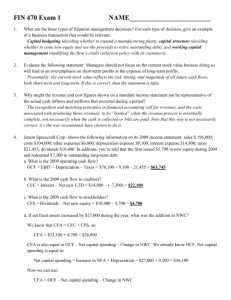

FIN 470 Exam1

advertisement

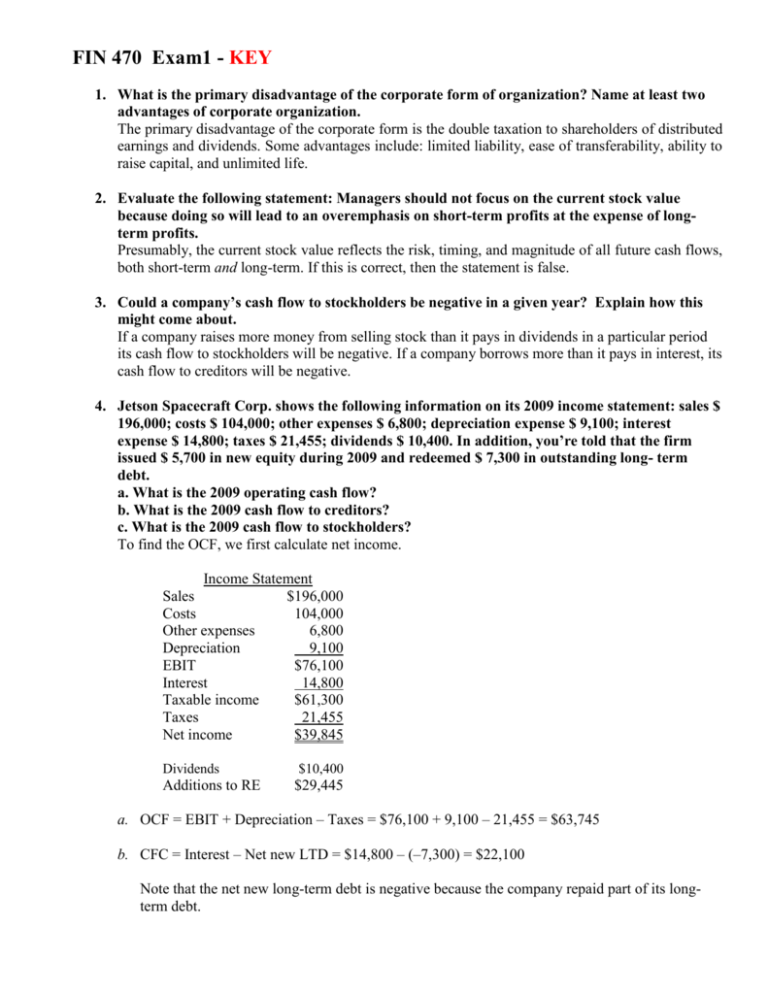

FIN 470 Exam1 - KEY

1. What is the primary disadvantage of the corporate form of organization? Name at least two

advantages of corporate organization.

The primary disadvantage of the corporate form is the double taxation to shareholders of distributed

earnings and dividends. Some advantages include: limited liability, ease of transferability, ability to

raise capital, and unlimited life.

2. Evaluate the following statement: Managers should not focus on the current stock value

because doing so will lead to an overemphasis on short-term profits at the expense of longterm profits.

Presumably, the current stock value reflects the risk, timing, and magnitude of all future cash flows,

both short-term and long-term. If this is correct, then the statement is false.

3. Could a company’s cash flow to stockholders be negative in a given year? Explain how this

might come about.

If a company raises more money from selling stock than it pays in dividends in a particular period

its cash flow to stockholders will be negative. If a company borrows more than it pays in interest, its

cash flow to creditors will be negative.

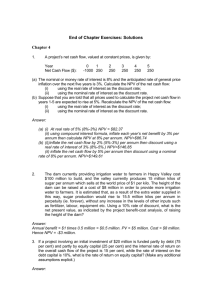

4. Jetson Spacecraft Corp. shows the following information on its 2009 income statement: sales $

196,000; costs $ 104,000; other expenses $ 6,800; depreciation expense $ 9,100; interest

expense $ 14,800; taxes $ 21,455; dividends $ 10,400. In addition, you’re told that the firm

issued $ 5,700 in new equity during 2009 and redeemed $ 7,300 in outstanding long- term

debt.

a. What is the 2009 operating cash flow?

b. What is the 2009 cash flow to creditors?

c. What is the 2009 cash flow to stockholders?

To find the OCF, we first calculate net income.

Income Statement

Sales

$196,000

Costs

104,000

Other expenses

6,800

Depreciation

9,100

EBIT

$76,100

Interest

14,800

Taxable income

$61,300

Taxes

21,455

Net income

$39,845

Dividends

Additions to RE

$10,400

$29,445

a. OCF = EBIT + Depreciation – Taxes = $76,100 + 9,100 – 21,455 = $63,745

b. CFC = Interest – Net new LTD = $14,800 – (–7,300) = $22,100

Note that the net new long-term debt is negative because the company repaid part of its longterm debt.

c. CFS = Dividends – Net new equity = $10,400 – 5,700 = $4,700

5. In recent years, Dixie Co. has greatly increased its current ratio. At the same time, the quick

ratio has fallen. What has happened? Has the liquidity of the company improved?

The firm has increased inventory relative to other current assets; therefore, assuming current

liability levels remain unchanged, liquidity has potentially decreased.

6. Y3K, Inc., has sales of $ 5,276, total assets of $ 3,105, and a debt– equity ratio of 1.40. If its

return on equity is 15 percent, what is its net income?

This is a multi-step problem involving several ratios. The ratios given are all part of the DuPont

Identity. The only DuPont Identity ratio not given is the profit margin. If we know the profit

margin, we can find the net income since sales are given. So, we begin with the DuPont Identity:

ROE = 0.15 = (PM)(TAT)(EM) = (PM)(S / TA)(1 + D/E)

Solving the DuPont Identity for profit margin, we get:

PM = [(ROE)(TA)] / [(1 + D/E)(S)]

PM = [(0.15)($3,105)] / [(1 + 1.4)( $5,276)] = .0339

Now that we have the profit margin, we can use this number and the given sales figure to solve for

net income:

PM = .0339 = NI / S

NI = .0339($5,276) = $194.06

7. Why do you think most long- term financial planning begins with sales forecasts? Put

differently, why are future sales the key input?

The reason is that, ultimately, sales are the driving force behind a business. A firm’s assets,

employees, and, in fact, just about every aspect of its operations and financing exist to directly or

indirectly support sales. Put differently, a firm’s future need for things like capital assets,

employees, inventory, and financing are determined by its future sales level.

8. The most recent financial statements for Zoso, Inc., are shown here (assuming no income

taxes): Income Statement

Balance Sheet

Sales

$ 6,300

Assets $ 18,300

Debt $ 12,400

Costs

3,890

Equity

5,900

Net income $ 2,410

Total $ 18,300

Total $ 18,300

Assets and costs are proportional to sales. Debt and equity are not. No dividends are paid.

Next year’s sales are projected to be $ 7,434. What is the external financing needed?

An increase of sales to $7,424 is an increase of:

Sales increase = ($7,424 – 6,300) / $6,300

Sales increase = .18 or 18%

Assuming costs and assets increase proportionally, the pro forma financial statements will look like

this:

Pro forma income statement

Sales

$

Costs

Net income $

7,434

4,590

2,844

Pro forma balance sheet

Assets

$ 21,594

Total

$ 21,594

Debt

Equity

Total

$ 12,400

8,744

$ 21,144

If no dividends are paid, the equity account will increase by the net income, so:

Equity = $5,900 + 2,844

Equity = $8,744

So the EFN is:

EFN = Total assets – Total liabilities and equity

EFN = $21,594 – 21,144 = $450

9. Would you be willing to pay $ 24,099 today in exchange for $ 100,000 in 30 years? What

would be the key considerations in answering yes or no? Would your answer depend on who

is making the promise to repay?

The key considerations would be: (1) Is the rate of return implicit in the offer attractive relative to

other, similar risk investments? and (2) How risky is the investment; i.e., how certain are we that we

will actually get the $100,000? Thus, our answer does depend on who is making the promise to

repay.

10. You are scheduled to receive $ 20,000 in two years. When you receive it, you will invest it for

six more years at 8.4 percent per year. How much will you have in eight years?

We need to find the FV of a lump sum. However, the money will only be invested for six years, so

the number of periods is six.

FV = PV(1 + r)t

FV = $20,000(1.084)6 = $32,449.33

11. Suppose two athletes sign 10-year contracts for $ 80 million. In one case, we’re told that the $

80 million will be paid in 10 equal installments. In the other case, we’re told that the $ 80

million will be paid in 10 installments, but the installments will increase by 5 percent per year.

Who got the better deal?

Because if the time-value-of-money the better deal is the one with equal installments.

12. A 5- year annuity of ten $ 7,000 semiannual payments will begin 8 years from now, with the

first payment coming 8.5 years from now. If the discount rate is 10 percent compounded

monthly, what is the value of this annuity five years from now? What is the value three years

from now? What is the current value of the annuity?

The cash flows in this problem are semiannual, so we need the effective semiannual rate. The

interest rate given is the APR, so the monthly interest rate is:

Monthly rate = .10 / 12 = .00833

To get the semiannual interest rate, we can use the EAR equation, but instead of using 12 months as

the exponent, we will use 6 months. The effective semiannual rate is:

Semiannual rate = (1.00833)6 – 1 = .0511 or 5.11%

We can now use this rate to find the PV of the annuity. The PV of the annuity is:

PVA @ year 8: $7,000{[1 – (1 / 1.0511)10] / .0511} = $53,776.72

Note, this is the value one period (six months) before the first payment, so it is the value at year 8.

So, the value at the various times the questions asked for uses this value 8 years from now.

PV @ year 5: $53,776.72 / 1.05116 = $39,888.33

Note, you can also calculate this present value (as well as the remaining present values) using the

number of years. To do this, you need the EAR. The EAR is:

EAR = (1 + .0083)12 – 1 = .1047 or 10.47%

So, we can find the PV at year 5 using the following method as well:

PV @ year 5: $53,776.72 / 1.10473 = $39,888.33

The value of the annuity at the other times in the problem is:

PV @ year 3: $53,776.72 / 1.051110 = $32,684.88

PV @ year 3: $53,776.72 / 1.10475 = $32,684.88

PV @ year 0: $53,776.72 / 1.051116 = $24,243.67

PV @ year 0: $53,776.72 / 1.10478 = $24,243.67

13. Is it true that a U. S. Treasury security is risk- free?

No. As interest rates fluctuate, the value of a Treasury security will fluctuate. Long-term Treasury

securities have substantial interest rate risk.

14. Say you own an asset that had a total return last year of 11.4 percent. If the inflation rate last

year was 4.8 percent, what was your real return?

The Fisher equation, which shows the exact relationship between nominal interest rates, real interest

rates, and inflation is:

(1 + R) = (1 + r)(1 + h)

r = [(1 + .114) / (1.048)] – 1 = .0630 or 6.30%

15. A substantial percentage of the companies listed on the NYSE and NASDAQ don’t pay

dividends, but investors are nonetheless willing to buy shares in them. How is this possible

given the belief that the price of a share of stock is the Present Value of future dividends?

Investors believe the company will eventually start paying dividends (or be sold to another

company).

16. Marcel Co. is growing quickly. Dividends are expected to grow at a 30 percent rate for the

next three years, with the growth rate falling off to a constant 6 percent thereafter. If the

required return is 13 percent and the company just paid a $ 1.80 dividend, what is the current

share price?

With supernormal dividends, we find the price of the stock when the dividends level off at a

constant growth rate, and then find the PV of the futures stock price, plus the PV of all dividends

during the supernormal growth period. The stock begins constant growth in Year 4, so we can find

the price of the stock in Year 3, one year before the constant dividend growth begins as:

P3 = D3 (1 + g) / (R – g) = D0 (1 + g1)3 (1 + g2) / (R – g)

P3 = $1.80(1.30)3(1.06) / (.13 – .06)

P3 = $59.88

The price of the stock today is the PV of the first three dividends, plus the PV of the Year 3 stock

price. The price of the stock today will be:

P0 = $1.80(1.30) / 1.13 + $1.80(1.30)2 / 1.132 + $1.80(1.30)3 / 1.133 + $59.88 / 1.133

P0 = $48.70

We could also use the two-stage dividend growth model for this problem, which is:

P0 = [D0(1 + g1)/(R – g1)]{1 – [(1 + g1)/(1 + R)]T}+ [(1 + g1)/(1 + R)]T[D0(1 + g1)/(R – g1)]

P0 = [$1.80(1.30)/(.13 – .30)][1 – (1.30/1.13)3] + [(1 + .30)/(1 + .13)]3[$1.80(1.06)/(.13 – .06)]

P0 = $48.70

17. Suppose a project has conventional cash flows and a positive NPV. What do you know about

its payback? Its discounted payback? Its profitability index? Its IRR? Explain.

If a project has a positive NPV for a certain discount rate, then it will also have a positive NPV for a

zero discount rate; thus, the payback period must be less than the project life. Since discounted

payback is calculated at the same discount rate as is NPV, if NPV is positive, the discounted

payback period must be less than the project’s life. If NPV is positive, then the present value of

future cash inflows is greater than the initial investment cost; thus PI must be greater than 1. If NPV

is positive for a certain discount rate R, then it will be zero for some larger discount rate R*; thus

the IRR must be greater than the required return.

18. A project that provides annual cash flows of $ 28,500 for nine years costs $ 138,000 today. Is

this a good project if the required return is 8 percent? What if it’s 20 percent? At what

discount rate would you be indifferent between accepting the project and rejecting it?

The NPV of a project is the PV of the outflows minus the PV of the inflows. Since the cash inflows

are an annuity, the equation for the NPV of this project at an 8 percent required return is:

NPV = –$138,000 + $28,500(PVIFA8%, 9) = $40,036.31

At an 8 percent required return, the NPV is positive, so we would accept the project.

The equation for the NPV of the project at a 20 percent required return is:

NPV = –$138,000 + $28,500(PVIFA20%, 9) = –$23,117.45

At a 20 percent required return, the NPV is negative, so we would reject the project.

We would be indifferent to the project if the required return was equal to the IRR of the project,

since at that required return the NPV is zero. The IRR of the project is:

0 = –$138,000 + $28,500(PVIFAIRR, 9)

IRR = 14.59%

19. The Present Value of a perpetuity equals

C

C

C

. Show how this

2

1 R (1 R)

(1 R) 3

C

.

R

Let: a = C/(1 + R), and x = 1/(1 + R)

Then: PV = a + ax + ax2 + ax3 + ∙∙∙

Multiply both sides of the equation by x to get: PVx = ax + ax2 + ax3 + ∙∙∙

Find the difference: PV – PVx = a

Rearrange to get: PV(1 – x) = a → PV = a/(1 – x)

equation reduces to PV

C

Substitute back into the equation to get: PV = 1 R

1

1

1 R

Multiply the top and bottom by 1 + R to get: PV = C/(1 – 1 + R) = C/R

20. CWU receives funding from the state for each student up to a certain limit. If enrollment goes

above that limit the only funding for each additional student comes from tuition and fees. In

determining whether or not it is profitable to allow enrollment to exceed the limit which is

more important, average cost per student or marginal cost per student? Argue your case.

The question here boils down to whether or not the university is operating at full capacity. If the

university is operating at full capacity then the average cost is more important, but if it is operating

at less than full capacity then the marginal cost is more important.