News Release - Fatca

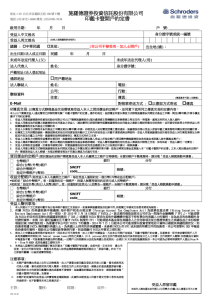

advertisement

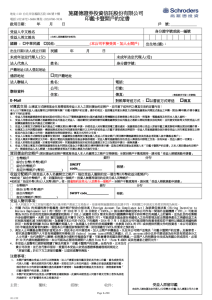

Thomson Reuters Launches FATCA Compliance Solution Combined market leading content and technology reduces regulatory burden for firms LONDON, 07 January, 2013 – Thomson Reuters, the world’s leading source of intelligent information for businesses and professionals, today announced the launch of a solution to help institutions fulfil and comply with their obligations under the forthcoming US Foreign Account Tax Compliance Act (FATCA). Supported with the full power of Thomson Reuters content and solutions assets from its Governance, Risk & Compliance, and Tax & Accounting businesses Thomson Reuters for FATCA Solution, brings together market leading technology already widely used by organizations around the world to solve issues with regulatory compliance, tax documentation and tax reporting. It will enable organisations to identify, maintain and validate their customer records to assist in FATCA compliance. It is estimated that tax avoidance by US citizens and entities using offshore bank accounts and other vehicles held at foreign financial institutions (FFIs) is costing the US government around $500 billion a year. Under FATCA rules, which become effective on 1 January 2013, all FFIs will be required to collect, manage and report all information that could reasonably point to individual’s liability for US taxation to the Internal Revenue Service (IRS) – a process estimated to cost foreign banks, with more than 25 million accounts, at least US$250 million (US$10 per account) to implement, according to the European Banking Federation and the Institute of International Bankers. “The real costs for FATCA compliance, on an individual firm basis, will vary based on the state of the client account data in question and the technology and systems framework in place to store that data,” said Virginie O’Shea, analyst, Aite Group. “Those with a more robust legal entity or client data management framework or anti-money laundering (AML), or Know Your Customer (KYC) assessment scheme in place are likely to be better positioned to tackle the challenge.” The impact of FATCA will be widely felt across the financial industry with banks, investment funds, insurance companies, mutual funds, broker-dealers, custodians, intermediaries, and private equity firms all having to comply. FATCA places significant reporting requirements on firms to identify US account holders. This will create significant operational and systemic pain points, particularly around on-boarding, classifying and documenting new clients, and in gathering sensitive data from a variety of structured and unstructured sources. Thomson Reuters for FATCA Solution comprises modules for On-Boarding, featuring US indicia search; Self-Assessment, featuring W-8 and W-9 form preparation and collection; and Tax Information Reporting, featuring forms 1042, 1042S and 1099. The solution also features configurable regulatory and management reporting. It is designed to integrate easily with organisations existing processes and technology and is offered as an installed or hosted solution. “FATCA compliance will require a multi-disciplinary approach that will touch many points across an organization,” said Laurence Kiddle, commercial director, FATCA, Thomson Reuters. “Thomson Reuters has brought together a number of leading tried and tested technologies, spanning governance, risk, compliance, tax and accounting to enable compliance with this new direction in taxation regulation. This approach makes us uniquely placed to provide a full, and modular, solution that can help institutions fulfil and comply with the obligations they are under and supports every stage of the challenges they will face as a result of FATCA.” Thomson Reuters Thomson Reuters is the world's leading source of intelligent information for businesses and professionals. We combine industry expertise with innovative technology to deliver critical information to leading decision makers in the financial and risk, legal, tax and accounting, intellectual property and science and media markets, powered by the world's most trusted news organization. With headquarters in New York and major operations in London and Eagan, Minnesota, Thomson Reuters employs approximately 60,000 people and operates in over 100 countries. Thomson Reuters shares are listed on the Toronto and New York Stock Exchanges. For more information, go to: http://thomsonreuters.com CONTACTS Alan Duerden PR Director, GRC & Marketplaces +44 20 7542 0561 +44 7825282483 alan.duerden@thomsonreuters.com Tina Allen PR Manager, Tax & Accounting + 44 207 375 6814 +44 7766 922022 tina.allen@thomsonreuters.com