The Troubled Partnership - Workouts and Debt Restructurings

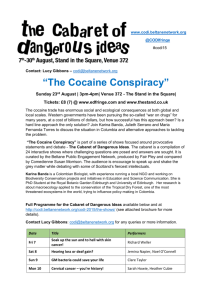

advertisement

From PLI’s Course Handbook Tax Planning for Domestic & Foreign Partnerships, LLCs, Joint Ventures & Other Strategic Alliances 2009 #18554 32 PARTNERSHIP WORKOUTS: BASIC ISSUES AND ANALYSIS Adam Handler Julie Bruington PricewaterhouseCoopers LLP 1 PARTNERSHIP WORKOUTS: BASIC ISSUES AND ANALYSIS By Adam Handler Julie Bruington1 I. Introduction The topic of debt workouts and restructuring for partnerships and partners is timely for a variety of reasons, including but not limited to: Declining asset values and deterioration of operational profitability; Lack of access to credit in the public market; Debt instruments trading at substantial discounts to book value; and Ambiguity in debt valuations. Debt restructuring is generally accomplished by using one, or a combination, of the following techniques: (a) satisfy the debt with cash; (b) modify the terms of the existing debt or exchange the existing debt for new debt containing different terms; (c) exchange all or a portion of the existing debt for an equity interest in the partnership; or (d) some combination of the techniques above. II. Cancellation of Indebtedness Income The key consideration is will the debt workout result in cancellation of debt income ("CODI"), and if so what are the collateral consequences to the partnership, its partners and third-party lenders.2 Absent any statutory exceptions, if a debt is being forgiven or reduced, the forgiveness or reduction will result in CODI.3 However, the nature of the debt (recourse vs. nonrecourse) must also be considered as it can effect the allocation of the CODI by a partnership or the amount of gain recognized if the property is disposed of in connection with the debt forgiveness.4 1 Adam Handler is a principal in the Los Angeles office and Julie Bruington is a partner in the Tysons Corner, VA office of PricewaterhouseCoopers, LLP. 2 Section 108 of the Internal Revenue Code of 1986, as amended (the "Code"). Unless otherwise noted, all "Section" references are to sections of the Code and all "Reg." references are to regulations published under the Code. 3 Reg. 1.61-12; Section 108(a). 4 Section 752; Reg. 1001-2. 2 Debt satisfaction by cash payment The partnership's liabilities are reduced by the amount of the payment. The reduction in partnership liabilities is allocated among the partners and each partner's share is considered as a distribution of money to the partner by the partnership.5 If the amount considered as a distribution of money to a partner exceeds the adjusted basis of that partner's partnership interest, the distributee recognizes taxable gain.6 Partnership liabilities also can be reduced by a sale or distribution of encumbered partnership property.7 No recognition of CODI if the debt is neither forgiven nor reduced. Debt modifications8 Presumes that the debt will be either forgiven or reduced. The determination of and subsequent recognition of any CODI is made at the partnership level. Any CODI recognized must then be allocated by the partnership to its partners pursuant to Section 703. Generally, any available Section 108(a) exclusion is applied at the partner level.9 Foreclosure - Recourse vs. Nonrecourse A foreclosure of property that secures a recourse obligation is bifurcated into two separate and independent transactions (1) a sale or other disposition of the subject property and (2) a discharge of a portion of the taxpayer's indebtedness.10 If the property was secured by nonrecourse debt, the full amount of the debt is treated as the taxpayer's amount realized on the disposition.11 The amount realized on the foreclosure sale involving recourse debt is calculated by reference to the fair market value ("FMV") of the property as though the property were first sold for that value and the cash proceeds paid to the creditor in satisfaction of its liability to that extent.12 5 Section 752(b); Reg. 1.752-1(c). Section 731(a). 7 Reg. 1.1001-2. 8 Reg. 1.1001-3. 9 Section 108(d)(6). 10 Reg. 1.166-6. 11 Commissioner v. Tufts, 461 U.S. 300 (1983). 12 Absent clear and convincing proof to the contrary, the amount bid in by the creditor is presumed to be the fair market value. Reg. 1.166-6. 6 3 Allocation of CODI to partners generally No existing guidance under either Section 108 or Section 704(b), or the regulations thereunder. In a simplified case that assumes the amount of CODI allocated to a partner would be exactly equal to the portion of the debt discharged and allocated under Section 752, the result would be: o An increase in the partner's basis of her partnership interest under Section 705 for the amount of the allocated CODI; o A reduction in the partner's share of her partnership liabilities caused by the debt discharge, resulting in a deemed distribution under Section 752; and o A reduction of the partner's basis in the partnership under Section 733, thus offsetting the Section 705 basis increase. o Insolvent partners or partners in bankruptcy may exclude the allocated CODI.13 o CODI resulting from the discharge of qualified real property business indebtedness to a taxpayer other than a C corporation can also be excluded.14 Typical general partnership structure Partners share income, gain, loss and deductions on the same proportionate basis. o CODI and decreased partnership's liabilities resulting from the debt discharge will typically be allocated to the partners in accordance with their respective partnership percentages. o A debt modification or exchange should not result in income to any partner in excess of any CODI allocation unless a partner or a related party was the lender on a nonrecourse liability.15 Typical limited partnership and limited liability company structure Partners do not share all items on the same proportionate basis. o Two critical considerations in CODI allocation: nature of debt discharged (nonrecourse vs. recourse). extent to which a particular partner is personally liable for the repayment of the debt. 13 Section 108(a)(1)(A) and (B). Section 108(a)(1)(D). There are also exclusions for qualified farm indebtedness and qualified principal residence indebtedness. Section 108(a)(1)(C) and (E). 15 Reg. 1.752-2(c). 14 4 Allocation of Nonrecourse Debt CODI generally should be allocated to the partners in the same ratios as the nonrecourse debt that is being discharged was allocated under Section 752. Partner's net adjusted basis should be unaffected and the only income recognized by the partner will be the allocated CODI. Presumably this allocation should be respected under Section 704(b).16 Allocation of Recourse Debt Allocated in accordance with partners' profit-sharing percentages? or Consistent with the partner's economic risk of loss for the discharged debt immediately prior to the discharge? Profit-sharing Percentage based Allocation Non-Liable Partners (those with no burden of economic loss) will be allocated CODI on debt for which another partner bore the economic risk of loss. Result to a Non-Liable solvent partner (1) phantom income and (2) corresponding tax burden; Bankrupt or insolvent partner could exclude under Section 108(a)(1)(A) or (B);17 Partner with NOLs or passive activity losses may be able to minimize the tax consequences of the CODI allocation; Other exclusions (qualified real property business or farm indebtedness) could apply under Section 108(a)(1)(C) or (D). Liable Partners (those with burden of economic loss) Allocation of CODI may result in a deemed distribution under Sections 731 and 752 in an amount greater than such partners' shares of the CODI Potential for additional gain recognition under Section 731(a). Economic Risk of Loss based Allocation May be preferable for reasons outlined above. No phantom income to Non-Liable Partners. Liable Partners' adjusted bases in their partnership interests remain unchanged. Must consider potential for alteration of the partners' economic arrangement. Consider need for amended partnership agreement to reestablish parity between the CODI allocation and future loss recognition on assets for the liable partners 16 See generally, Reg. 1.704-1 and 1.704-2. The Section 108 exclusions apply at the partner level. Section 108(d)(6). The CODI exclusion generally requires the reduction of tax attributes under Section 108(b) and Section 1017. 17 5 Special Allocations of CODI May be desirable to allocated CODI to insolvent partners. However, special allocations of CODI to insolvent partners able to exclude the income under Section 108(a)(1)(B) may not be respected as "substantial".18 Consider the IRS's ability to reallocate the CODI in accordance with the partners' interests in the partnership.19 Consider the guidance found in Rev. Rul. 92-9720 regarding substantial economic effect. In part, the allocation of CODI will not be respected if, following the allocation, any partner has a negative capital account which he has no liability to restore upon the liquidation of the partnership and is not otherwise matched by a share of minimum gain. Partnership debt-for-equity exchanges Section 108(e)(8), enacted in 2004, provides generally: Recognition of CODI for existing partners to the extent the adjusted issue price of the indebtedness contributed exceeds the FMV of the partnership interest received by the lender. Debt satisfaction is deemed to equal the FMV of the partnership interest. Rule applies regardless of whether the debt was recourse or nonrecourse. This provision repealed the so-called partnership analog to the stock-for-debt exception to CODI.21 Proposed regulations under Section 108(e)(8) issued October, 200822 If a debtor partnership transfers a capital or profits interest in the partnership to a creditor in satisfaction of its recourse or nonrecourse indebtedness, the partnership is treated as having satisfied the indebtedness with an amount of money equal to the FMV of the partnership interest received in exchange for the debt.23 For these purposes FMV of a partnership interest is the liquidation value of the partnership interest if certain requirements are met. Otherwise the FMV is determined based on all the facts and circumstances.24 Liquidation value equals the amount of cash that the creditor would receive with respect to the interest if, immediately after the transfer, the partnership sold all of 18 To be respected, allocations must have "substantial economic effect" or be in accordance with the partner's interest in the partnership. Section 704(b) and Reg. 1.704-1. 19 Reg. 1.704-1(b)(3). 20 1992-2 C.B. 124. 21 The partnership rule is now the same as the corporate rule. See Section 108(e)(10). Note, however, that the contribution of debt to capital rule for corporations contained in Section 108(e)(6) was not made applicable to partnerships. 22 Prop. Reg. 1.108-8. REG-164370-05 (10/31/2008). 23 Prop. Reg. 1.108-8(a). 24 Prop. Reg. 1.108-8(b). 6 its assets (including goodwill and other intangible assets) for cash equal to the FMV of those assets and then liquidated.25 Conditions for use of liquidation value for purposes of this rule: 1. Partnership must maintain the capital accounts of its partners in accordance with Reg. 1.704- 1(b)(2)(iv). 2. The creditor, the debtor partnership, and its partners treat the FMV of the indebtedness as being equal to the liquidation value of the interest for purposes of determining the tax consequences of the exchange (i.e., consistency among all parties). 3. The debt-for-equity exchange must be an arm's-length transaction. 4. After the exchange, neither the partnership nor any person related to the partnership purchases the interest as part of a plan which has a principal purpose of avoidance of CODI by the partnership.26 Query What if the partnership does maintain capital accounts, but did not liquidate in accordance with those capital accounts? Must the allocations meet the substantial economic effect safe harbor set forth in Reg. 1.704-1(b)(2)? Note: Commentators have criticized these regulations on a number of grounds. Tax Consequences to the Contributing Creditor Even if the partnership is required to treat the exchange as giving rise to CODI, the creditor should not recognize a loss in a debt-for-equity exchange subject to Section 721. 25 26 Prop. Reg. 1.721-1(d) provides for nonrecognition treatment to the contributing creditor. As a result, no gain or loss is recognized by the creditor on the transfer of debt to a partnership in exchange for an interest. Does not apply to contribution of debt relating to rent, royalties or interest on the debt (including accrued OID). Basis of the creditor's interest in the partnership is determined under Section 722. o basis acquired by a contribution of property, including money, is equal to the amount of money contributed, and o the adjusted basis of such property to the contributing partner at the time of the contribution, and o increased by the amount (if any) of gain recognized under Section 721(b) to the contributing partner at such time. Prop. Reg. 1.108-8(b)(1). Prop. Reg. 1.108-8(b)(1). 7 The holding period for the partnership interest received in exchange for debt include the creditor's holding period for the indebtedness under Section 1223. Effective date - on or after the date the final regulations are published.27 Consequences for Partner Creditors Consider the form of the transaction in determining the tax consequences to the partner creditor. CODI can result if debt is converted into capital after losses have been incurred (i.e., the most likely time when a partnership will want to convert debt into capital). For debt that has declined in value, transactions other than a contribution of the debt to the partnership may have more favorable tax results. o Will the creditor be able to recognize a loss? o Would a capital contribution by a partner rather than a debt contribution provide different results? Lack of Section 108(e)(6) equivalent for partnership transactions. Consequences for Non-Partner Creditors Contributing creditor either would receive a partnership interest with a value less than the amount of the debt (resulting in CODI to the partnership and allocated to the partners), or Contributing creditor would receive an interest with a value equal to the debt (no CODI) but the value of the equity owned by the other partners would have declined. Thus, there can be CODI based on the value of the interest received. Other Considerations When debt is contributed by a creditor in exchange for a partnership interest, the other partners receive a deemed distribution under Section 731 due to the decrease in their shares of partnership debt.28 Deemed distribution would be taxable only to the extent that it exceeds their basis in their partnership interests.29 If the CODI is taken into account first, the partners' basis would increase by an equal amount, thereby preventing gain recognition under Section 731. Potential impact of Section 704(c) to existing partners of any built-in gain or loss. Opportunities to change the manner in which Section 704(c) is applied to the partnership's assets as a result of the book-up of the capital accounts.30 27 Prop. Reg. 1.108-8(d) and 1.721-1(d). Section 752. Note that if the debt is contributed only in part, then the creditor becomes a partner which could increase the amount of the debt shift under Section 752. 29 Section 731. 28 30 Reg. 1.704-1(b)(2)(iv)(f) and (g). 8 Query How should the debt contribution be characterized if the transaction involves related parties? Debt forgiveness? Contribution to capital? What if the amount of debt forgiven is de minimis--will every partnership have to value its interests every time a small obligation is forgiven? What if the debt is deductible (such as accrued interest); will Section 108(e)(2) override Section 108(e)(8)? Merger of debtor and creditor positions What are the tax consequences of the treatment of the deemed extinguishment of debt between a creditor-partner and a debtor-partnership that arises as a result of a termination under Section 708(b)(1)(A) in a Rev. Rul. 99-631 context? Any CODI? Net distribution or contribution under Reg. 1.752-1(f)? If there is a deemed distribution is there any gain under Section 731(a) from a cash distribution in excess of basis? III. New CODI Legislation under the American Recovery and Reinvestment Act of 2009 ("ARRA") New Section 108(i)32 Elective CODI deferral Provides debtor an election to defer CODI realized in 2009 or 2010.33 CODI is included ratably over a future 5 year tax period (4 year period for debt discharges in 2010).34 Deferral is terminated upon liquidation, business cessation or other acceleration events.35 Election may be made for each separate debt independently. Election is irrevocable, and no other exclusion under Section 108 is permitted.36 Applies to debt instruments issued by C corporations or any other person in connection with the conduct of a trade or business.37 31 1999-1 C.B. 432. Section 1231 of ARRA. Effective for debt discharges in taxable years ending after December 31, 2008. 33 Election is made on the tax return. Section 108(i)(5)(B). 34 Section 108(i)(1). 35 Section 108(i)(5)(D). 36 Section 108(i)(5)(B)(ii) and (C). 37 Section 108(i)(3)(A). 32 9 OID Deferral Relevant in debt-for-debt exchanges or issuance of new debt to purchase existing debt. For transactions in which there is deductible OID in relation to the transaction that generated the CODI, the OID deduction must also be deferred.38 Matching concept on timing of recognition.39 No direct guidance on the allocation of the OID. Application to Partners and Partnerships CODI deferral election is made at the partnership level.40 Election is limited to CODI arising from debt incurred "in connection with a trade or business".41 Partnership is treated as allocating the deferred CODI to its partners immediately before the CODI realization event.42 Favorable rule permitting deferral in the case of deemed distributions as a result of liability relief under Section 752 that would otherwise give rise to gain under Section 731(a).43 Additional issues and considerations There is a need for additional guidance on a number of points to clarify the application of the rules outlined above. Given that the election is made at the partnership level there is the potential for tension between partners who would prefer to defer CODI versus those who would prefer current recognition (those with NOLs or who are otherwise insolvent). What a merger of the debtor and creditor positions in a Rev. Rul. 99-6 type transaction be an acceleration event for recognizing CODI? Would a technical termination under Section 708(b)(1)(B) be an acceleration event? In addition to the two examples presented above, it is unclear how far the definition of acceleration event extends. Section 108(i) does not address tiered partnership structures, among other issues. The IRS is granted broad authority to issue regulations or other guidance interpreting Section 108(i), specifically including rules for partnerships.44 Careful tax planning will be critical in this particular area. 38 Section 108(i)(2). Id. 40 Section 108(i)(5)(B)(iii). 41 Section 108(i)(3)(A). 42 Section 108(i)(6). 43 Section 108(i)(6). 44 Section 108(i)(7). 39 10