Handbook for

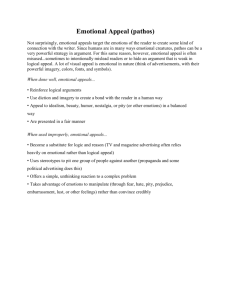

advertisement