Problem Set IV

advertisement

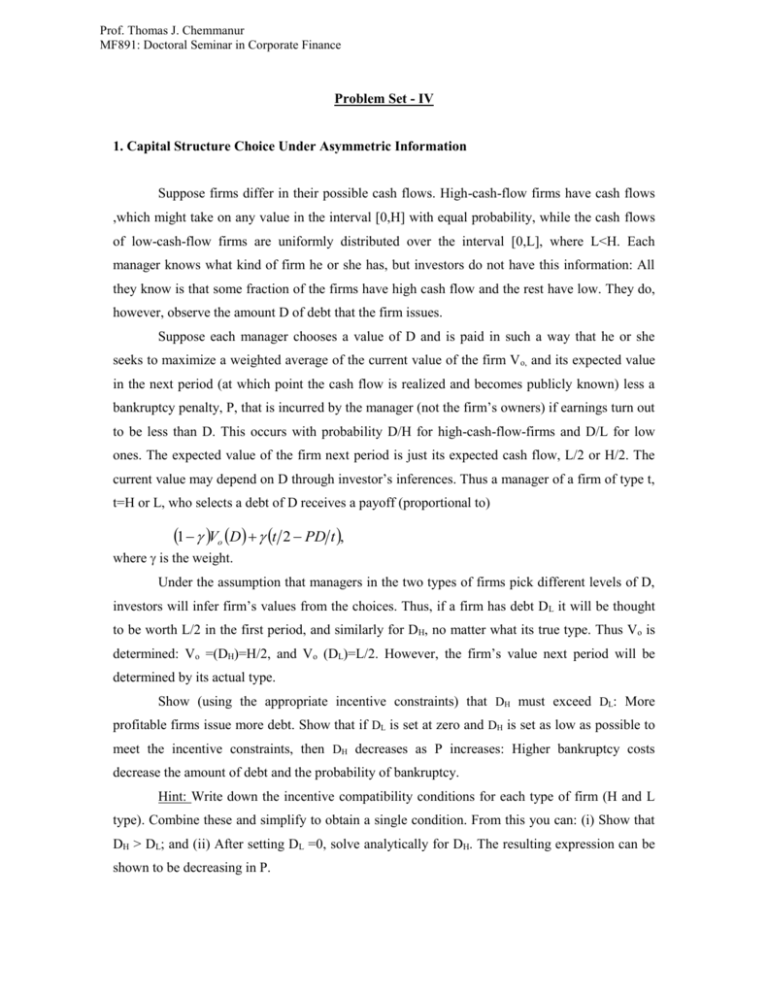

Prof. Thomas J. Chemmanur MF891: Doctoral Seminar in Corporate Finance Problem Set - IV 1. Capital Structure Choice Under Asymmetric Information Suppose firms differ in their possible cash flows. High-cash-flow firms have cash flows ,which might take on any value in the interval [0,H] with equal probability, while the cash flows of low-cash-flow firms are uniformly distributed over the interval [0,L], where L<H. Each manager knows what kind of firm he or she has, but investors do not have this information: All they know is that some fraction of the firms have high cash flow and the rest have low. They do, however, observe the amount D of debt that the firm issues. Suppose each manager chooses a value of D and is paid in such a way that he or she seeks to maximize a weighted average of the current value of the firm V o, and its expected value in the next period (at which point the cash flow is realized and becomes publicly known) less a bankruptcy penalty, P, that is incurred by the manager (not the firm’s owners) if earnings turn out to be less than D. This occurs with probability D/H for high-cash-flow-firms and D/L for low ones. The expected value of the firm next period is just its expected cash flow, L/2 or H/2. The current value may depend on D through investor’s inferences. Thus a manager of a firm of type t, t=H or L, who selects a debt of D receives a payoff (proportional to) 1 Vo D t 2 PD t , where is the weight. Under the assumption that managers in the two types of firms pick different levels of D, investors will infer firm’s values from the choices. Thus, if a firm has debt D L it will be thought to be worth L/2 in the first period, and similarly for DH, no matter what its true type. Thus Vo is determined: Vo =(DH)=H/2, and Vo (DL)=L/2. However, the firm’s value next period will be determined by its actual type. Show (using the appropriate incentive constraints) that DH must exceed DL: More profitable firms issue more debt. Show that if DL is set at zero and DH is set as low as possible to meet the incentive constraints, then DH decreases as P increases: Higher bankruptcy costs decrease the amount of debt and the probability of bankruptcy. Hint: Write down the incentive compatibility conditions for each type of firm (H and L type). Combine these and simplify to obtain a single condition. From this you can: (i) Show that DH > DL; and (ii) After setting DL =0, solve analytically for DH. The resulting expression can be shown to be decreasing in P. 2. Issuing Securities Under Asymmetric Information At a point in time, say t=0, an all equity financed firm has assets in place and a positive NPV investment opportunity. The current value of the firm’s assets in place is either XH (type H firm) or XL < XH (type L firm), and is known only to firm’s insiders. Outside investors have an ex- ante belief that the firm is of type H with probability p, and of type L with probability 1-p. The investment project must be undertaken in the current period and it is the same for both types of firms. This project requires an initial investment of I and its cash flow will be realized one period from now (i.e., at t=1), at which time it will be observable by all. The cash flow from this project will have a value C>0 with a probability h; it will be 0 with the complementary probability (1-h) (the values C and h are known to both outsiders and insiders). The insiders (management) of the firm makes its investments and financing decisions with the objective of maximizing the t=1 expected value of cash flows to the firm’s original (t=0) stockholders. You may assume throughout that the risk-free rate of return is zero, and that all agents are risk-neutral. a. Assume first that the firm management is constrained to raise the requisite investment amount I through selling equity alone (i.e. there is no internal financing available, and securities other than equity cannot be issued). Write down the conditions at which the investment project is undertaken and not undertaken. Discuss the kind of equilibria that may emerge on the equity market as a consequence of the planned equity issue (under different parameter values). b. For this section, assign the following numerical value: XH =100, XL=0; p=0.5, C=20, h=0.8, I=10. (i)Maintain for this subsection that only equity can be used to raise financing. Under these conditions, show that, with the above numerical values, a pooling equilibrium where both types of firms issue equity and implement the project does not exist. Further, demonstrate that (using the appropriate incentive compatibility conditions) that a separating equilibrium where the type L firm issues equity and implements the project, while the type H firm does not, exists. Give the equilibrium beliefs consistent with this separating equilibrium. (ii)Now allow for the possibility that the firm can issue debt. Show that a pooling equilibrium where both types of firms raise the requisite external financing using debt exists. What is the face value of debt to be issued in this equilibrium (assuming a competitive debt market)? Is this debt risk-free or risky? Hint: After conjecturing a pooling equilibrium, compute the face value of debt to be issued that will leave the debt holder as well off as if he had invested in his alternative investment opportunity. Then show, using this particular face value of debt that the shareholders in both types of firms are better off (in terms of their time 1 expected cash flow) if they implement the project. c. Go back to the assumption in section b(i) that the firm can only issue equity. Further, assume that you are the CFO of a firm with favorable private information about its assets in place (i.e., a type H firm), with the various parameter values as in section (b). The investment bank you have hired has advised you that you can avoid the problems of asymmetric information in the above situation by spinning-off the new project into a separate firm, and then issuing equity against the new firm, thereby raising the amount I required to implement it. Is this a good idea? If so why (if not, why not)? 3. Consider an example in the spirit of Leland and Pyle (1977). Unlike in Leland and Pyle (1977), assume that while entrepreneurs are risk-averse (with initial wealth w0 = 100, and utility function of end of period wealth given by U(w1) = E(w1) - 2w2), all outside investors are risk-neutral. Assume further that an entrepreneur can choose between only two assets: the risk-free asset and the stock in her own firm. There are two types of firms in the economy. A firm can be either of type G (“good”), or of type B (“bad”). Each firm has an investment project which involves a capital outlay K = 5, and a future return + x~. A type G firm’s expected end-of-period project value is G = 20, while the corresponding value for a type B firm is B = 10 (note that x~ is a random variable with zero mean and variance 2 = 100). The risk-free rate of return is normalized to 0. Further, assume that each firm will only use equity financing (i.e., the firm will not issue any debt). Each entrepreneur chooses their time 0 wealth allocation between the risky asset (their own firm’s stock) and the risk-free asset to maximize their expected utility of end of-period (time 1) wealth. (a) To begin with, assume that there is no information asymmetry in the economy (i.e., all the investors know the true type of firms) at time 0. What fraction of their firm will each type of entrepreneur retain? (b) Now assume that the entrepreneur has private information about her own firm value at time 0, i.e., the entrepreneur knows the type of her own firm, but outside investors only know a prior probability distribution over firm types: outsiders believe that with probability ¼, the entrepreneur’s firm is of type G, and with probability ¾ the entrepreneur’s firm is of type B. What fraction of equity in her own firm will each type of entrepreneur retain in this case (in a separating pure strategy equilibrium)? (c) Depict the separating pure strategy equilibrium in V - space. Hint: Draw in V - space the indifference curve of type G, the indifference curves of the type B and the type G (which one is steeper?), and the market rationality condition. Mark the value of at which the type B firm will no longer mimic the type G firm. 4. Consider a simplified example of the Myers and Majluf (1984) model. There are three dates: time –1, time 0, and time +1. There are three types of all-equity financed firms in the economy: type H (“high” type), type M (“medium” type), or type L (“low” type) firms. At time –1, both the insiders and the outsiders know only the prior probability distribution of the firm types. They know that each firm has a probability of 1/3 of being a type H, 1/3 of being a type M, and 1/3 of being a type L. At time 0, firm insiders learn the true type of their own firm, but outsiders still know only the prior probability distribution of firm types. At time +1, all cash flows are realized and observed by everyone. The type H firm has assets in place that generates a cash flow of 100 at time +1; the type M firm’s assets in place generate a cash flow of only 50, while the type L firm’s assets in place that generates a cash flow of 0. In addition, each firm (regardless of type) faces a positive NPV project that requires an investment of 50 at time 0, and which generates a cash flow of d at time +1. While only firm insiders know the true value of their firm’s assets in place at time 0, the NPV and investment requirements for new projects are common knowledge. Firm insiders need to decide if they want to issue equity to implement the new project or not at time 0 (the project will be extinguished otherwise). If they decide to implement, they issue equity at time 0 to generate the required external financing. The outsiders decide whether or not to buy the firm’s equity based on their breakeven condition between investing in the firm’s equity and investing in risk-free asset (the risk-free rate of return is normalized to zero). If they decide to contribute the required external financing, outsiders will receive a certain fraction f of the firm’s equity, with the remaining (1 – f) being held by firm insiders. The equity market is competitive and all agents in the economy are risk-neutral. (a) Assume that d = 10. Characterize the equilibrium in this case. Hint: Consistent with the spirit of the equilibrium in the two-type example discussed in class, write down in detail the equilibrium strategy of each type of the firm. Specify the on-equilibrium-path and off-equilibrium-path beliefs. (b) Assume now that d = 20. What is the equilibrium in this case? (c) Assume now that d = 30. Describe the equilibrium in this case also.