Input File 1 – GL Account Posting - ABS

advertisement

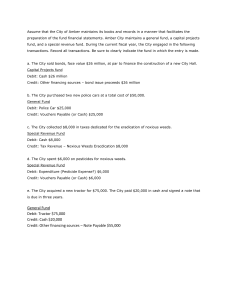

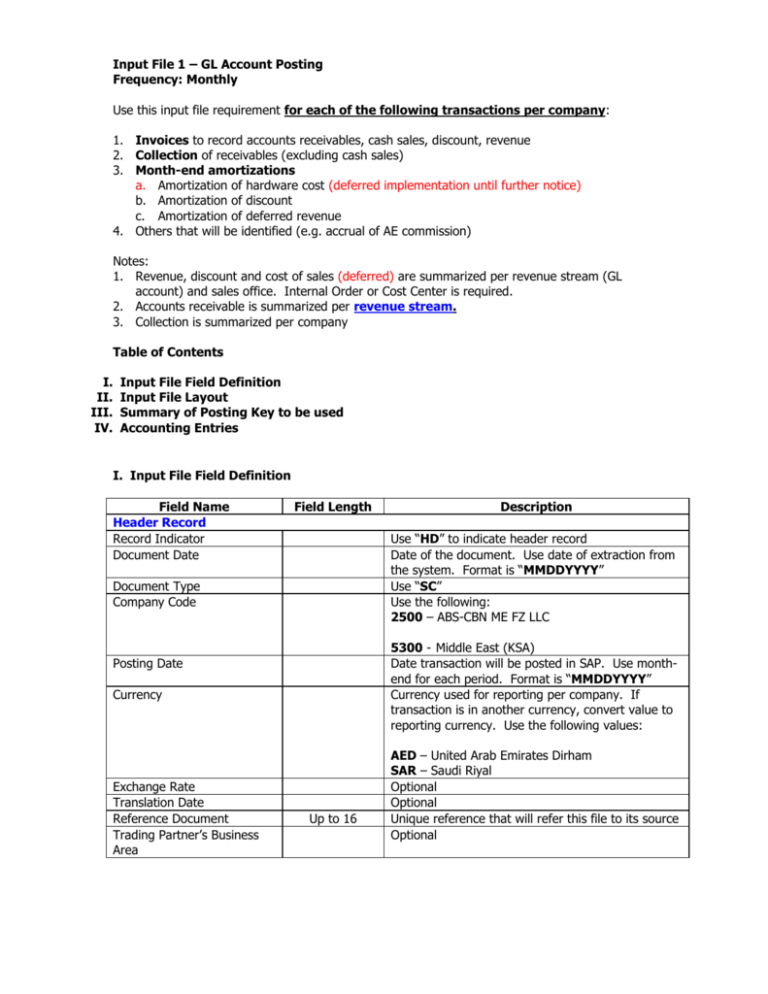

Input File 1 – GL Account Posting Frequency: Monthly Use this input file requirement for each of the following transactions per company: 1. Invoices to record accounts receivables, cash sales, discount, revenue 2. Collection of receivables (excluding cash sales) 3. Month-end amortizations a. Amortization of hardware cost (deferred implementation until further notice) b. Amortization of discount c. Amortization of deferred revenue 4. Others that will be identified (e.g. accrual of AE commission) Notes: 1. Revenue, discount and cost of sales (deferred) are summarized per revenue stream (GL account) and sales office. Internal Order or Cost Center is required. 2. Accounts receivable is summarized per revenue stream. 3. Collection is summarized per company Table of Contents I. II. III. IV. Input File Field Definition Input File Layout Summary of Posting Key to be used Accounting Entries I. Input File Field Definition Field Name Header Record Record Indicator Document Date Field Length Use “HD” to indicate header record Date of the document. Use date of extraction from the system. Format is “MMDDYYYY” Use “SC” Use the following: 2500 – ABS-CBN ME FZ LLC Document Type Company Code 5300 - Middle East (KSA) Date transaction will be posted in SAP. Use monthend for each period. Format is “MMDDYYYY” Currency used for reporting per company. If transaction is in another currency, convert value to reporting currency. Use the following values: Posting Date Currency Exchange Rate Translation Date Reference Document Trading Partner’s Business Area Description Up to 16 AED – United Arab Emirates Dirham SAR – Saudi Riyal Optional Optional Unique reference that will refer this file to its source Optional Field Name Document Header Text Field Length Up to 25 Description Header text that will describe the transaction. Use the same header text per transaction type but include month and year of the posting date. Example: GES Invoice 9/2004 Line Item Record Posting Key Account Amount Amount in Local Currency Tax Code Calculate Tax Automatically Indicator: Determine Tax Base Cost Center Internal Order Posting indicator for debit and credit depending on account as follows: 40 – to debit a GL account 50 – to credit a GL account 01 – to debit a customer account in an invoice 11 – to credit a customer account (credit memo) 15 – to credit a customer account in a collection General ledger or customer account Refer to accounting entries below The converted amount to reporting currency of a company Optional Optional Use “X” in upper case Use “X” in upper case Required for expense account GL accounts (7 series GL account). If supplied, Internal Order field must be empty. For Company: 2500- ABS-CBN ME FZ LLC 66250 FZLLC: Sales & Marketing For Company: 5300- ME KSA 66500 KSA: Sales & Marketing Required for revenue and expense account GL accounts (4, 5 and 6 series GL accounts). If supplied, Cost Center field must be empty . For Company: 2500- ABS-CBN ME FZ LLC QB0125000000 FZLLC: DTH – Dubai QB0225000000 FZLLC: DTH – Swiftel QB0325000000 FZLLC: DTH – Global Direct QB0425000000 FZLLC: DTH - MediaCom QB0525000000 FZLLC: DTH - Satlink QB0625000000 FZLLC: DTH - Mustaffaenjawad QB0725000000 FZLLC: DTH - Ghamdan For Company: 5300- ME KSA QB5153000000 KSA: DTH – Jeddah QB5253000000 KSA: DTH – Riyadh QB5353000000 KSA: DTH - Dammam Text Trading Partner Use value of document header text Optional Field Name Assignment Transaction Type Special GL New Company Code Withholding Tax Field Length Description Optional Optional Optional Use company code Use “X” in upper case II. Input File Layout HD|12312003|SC|1000|12312003|PHP||12312003|IBM-Lease rental for December 2003||IBM-Lease rental for December 2003 40|702020013|227.97|||X|X|10506||Lease rental for December 2003 inv 118723||19 - Lea G Agbada|||1000|X| 40|702020013|227.97|||X|X|10506||Lease rental for December 2003 inv 118723||19 - Katherine Solis|||1000|X| 40|702020013|227.97|||X|X|10506||Lease rental for December 2003 inv 118723||19 - Edgar Allan Bopis Flores|||1000|X| 40|702020013|227.97|||X|X|10506||Lease rental for December 2003 inv 118723||19 - Allan Andaya Chongco|||1000|X| 40|702020013|227.97|||X|X|35629||Lease rental for December 2003 inv 118723||19 - Bernie Acosta|||1000|X| 50|702020013|1139.85|||X|X|45508||Reclass of Lease Charges for December 2003 - inv 124430|||||1000|X| III. Summary of Posting Keys with IO / CC status Account GL accounts beginning with 1 GL accounts beginning with 2 GL accounts beginning with 4 GL accounts beginning with 5 GL accounts beginning with 6 GL accounts beginning with 7 Customer account (invoice) Customer account (debit memo) Customer account (credit memo) Customer account (collection) Posting Key Debit Credit 40 50 40 50 40 50 40 50 40 50 40 50 01 N/A 01 N/A N/A 11 N/A 15 IO Required No No Yes Yes Yes No No No No No CC Required No No No No No Yes No No No No IV. Accounting Entries: 1. To record GES invoice & Debit / Credit Memo For Company Code 2500 (ABS-CBN ME FZ LLC) and 5300 (ME KSA): (Debit) 101010001 - Cash on Hand (for prepaid) (Debit) TBD - A/R Subscription (for post paid) (Debit) TBD - A/R Equipment (for post paid) (Debit) TBD - A/R Service (for post paid) (Debit) 501010006 - Sales Discount (for current month portion) (per IO) (Debit) 103010014 - Unamortized Sales Discount (for subsequent month/s portion) (Debit) Other accounts to record debit / credit memo (Credit) 405010001 - Subscription Revenue (for current month portion) (per IO) (Credit) 407010001 - Merchandising Revenue (for current month portion) (per IO) (Credit) 404010004 - Installation Service Revenue (per IO) (Credit) 201100028 - Deferred Subscription Revenue (for subsequent month/s portion) (Credit) 201100029 - Deferred Merchandise Revenue (for subsequent month/s portion) (Credit) Other account to record debit / credit memo 2. To record amortization of Deferred Revenue (Subscription and Merchandise) For Company Codes 2500 and 5300 Current month portion on accounts previously book as deferred revenue (Debit) 201100028 - Deferred Subscription Revenue (Debit) 201100029 - Deferred Merchandise Revenue (Credit) 405010001 - Subscription Revenue (per IO) (Credit) 407010001 - Merchandising Revenue (per IO) 3. To record amortization of Sales Discount For Company Codes 2500 and 5300 Current month portion on accounts previously book as unamortized discount (Debit) 501010006 - Sales Discount (per IO) (Credit) 103010014 - Unamortized Sales Discount 4. To record monthly amortization of Hardware Cost (deferred until further notice) For Company Codes 2500 and 5300 (Debit) 601010004 - Cost of Merchandise (per IO) (Credit) 103010015 - Deferred Cost of Merchandise 5. To record collection from post paid accounts a. For Company Code 2500 and 5300 (Debit) 101010001 - Cash on Hand (Credit) TBD - A/R Subscription (Credit) TBD - A/R Equipment (Credit) TBD - A/R Service