STEMLFE211210

advertisement

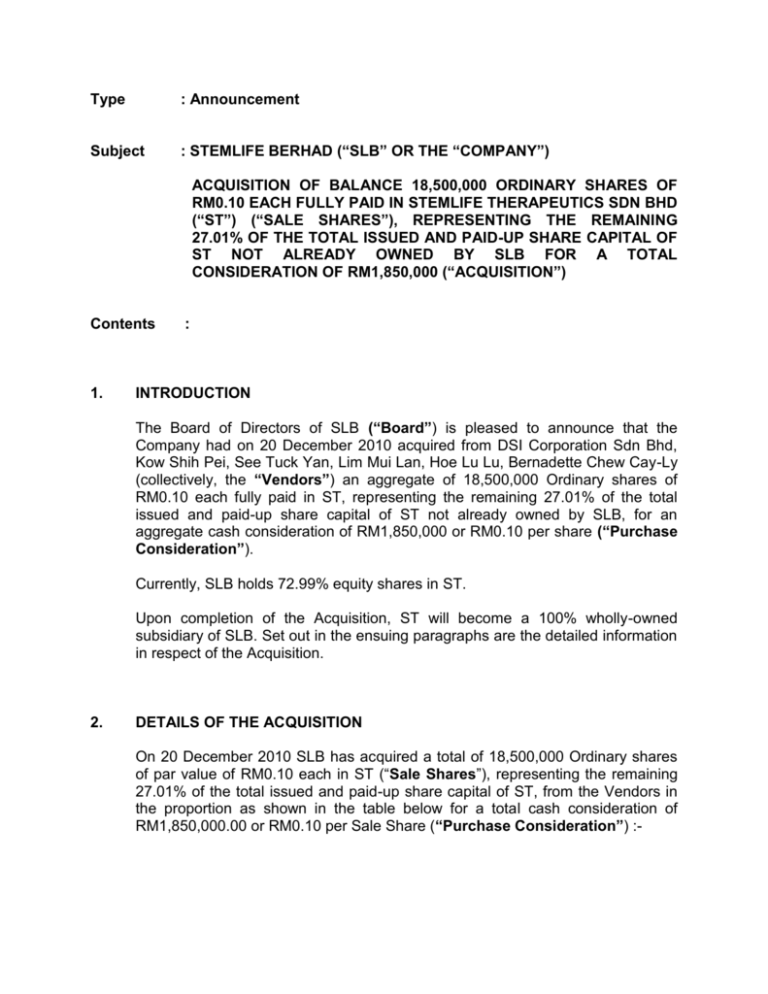

Type : Announcement Subject : STEMLIFE BERHAD (“SLB” OR THE “COMPANY”) ACQUISITION OF BALANCE 18,500,000 ORDINARY SHARES OF RM0.10 EACH FULLY PAID IN STEMLIFE THERAPEUTICS SDN BHD (“ST”) (“SALE SHARES”), REPRESENTING THE REMAINING 27.01% OF THE TOTAL ISSUED AND PAID-UP SHARE CAPITAL OF ST NOT ALREADY OWNED BY SLB FOR A TOTAL CONSIDERATION OF RM1,850,000 (“ACQUISITION”) Contents 1. : INTRODUCTION The Board of Directors of SLB (“Board”) is pleased to announce that the Company had on 20 December 2010 acquired from DSI Corporation Sdn Bhd, Kow Shih Pei, See Tuck Yan, Lim Mui Lan, Hoe Lu Lu, Bernadette Chew Cay-Ly (collectively, the “Vendors”) an aggregate of 18,500,000 Ordinary shares of RM0.10 each fully paid in ST, representing the remaining 27.01% of the total issued and paid-up share capital of ST not already owned by SLB, for an aggregate cash consideration of RM1,850,000 or RM0.10 per share (“Purchase Consideration”). Currently, SLB holds 72.99% equity shares in ST. Upon completion of the Acquisition, ST will become a 100% wholly-owned subsidiary of SLB. Set out in the ensuing paragraphs are the detailed information in respect of the Acquisition. 2. DETAILS OF THE ACQUISITION On 20 December 2010 SLB has acquired a total of 18,500,000 Ordinary shares of par value of RM0.10 each in ST (“Sale Shares”), representing the remaining 27.01% of the total issued and paid-up share capital of ST, from the Vendors in the proportion as shown in the table below for a total cash consideration of RM1,850,000.00 or RM0.10 per Sale Share (“Purchase Consideration”) :- Vendors Number of Sale Shares % of Issued Purchase and Paid-Up Consideration Share Capital (RM) of ST 1. DSI Corporation Sdn Bhd*(1) 12,500,000 18.25 1,250,000 2. Kow Shih Pei (f) 2,000,000 2.92 200,000 3. See Tuck Yan 2,000,000 2.92 200,000 4. Lim Mui Lan (f) *(2) 1,000,000 1.46 100,000 5. Hoe Lu Lu (f) 500,000 0.73 50,000 6. Bernadette Chew Cay-Ly (f) 500,000 0.73 50,000 18,500,000 27.01 RM 1,850,000 Total Note:*Deemed Related Party to the Transaction *(1) The acquisition of the Sale Shares held by DSI Corporation Sdn Bhd is deemed a related party transaction by virtue of Tan Sri Dr Aseh bin Che Mat, the Non-Executive Chairman of SLB and Tan Sri Dr Aseh bin Che Mat is a major shareholder of DSI Corporation Sdn Bhd; and *(2) Lim Mui Lan being the sister of Dato’ Lim Oi Wah and Lim Jit Soon, who are the Executive Directors of SLB. Dato’ Lim Oi Wah is also a substantial shareholder of SLB. Pursuant to Section 10.08 (1), Part E of Chapter 10 of the Bursa Malaysia Securities Berhad’s (“Bursa Securities”) ACE Market Listing Requirements (“AMLR”), the percentage ratio pertaining to the Related Party Transactions exceed 0.25% but are less than 5%. In compliance with the AMLR, SLB is required to make an announcement to Bursa Securities in relation to the Related Party Transactions but is not required to seek shareholders’ approval and/or appoint an independent adviser in respect of the Related Party Transactions. 2.1 INFORMATION ON ST ST was incorporated in Malaysia on 10 May 2005 under the Companies Act, 1965 as a private limited company under the name of Cell Therapy Innovation Sdn. Bhd., which was subsequently changed to its present name on 27 March 2007. The authorized share capital of ST is RM10,000,000 comprising 100,000,000 Ordinary shares of par value of RM0.10 each, of which 68,500,000 have been issued and credited as fully paid-up. ST is principally involved in stem cells therapeutics transplant and consultancy services and testing, processing and preservation of peripheral blood stem cells. For the financial year ended (“FYE”) 31 December 2009, ST registered an audited loss after taxation of RM786,130 on the back of RM831,027 in revenue. ST also registered audited net assets and net tangible assets of RM6,212,332 and RM6,212,332 respectively as at 31 December 2009. ST’s wholly-owned subsidiary, Stemvet Sdn Bhd, incorporated in Malaysia is a dormant company. 2.2 Basis of arriving at the Purchase Consideration The Purchase Consideration was arrived at on a willing buyer-willing seller basis after taking into consideration the following: (i) (ii) the audited net assets of RM6,212,332 or RM0.09 per share based on ST’s latest available audited financial statements as at 31 December 2009, which translates to a price to book multiple of approximately 1.11 times from the Purchase Consideration; and the earnings potential of ST. The purchase price of RM0.10 per Sale Share is in line with the Company’s intention to acquire the remaining shares not already owned by SLB in ST for a consideration of not more than RM0.10 per ST share to be a wholly-owned subsidiary of SLB. 2.3 Source of Funding for the Purchase Consideration The Purchase Consideration will be funded solely from internally generated funds of the Company. 2.4 Liabilities to be Assumed Save for the liabilities of ST incurred in the ordinary course of business, there are no liabilities to be assumed by SLB arising from the Acquisition. 2.5 Original Cost and Date of Investment The original cost of investment of the Vendors in ST and the dates such investments were made are set out in the table below:- Vendors 3. Date of Investment Number of ST Shares Cost of Investment (RM) DSI Corporation Sdn Bhd 25.4.2008 12,500,000 1,250,000 Kow Shih Pei 23.9.2008 2,000,000 200,000 See Tuck Yan 23.9.2008 2,000,000 200,000 Lim Mui Lan 23.9.2008 1,000,000 100,000 Hoe Lu Lu 23.9.2008 500,000 50,000 Bernadette Chew Cay-Ly 23.9.2008 500,000 50,000 SALIENT TERMS OF THE ACQUISITION The salient terms and conditions of the acquisition are set out below:(i) The parties mutually agree that the obligation to pay the Purchase Consideration shall be on a date which the parties may mutually agree in writing (the “Prescribed Date”), provided always that such Prescribed Date shall be notified to either party at least 7 days before the actual Prescribed Date. (ii) the parties mutually agree that the failure of payment of the Purchase Consideration by the Prescribed Date shall not constitute a breach of the terms of the acquisition, provided always that another date has been already determined and agreed to by the parties, as well as each party hereto already notified at least 7 days of such date, for the payment of the Purchase Price. 4. RATIONALE FOR THE ACQUISITION It is the intention of SLB to acquire the remaining 27.01% interests in ST not already owned by SLB from the remaining shareholders of ST upon completion of the acquisition, such that ST will be a wholly-owned subsidiary of SLB. The Acquisition will allow SLB to have full control and set the direction of the business of ST which is complementary to SLB with both companies operating in the stem cells industry. 5. RISK FACTORS As ST is currently an operating subsidiary of SLB, the Board does not foresee any additional risk that SLB is not already exposed to pertaining to the increase in its shareholdings in ST in relation to the Acquisition. 6. EFFECTS OF THE ACQUISITION 6.1 Share Capital and substantial shareholder The Acquisition has no effect on the issued and paid-up share capital of SLB and the Company’s substantial shareholders’ shareholdings as the Purchase Consideration is settled wholly in cash. 6.2 Earnings The Acquisition will have no material effect on the earnings of SLB as the earnings of ST have already been consolidated into SLB’s financial results. 6.3 Net assets and gearing The Acquisition will have no material effect on SLB’s consolidated net assets and gearing. 7. APPROVALS REQUIRED The Acquisition is not subject to the approval of shareholders and the relevant government authorities. 8. DIRECTORS’ AND MAJOR SHAREHOLDERS’ INTEREST The following Directors of SLB do not consider themselves independent in respect of the Related Party Transactions by virtue of the following:(i) Dato’ Lim Oi Wah is the Deputy Managing Director and major shareholder of SLB and is the sister of Lim Mui Lan, one of the Vendors of the Acquisition; and (ii) Mr. Lim Jit Soon is the Chief Financial Officer and Executive Director of SLB is the brother of Lim Mui Lan, one of the Vendors of the Acquisition; and (iii) Tan Sri Dr Aseh Bin Che Mat is the Non-Executive Chairman of SLB and is the major shareholder and director of DSI Corporation Sdn Bhd, one of the Vendors of the Acquisition. (collectively referred to as the “Interested Directors”) The interests, direct and indirect, of the Interested Directors in SLB as at the date of this announcement are set out below:- Interests of Interested Director Direct Indirect No. of SLB Shares % No. of SLB Shares % Dato’ Lim Oi Wah 18,465,200 11.19 - - Mr. Lim Jit Soon 2,855,120 1.73 - - - - - - Tan Sri Dr Aseh Bin Che Mat Save as disclosed above, none of the Directors, major shareholders of SLB and/or persons connected to them has any interest, direct or indirect, in the Acquisition. 9. DIRECTORS’ OPINION The Directors of SLB, save for the Interested Directors, having considered all aspects of the Acquisition including its rationale, are of the opinion that the Acquisition is in the best interest of the Company and its shareholders. 10. HIGHEST PERCENTAGE RATIO APPLICABLE TO THE ACQUISITION PURSUANT TO PARAGRAPH 10.02(G) OF THE AMLR The highest percentage ratio applicable to the Acquisition pursuant to Paragraph 10.02 (g) of the AMLR is 5.29%, of which 3.86% is under the Related Party Transaction while the balance is 1.43% is under the non-related party. 11. STATEMENT ON DEPARTURE FROM SC’S GUIDELINES ON EQUITY AND EQUITY LINKED SECURITIES (“SC GUIDELINES”) The Acquisition does not fall under the ambit of the SC Guidelines and to the best of the Board’s knowledge, the Acquisition has not departed from the SC Guidelines. 12. ESTIMATED TIME FRAME FOR COMPLETION The Acquisition was completed on 20th December 2010.