1: “Terms contract” definitions prior to 2008 amendments Current definition of “terms contract” 5. Following amendments to the Act in 2008 introduced by the Consumer Credit (Victoria) and Other Acts Amendment Act 2008, the definitions of both types of terms contracts were moved to new section 29A, and section 2(4) was repealed. 6. Section 29A now defines a multiple payments terms contract as an executory contract for the sale and purchase of any land under which the purchaser is “obliged to make two or more payments (other than a deposit or final payment) to the vendor after the execution of the contract and before the purchaser is entitled to a conveyance or transfer of the land”. For the purposes of the provision: 7. “deposit” is defined to mean “a payment made to the vendor before the purchaser becomes entitled to possession or to the receipt of rents and profits under the contract”; and “final payment” is defined to mean “a payment on the making of which the purchaser becomes entitled to a conveyance or transfer of the land”. The elements required for an early possession terms contract under section 29A remain unchanged from the previous definition. Fig. 2: “Terms contract” definitions following 2008 amendments Concerns with the current definition of “terms contract” 8. 9. Prior to the 2008 legislative amendments, the “two or more payments” to be made post-execution and pretransfer under a multiple payments terms contract could be made regardless of when the entitlement to possession or rents and profits arose. The section 29A definition of “deposit” now means that any payment made prior to the entitlement to possession or rents and profits arising constitutes part of the deposit, so the only multiple payments terms contracts currently regulated by the Act are ones where: the purchaser is obliged to make two or more payments to the vendor after the execution of the contract and before the purchaser is entitled to a conveyance or transfer of the land; and at least two of those payments occur after the entitlement to possession or rents and profits arises under the contract. If the entitlement to possession or rents and profits does not occur until later (i.e. at a point in time when the number of remaining payments to be made before final payment is either one or zero), the contract will not be a multiple payments terms contract under section 29A. Submissions 10. Consumer Affairs Victoria invites you to make written submissions, to be received no later than Monday, 15 October 2012, in relation to the following issues: a) whether there are material examples of multiple payments terms contracts in Victoria that would have been “terms contracts” under the previous wording of the Act but are now unprotected by the Act, accompanied by descriptions of any such transactions; b) the extent to which the consumer protection provisions of the National Credit Code apply to terms contracts; c) any amendments that you would propose to section 29A of the Act; and d) any other matters relevant to the definition of “terms contract” under the Act.