Price is an objective element of exchange, but Usunier argues in

advertisement

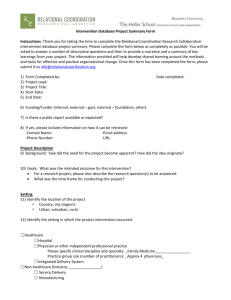

Marketing Across Cultures, chapter 11 The critical role of price in relational exchange The chapter focuses on one of the elements in the marketing mix, viz. price. Price is an objective element of exchange, but Usunier argues in chapter 11 that even a seemingly objective notion like ‘price’ has a subjective and perceptual side to it. In other words: price may be viewed as a signal conveying meaning. 1. Price as a signal conveying meaning NB. Do not use the singular of ‘goods’. Instead write ‘product’. When clearly displayed or announced, prices are not central to the relationship between a buyer and a seller. However, if not announced prices may stimulate contact . Usunier distinguishes between prices as ‘strictly economic’ and ‘relational’ (causing relationships to develop between the buyer and the seller). See table 11.1, p. 355 for an overview of meaning conveyed by prices through a number of situations. 1.1. Bargaining Terms: Oligopolistic distribution channels (distribution channels controlled by a limited number of giant companies, who compete). Bargaining is unheard of in a number of situations, such as at the checkout in a supermarket. This goes especially for consumer non-durables whereas it is much more common to bargain in the market for consumer durables such as equipment for firms and households. In developing countries bargaining is much more common in all markets. People bargain for survival, because they have enough time and for fun. There are many psychological elements in bargaining, which becomes a role play. Asking the price may indicate that you cannot afford the product. How are prices fixed? There are at least 4 elements present in prices: 1) the power of each party, 2) the degree of urgency on the part of the buyer or seller, 3) the importance of a buyer being able to show negotiation skills, 4) the social process in which the deal is negotiated (e.g. competitive bidding situations) 5) The scarcity of the product. 1 Marketing Across Cultures, chapter 11 The critical role of price in relational exchange Non-monetary price (Becker 1965) Consumers accept sacrifices when they buy a product. There is the objective price, which may be ‘more or less expensive’, but there is also the time spent in shopping, or the idea that home-made food is best, etc. (This is the perceived non-monetary price). The question raised here is how consumers use price as a cue to assess quality. E.g. does the German washing machine Miele last 3 times as long as the Zanussi, which is 3 times cheaper? (To what extent does the consumer’s belief reflect his or her willingness to buy the product). Is there a one-to-one relationship between objective quality and high price? (p. 361). Studies have shown that in many cases there is no such relationship. Positive price-quality correlations indicate correlations between objective price and objective quality. Negative correlations indicate correlations between high price and low quality or vice versa. Correlations measured across a number of countries seem weak. Methods of assessment: Best value: Customers choose the brand with the best utility compared to price Price seeking: Customers choose the brand with the highest price, presuming that it is also best quality Price aversion: Customers infer that the brand with the lowest price is the best buy to minimize cost. The role of religion (Chatolicism, Protestantism – Northern ad Southern Europe). 1.2. International price tactics What are the overall objectives of price manipulation? The answer is: 1) profit, 2) volume of sales and 3) market interactions. The third point includes a number of elements, viz. image promotion, market stability, customer loyalty, elimination of competitors. Three possible positions are described for international strategic pricing: 2 Marketing Across Cultures, chapter 11 The critical role of price in relational exchange a) The extension/ethnocentric position (one single price based on factory price (ex works)) b) The polycentric adaptation position: (local subsidiaries fix their own prices) c) The intermediate geocentric inventive position: (the subsidiary tries to strike a balance of local price levels and international ones) For a firm to maximise its profits it must sell its products at a price that is higher than or equal to the marginal cost (the expenses incurred in the production of the last unit, that is the direct cost of additional production) (Usunier: p 365) Sunk costs: Overheads and other initial fixed expenditure. Cost price or direct costing? The problem here is whether the price of a product is calculated on the basis of all costs or on the basis of marginal cost (the cost of producing the last unit (in additional production). Marginal cost is always lower than the average cost based on all costs. What is dumping? Selling products in foreign markets at prices based on marginal cost rather than on total cost. Prices of dumped products may sometimes even have been calculated on the basis of subsidies. Dumping is not allowed according to GATT. Prices may sometimes be reduced temporarily when companies penetrate new markets, only to be raised after a while. Japan is notorious for following that strategy. (Price slashing as a global strategy). For example Japanese car manufacturers entered African markets and sold cars at low prices. Later they increased their prices, saved the image of the product and raised profit margins. Another example is the Toyota Celica, which was sold in France at a higher price than in the USA (because of low taxation in the US). Japan tend to position their cars in the luxury bracket. Grey markets: an exporter sells to an unauthorized agent, who resells the products in a local market at prices lower than those charged in the manufacturing country. The basis of grey market operations is found in price differences between 3 Marketing Across Cultures, chapter 11 The critical role of price in relational exchange neighbouring countries. Tourists buying products in e.g. Bhali and benefiting from exchange rate fluctuations may be able to sell the same products in the home country, thus competing with officially appointed agents. (Parallel markets based on urgent demand). How can grey markets be countered? Prices may be lowered in national markets to offset the price differential; the official product may be changed so that it has favourable features compared to the product sold on the grey market; different customer segments may be targeted; dealers may be trained to understand the mechanisms behind parallel markets; dealer agreements may be terminated, if the dealer buys from unauthorized parallel sources; the grey market goods may be bought back. An example of a parallel market is the aftermarket for spare parts for the automotive industry. 1.3. Market situations, competition and price agreements What is the role played by Adam Smith’s ‘the invisible hand’? Do companies prefer to ‘fight it out’ in cutthroat competition, or do they seek agreement? That all depends on each individual situation. American anti-trust legislation counters the formation of monopolies, but in other parts of the world competition has been somewhat suppressed: e.g. cartels in Germany and zaibatzus (industrial giants under the control of one extended family) in Japan. However, in Japan zaibatzus have co-existed informally with competition in other parts of society. That competition is so fierce in Japan often surprises foreign companies investing in Japan. The role played by high inflation rates is that of weakening local currencies, thus lowering the purchasing power of local consumers when they buy imported goods. Interestingly, there seems to be a correlation of high power distance and high inflation rates. Over- and under-invoicing 4 Marketing Across Cultures, chapter 11 The critical role of price in relational exchange Local business people (subsidiaries), e.g. in South Africa, ask their suppliers to over-invoice them, which means that they transfer more money than the value of the goods received, and their customers abroad to under-invoice, which means than their customer pay less money than the value of the goods bought by them. (The result is that money flows out of e.g. South Africa from subsidiaries to mother companies in the US or Europe and the foreign customer will pay the difference into an account abroad in a fully convertible currency, such as dollars). This is used when there are strict currency regulations. 5