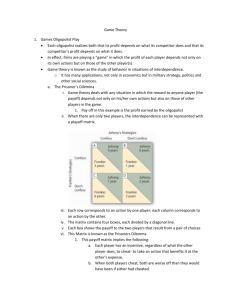

Game Theory: Tutorial

advertisement

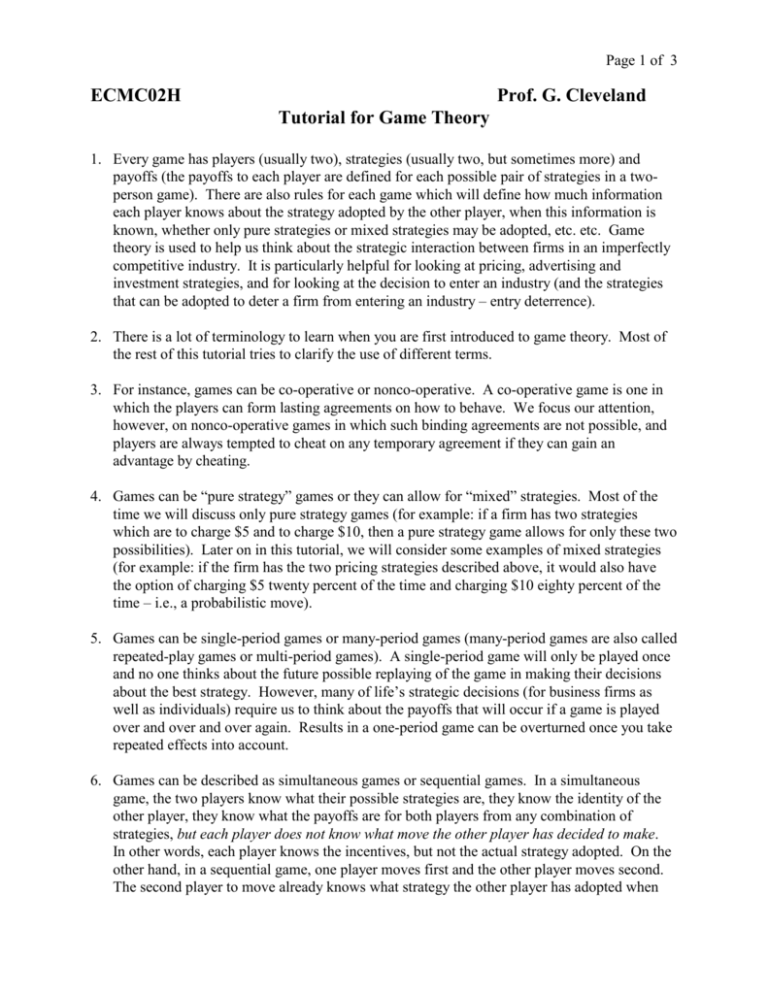

Page 1 of 3 ECMC02H Prof. G. Cleveland Tutorial for Game Theory 1. Every game has players (usually two), strategies (usually two, but sometimes more) and payoffs (the payoffs to each player are defined for each possible pair of strategies in a twoperson game). There are also rules for each game which will define how much information each player knows about the strategy adopted by the other player, when this information is known, whether only pure strategies or mixed strategies may be adopted, etc. etc. Game theory is used to help us think about the strategic interaction between firms in an imperfectly competitive industry. It is particularly helpful for looking at pricing, advertising and investment strategies, and for looking at the decision to enter an industry (and the strategies that can be adopted to deter a firm from entering an industry – entry deterrence). 2. There is a lot of terminology to learn when you are first introduced to game theory. Most of the rest of this tutorial tries to clarify the use of different terms. 3. For instance, games can be co-operative or nonco-operative. A co-operative game is one in which the players can form lasting agreements on how to behave. We focus our attention, however, on nonco-operative games in which such binding agreements are not possible, and players are always tempted to cheat on any temporary agreement if they can gain an advantage by cheating. 4. Games can be “pure strategy” games or they can allow for “mixed” strategies. Most of the time we will discuss only pure strategy games (for example: if a firm has two strategies which are to charge $5 and to charge $10, then a pure strategy game allows for only these two possibilities). Later on in this tutorial, we will consider some examples of mixed strategies (for example: if the firm has the two pricing strategies described above, it would also have the option of charging $5 twenty percent of the time and charging $10 eighty percent of the time – i.e., a probabilistic move). 5. Games can be single-period games or many-period games (many-period games are also called repeated-play games or multi-period games). A single-period game will only be played once and no one thinks about the future possible replaying of the game in making their decisions about the best strategy. However, many of life’s strategic decisions (for business firms as well as individuals) require us to think about the payoffs that will occur if a game is played over and over and over again. Results in a one-period game can be overturned once you take repeated effects into account. 6. Games can be described as simultaneous games or sequential games. In a simultaneous game, the two players know what their possible strategies are, they know the identity of the other player, they know what the payoffs are for both players from any combination of strategies, but each player does not know what move the other player has decided to make. In other words, each player knows the incentives, but not the actual strategy adopted. On the other hand, in a sequential game, one player moves first and the other player moves second. The second player to move already knows what strategy the other player has adopted when Page 2 of 3 the second player is making his/her decision. Your textbook does not use the terminology of “simultaneous” and “sequential” games but describes the same issue (drawing an oval around the nodes if a player is assumed not to know what strategy the other player has adopted – see page 390). 7. What constitutes a dominant strategy? A dominant strategy is one that gives you the best result, no matter what the other person chooses to do. For example, consider the following game (note: in all the games I will discuss, the payoff for the first firm will always be listed first): Firm #2 Firm #1 Strategy A Strategy B Strategy Y (10,5) (7,8) Strategy Z (4,3) (6,2) For firm #1, Y is a dominant strategy, because firm#1 always ends up with a higher payoff by choosing this strategy. For firm #2 there is no dominant strategy, because firm #2 does better by choosing A if #1 chooses Z, but firm#2 does better by choosing B if #1 chooses Y. 8. What constitutes a Nash equilibrium? A Nash equilibrium occurs when neither party has any incentive to change his or her strategy, given the strategy adopted by the other party. Clearly, the existence of a dominant strategy will result in a Nash equilibrium: in the game above, firm 1 always chooses Y; firm 2 then chooses B; Y,B is a Nash equilibrium. However, games without any dominant strategies also often have Nash equilibria. A game may have no Nash equilibrium, a single Nash equilibrium, or multiple Nash equilibria. 9. What is a Prisoners’ dilemma game? A prisoners’ dilemma occurs when the Nash equilibrium is a clearly inferior result for both players compared to some other combination. For example: Firm #2 Firm #1 Strategy Y Strategy A Strategy B (10,10) (2,11) Strategy Z (11,2) (3,3) Demonstrate to your own satisfaction that B,Z is a Nash equilibrium, but that it is clearly inferior for both players to A,Y. In fact, here A,Y provides the greatest total payoff for the two players combined, but it is not a stable equilibrium. We call A,Y the joint profit maximizing outcome when we are dealing with an oligopoly arrangement - that is, A,Y would be the outcome of a collusive agreement. Page 3 of 3 10. What is a credible threat? A threat is credible if carrying out the threat does not hurt the party making the threat. In a sequential game or a repeated-play game, a player can threaten to choose a particular strategy if the other player chooses some particular strategy. The objective might be to make that strategy choice unattractive, encouraging a different strategic choice. The threat is credible only if it is truly in the interests of the player making the threat. 11. Provide an example of a noncredible threat. Firm #2 (incumbent) Firm #1 Strategy A Strategy H Strategy E (10,10) (-3, 4) Strategy N (0,16) (0, 10) Firm #2 wants to stop firm #1 from entering the industry (strategy E is entry). The problem is that E,A is a Nash equilibrium (in fact, A is a dominant strategy for firm #2 - to help you remember, A stands for “accommodating” and H stands for “hostile”). Firm #2 may try to stop entry by threatening to play H if firm #1 enters, but such a threat is noncredible because it hurts firm #2. 12. How does commitment make threats credible? One way to make a noncredible threat credible is to take some action that alters the payoffs in advance in a manner that cannot be reversed (usually by incurring sunk costs). Suppose that strategy H in the above model requires firm #2 to spend 10 on various hostile measures (advertising/marketing campaigns, lawsuits, etc.). One approach might be for firm #2 to actually spend this money (10) in advance on preparing these hostile measures. This money is committed even if firm #2 ends up playing the strategy A (you might imagine that firm #2 prepays the lawyers and advertising agency, with an explicit provision that the payments are nonrefundable). The resulting payoff matrix is now: Firm #2 Firm #1 Strategy A Strategy H Strategy E (10,0) (-3, 4) Strategy N (0,6) (0, 10) You can see that this reduces firm #2's payoffs by 10 when it plays A, because the prepayment is now wasted. But now H is a dominant strategy for Firm #2, and N,H is a Nash equilibrium. Firm #2 does better than it did before discovering the commitment.