Dear Valued Customer: Choice Bank Ltd. takes this opportunity to

advertisement

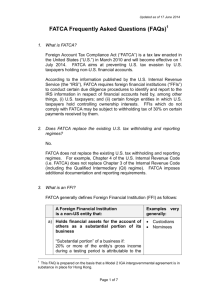

Dear Valued Customer: Choice Bank Ltd. takes this opportunity to advise United States (US) citizens and residents about FATCA and its impact on the Bank Account you maintain with us. What is FATCA all about? The Foreign Account Tax Compliance Act (FATCA) is a law enacted in the United States of America (USA) that is principally aimed at improving US tax compliance by US tax payers.It imposes certain obligations on foreign financial institutions (FFI’s) worldwide to report to the US Internal Revenue Service (IRS) on certain accounts held by US persons (that is, accounts held or deemed to be held by US citizens or residents) and requires withholding of 30% of certain payments to accounts held by non-cooperating US persons. How will FATCA affect you? FATCA applies to and impacts upon all financial institutions in Belize – both domestic and international (offshore), including Choice Bank Ltd. Consistent with most financial institutions in Belize and elsewhere, Choice Bank Ltd.’s intention is to meet all obligations imposed under FATCA while maintaining full compliance with the laws of Belize. To that end, for Choice Bank Ltd. to maintain accounts held by US persons, we shall require your authority to disclose and report the relevant information to the IRS. In this regard, we enclose herewith an authorization form for your completion, signature and delivery to us at your earliest convenience but no later than August 31th, 2013. When does FATCA come into effect? FATCA was enacted in the USA on the 18th of March, 2010, it is expected that FATCA will come into effect in stages, beginning as early as January 1, 2014. Further information on FATCA can be found at www.irs.gov/FATCA. CUSTOMER AUTHORIZATION & RELEASE FORM TO: CHOICE BANK LIMITED One Coney Drive, 3Rd Floor Belize City, Belize The undersigned accountholder (“Accountholder”) hereby acknowledges and agrees that pursuant to the Foreign Account Tax Compliance Act (FATCA) enacted under the laws of the United States of America (US), Choice Bank Ltd. is or may be required to disclose and reportcertain information concerning his/her/their/its account to relevant authorities, including but not necessarily limited to the US Internal Revenue Service (“the Authorities”). The Accountholder further acknowledges and confirms that Choice Bank Ltd. has duly informed Accountholder of the bank’s reporting and withholding obligations under FATCA in connection with certain accounts held by US persons. In the interest of full disclosure and for the purpose of ensuring full compliance with FATCA and the laws of Belize, Accountholder voluntarily and unconditionally hereby authorizes Choice Bank Ltd.to disclose and report to the Authorities any and all information concerning Accountholder’s account held by Choice Bank Ltd. In furtherance thereof, Accountholder undertakes to provide Choice Bank Ltd. with its US tax identification number (TIN), social security number (SSN) and other relevant information and supporting documentation as may be required to enable Choice Bank Ltd. to fulfill its obligations under FATCA. In consideration of the premises and Choice Bank Ltd. continuing to maintain Accountholder’s account, Accountholder hereby releases, discharges and forever acquits Choice Bank Ltd. and its directors, officers, employees, servants and agents and related parties from any and all claims, liabilities, damages, loss or expense arising from Choice Bank Ltd. disclosing and reporting any such information concerning Accountholder’s account to the Authorities. This authorization and release may not be revoked. SIGNED: _____________________________ …………………………………………. ACCOUNT HOLDER NAME ………………………………………………….. US SOCIAL SECURITY NUMBER (SSN) ………………………………………………….. US TAX IDENTIFICATION NUMBER (TIN)