Gear Tire Company - Part 2

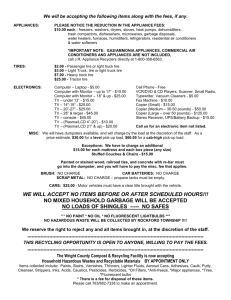

advertisement

Business Applications of Normal Distribution: Gear Tire Company – Part 2 Suppose Gear Tire Company want to make a warranty policy. The warranty will guarantee an exchange with a new tire if a customer’s tire has a quality issue by 25,000 miles. Given Information: o The number of miles that a tire lasts is considered a continuous random variable. o From the product test, we found out that the mean average is 36,500 miles with 5,000 miles of standard deviation. o It is assumed that the population of this variable (X = the tire product life span in terms of # of miles) is normally distributed, X ~ N (36500, 5000). o Gear Tire Company supplies a tire to a discount tire store at $30. The discount tire store charges $10 to Gear Tire Company for the warranty service including the installation of a new tire. As a result, a warranty cost per tire is estimated at $40 (= 30 + 10). o It is forecasted that about 1,000,000 tires of this new product will be sold in the next year. o Gear Tire Company’s operating margin is estimated at 10%. In other word, the unit profit is estimated at: $30 x 10% = $3 per tire. Problem Solving Process: o First, find the probability that a tire will last by 25,000 miles: P ( X < 25000 ). This probability information will be used to project/estimate about the future sales (i.e. population). Instead of having a guess, we are conducting a scientific analysis, which produces an objective/impartial empirical evidence. Business decision-makers can take advantage of using this evidence. o Second, find the Z-Score (Z). To find the probability, we need to convert the original data (# of miles) into the standardized value (Z-Score). Z = Here, ? = 25000 µ = 36500 σ = 5000 Thus, Z = 25000 - 36500 k ? - µ k σ where µ = the population mean average, σ = the population standard deviation. = - 2.3 5000 As a result, P ( X < 25000 ) = P ( Z < - 2.3 ). o Third, find the probability from the textbook table. We use the normal probability distribution table and find a probability for P ( Z < - 2.3 ). From the textbook table, we can find “0.0107” o Fourth, apply the probability to make the estimated # of tires that will last up to 25000 miles. The next year’s total sales is estimated at 1,000,000 tires. The chance that a tire will last 25,000 miles or less was estimated at 0.0107. Thus, the estimated # of tires that will last up to 25000 mils = 1,000,000 x 0.0107 = o 10,700 tires Fifth, compute the estimated warranty cost. The unit warrant cost was estimated at $40. The number of warranty claims was estimated at 10,700 tires. Thus, the total warranty cost is estimated at: $40 x 10,700 = $428,000 Managerial Implications: o The estimated total sales = 1,000,000 tires The estimated revenue = $30,000,000 (= 1,000,000 x $30 ) The profit margin = 10% The estimated profit = $3,000,000 (= 30,000,000 x 10%) The estimated chance of having the warranty claims = 0.0107 The estimated warranty claims = 10,700 tires ( = 1,000,000 x 0.0107 ) The warranty cost per tire = $40. The estimated total warranty cost = $428,000 o If Gear Tire Company adopts this warranty policy, it will cost about $428,000 which can be covered by the projected profit ($3,000,000). Therefore, the warranty policy is feasible and the company’s sustainability will not be compromised. [Note: Here, it is assumed the company will face the worst scenario for the warranty claims] o Suppose Ms. Kristin Berry, VP in Marketing proposes a more aggressive marketing campaign because a competitor, Goodyear Tire, offers 30,000 mile warranty program. If Gear Tire Company goes for 30,000 miles, will it be feasible & sustainable? In contrast, Mr. Timmy Moran, VP in Finance, argues that the 30,000 mile warranty program is not sustainable. Kristin and Timmy are calling each other’s name. Who is right? You are the President of Gear Tire Company. How would you make a decision?