SA8 - Trinity College Dublin

advertisement

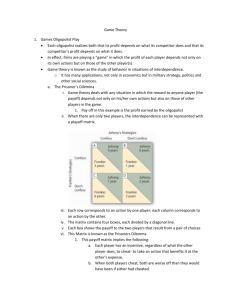

EC2010-Intermediate Economics Microeconomics Module Lecturer: Martín Paredes Trinity College Dublin Department of Economics Hilary Term 2007 SOLUTIONS TO ASSIGNMENT # 8 1. Chapter 14, Review Question # 1 A Nash equilibrium in a game occurs when each player chooses a strategy that gives it the highest payoff, given the strategies chosen by the other players in the game. If players chose strategies that did not constitute a Nash equilibrium, then the players could choose another strategy that increased their payoff given the strategies chosen by the other players. Since players could increase their payoffs by choosing other strategies, strategies that do not constitute a Nash equilibrium are an unlikely outcome in a game. 2. Chapter 14, Review Question # 3 A dominant strategy is a strategy that is better than any other strategy the player might follow no matter what the other player does. A player has a dominated strategy when it has other strategies that give it a higher payoff no matter what the other player does. A player would be unlikely to choose a dominated strategy because the player could always improve his payoff by choosing another strategy regardless of the strategies chosen by the other players. 3. Chapter 14, Review Question # 5 Yes, a game can have a Nash equilibrium even though neither player has a dominant or dominated strategy. In fact, every game has a Nash equilibrium, possibly in mixed strategies. The game of Chicken is an example of a game with no dominant or dominated strategies but which has a Nash equilibrium. 4. Chapter 14, Problem # 14.1 The Nash Equilibrium is: Player 1 chooses Up while Player 2 chooses Left. 5. Chapter 14, Problem # 14.2 There are two Nash equilibria. Nash equilibrium #1: Player 1 chooses SOUTH, Player 2 chooses WEST. Nash equilibrium #2: Player 1 chooses NORTH, Player 2 chooses EAST 6. Chapter 14, Problem # 14.3 Player 1 has a dominant strategy (UP), which means that DOWN is dominated. Player 2 does not have a dominant strategy, but it does have a dominated strategy (MIDDLE). The Nash equilibrium in this game is for Player 1 to choose UP and Player 2 to choose LEFT 1 7. Chapter 14, Problem # 14.5 a) Neither player has a dominant strategy in this game. b) In this game, Asahi has a dominated strategy, ¥720 is dominated by ¥690, and Kirin has a dominated strategy, ¥720 is dominated by ¥690. Assuming neither player will play these dominated strategies we can remove them from the game. The reduced game is ¥630 ¥660 ¥690 Asahi c) ¥630 180, 180 178, 184 175, 185 Kirin ¥660 184, 178 183, 183 182, 192 ¥690 185, 175 192, 182 191, 191 Now that we have eliminated a dominated strategy from the original game, both players now have a dominated strategy in the reduced game. Asahi has a dominated strategy, ¥690 is dominated by ¥660, and Kirin has a dominated strategy, ¥690 is dominated by ¥660. Assuming neither player will play these dominated strategies we can remove them from the game. The reduced game is Kirin Asahi ¥630 180, 180 178, 184 ¥630 ¥660 ¥660 184, 178 183, 183 d) Now that we have eliminated another dominated strategy from the original game, both players have a dominant strategy to choose ¥630. e) Based on the analysis above, the Nash equilibrium in this game has both players choosing ¥630. 8. Chapter 14, Problem # 14.7 This game has two Nash equilibria corresponding to the outcomes where one firm chooses “Enter” and the other firm chooses “Do Not Enter.” Thus, Alcatel choosing “Enter” and Nokia choosing “Do Not Enter” is one Nash equilibrium; and Alcatel choosing “Do Not Enter” and Nokia choosing “Enter” is the other. 9. Chapter 14, Problem # 14.10 a) For x > 50, both firms have a dominant strategy. The unique NE is (Low, Low). b) For 40 < x < 50 only Firm 2 has a dominant strategy. The unique NE in this case is still (Low, Low). c) For x < 40, there are zero dominant strategies, and no NE exists. 2 10. Chapter 14, Problem # 14.11 a) Jack $0 Jill $1 $2 $0 10, 10 0, 19 0, 18 $1 19, 0 9, 9 -1, 18 $2 18, 0 18, -1 8, 8 b) For both players, bidding $0 is always dominated by bidding $2. c) The Nash equilibrium is ($2, $2). d) At ($11, $11), each player would earn $10 – $11 = –$1. This would not be a Nash equilibrium because either player would prefer to bid $0 and lose the auction (earning $0) rather than bidding $11 and losing money in the end. 11. Chapter 13, Review Question # 1 In a Cournot setting, each firm chooses a level of output that maximizes its own profit given the output choice of the other firm. In equilibrium each firm is choosing the profitmaximizing level of output given the other firm’s output choice. Thus, neither firm will have any regret since it is doing the best it can given the other firm’s choice. 12. Chapter 13, Review Question # 2 A reaction function represents a firm’s best response to each possible choice of another firm. For example, in a Cournot model a reaction function represents the firm’s profit-maximizing level of output given another firm’s choice of output. At the point where the reaction functions intersect, both firms are choosing a level of output that maximizes its profit given the output choice of the other firm. Thus, neither firm would choose to deviate from this point since doing so would reduce its profit. This point, therefore, represents an equilibrium since neither firm would choose to change what it is doing given the other firm’s choice. 13. Chapter 13, Review Question # 3 The Cournot equilibrium price is less than the monopoly price because the firms in the Cournot oligopoly are not trying to maximize industry profits. By acting in their own self- 3 interest the firms will expand their output to achieve greater profits. By expanding output, market price falls. The Cournot equilibrium price is greater than the perfectly competitive price because the firms in the Cournot oligopoly exhibit market power. This market power allows the firms to set a price above the perfectly competitive price. 14. Chapter 13, Review Question # 4 In the Cournot model of oligopoly, firms choose a level of output given the output choices of rival firms. In the Bertrand model of oligopoly, firms choose a price given the prices set by rival firms. In the Bertrand model it is assumed that the firm with the lowest price will achieve 100% market share. Therefore, firms will undercut the prices of rival firms until price is driven down to the firm’s marginal cost. In a homogenous products oligopoly, Cournot firms exhibit market power and set a price above the perfectly competitive price and provide a level of output below the perfectly competitive level. Bertrand firms, by undercutting prices of rival firms, drive the price down to the level of marginal cost, achieving the perfectly competitive solution. Thus, in the Cournot model price is above the perfectly competitive price and in the Bertrand model price is equal to the perfectly competitive price. 4