CODES OF PRACTICE FOR CERTIFIED FUNDS

advertisement

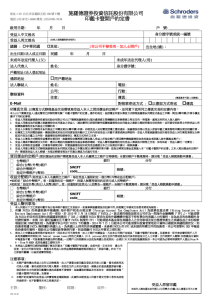

JFA – Legal Update 24 October 2013 PRESENTED BY Robert Milner LEGAL UPDATE ■ AIFMD ■ New Prospectuses Order ■ Managed Accounts ■ LLPs ■ FATCA and Son of FATCA ■ New Security Interests Law FOCUS FOR TODAY – FUNDS PRACTITIONERS ■Background? ■Why should you care? ■Next Steps? AIFMD: BACKGROUND ■ EU legislation seeks to harmonise regulation and marketing of AIFs by AIFMs ■ Ultimately, aims to provide a ‘passport’ to market throughout the EU (per prospectus directive, UCITs, etc) ■ Focuses on the AIFM (although does impact AIFs too) ■ Went through many iterations (political dynamite) AIFMD: WHY SHOULD YOU CARE? ■ New Jersey laws – apply where any fund is marketing into EU – Require all AIFs and AIFMs to be regulated – BUT only if AIFMD applies ■ Existing regulated funds and managers pretty much OK ■ Transitional provisions ■ AIFs – AIF certificate ■ AIFM – FS(J)L registration (consent for “sub-threshold”) ■ Horrible consequences of getting it wrong: criminal offences in EU and Jsy PLUS Art 22 FS(J)L – contracts can be void EXISTING AIFS: BRIDGING THE GAP ■ AIFMD rules AIF Codes of Practice ■ Consent to marketing ■ Supervision ■ Information Notice AIF Cert AIF Cert ■ Authorisation ■ Permission Very private COBO only / PPF Regulated CIF Unregulated Fund JERSEY REGULATION: AIFS * The Alternative Investment Funds (Jersey) Order 2013, Article 2(3) ** The Alternative Investment Funds (Jersey) Order 2013, Article 2(1) JERSEY REGULATION: AIFMS *The Financial Services (Jersey) Law 1998, Schedule 2, Part 5, Article 23(3) ** The Financial Services (Jersey) Law 1998, Schedule 2, Part 5, Article 23(1) NEW STRUCTURES – SPOTTING THE ISSUES ■ What is “marketing”? ■ What is an AIF? ■ What is an AIFM? Why aren’t the answers clear? ■ 28 interpretations ■ Little guidance outside UK ■ ESMA / EU review NEW STRUCTURES: WHAT IS AN AIF? ■ Very broad definition - easier to look at what isn’t caught ■ Trading companies – ie commercial activity (not including financial services) or industrial activity is OK ■ Joint-ventures ■ Intra-group: only investors are in manager’s group and none are funds ■ Employee participation schemes ■ Managed accounts NEW STRUCTURES: WHAT IS AN AIF? ■ Other things that aren’t caught: ■ UCITS ■ Holding companies ■ Securitisation special purpose vehicles (SPVs) ■ Pension funds, insurance contracts Concerns about club deals, co-invest vehicles etc NEW PROSPECTUSES ORDER: BACKGROUND ■ Collective Investment Funds (Certified Funds – Prospectuses) (Jersey) Order 2012 ■ All certified funds (unclassified, expert, listed) must comply from November 2013 ■ Replaces UFPO and CGPO NEW PROSPECTUSES ORDER: WHY DO YOU CARE? ■ Transitional provisions about to expire ■ All open-ended funds will be caught ■ Closed-ended funds – impact if they started marketing before November 2012 ■ Requirement for ongoing revision (can be done by supplement) if new offer or material change ■ Criminal offence- 5ys and/or fine NEW PROSPECTUSES ORDER: NEXT STEPS ■Beat the rush! ■If UFPO compliant, should be straightforward ■Can get derogations – need to be reasoned and specifically requested MANAGED ACCOUNTS: BACKGROUND ■ What is a managed account? ■ Art 2 FS(J)L – distinguishes FSB and IB based on who the client is ■ FSB regime less onerous than IB ■ Fund managers prejudiced – need IB as well as FSB for doing exactly the same job ■ Proposed new class of FSB and IB exemption ■ Hopefully in force early 2014 MANAGED ACCOUNTS: WHY SHOULD YOU CARE? ■ Can streamline regulation for existing Jersey fund managers ■ Can attract new managers to the Island and encourages substance ■ Provides clarity on tax position ■ Potentially neat solution to AIFMD MANAGED ACCOUNTS: CRITERIA ■Minimum investment US$1,000,000 ■Single Individual (includes couples and family offices) or Corporate client ■Discretionary investment management ■Investment policy/restrictions either the same or substantially similar to existing fund ■Subject to change! MANAGED ACCOUNTS: NEXT STEPS ■Tell people! ■See if suitable for fund manager clients MoME’d or otherwise ■Convert existing structures? ■Develop custody products? LLPs: BACKGROUND ■ Introduced in 1997 ■ Supposed to attract international professional partnerships ■ Combination of £5m ‘deposit’ and UK government pressure on HMRC meant no-one used them ■ UK LLPs have since became popular structures for fund managers ■ LLP law changing - £5m requirement already gone - and wholesale modernisation in progress LLPs: WHY SHOULD YOU CARE? ■ Key product for fund managers looking to set up in Jersey ■ Combination of separate legal personality, tax transparency and limited liability ■ Other tax advantages in UK ■ More flexible than companies - like a ‘general’ partnership but with limited liability ■ More flexible than limited partnerships – every partner can take part in management without losing limited liability LLPs: NEXT STEPS ■ Get familiar with the structure – basic filing and solvency requirements ■ Spread the word ■ Await new LLP law later this year ■ New UK proposals may drive existing LLPs offshore FATCA/SON OF FATCA: BACKGROUND ■ The US wants the rest of the world to help it collect taxes ■ This is done by identifying US investors in local structures and providing information on their interests or by making foreign financial institutions withhold tax on payments they make ■ If you don’t comply, the US can impose withholding taxes on any US investments ■ Everyone hates FATCA – delayed and possibly diminished – 1 Jan 2015 now deadline for FFIs ■ UK wants in on the act – Son of FATCA ■ Stop Press: Jsy/UK IGA signed up this week FATCA/SON OF FATCA: WHY SHOULD YOU CARE? ■ Withholding tax = very unhappy investors (particularly non-US) ■ Either Fund or Administrator/Custodian will be responsible ■ Need to know who your investors are ■ Deemed compliance ■ Data Protection issues? ■ Son of FATCA could drive UK investors elsewhere FATCA: NEXT STEPS ■ FATCA: Wait for Guidance Notes ■ Son of FATCA: IGA details to follow ■ In the meantime, identify existing US investors ■ Identify new US investors – use subscription agreement reps ■ Sort potential Data Protection issues – use subscription agreement ■ New world order on tax network agreements by 2015? NEW SECURITY INTERESTS LAW: BACKGROUND ■ Old law was old ■ New law is new ■ New not necessarily better but coming in on 1 January 2014 anyway NEW SECURITY INTERESTS LAW: WHY SHOULD YOU CARE? ■ If your structures lend against Jersey-situate collateral, all security must be taken in accordance with new law from 1/1/14 ■ Existing security OK – but could it be improved? ■ More certainty on non-sale enforcement ■ Register introduced so need to check when buying Jersey assets ■ If you are a bank or custodian, you may have to be party to SIAs ■ Third party security now officially OK CONTACT DETAILS Robert Milner Partner, Carey Olsen T 01534 822 336 E robert.milner@careyolsen.com This presentation is intended for educational purposes only, is not for circulation and does not constitute legal advice. Legal advice should be sought for specific queries or circumstances. © Copyright 2013