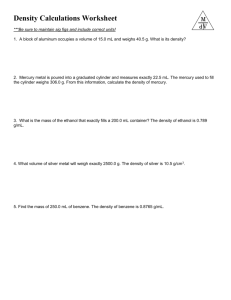

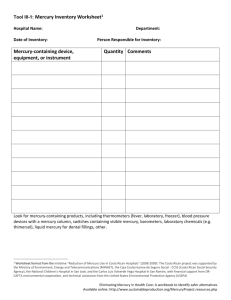

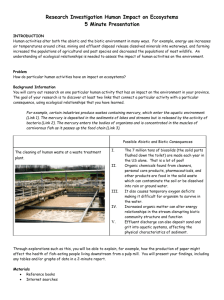

Environment for Development Perspectives: Mercury Use in

advertisement