Research Digest

Marchcom

6, 2006

Research Associate: Praveen Nevatia,C.A.&M.Sc.

Editor: Nelson Bishop, CFA

Sr. Ed. : Ian Madsen, CFA : imadsen@zacks.com 1-800-767-3771,x417

www.zackspro.com

155 North Wacker Drive

Inamed Corporation

(IMDC-NSDQ)

Chicago, IL 60606

$90.22

Note: All new material since last report is highlighted.

Reason for Report: Pre Earnings Update

Previous Report: January 11, 2006

Overview

Inamed Corporation (IMDC), a global health care company, engages in the development, manufacture,

and marketing of health care products worldwide. It is a leading manufacturer and marketer of medical

products for aesthetics and lifestyle. IMDC’s divisions are breast aesthetics, facial aesthetics, and

obesity intervention.

It offers saline-filled and silicone gel-filled breast implants for aesthetic

augmentation and reconstructive surgery following a mastectomy and various tissue expanders for breast

reconstruction and as an alternative to skin grafting to cover burn scars and correct birth defects; various

dermal filler products to improve facial appearance by smoothing wrinkles and scars, and enhancing the

definition of facial structure. The company also produces the BioEnterics Lap-Band System, a long-term

treatment system for severe obesity, and BioEnterics Intragastric Balloon, a short-term therapy for

patients who need to reduce weight in preparation for surgery or for moderately obese patients. The

company also offers Contigen, a collagen product used for treatment of urinary incontinence due to

intrinsic sphincter deficiency. The company sells its products directly and through independent

distributors. Medicis (MRX) and Inamed Corporation jointly announced that they have entered into a

definitive merger agreement to create a global leader in breast and facial aesthetics products and

therapeutic dermatological medicine. The company is headquartered in Santa Barbara, California.

Additional information is available online at www.inamed.com.

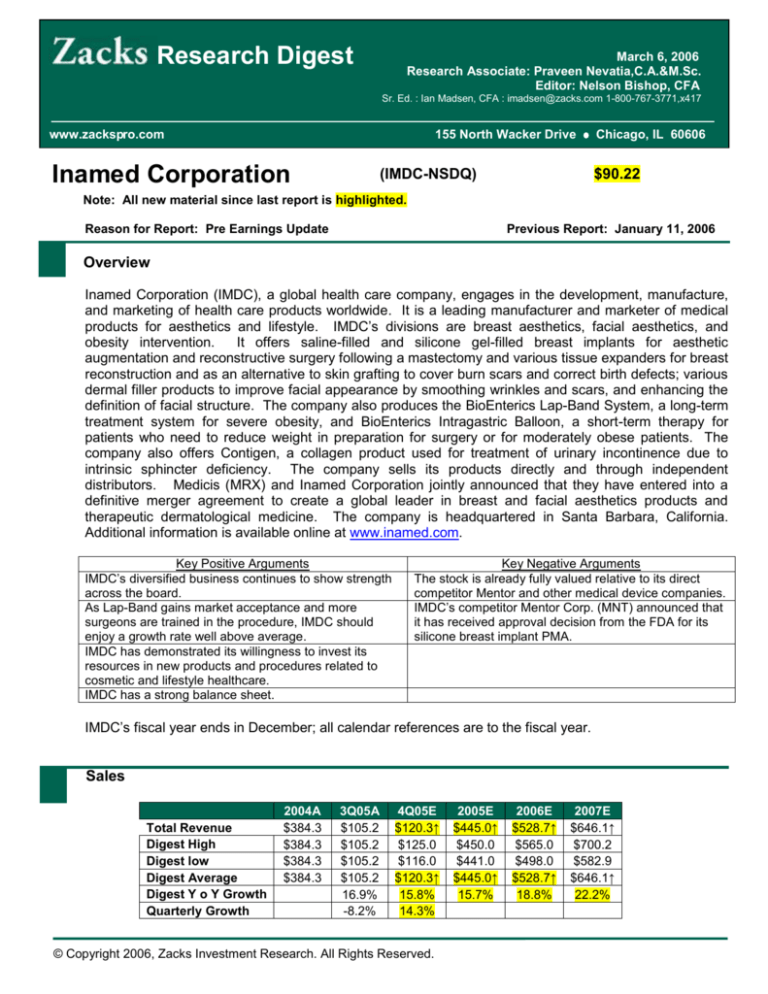

Key Positive Arguments

IMDC’s diversified business continues to show strength

across the board.

As Lap-Band gains market acceptance and more

surgeons are trained in the procedure, IMDC should

enjoy a growth rate well above average.

IMDC has demonstrated its willingness to invest its

resources in new products and procedures related to

cosmetic and lifestyle healthcare.

IMDC has a strong balance sheet.

Key Negative Arguments

The stock is already fully valued relative to its direct

competitor Mentor and other medical device companies.

IMDC’s competitor Mentor Corp. (MNT) announced that

it has received approval decision from the FDA for its

silicone breast implant PMA.

IMDC’s fiscal year ends in December; all calendar references are to the fiscal year.

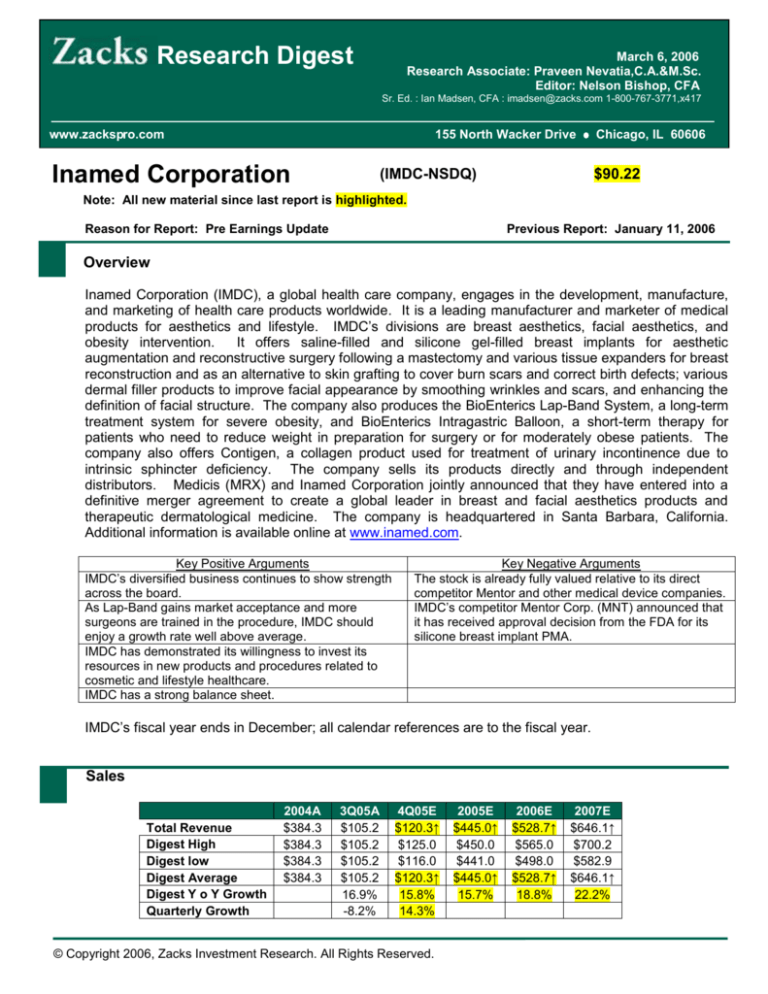

Sales

Total Revenue

Digest High

Digest low

Digest Average

Digest Y o Y Growth

Quarterly Growth

2004A

$384.3

$384.3

$384.3

$384.3

3Q05A

$105.2

$105.2

$105.2

$105.2

16.9%

-8.2%

4Q05E

$120.3↑

$125.0

$116.0

$120.3↑

15.8%

14.3%

© Copyright 2006, Zacks Investment Research. All Rights Reserved.

2005E

$445.0↑

$450.0

$441.0

$445.0↑

15.7%

2006E

$528.7↑

$565.0

$498.0

$528.7↑

18.8%

2007E

$646.1↑

$700.2

$582.9

$646.1↑

22.2%

In 3Q05, total sales were $105.2M; up 16.9% Y/Y. Management expects sales growth in the mid-double

digit. Analysts generally believe that IMDC’s sales growth rate will continue through 2005 and beyond as

it introduces new facial products to its customers, continues to work with the FDA on silicone-breast

implant approval, and achieves market acceptance of its obesity intervention product, Lap-Band. Annual

sales estimates of the analysts with published updated income statements are included in the

accompanying spreadsheet.

One analyst (Piper Jaffray) notes that the FDA approval of silicone appears imminent. This will remove

worry from investors and allow the firm to continue to build its revenues. One analyst (Lazard) also notes

that the firm may have significant upside to revenues in its silicone breast implant division (which

represents 83% of 2005 revenue). They also note that the IMDC product has an operational advantage

over its competitor MNT.

IMDC derives its revenue from four divisions/areas: Breast Aesthetics, Facial Aesthetics, Obesity

Intervention, and Other.

Breast Aesthetics:

IMDC manufactures a range of saline and silicone-filled breast implants used for both cosmetic and

reconstructive procedures. In 3Q05, breast aesthetic product sales increased 5.9% Y/Y to $52.2M.

Analysts note that the imminent approval of silicone will allow sales from this division to continue to grow.

Facial Aesthetics:

IMDC manufactures a full line of facial aesthetic products used in cosmetic procedures to correct facial

wrinkles and lip definition. Its products include Zyderm/Zyplast, Hylaform, and CosModerm/CosmoPlast.

Zyderm/Zyplast implants are injectable formulations of bovine collagen used to smooth wrinkles and

scars. The worldwide sales of the facial aesthetics division decreased 3.5% Y/Y to $16.5M. The

decrease was primarily due to lower sales of dermal filler products in the U.S. market.

On December 06, 2005, Inamed announced that it has submitted the fourth and final module of its

Premarket Approval Application (PMA) for three formulations of Juvederm(TM) [Juvederm(TM) 24 HV,

Juvederm(TM) 30 HV, and Juvederm(TM) 30] to the U.S. FDA. Juvederm(TM) is a non-animal based,

cross linked hyaluronic acid-based dermal filler which Inamed has exclusive rights to market in the United

States. The submission of the final module for Juvederm completes the company’s filing with the FDA

and represents another key milestone in the development of its facial aesthetic products. A late-stage

clinical trial has shown that its Juvederm dermal filler is superior to its Zyplast brand of injectable

collagen.

Obesity Intervention:

IMDC manufactures and markets the Lap-Band adjustable gastric banding system in Obesity

Intervention. This product is designed to treat severe obesity by tightening the top of the stomach and

slowing the passage of food. This minimally invasive procedure is provided as an alternative to full

gastric bypass surgery. Worldwide sales of this segment increased 59.9% Y/Y to $35.5M. The growth

was primarily driven by U.S. sales of the Lap-Band system. Analysts believe that Lap-Band gains are

slowing due to increasingly difficult year-over-year comparisons. Analysts feel Inamed's high-margin

gastric band, the only one currently cleared in the U.S., will continue to penetrate the obesity surgical

intervention market at the expense of gastric bypass procedures.

Other:

Zacks Investment Research

Page 2

www.zackspro.com

IMDC’s other sales include sales of non-breast tissue expanders used as an alternative for skin grafting

to cover burn scars and birth defects.

Margins

2004A

74.6%

23.5%

19.1%

Gross

Operating

Net

3Q05A

72.2%

22.9%

16.6%

4Q05E

73.6%

24.8%

19.6%

2005E

73.2%

22.8%

18.0%

2006E

73.3%

25.5%

19.8%

2007E

71.2%

27.5%

21.0%

From January 1, 2005, IMDC has begun expensing royalties as part of cost of goods and is no longer

including these in SG&A expenses. In 3Q05, gross margin was 72.2%. This was relatively unchanged

from the previous quarter. Year over year, the increase in margins of 29.2% is due mainly to the

exclusion of royalties being included in cost of goods expense.

In 3Q05, SG&A was $42.4M. SG&A as a percentage of sales was 40.3% in 3Q05, which was up from

39.1% in 2Q05, and down from 43.1% in 2Q2004. R&D expense in 3Q05 was $9.1M, compared to

$7.2M in 3Q04, an increase of 26.4%. The increase was primarily due to the ongoing Reloxin and

Juvederm clinical programs in facial aesthetics as well as costs related to sustained activities in the

silicone breast implant regulatory programs.

Earnings Per Share

IMDC reported 3Q05 EPS of $0.53. Including merger-related expense, EPS on a GAAP basis was

$0.41. There were nominal changes in earnings estimates by analysts; none were material, and mainly

due to small adjustments. The firm also released an EPS guidance of $2.24 to $2.32 for FY2005.

Zacks Consensus

Digest High

Digest Low

Digest Avg.

Digest YoY growth

2004A

$2.04

$2.04

$2.04

$2.04

3Q05A

$0.53

$0.53

$0.53

$0.53

12.8%

4Q05E

$0.63

$0.66

$0.62

$0.64

23.1%

2005E

$2.25

$2.33

$2.24

$2.24↓

10.9%

2006E

$2.83↓

$2.94

$2.83

$2.89↑

27.5%

2007E

$3.66

$3.58

$3.63

25.8%

Target Price/Valuation

Target price for IMDC ranges from $93.60 (Zacks Investment Research) to $95 (Lazard). The Digest

average target price is $94.30. This is slightly higher than the previous target price of $93.30. Of the

analysts covering the stock, one has given a positive rating and four others have given a neutral rating.

Rating Distribution

Positive

25.0%

Neutral

75.0%

Negative

0.0%

Avg. Target Price

$94.3↑

Go to the Valuation tab of the IMDC earnings model spreadsheet for more details on the brokers’

valuation methodologies and individual price targets.

Zacks Investment Research

Page 3

www.zackspro.com

Long-Term Growth

The long-term growth rates range from 15% (Piper Jaffray) to 26.9% (Lazard). The Digest average longterm growth rate is 21.0%.

Inamed participates in several high-growth markets, and the company appears to be well situated for

above-average growth rates as it serves the increasing demand for cosmetic and obesity procedures.

The company is unique with its development of its Lap-Band morbid obesity solution, and it expects a

high rate of future growth as the product benefits from increased consumer awareness, further physician

training, and insurance coverage. Analysts feel Inamed is well positioned to capture share in the silicone

breast implant market should the FDA approve the product. This could be a long-term growth driver for

the company.

Capital Structure/Solvency/Cash Flow/Governance/Other

On March 6, 2006, Allergan Inc., maker of the Botox wrinkle treatment, commented that it had extended

its offer for the shares of takeover target Inamed Corp. until March 10. Allergan further clarified that

around 17,779,617 shares or 48 percent of IMDC’s outstanding shares have already been tendered.

On September 21, 2005, IMDC received an approval letter from the FDA for its silicone breast implants.

IMDC must satisfy various conditions outlined in the letter before it receives FDA’s final approval. One

analyst (Adams Harkness) expects final approval by 1Q06. IMDC’s competitor Mentor Corp. (MNT)

announced that it has received an approval decision from the FDA for its silicone breast implant PMA.

Analysts have also noted that Allergan (AGN-SP) has proposed an $84 per share offer for Inamed.

Some analysts think FTC could potentially block the deal. This deal came after the FTC stated it was not

going to require that MRX license Juvederm to it.

On December 13, 2005, Inamed and MRX entered into a merger termination agreement (the plan of

merger was previously executed on March 20, 2005), which had entitled MRX to collect $90M as breakup fees and an additional $481,985 in expense reimbursement fees. Inamed paid these fees in full on

the same day. The termination was brought about by a more attractive offer from Allergan (AGN-SP).

On December 20, 2005, Inamed announced that it had entered into a definitive agreement and plan of

merger with Allergan. Pursuant to the definitive merger agreement and consistent with the exchange

offer previously commenced by Allergan, Allergan will exchange for each outstanding common share of

Inamed either $84 in cash or 0.8498 of a share of Allergan common stock.

On December 20, 2005, Inamed also entered into a termination agreement with Ipsen as a result of

which Ipsen will take back its rights on the botulinum toxin product Reloxin(R), and Inamed and Ipsen will

release each other of all obligations under the distribution agreement regarding Reloxin(R).

Individual Analyst Opinions

POSITIVE RATINGS

Lazard – Buy ($95): Report Date: December 14, 2005: The analyst believes the current offer still does

not cover the value of IMDC, and is unlikely to be accepted. They state that due to recent performance

Zacks Investment Research

Page 4

www.zackspro.com

of the Lap-Brand, breast implant business, strong outlook from Juvederm and Reloxin, IMDC has

experienced a material increase in value not reflected. The analyst believes that the firm will receive an

offer that is higher than the current offer by AGN.

NEUTRAL RATINGS

Cathay Financial - Neutral: Report Date: November 17, 2005: With the new offer from AGN, the

analyst feels the potential upside is more balanced with the downside. The company has already filed for

HSR approval, and the analyst does not anticipate any antitrust issues. The offer also contains a higher

cash component ($1.45 billion vs. $1.1 billion) than the MRX offer, and has lower integration risk.

CIBC – Sector Perform: Report Date: December 07, 2005: The analyst notes the proposed takeover

bid by Allergen provides a significant upside to the stock price, even though it is possible that FTC would

block the deal.

NEGATIVE RATINGS

None

DROPPED COVERAGE

Piper Jaffray – Report Date: November 2, 2005

Canaccord – Market Perform: Report Date: February 24, 2006

Copy Editor: Pushpanjali B.

Zacks Investment Research

Page 5

www.zackspro.com