THE SPECIALIST IN TRADING AND INVESTMENT Commodity

advertisement

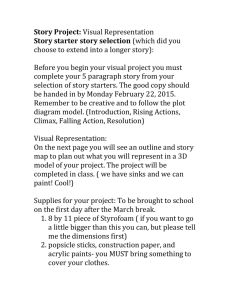

THE SPECIALIST IN TRADING AND INVESTMENT Commodity weekly: Dollar strength adversely impacting commodities. By Ole S. Hansen, Senior Manager A trading week shortened by US Thanksgiving was driven by Euro woes, political tensions on the Korean peninsula and worries about China tightening monetary policy. The winner on the back of these uncertainties has been the dollar and safe government bonds while riskier assets such as commodities and equities has been mixed with many investors refraining from adding risk with the US market almost absent for most of the week. Risk sentiment suffered a setback last Monday as North Korea sent bombs onto a South Korean island. Although commentators described it as another round of “sabre-rattling” and the impact could prove to be temporary it nevertheless added to the general nervousness across financial markets. The Euro zone nations are fighting a hard battle to contain the spiraling debt mountain which so far has brought down Greece and Ireland and threatening to spread to other countries such as Portugal and very worryingly to Spain. Bond yields on Irish, Portuguese and Spanish government debt rose to their highest points since the launch of the Euro as investors scramble to reduce exposure of fear of what happens next. China once again raised the reserves that commercial banks are required to hold. Given the uncomfortable high level of inflation further action, such as raising official interest rates, seems likely over the coming weeks and months. The Shanghai stock index as a consequence has lost ten percent during the past couple of weeks. The dollar has been the main winner as short positions stemming from the QE2 euphoria has continued to be unwound with traders now much more worried about the near term outlook for the Euro rather than the dollar. The dollar index has now recovered by 5.5 percent in just three weeks while the Euro has slumped 6.6 percent during the same period. Commodity markets have held up reasonably well despite this dollar strength showing only small losses across sectors. Natural gas has been the best performer as colder weather in the US have supported prices while cotton continues to suffer heavy losses after the vertical rally came to an abrupt halt two weeks ago. CO PENHAGEN. LO NDO N. SINGAPO RE. D UBAI. PARIS. TO KYO . AND OTHER FINANCI AL CENTRES A ROUND THE W ORLD WWW.SAXO BANK .COM SAXO BANK A/S Philip Heymans Allé 15 2900 Hellerup Denmark Telephone: +45 3977 4000 Telefax: +45 3977 4200 Reuters Dealing Code: SAXO Cvr. nr. 15 73 12 49 info@saxobank.com THE SPECIALIST IN TRADING AND INVESTMENT The price of WTI Crude has been range bound this past week having found support towards the 80 dollar level despite the stronger dollar. The fundamental outlook has continued to improve, as the global supply glut has been reduced significantly and this point towards higher prices over the coming months. Hedge funds and money managers have shown their hand by continuing to add to existing record long speculative positions. Cold weather across the northern hemisphere will keep prices supported. However until we have further clarification on the European debt situation and subsequent risk of a weaker euro and stronger dollar the upside seems limited. Further news on Chinese measures to curb rising inflation will also keep the market guessing. For now the market is confine to a range between 80 and 85 dollar. Natural gas saw the first withdrawal from underground storage as the winter demand begins to reduce inventories. Forecast for seasonal colder weather over the coming period have supported prices over the past couple of weeks with natural gas for January delivery having rallied 17 percent during this period. Current inventory levels, which stands at 3,837 billion cubic feet, is still above the five year average so any change back towards the seasonal average could halt the recent rally. Precious metals are caught between buyers who see it as a hedge against Korean tension and European sovereign debt problems while others has been selling it on the back of the continued dollar rally. The previous strong correlation between gold and dollar has evidently gone down recently highlighting gold and silvers ability to attract safe haven demand. CO PENHAGEN. LO NDO N. SINGAPO RE. D UBAI. PARIS. TO KYO . AND OTHER FINANCI AL CENTRES A ROUND THE W ORLD WWW.SAXO BANK .COM SAXO BANK A/S Philip Heymans Allé 15 2900 Hellerup Denmark Telephone: +45 3977 4000 Telefax: +45 3977 4200 Reuters Dealing Code: SAXO Cvr. nr. 15 73 12 49 info@saxobank.com THE SPECIALIST IN TRADING AND INVESTMENT Gold measured in Euros has been performing strongly reaching the levels seen during the Greek sovereign crisis back in May. European investors, worrying about the future of the Euro, see gold as a safe haven from the current problems. Total investments in gold ETFs has seen a small decrease during October and November while the speculative long position in futures has decreased by 15 percent for gold and 45 percent for silver during this same period. This indicates that some of the pre QE2 position buildup has now been removed. End of year position squaring has slowly begun increasing the likelihood that the high of 2010 has been seen already while longer term the uptrend is still firmly in place. Current range is 1,385 to 1,340 with additional support at 1,315 and resistance at 1,425. Copper traders will be looking out for any initiatives from the Chinese government to curb inflation as much of the current demand comes from that region. The 12 percent sell off in High Grade Copper for March delivery has been followed by a period of stabilization. Traders will however keep a close eye on the dollar performance with continued strength having the potential for putting the support at 360 under pressure. Grain and oilseeds markets had a quiet week ahead of the US holiday with early strength attributed to dry weather in South America which could lower current crop estimates but somewhat offset by the rising dollar which is making US export less competitive. CO PENHAGEN. LO NDO N. SINGAPO RE. D UBAI. PARIS. TO KYO . AND OTHER FINANCI AL CENTRES A ROUND THE W ORLD WWW.SAXO BANK .COM SAXO BANK A/S Philip Heymans Allé 15 2900 Hellerup Denmark Telephone: +45 3977 4000 Telefax: +45 3977 4200 Reuters Dealing Code: SAXO Cvr. nr. 15 73 12 49 info@saxobank.com THE SPECIALIST IN TRADING AND INVESTMENT Past week performances: CO PENHAGEN. LO NDO N. SINGAPO RE. D UBAI. PARIS. TO KYO . AND OTHER FINANCI AL CENTRES A ROUND THE W ORLD WWW.SAXO BANK .COM SAXO BANK A/S Philip Heymans Allé 15 2900 Hellerup Denmark Telephone: +45 3977 4000 Telefax: +45 3977 4200 Reuters Dealing Code: SAXO Cvr. nr. 15 73 12 49 info@saxobank.com