In the 20 years since Birnberg and Shields reviewed behavioral

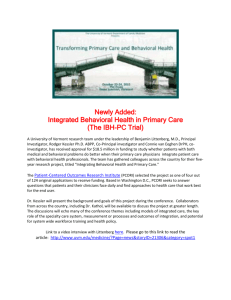

advertisement