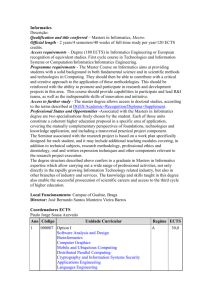

Management - EEG - Universidade do Minho

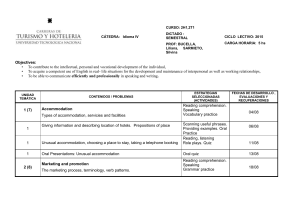

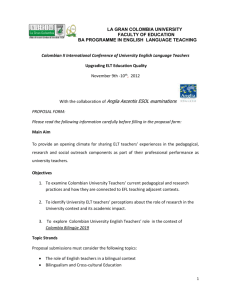

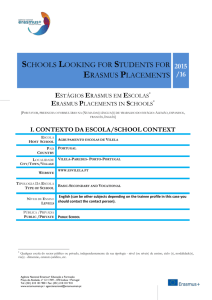

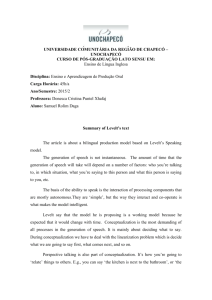

advertisement