3. semester lecture program - e

advertisement

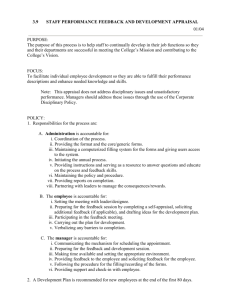

UNIVERSITY OF THESSALY - SCHOOL OF ENGINEERING DEPARTMENT OF PLANNING AND REGIONAL DEVELOPMENT Program of Postgraduate Studies in European Regional Development Studies COURSE: PROJECT AND INVESTMENT APPRAISAL TAUGHT BY: S. POLYZOS, A. PAPADOULIS 1. AIM OF COURSE This course aims at contributing to the comprehension of Project and Investment Appraisal fundamental principles and to the way these principles have been applied on planning, programming and management of private and public Projects and Investments. The course focuses on describing and analyzing Project and Investment outlining, Project Objectives and Identification, Mathematical methods in economics and Finance and Project Financial Analysis. Even, it outlines the methodologies of evaluation approaches and project risk assessment and the relationships between investment and regional or urban development are analyzed. Moreover, project analysis by sector is presented and characteristic exercises and case studies are discussed. The course contains a series of exercises regarding the implementation of methodologies presented in the theoretical part. The exercises target at simulating real-world problems and, thus special attention is paid to project size issues. In this way, students can become effectively familiar with reality and get the sense of project or investment appraisal, project programming and planning. 2. CONTENT OF COURSE Introduction to project and investment appraisal, description, concise description of basic concepts concerning project and investment objectives, cost and benefit analysis, direct and indirect cost and effects, project and investment life cycle Analysis of factors that influence investment decision Analysis of fundamental concepts on financial mathematics (cash flows, rate of return, interest rate, compound interest, time value of money, present value, future value, annuities) Investment and project appraisal techniques (net present value NPV, benefit – cost B/C ratio, internal rate of return IRR), project financing, estimation on investment costs, total operating costs and revenues, estimation on loan repayments and loan balance Strategic analysis of Business Environment Special Issues in project appraisal, social discounting, economic performance indicators, cost-effectiveness analysis, multi-criteria analysis, economic impact analysis Direct positive impact of an investment Project and investment appraisal under uncertainty, sensitivity analysis, probability distributions, expected present value, assessment of acceptable levels of risk, decision tree Indirect positive impact of an investment Direct and indirect negative impact Break even point analysis, linear and non linear model of break even point, sensitivity analysis Project and investment analysis in the context of urban and regional planning, case studies 1 3. SEMESTER LECTURE PROGRAM Lecture/ Content of lecture week 1 Introduction to project and investment appraisal and course description Lecturer S. Polyzos (a) (b) (c) (d) Definition of project and investment, examples Definition of project and investment objectives What is “cost and benefit analysis CBA” Project analysis in a social and economic context, economic, definition of financial and social evaluation. (e) Direct and indirect cost and effects (f) Project and investment life cycle 2 Introduction to the terms of the investment decision A. Papadoulis (a) Entrepreneurship of opportunity and necessity. (b) Competition conditions. 3 Fundamental concepts of financial mathematics S. Polyzos (a) Definition of basic financial concepts, cash flows, rate of return, interest rate, compound interest, time value of money. (b) Accumulated value (c) Discount or Present value, future value (d) Annuities (e) Valuing annuities, annuity due, increasing annuities 4 Investment and project appraisal techniques S. Polyzos (a) Discounted cash flow techniques for investment appraisal (b) Definition and equation of net present value (NPV) (c) Benefit – cost (B/C) ratio (d) Internal rate of return (IRR), IRR decision rule, problems with the IRR (e) Project financing, cost of capital, sources of financing, financial return on investment, financial sustainability, financial return on capital (f) Total investment costs, Total operating costs and revenues (g) Loan repayments, loan balance 5 Strategic analysis of Business Environment A. Papadoulis 6 (a) External Environment. (b) Internal Forces. Special Issues in project appraisal S. Polyzos 2 (a) (b) (c) (d) (e) (f) 7 Monetisation of non-market impacts Inclusion of indirect effects Social discounting Calculation of economic performance indicators Cost-effectiveness analysis, multi-criteria analysis Economic impact analysis Direct positive impact of an investment A. Papadoulis (a) Economic impact. (b) Socio – political impact. (c) Fiscal impact. 8 Project and investment appraisal under risk S. Polyzos (a) Sensitivity analysis (b) Probability distributions for critical variables, Expected value, Standard deviation, Coefficient of variation (c) Risk analysis (d) Assessment of acceptable levels of risk (e) Risk prevention, Risk-adjusted discount rate, Decision tree 9 Indirect positive impact of an investment A. Papadoulis (a) Economic impact. (b) Socio – political impact. (c) Fiscal impact. 10 Direct and indirect negative impact A. Papadoulis (a) Socio – economic (b) Political. 11 S. Polyzos Break even point analysis (a) Definition and mathematic formulae of break even point, fixed cost, variable cost, total cost (b) Linear model of break even point (c) Non linear model of break even point (d) Sensitivity analysis by using break even point 12 Project and investment analysis in Urban and Regional Planning (a) Investment and urban impact (b) Investment and regional impact (c) Evaluating investment impact in urban and regional level (d) Case studies S. Polyzos 13 General review and discussion S. Polyzos and A. Papadoulis 3 4. ASSIGMENTS AND EXAMS Student performance evaluation will be based on one take-home assignment (30% of final grade) and a final exam (70% of final grade). 5. BIBLIOGRAPHY Main textbook European Commission, Directorate General Regional Policy (2008), Guide to Cost – Benefit Analysis of investment projects, Structural Funds, Cohesion Fund and Instrument for Pre-Accession, Final Report. Additional textbooks 1 Asian Development Bank, (2002), Handbook of integrating risk analysis in economic analysis of project, Manila. 2 Australian Transport Council, (2007), National Guidelines for Transport System Management in Australia, Volume 2: Project Appraisal 3 Belli, P., Anderson, J. R., Barnum, H.N, Dixon, J. A., Tan, J-P, (2001), Economic Analysis of Investment Operations, Analytical Tools and Practical Applications, WBI, World Bank, Washington D.C. 4 Brown W. Brayan, (1972), Public investment criteria in cost-benefit analysis. A thesis in economics submitted to the Gratuate Faculty of Texas Tech University, AC 805, T3 1072, No 11, Cop. 2 Chvanov K., Okladnikov G., Plakhuta D., Stanyakin P., (2009), Issues in Public Investment Evaluation, Public Policy Paper, St. Retersburg State University. 5 6 Dixit, A.K., Pindyck, R.S., (1994), Investment under uncertainty, Princeton University Press, New Jersey. 7 Economic Development Institute, (1996), The economic evaluation of projects, World Bank, Washington D.C. EVALSED the resource for the evaluation of socio-economic development (2007), european Commission, Directorate General Regional Policy Florio, M., (2007), Cost-Benefit Analysis and Incentives in Evaluation. The Structural Funds of the European Union, Edward Elgar, Cheltenham. 8 9 10 Guide to cost-benefit analysis of investment project, structural funds, cohesion funds and instrument for pre-accession, (2008), European Commission, Directorate General Regional Policy. 11 Guide to cost-benefit analysis of investment project (1997), structural funds – ERDF, cohesion fund and ISPA, European Commission, Directorate General Regional Policy, evaluation unit. 12 HEATCO, (2006) Conference on a Harmonised European Approach for Transport Costing and project assessment, sixth Framework Programme 2002-2006 13 Kirkpatrick, C., Weiss, J., (1996), Cost-Benefit Analysis and Project Appraisal in Developing Countries, Edward Elgar, Cheltenham. 14 Nijkamp P. (1975) A multicriteria analysis for project evaluation: Economicecological evaluation of a land reclamation project, Papers in Regional Science Vol. 35(1) pp. 87-111. 4 15 Lundolm, M., (2005), Cost-benefit analysis and the marginal cost of public funds, Stockholm University, Stockholm. 16 Mishan, E.J., Quah, E., (2007), Cost Benefit Analysis, 5th edition, Routledge, New York. 17 Polyzos S., (2011), Project Management, Kritiki Publications, Athens (in Greek). 18 Polyzos S., (2011), Exercises on Project and Investment Appraisal, University of Thessaly (in Greek). 19 Potts, D., (2002), Project planning and analysis for development, Lynne Rienner Publishers, London. 20 Ray, A. 1984, Cost-benefit analysis. Issues and methodologies, The Johns Hopkins University Press, Baltimore, Maryland. 21 Shofield, J.A., (1989), Cost-benefit analysis in urban and regional planning, Allen & Unwin, London. 22 Transport Economics, Policy and Roverty Thematic Group (2005), Notes on the Economic Evaluation of Transport Project. The World Bank, Washington D.C. 5