What is a Nonprofit Organization

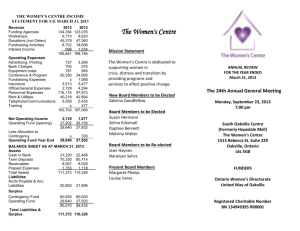

advertisement

KEY ACCOUNTING ISSUES FOR NONPROFITS—EXPENSE ACCOUNTING By Larry L. Perry, CPA CPA Firm Support Services, LLC LEARNING OBJECTIVES Properly account for expenses of nonprofit organizations Understand and explain principles of accounting and reporting for accounts presented on the statement of activities Describe internal controls over cash disbursements that enable their proper recognition in financial statements Discuss the features of the statement of functional expenses Allocate joint costs NONPROFIT ORGANIZATION FINANCIAL STATEMENTS Basic nonprofit organization financial statements include: Statement of Financial Position This statement reports total assets, liabilities, and net assets of an organization and any consolidated subsidiaries. SAS No. 117 requires net assets to be reported as permanently restricted net assets, temporarily restricted net assets, and unrestricted net assets. Unrestricted net assets may include designations made by an entity’s board of directors or trustees. Statement of Activities This statement reports the changes in permanently restricted net assets, temporarily restricted net assets, unrestricted net assets, and the total change in net assets. Revenues are reported in the classes to which they apply. Temporarily restricted revenues are reclassified as unrestricted when time and purpose designations have been accomplished. Revenues from permanently restricted net assets will be accounted for as specified in the related agreements or, if not specified, as unrestricted. All expenses will be recorded as unrestricted in functional categories, program services, management and general, fundraising and, if applicable, member development. Statement of Cash Flows This statement follows the requirements of SFAS No. 95. The statement of cash flows reports cash flows in total rather than by the three classes of net assets. One significant difference is that certain restricted donations (usually permanently restricted) are classified as cash flows from financing activities and not included in income from operations. 1 Statement of Functional Expenses Voluntary health and welfare organizations must present this statement in a matrix format that identifies major categories of expense and their allocation among major categories of program services, management and general and fundraising expenses. Other nonprofit organizations may voluntarily present this Statement to provide financial statement users a better understanding of the entity’s use of resources. ILLUSTRATIVE FINANCIAL STATEMENTS AND FOOTNOTES The following illustration is designed for a small, hypothetical nonprofit organization and includes only common presentation and disclosures. FASB ASC paragraphs 958-205-05 through 55 include numerous illustrations of financial statements presentations and footnotes disclosures for nonprofit organizations. The ASC should be consulted for issues that are not presented in these materials. ILLUSTRATIVE FINANCIAL STATEMENTS AND FOOTNOTES 2 DISASTER RELIEF, INC. STATEMENT OF FINANCIAL POSITION December 31, 2014 ASSETS CURRENT ASSETS Cash: Unrestricted Restricted Inventories of merchandise and supplies Prepaid expenses and deposits Total Current Assets $192,712 87,896 33,214 9,188 323,010 INVESTMENTS 215,632 PROPERTY AND EQUIPMENT 167,946 TOTAL ASSETS $706,588 LIABILITIES AND NET ASSETS CURRENT LIABILITIES Current portion of long-term debt Accounts payable Payroll tax liabilities $ 32,259 15,333 3,115 Total Current Liabilities 50,707 LONG-TERM DEBT 113,839 NET ASSETS Unrestricted (Board designated—$29,672) Temporarily restricted 454,146 87,896 Total Net Assets 542,042 TOTAL LIABILITIES AND NET ASSETS See Accompanying Notes to Financial Statements. 3 $706,588 DISASTER RELIEF, INC. STATEMENT OF ACTIVITIES Year Ended December 31, 2014 Unrestricted Temporarily Restricted Total . SUPPORT AND REVENUES Contributions: Unrestricted Restricted In-kind Unrealized gain on investments Interest Net assets released from restrictions $3,676,820 205,000 863 1,101 153,064 Total Support and Revenues 4,036,848 $3,676,820 $ 240,960 240,960 205,000 863 1,101 (153,064) -087,896 4,124,744 EXPENSES Program services Supporting services Management and general Fundraising Total Expenses 2,593, 401 2,593,401 751,923 563,710 751,923 563,710 3,909,034 3,909,034 INCREASE IN NET ASSETS 127,814 87,896 215,710 NET ASSETS AT BEGINNING OF YEAR 326,332 -0- 326,332 $ 454,146 $ 87,896 $ 542,042 NET ASSETS AT END OF YEAR See Accompanying Notes to Financial Statements. 4 DISASTER RELIEF, INC. STATEMENT OF CASH FLOWS Year Ended December 31, 2014 CASH FLOWS FROM OPERATING ACTIVITIES Increase in net assets Adjustments to reconcile increase in net assets to net cash provided by operating activities In-kind contributions Depreciation Increase in unrealized gains and losses on investments Increase in accounts payable Increase in payroll tax liabilities $ 215,710 (205,000) 18,738 (863) 6,886 1,175 NET CASH PROVIDED BY OPERATING ACTIVITIES 36,646 CASH FLOWS USED IN INVESTING ACTIVITIES Purchase of tractor/trailer (64,031) CASH FLOWS USED BY FINANCING ACTIVITIES Payments on debt obligations __ (54,229) NET DECREASE IN CASH (81,614) CASH AT BEGINNING OF YEAR 362,222 CASH AT END OF YEAR $ See Notes to Accompanying Financial Statements. 5 280,608 DISASTER RELIEF, INC. NOTES TO FINANCIAL STATEMENTS Year Ended December 31, 2014 NOTE A—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES Organization Disaster Relief, Inc. was organized in 1983 and is a nonprofit organization, exempt from income taxes under Section 501 (c) (3) of the Internal Revenue Code. It’s purpose if to distribute lifesustaining supplies and services to residents of areas of the United States that have suffered natural or man-made disasters. The Organization receives a majority of its support and revenues from contributions made by the general public. The Organization maintains operating relationships with several affiliated entities but has no monetary investment in, or substantial influence or control over, these entities. These financial statements, therefore, include only the accounts of Disaster Relief, Inc. Summary of Significant Accounting Policies Method of Accounting: The financial statements of Disaster Relief, Inc. have been prepared on the accrual basis of accounting and in accordance with the American Institute of Accountants’ Audit and Accounting Guide, Not-for-Profit Organizations. The significant accounting policies followed are described below to enhance the usefulness of the financial statements to the reader. Basis of Presentation Financial statement presentation follows the recommendations of the Financial Accounting Standards Board in its Statement of Financial Accounting Standards (SFAS) No. 117 (ASC 958), Financial Statements of Not-for-Profit Organizations. Under SFAS No. 117, the Organization is required to report information regarding its financial position and activities according to three classes of net assets: unrestricted net assets, temporarily restricted net assets, and permanently restricted net assets. Unrestricted Net Assets: Unrestricted net assets are resources over which the Board of Directors has discretionary control and are available for the various programs and administration of the Organization. 6 Temporarily Restricted Net Assets: Temporarily restricted net assets are resources subject to donor imposed restrictions which will be satisfied by actions of the Organization or the passage of time. Donor restricted contributions for which restrictions are met in the same reporting period are reported as unrestricted support. Permanently Restricted Net Assets: Permanently restricted net assets are resources subject to donor imposed restrictions that neither expire by the passage of time nor can be fulfilled or otherwise removed by actions of the Organization. There currently are no permanently restricted net assets. Inventory of Merchandise and Supplies The inventory consists of merchandise and supplies used in the Organization’s program services. The purchased inventory is valued at average cost, which is less than market value. Donated merchandise and supplies are recorded at their fair value at the date of donation. Property and Equipment Property and equipment expenditures of $1,000 or more are capitalized at cost and depreciated over the estimated useful lives of the respective assets on a straight-line basis. Donated fixed assets are capitalized at fair market value and depreciated on a straight-line basis. Routine repairs and maintenance are expensed as incurred. Revenue Recognition All contributions are considered to be available for unrestricted use unless specifically restricted by the donor. Amounts received that are designated for future periods or restricted by the donor for specific purposes are reported as temporarily restricted support, which increases that category of net assets. When a donor restriction expires, that is, when a stipulated time restriction ends or the purpose of the restriction is accomplished, temporarily restricted net assets are reclassified to unrestricted net assets and reported in the statement of activities as net assets released from restrictions. Income Taxes Disaster Relief, Inc. is a nonprofit organization that is exempt from income taxes under Section 501 (c) (3) of the Internal Revenue Code. Management has reviewed all open tax years for all tax jurisdictions and there are no uncertain tax positions or other provision for income taxes that should be recognized in these financial statements. The Organization has also been classified as an entity that is not a private foundation within the meaning of IRC Section 509(a) and qualifies for deductible contributions as provided in IRC Section 170(b)(1)(A)(vi). 7 Use of Estimates The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Concentrations Risk Concentrations risk consists of cash deposits. The Organization maintains its cash in various bank deposit accounts that, at times, may exceed federally insured and other insured limits. The Organization has not experienced any losses in such accounts nor does it expect to incur any such losses in the future. Cash Cash consists of funds on deposit at financial institutions. The Organization has no cash equivalents. NOTE B—INVESTMENTS The Organization has invested in various marketable equity securities. All of the investments are accounted for using fair value accounting in accordance with SFAS Nos. 124 (ASC 958 and 157 (ASC 820). All securities were valued based on quoted market prices on the New York Stock Exchange as of December 31, 2014. Unrealized Description Shares Input Level Gains and Losses Fair Value Dorcus, Intl. Pork Belly Feeds Shovels, Inc. Bean Bagger Co. U.S. Motors 100 390 510 10,105 215 Level 1 Level 1 Level 1 Level 1 Level 1 $ 298 1,398 5,135 1.133 (7,101) $ 863 $ 8,432 43,315 88,999 50,250 24,636 $215,632 NOTE C—PROPERTY AND EQUIPMENT Property and equipment, at cost, consists of the following at December 31, 2014: Office furniture and equipment Delivery trucks $ 87,789 124,664 212,453 44,507 $ 167,946 Less accumulated depreciation 8 Depreciation expense was $18,738 for the year ended December 31, 2014. NOTE D—RELATED PARTY TRANSACTIONS The Organization purchases merchandise and supplies from affiliated organizations dedicated to disaster relief. The Organization has no monetary investment in any of the affiliates or the power to control their operating activites. These organizations and the volume of transactions during the year ended December 31, 2014 are: Pure Water, Inc.—Purchased bottled water--$ 39,548 Surplus Supplies—Purchased canned rations --$ 71,598 Tents and Poles—Purchased tents--$ 149,713 All purchase prices in these transactions were at arms-length and approximated fair market value. NOTE E—DEBT OBLIGATIONS Debt obligations as of December 31, 2014 consist of: Note payable to bank, payable in monthly installments of $ 1,252 including interest at 1.75%, collateralized by 2010 Gruman van $ 15,768 Installment contract payable to GMAC, payable in monthly installments of $ 1,250 including interest at 3.5%, collateralized by 2011 GMC tractor/trailer 64,765 Installment contract payable to Easy Credit Company, payable in monthly installments of $ 668 including interest at 5.99%, collateralized by 2012 Ford F350 flatbed 22,646 Installment contract payable to Legal Lenders, payable in monthly installments of $ 497 including interest at 10.25%, collateralized by 2008 Strato-Liner 42,919 146,098 Less current portion (32,259) $ 113,839 9 Principal maturities on these obligations are: Year Ending December 31, 2015 2016 2017 2018 2019 2020 and thereafter $ 32,259 19,288 20,999 19,132 16,257 38,163 $146,098 Interest paid during the year ended December 31, 2014 amounted to $ 12,196. NOTE F—RESTRICTED NET ASSETS Unexpended temporarily restricted net assets as of December 31, 2014 result from gifts containing donor restrictions requiring use of the funds in the following locations: New Orleans Balance, January 1, 2014 $ Contributions Change in net assets Transfer to unrestricted funds upon satisfaction of purpose restrictions Increase in temporarily restricted net assets Balance, December 31, 2014 $ -0- Galveston $ -0- Total $ -0- 210,980 29,980 240,960 210,980 29,980 240,960 (135,255) (17,809) (153,064) 85,725 2,171 $ 87,896 85,725 $ 2,171 $ 87,896 One individual contributed $ 100,000 of these designated funds during the year ended December 31, 2014. NOTE G—OPERATING LEASE The Organization leases office facilities under an operating lease. As of December 31, 2014, the lease payments are as follows: 10 Year Ended December 31, 2015 2016 2017 2018 $ 62,112 63,729 65,670 10,999 $202,510 Rental expense for the year ended December 31, 2014 amounted to $ 64,887. NOTE H—DONATED SERVICES A number of volunteers have donated significant amounts of their time to the organization’s program services and administrative operations. These donated services are not reflected in the financial statements since none are specialized and, therefore, these services do not meet the criteria for recognition as contributed services. NOTE I—NON-CASH TRANSACTIONS Non-cash transactions during the year ended December 31, 2010, not included in the Statement of Cash Flows, consist of the following: 1. Purchase of 2006 GMC tractor/trailer on an installment contract for $ 69,399. 2. Donations of bedding and linens recorded at fair market value of $ 205,000. NOTE J—JOINT COST ALLOCATION In 2014, the Organization conducted activities that were multi-functional, i.e., they contained program, management and general and fundraising components. Such activities were special events, conferences, workshops and direct mail campaigns. Joint activity costs not directly attributable to these activities are $31,000. Joint costs for each activity were $5,000, $10,000, $9,000 and $7, 000, respectively. These costs were allocated to functional components as follows: New Orleans relief Galveston relief Management and general Fundraising Total $ 8,000 4,000 10,000 9,000 $31,000 11 NONPROFIT GAAP FOR EXPENSES Types of Expenses—Accounting and Presentation Nonprofit organizations’ expenses are classified as follows: Functional expenses Naturally classified expenses Classification of particular costs The statement of activities and footnotes contain information about the costs associated with an NPO’s services and how it uses its resources. Expenses are reported according to their functional classification and include: Program services Supporting activities: o Management and general activities o Fundraising activities o Membership development activities Program services include the activities that result in the fulfillment of the organization’s mission or purposes by distributions of goods or services to the appropriate recipients. Providing food and clothing, educational activities, counseling and child care are examples of such services. A statement of functional expenses is required for health and welfare organizations, or may voluntarily be presented by other NPOs, which allocates the natural classifications of expenses to individual major programs. Management and General activities include: Oversight Business management General recordkeeping Budgeting Financing Soliciting funds other than contributions (exchange transactions, government contracts, etc.) Distributing information to the public regarding stewardship Announcements concerning appointments Preparation and distribution of annual reports All management and administration except that which is directly related to program services or fundraising activities Fundraising activities include: 12 Publicizing and conducting fundraising campaigns Maintaining donor mailing lists Conducting special fundraising events Preparing and distributing fundraising manuals, instructions and other materials Conducting other activities involved with soliciting contributions Membership Development activities include: Soliciting for prospective members and membership dues Membership relations Similar activities When there are no significant benefits or duties connected with membership in an NPO, the membership development costs may be classified with fundraising. When membership development activities are conducted jointly with other activities, costs should be allocated to both (discussed further below). Classification of Particular Costs Certain costs should be classified as follows: Premiums given to potential donors—fundraising expense. Costs of sales—separately deducted from related sales amount unless it is a program (museum bookstore) or supporting service (not a program but major activity) or a peripheral activity (such as a church selling a cookbook) for which costs are presented separately. Interest costs—allocated to program and supporting services; un-allocable amounts should be reported as management and general expenses. Costs of occupancy and maintenance—allocated to program and supporting services but it is not a separate supporting service. Payments to related local and national organizations—allocated to functional classifications to the extent possible; un-allocable amounts are presented as a separate supporting service. Expenses of Federated Fundraising Entities (such as United Way)—fundraising expenses. COST ALLOCATIONS IN THE STATEMENT OF ACTIVITIES Introduction An evaluation of the results of operations of a nonprofit organization is often based on analysis of the costs reported in financial statements and Forms 990 Information Returns. The problem is these evaluations focus only on what was spent rather than how the resources were used by the organization. Cost allocations in financial statements and footnotes should present information about how an NPO used its resources. 13 Expenses are incurred for joint activities among an organization’s program services, its management and general, and its fundraising activities. These expenses should be allocated among program and supporting services to reflect the purposes for which the expenses are incurred. SFAS No. 117 (ASC 958), Financial Statements of Not-for-Profit Organizations, requires functional expense reporting which usually includes cost allocation. Cost allocation may also be necessary for unrelated business income tax calculations, lobbying and government awards expense reimbursement. Accounting for Costs of Joint Activities that Include Fundraising The ASC Glossary for nonprofit GAAP defines a joint activity as one that is part of the fundraising function and that has elements of program and supporting services functions. Joint costs are those connected with joint activities that can’t be identified with a component of the activity. Joint costs may include: Salaries Contract labor Consultants Professional fees Paper Printing Postage Event advertising Telephones Airtime Facility rentals The Fundraising Presumption: FASB ASC, paragraph 958-720-45-37 states, “In circumstances in which joint activities are conducted, a presumption exists that expenses shall be reported as fundraising rather than as program or management and general. The following circumstances are insufficient to overcome that presumption: a. The purpose of the activity includes educating the public about causes. b. The audience has a need or reasonable potential for use of any educational component of the activity pertaining to causes. c. The audience has the ability to assist the NFP in meeting the goals of the program component of the activity by becoming educated about causes.” The ASC provides guidance for overcoming the fundraising presumption by meeting these criterions: Purpose 14 Audience Content When these criterions are met, direct costs are charged to the applicable function and joint costs are allocated among the applicable functions. If any of the criterions are not met, the costs are required to be reported as fundraising activities. A joint activity is one that combines fundraising activities with program, management and general or other activities, such as newsletters, websites, special events, or direct mail and door-to-door solicitations. Two common examples are the use of websites and newsletters for multi-functional purposes. A website is commonly used by NPOs to present organizational, financial, and educational information. Most websites also solicit contributions from visitors. The contributions solicitation qualifies the website as a joint activity. If the purpose, audience and content criteria are not met, all website related expenses must be classified as fundraising. Newsletters are also used by NPOs to present organizational, financial and educational information. The newsletters may contain a contributions solicitation section or an accompanying solicitation device or reply envelope. Even if the newsletter contains no solicitation, and it includes a device or reply envelope, it would usually be considered a joint activity including fundraising. Again, if the purpose, audience and content criteria are not met, all newsletter related expenses must be classified as fundraising. Overcoming the Fundraising Presumption: Purpose Criterion The purpose criterion is met when the costs of the joint activity are related to accomplishing program or management and general functions. To accomplish program functions, the activity must call for specific action by the audience that helps accomplish the organization’s exempt purpose by benefiting recipients or society in general. When program services and/or management and general functions are combined with fundraising, these factors must be considered in order to determine if the purpose criterion is met: 1. The Compensations or Fees Test. The purpose criterion is not met when any individual is compensated for performance based on the funds raised in an activity (such as a church building program with a compensated fundraiser). 2. The Separate and Similar Activities Test. The purpose criterion is met if a similar activity is conducted separately on a similar or greater scale. 3. The Other Evidence Test. If the first two tests cannot be completed because of inadequate information, other evidence such as verbal appeals or previous operations of the organization may be considered. 15 Audience Criterion A rebuttable presumption exists that the audience criterion is not met if the audience is selected from a database of prior donors or the ability or likelihood of recipients to contribute. In making such determinations, the organization must consider the extent to which the selection was made for these reasons. If the audience’s ability and likelihood to donate is a significant factor in its selection, and its need is an insignificant factor, the presumption would not be overcome. When the audience is not selected as described in the previous paragraph, the audience criterion is met if the audience is selected for any of these reasons: The audience’s need for the action called for. The audience’s ability to take the action. The organization is required to direct the management and general component to a particular audience or one that can be reasonably expected to use the component. Content Criterion If the joint activity supports program or management and general functions, the content criterion will be met if: The program component of the joint activity calls for a specific action that will help accomplish the organization’s exempt purpose. The management and general component of the joint activity fulfills a management and general responsibility of the organization. A Chronology of the Application of Criteria to Overcome the Fundraising Presumption: 1. Determine if the activity includes a contribution solicitation. If not, the cost should be charged or allocated to the applicable program or supporting service. 2. If the activity includes a solicitation, apply the Purpose Criterion by determining if the activity calls for a specific action. 3. Determine if a majority of compensation of anyone performing the joint activity is based on the funds raised. If so, all the costs are fundraising. 4. If not, determine if the activity is conducted on a similar scale using the same medium without the solicitation. If it is not, determine if there is other evidence. If no other evidence, all the costs are fundraising. 5. If the program is conducted on a similar scale using the same medium, go to the Audience Criterion. 6. Determine if the audience is selected from prior donors or the ability or likelihood to contribute. If so, determine if the presumption the audience 16 criterion is not met can be overcome based on its selection of management and general reasons. If so, go to the Content Criterion. 7. Determine if the activity motivates the audience to take action in support of program goals or if it fulfills management and general responsibilities. If it does not, all costs are fundraising. 8. If the action called for supports these goals or responsibilities, joint costs can be charged or allocated to a particular function. A detailed flowchart and explanations of the application of the purpose, audience and content criterion is included in the FASB ASC, paragraphs 958-720-55-1 through 24. An Example of Application of the Purpose, Audience and Content Criterion A nonprofit organization was created for the purpose of educating and serving clients that have been diagnosed with a debilitating and potentially terminal disease. The NPO presents three types of conferences or events in carrying out its exempt purposes: 1. Conferences for its clients that only include workshops on how to improve the quality of client’s lives. The brochure challenges clients to take action and make changes in their lifestyles (the mission of the NPO). A small admission fee is charged to the clients. Conference organizers are salaried staff members of the organization. 2. A conference for past and possible future donors and clients that also includes quality of life workshops and, in addition, main sessions featuring well-known actors and sports heroes that suffer from the disease. 3. Events such a bike rides, fun runs and walks are held to create public awareness of the disease and to raise funds to support the work of the NPO. The first type of conference is carrying out the educational purposes of the NPO. Only clients are invited and there is no fundraising activity conducted at the conferences. The purpose, audience, and content criterion are met and costs of this conference can be charged to program services. While the second type of conference also includes workshops for clients, another purpose is the motivation of potential donors. The call to action for clients may also be to change their lifestyles but other individuals are invited because of their ability or likelihood to contribute to the organization. Because the organization is also holding the first type of conference, and because it is publicized in the same way, a general mailing that doesn’t concentrate on potential donors may satisfy the audience criterion. This mailing concentrated on potential donors and, therefore, the audience criterion is not met and all costs must be recorded as fundraising. The third type of event does create awareness of the disease, which is part of the NPO’s mission, but the events are clearly held for the purpose of raising funds and, therefore, the purpose, audience and content criterion need not be considered. All costs of these events must be recorded as fundraising expenses. 17 From this example and the text above, we can extract some tips for planning direct mail campaigns to maximize the costs that can be allocated to program services: Always include a strong call to action that helps accomplish the organization’s mission. Avoid paying organizers or fundraisers based on a percentage of funds raised. Use staff persons skilled in the program services as opposed to fundraisers to organize the event. Hold similar events using the same medium that are clearly program services. When the audience includes potential donors, but was not selected primarily for motivating contributions, the program services should be clearly documented in a brochure or other literature. When special events are held for fundraising purposes, or when the event will fail one of the three criterions for overcoming the fundraising presumption, program services should be minimized since all costs will be accounted for as fundraising. COST ALLOCATION METHODS Cost allocation methods for joint costs must be rational and systematic and result in a reasonable allocation of costs. The allocation methods must be applied consistently. Three allocation methods are described in the ASC: 1. Physical units method 2. Relative direct cost method 3. Stand-alone joint-cost-allocation method Physical Units Method Joint costs are allocated to materials and activities based on the proportion of the number of units of output that can be attributed to each of the materials or activities. Number of lines, square inches, and other physical content measures are examples of units of output. This method assumes benefits from the joint costs are proportional to the units of output. Use of the physical units method can result in a reasonable allocation of costs if the l units of output can be easily identified with each component of the joint activity. If the benefits received for each of the functional components of the joint activity are directly proportional to the units of output that includes that component, the resulting allocation will be reasonable. If the units of output cannot be clearly assigned to a component function, the method can result in an unreasonable allocation of costs. For example, assume the joint costs for a direct mail campaign are used to conduct programs and to solicit contributions. 75 % of the lines in the device pertain to programs and 25% are used for contributions solicitations. If the purpose, audience and content criterion can be satisfied, joint costs would be allocated in this ratio. Relative Direct Cost Method 18 Joint costs are allocated to each of the components on the basis of their relative direct costs. Direct costs are those costs specifically identifiable with a function. This method may result in an unreasonable allocation if the joint costs are not incurred in similar proportions and for the sane reasons as the direct costs. For example, assume that the costs of a direct mail campaign that can be specifically identified with program services are the costs of separate program materials and a postcard which calls for specific action by the recipient that will help accomplish the organization’s exempt purpose. These costs total $2,000. The direct costs of the fundraising component consist of the costs to develop and produce the fundraising letter, which total $8,000. Joint costs are $4,000 and would be allocated as follows: Program expenses $2,000 / $10,000 x $4,000 = $800 Fund raising expenses $8,000 / $10,000 x $4,000 = $3,200 Stand-Alone Joint-Cost-Allocation Method Joint costs are allocated to each component based on a ratio that uses estimates of the cost of each component if the activity was conducted independently. This method may result in an unreasonable allocation because it doesn’t take into account the positive or negative effect of each component on the other components conducted in a joint activity. For example, the programmatic impact of a brochure on school safety procedures may be lessened if it is distributed in a direct mail campaign that includes also includes a solicitation for contributions instead of a school safety brochure being distributed independently. FASB ASC paragraphs 958-720-55-35 to 165 contain numerous examples of application of the purpose, audience and content criterion and the related allocations of costs for joint activities. BASES FOR COST ALLOCATIONS The identification of direct costs, and the allocation of joint activity direct and indirect costs, is required to present a statement of activities on a functional basis and to present a statement or supplementary schedule of functional expenses. Examples of direct costs for a specific program are salaries of individuals assigned exclusively to the program or the cost of materials and supplies purchased solely for use in the program. Other costs described as joint activity costs above should be allocated among the various functions. Here are some considerations for effectively allocating costs: Each year’s planning should include an evaluation of the preceding year’s time records or activity reports of key personnel, the use of space, the consumption of supplies and postage, and other costs of activities. Reconsideration of allocation methods could result in more accurate cost allocations. 19 Periodic time and expense records should be kept by employees that are assigned to multiple functions. If time expenditures of these employees are relatively consistent from period to period, one or two month tests may be appropriate to support allocations. Expense or time reports may be used to allocate automobile and travel costs. Telephone expense includes direct costs for use and calls attributable to a specific function, or it may be allocated to multiple functions based on the allocation of the salaries of individuals performing the functions. Stationery, supplies, and postage costs may be allocated based on records supporting their use. The square footage of space used for specific programs or functions, or the salaries of persons assigned to those functions, normally will be used to allocate occupancy costs. Asset usage may form the basis for allocation of depreciation expense and equipment rental expense. STATEMENT OF FUNCTIONAL EXPENSES Here is an illustrative statement of functional expenses: DISASTER RELIEF, INC. STATEMENT OF FUNCTIONAL EXPENSES Year Ended December 31, 2010 Salaries and benefits Occupancy costs Relief supplies Travel expenses Conference and events Postage and printing Office expenses Merchandise purchases Publications costs Total New Orleans $ 321,880 52,863 506,412 412,080 41,187 8,778 $1, 343,200 Galvaston $ 195,218 35,242 706,368 262,919 41,187 9,267 $1,250,201 Management and General $ 423,168 79,295 69,949 179,511 $ 751,923 Fundraising $ 49,488 8,811 Total 118,766 90,165 $ 989,754 176,211 1,212,780 674,999 323,014 125,789 197,556 118,766 90,165 $563,710 $3,909,034 240,640 55,840 ILLUSTRATIVE FOOTNOTES DISCLOSURE FOR ALLOCATION OF COSTS Here is an illustration of a footnote disclosure for cost allocations: Note Y. Joint Cost Allocation 20 In 20XX, the Organization conducted activities that were multi-functional, i.e., they contained program, management and general and fundraising components. Such activities were special events, conferences, workshops and direct mail campaigns. Joint activity costs not specifically attributable to these activities are $31,000. Joint costs for each activity were $5,000, $10,000, $9,000 and $7, 000, respectively. These costs were allocated to functional components as follows: Program A Program B Management and general Fundraising Total $ 8,000 4,000 10,000 18,000 $31,000 INTERNAL CONTROLS AND EXPENSE RECOGNITION Management is responsible for designing internal controls over financial reporting to provide reasonable assurance their financial statements are fairly presented. Fair presentation includes the accuracy of management’s representations in financial statements, otherwise known as financial statement assertions. Control activities include entity-level controls and activity-level controls. Entity-level controls have the most pervasive effect on preventing errors or fraud from occurring and going undetected and, in small NPOs, are generally operated by management personnel. Activity-level controls may, in some cases, prevent errors from occurring and going undetected when key controls are not properly designed or operating. Key controls may exist at the entity level or the activity level; however, for small entities key controls are almost always operated at the entity level. Here are some examples of entity-level and activity-level controls over expenses for a small NPO. Entity-Level Controls The director receives bank and credit card statements directly either by mail or electronically. The director reviews contents of bank and credit card statements and investigates unusual items. The director signs vendor checks and payroll checks. The director reviews and approves vendor invoices, receiving reports and/or purchase orders when signing checks. The director determines account classifications are proper. The director reviews documentation of payroll calculations when signing checks. The director makes or approves all online bank transfers or payments. The director approves reconciliations of bank statements. The director reads monthly financial statements and investigates unusual items. Activity-Level Controls Checks are signed only when disbursement is made. 21 Only pre-numbered checks are used. Journal entries are approved by the director. All W-4s, I-9s and other payroll documents are maintained. Payroll checks are distributed by supervisors. Supervisors approve hires, fires, wage rates, time off. A detailed, descriptive chart of accounts is used. Checks are prepared only when supporting documents have been received. The person recording and posting transactions cannot sign checks. Vendor invoices are cancelled by the check signer. Both the entity-level and the activity-level controls help ensure that all transactions are recorded, only valid transactions are recorded, that transactions amounts are accurate and valued properly, that transactions are recorded in the proper period and that they are classified properly. These are management’s representations in financial statements (assertions) that ensure an entity’s financial statements are presented fairly. SUMMARY OF DIFFERENT PRESENTATION AND DISCLOSURE REQUIREMENTS FOR NPOs Nonprofit organizations generally follow U.S. GAAP for presentation of financial statements and footnotes. GAAP for nonprofit organizations, however, contains some differences. A summary of some common, significant differences in nonprofit GAAP for financial statements and footnotes presentation follow. Statement of Financial Position The statement can be classified or non-classified if the order of assets and liabilities discloses liquidity. Assets subject to donor-imposed restrictions must be disclosed. Net assets must be reported as unrestricted, temporarily restricted or permanently restricted. Requirements to hold cash in separate accounts must be disclosed. Cash designated or restricted for long-term purposes must be reported as noncurrent. Unconditional promises to give must be presented separately (according to their characteristics) and amounts due in one year, one to five years and in more than five years must be disclosed. The amount of the uncollectible promises to give must be disclosed and netted against the promises. Unamortized discounts of long-term promises, effective interest rates and the total related contribution amounts should be disclosed. Amortization of discounts should be recorded as contributions. Major classes of inventories and their method of valuations should be disclosed. Reasonable estimates of value are acceptable. Investment disclosures are similar except: o Fair values must be used for all marketable equity and debt securities 22 o Endowments and other donor restricted assets reported at fair values less than donor requirements must disclose deficiencies. o Information about investment returns by category of net assets must be disclosed. The basis of valuation of depreciation for purchased (cost) and contributed (fair value) fixed assets. Property and equipment used in operations with title held by a grantor must be disclosed. Collections capitalization policy must be disclosed. Separate disclosure must be made of any works of art, treasures, etc. that don’t meet the definition of collections that are capitalized. Policies regarding agency transactions must be disclosed. Liabilities for unconditional promises to give to other organizations require disclosures similar to receivable promises. The organization’s income tax status, including any uncertainties and excise taxes, must be disclosed. Statement of Activities The statement must present the change in net assets for unrestricted, temporarily restricted and permanently restricted net assets, separately and in total. Revenues are recorded when received based on the presence or absence of donorimposed restrictions. Reclassifications of contributions due to the satisfaction of time and purpose restrictions should be presented as a separate line item. All expenses are presented as decreases in unrestricted net assets. In-kind contributions of materials, services, free use of space and assets must be recorded on a separate line with special disclosures regarding the methods of valuation. Contributed services disclosures of their nature, use and the amounts of recorded and unrecorded contributions. The total of all fundraising costs must be disclosed. The types and methods of joint cost allocations and the amounts allocated to functional expense categories. Expenses must be reported by major functional category. A statement of functional expenses is required for voluntary health and welfare organizations and optional for other NPOs. Costs of major programs reconciled to total program costs must be disclosed. Statement of Cash Flows Certain long-term contributions with donor restrictions, usually endowments, should be presented as financing activities. 23 The disclosure requirements listed above are not all-inclusive. Complete Disclosure Checklists can be obtained from Practitioners Publishing Company, the AICPA and other providers of quality control materials. NONPROFIT GAAP VS. FORM 990 ACCOUNTING METHODS The instructions for Form 990, under Accounting Methods, states: “Unless instructed otherwise, the organization should generally use the same accounting method on the return to report revenue and expenses that it regularly uses to keep its books and records. To be acceptable for Form 990 reporting purposes, however, the method of accounting must clearly reflect income.” Some nonprofit organizations are using other comprehensive basis of accounting, such as the income tax basis, to prepare their financial statements. Most NPOs are using U.S. GAAP because it is required by oversight or grantor agencies. The reporting framework used by an organization for accounting purposes should also be used to prepare the Form 990 and all related schedules unless otherwise specified. Part IX of Form 990, Statement of Functional Expenses, must be completed by all 501(c)(3) and 501(c)(4) organizations. The allocation of joint-activity costs and the reporting of functional expenses in Part IX should use the same methods and reporting framework used by the NPO in its financial accounting and reporting, with the exception of recording expenses related to certain in-kind contributions. Contributions of services and the free use of space cannot be recorded in the Form 990. Because contributors and grantors may request copies of the Form 990, or view the return on www.guidestar.org, disclosure of the amounts of these contributions used in program services in the left column, line 24, of Part IX may be beneficial. Cost allocations for unrelated business income tax calculations (UBIT) must be done reasonably and consistently. All expenses deductible against unrelated business income must be “directly connected” with the source of the revenue and have a “proximate and primary” relationship to the revenue. Allocation methods similar to those used for financial reporting will be the easiest to defend. Deductible expenses must be “ordinary and necessary” and special UBIT rules in the Internal Revenue Code and Regulations must be followed. Differences between financial accounting and tax reporting, such as reporting bad debts, meals and entertainment expenses, fines and penalties and excise taxes must be taken into account. Cost allocation methods must include all expenses, i.e., direct and indirect. While certain functional expenses like fundraising and membership development are allocable only to nonprofit activities, all other applicable direct and indirect costs should be charged or allocated to unrelated business income. 24 CONCLUSION Nonprofit organizations’ financial statements and footnotes are designed to report the management and use of an entity’s resources. Funds available for carrying out the Organization’s mission in the future are reported in its financial statements and footnotes. Management is responsible for internal control over the financial reporting process and has primary responsibility for representations (assertions) in the financial statements and their presentation in accordance with the applicable reporting framework. Knowledge of the basic accounting and reporting requirements described in these materials will enable management and/or their auditors to prepare accurate and complete financial statements and footnotes. Disclosure checklists for nonprofit organizations are available from the AICPA and other major publishers. Obtaining and using such checklists will ensure the preparation of accurate and complete financial statements and footnotes. 25 26