Example of Derivatives Valuation to Value Real Investments

advertisement

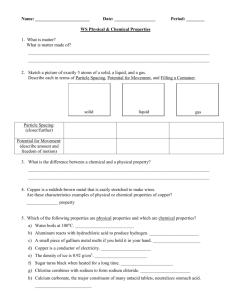

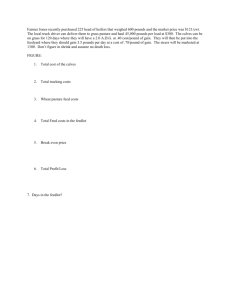

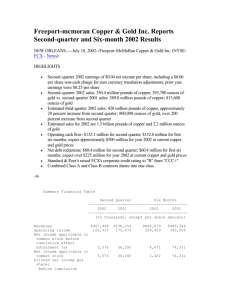

Example of Derivatives Valuation to Value Real Investments Lincoln Copper Company has a mine that will produce a total of 75,000 pounds of copper: 25,000 pounds of copper at the end of the first year and 50,000 pounds of copper at the end of the second year. Extraction costs are always $0.10 per pound. The current forward prices are $0.65 per pound for a one-year contract and $0.60 per pound for a two-year contract. The annually compounded risk-free rates are 5 percent for one-year zero-coupon bonds and 6 percent for two-year zero-coupon bonds. What is the present value of the cash flows from the mine, assuming that payments for the mined copper are received at the end of each year? SOLUTION USING Forward Contracts and zero-coupon bonds: F1 = Year 1 forward price = $.65 per pound F2 = Year 2 forward price = $.60 per pound Inverstment Beginning of year 0 Beginning of year 1 Beginning of year 2 Copper Mine PV Unknown 25,000(p1 - $.10) 50,000(p2 - $.10) ------------------------------------------------------------------------------------------------------------------------------ --a. Forward contract to buy $0 25,000(p1 - $.65) $0 25,000 pounds of copper at beginning of year 1 b. Forward contract to buy 50,000 pounds of copper at beginning of year 2 $0 c. Buy zero-coupon bonds: Maturity = 1 year Face amount = $25,000(.65-.10) -25,000(.65-.10) 1.06 d. Buy zero-coupon bonds: Maturity = 1 year Face amount = $50,000(.60-.10) -50,000(.60-.10) 1.08 Total: $.10) -$35,345 $0 $25,000(.65-.10) $0 50,000(p2 - $.60) $0 50,000(.60-.10) $25,000(p1 - $.10) $50,000(p2 -