Farm Tax Worksheet - Waupun, WI Accounting / O`Connor, Wells

advertisement

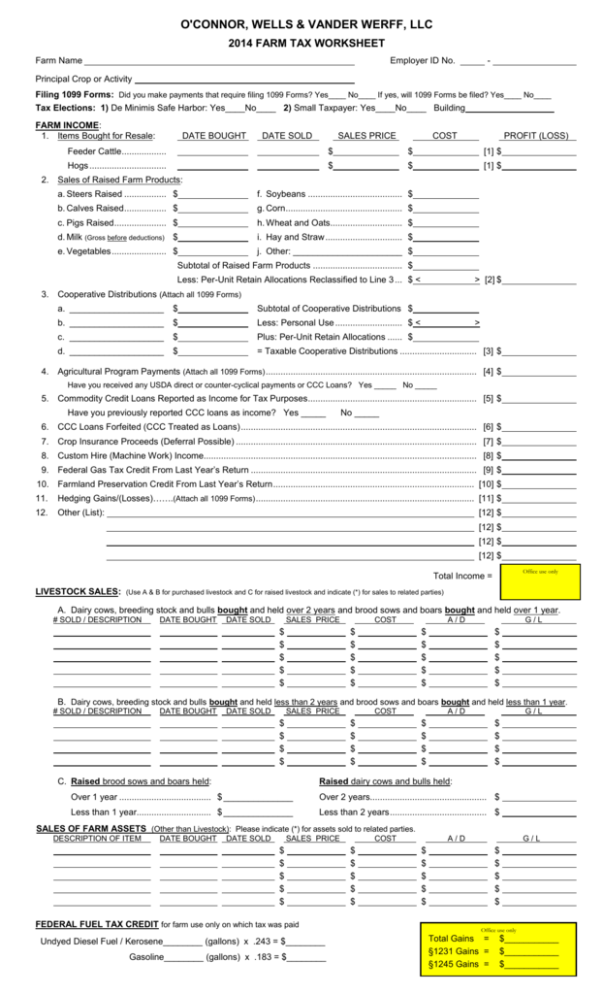

O'CONNOR, WELLS & VANDER WERFF, LLC 2014 FARM TAX WORKSHEET Farm Name Employer ID No. - Principal Crop or Activity Filing 1099 Forms: Did you make payments that require filing 1099 Forms? Yes____ No____ If yes, will 1099 Forms be filed? Yes____ No____ Tax Elections: 1) De Minimis Safe Harbor: Yes____No____ 2) Small Taxpayer: Yes____No____ Building FARM INCOME: 1. Items Bought for Resale: 2. DATE BOUGHT DATE SOLD SALES PRICE COST PROFIT (LOSS) Feeder Cattle .................. $ $ [1] $ Hogs ............................... $ $ [1] $ Sales of Raised Farm Products: a. Steers Raised ................. $ f. Soybeans ...................................... $ b. Calves Raised ................. $ g. Corn ............................................... $ c. Pigs Raised ..................... $ h. Wheat and Oats............................. $ d. Milk (Gross before deductions) $ i. Hay and Straw ............................... $ e. Vegetables ...................... $ j. Other: ______________________ $ Subtotal of Raised Farm Products .................................... $ Less: Per-Unit Retain Allocations Reclassified to Line 3 ... $ < 3. > [2] $ Cooperative Distributions (Attach all 1099 Forms) a. ___________________ $ Subtotal of Cooperative Distributions $ b. ___________________ $ Less: Personal Use ........................... $ < c. ___________________ $ Plus: Per-Unit Retain Allocations ...... $ d. ___________________ $ = Taxable Cooperative Distributions ............................... [3] $ > 4. Agricultural Program Payments (Attach all 1099 Forms) ..................................................................................... [4] $ 5. Commodity Credit Loans Reported as Income for Tax Purposes .................................................................... [5] $ Have you received any USDA direct or counter-cyclical payments or CCC Loans? Yes _____ No _____ Have you previously reported CCC loans as income? Yes _____ No _____ 6. CCC Loans Forfeited (CCC Treated as Loans) ............................................................................................... [6] $ 7. Crop Insurance Proceeds (Deferral Possible) ................................................................................................. [7] $ 8. Custom Hire (Machine Work) Income.............................................................................................................. [8] $ 9. Federal Gas Tax Credit From Last Year’s Return ........................................................................................... [9] $ 10. Farmland Preservation Credit From Last Year’s Return ................................................................................. [10] $ 11. Hedging Gains/(Losses)…….(Attach all 1099 Forms) ........................................................................................ [11] $ 12. Other (List): [12] $ [12] $ [12] $ [12] $ Office use only Total Income = LIVESTOCK SALES: (Use A & B for purchased livestock and C for raised livestock and indicate (*) for sales to related parties) A. Dairy cows, breeding stock and bulls bought and held over 2 years and brood sows and boars bought and held over 1 year. # SOLD / DESCRIPTION DATE BOUGHT DATE SOLD SALES PRICE $ $ $ $ $ COST $ $ $ $ $ A/D G/L $ $ $ $ $ $ $ $ $ $ B. Dairy cows, breeding stock and bulls bought and held less than 2 years and brood sows and boars bought and held less than 1 year. # SOLD / DESCRIPTION DATE BOUGHT DATE SOLD SALES PRICE $ $ $ $ COST $ $ $ $ C. Raised brood sows and boars held: A/D G/L $ $ $ $ $ $ $ $ Raised dairy cows and bulls held: Over 1 year ..................................... $ ______________ Over 2 years............................................... $ Less than 1 year.............................. $ ______________ Less than 2 years ....................................... $ SALES OF FARM ASSETS (Other than Livestock): Please indicate (*) for assets sold to related parties. DESCRIPTION OF ITEM DATE BOUGHT DATE SOLD SALES PRICE $ $ $ $ $ FEDERAL FUEL TAX CREDIT for farm use only on which tax was paid Undyed Diesel Fuel / Kerosene________ (gallons) x .243 = $________ Gasoline________ (gallons) x .183 = $________ COST $ $ $ $ $ A/D G/L $ $ $ $ $ $ $ $ $ $ Office use only Total Gains = §1231 Gains = §1245 Gains = $___________ $___________ $___________ FARM EXPENSES: (Identify any interest or rent paid to a related-party individual or entity) 1. Auto Expense using standard mileage rate: Total miles _____________- personal miles_____________= farm miles_____________x 56¢ = ....... 2. Chemicals ................................................................................................................................................... 3. Custom Hire (See Note 2 Below) ................................................................................................................ 4. Employee Benefit Programs (Include Section 105 Medical Plan Expense) ...................................................... 5. Feed Purchased .......................................................................................................................................... 6. Fertilizer and Lime ...................................................................................................................................... 7. Freight and Trucking (Include Milk Hauling) .............................................................................................. 8. Gasoline, Fuel, Oil & Grease (Don’t include Home or Personal Use) ........................................................ 9. Insurance on Buildings, Livestock, Machinery & Crops: Total $__________ less $________ for Home = 10. Interest Paid on Farm Loans to Individuals and Organizations (See Note 2 Below) Name 1098 Mtg? Amount Name 1098 Mtg? Page 2 [1] [2] [3] [4] [5] [6] [7] [8] [9] $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ Amount a) Yes / No $ f) Yes / No $ b) Yes / No $ g) Yes / No $ c) Yes / No $ h) Yes / No $ d) Yes / No $ i) Yes / No $ e) Yes / No $ j) Yes / No $ Total Interest Paid $ Less: Home Interest (Reported on page 2 of Personal Worksheet) & Personal Interest $ < > [10] Net Farm Interest $ [10] 11. Labor Hired (See Note 1 Below) Exclude commodity wages paid from your total .................................. [11] 12. Pension and Profit-Sharing Plans ............................................................................................................. [12] 13. Rent or Lease (See Note 2 Below) [ a ] Vehicles, Machinery, and Equipment ..................................... [13a] [ b ] Land, Buildings, Animals, etc ................................................. [13b] 14. Repairs & Maintenance (Excluding Home) Buildings $__________ Machinery $__________ Total .. [14] 15. Seeds and Plants ........................................................................................................................................ [15] 16. Storage and Warehousing ......................................................................................................................... [16] 17. Supplies Purchased (General, Twine, Small Tools, Postage, Office Supplies) .......................................... [17] 18. Real Estate & Personal Property Tax: Total $__________ less $________ for Home = [18] Are the 2013 Real Estate Taxes paid? Yes / No 19. Electricity, Telephone and Internet Fees: Total $__________ less $________ for Home = [19] 20. Veterinary Fees, Breeding Fees, and Medicine (See Note 2 Below)........................................................ [20] 21. Truck Expenses (Actual Costs for Insurance, License, Repairs, Tires, etc.) .............................................. [21] 22. Bank Service Charges and Safe Deposit Box .......................................................................................... [22] 23. Legal and Accounting (See Note 2 Below) Total $__________ less $________ Personal = [23] 24. Food for Farm Labor Total $__________ less $________ Personal = [24] 25. FICA Tax (Employer's Share) .................................................................................................................... [25] 26. Unemployment Tax .................................................................................................................................... [26] 27. Farm Dues and Associations .................................................................................................................... [27] 28. Farm Journals and Subscriptions............................................................................................................. [28] 29. Milk Marketing Assessments: NDPRB, WMMB and CWT ........................................................................ [29] 30. Other (List): ______________________________________________________________________ [30] ______________________________________________________________________ [30] ______________________________________________________________________ [30] ______________________________________________________________________ [30] ______________________________________________________________________ [30] ______________________________________________________________________ [30] ______________________________________________________________________ [30] Total Expenses Before Depreciation ................................................................................................................. Depreciation............................................................................................................. ( please leave blank ) Total Expenses Including Depreciation............................................................................................................. $_____________ MTG $______________OTH $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ $______________ Office use only ASSETS PURCHASED - Dairy Cattle, Breeding Stock, Vehicles, Machinery & Buildings (include sales tax) Indicate (*) assets purchased from related parties. Description of Item Purchased New or Used Date Bought Cost or Boot Paid, if Asset Traded Net Income = Description of Item Traded $ $ $ $ $ $ $ $ $ $ $ $ $ $ Wisconsin Only: Addition for 2013 MA Tax Credit $_________ Subtraction for 20% Depreciation Basis Adj. $ (1) If you paid employees, see the attached worksheet and the January 31, 2015 deadline for filing Forms W-2 and 943. (2) Please see the attached worksheet for 1099 Forms filing requirements and the January 31, 2015 deadline.