SUPPLY BASE OPTIMIZATION/RATIONALIZATION

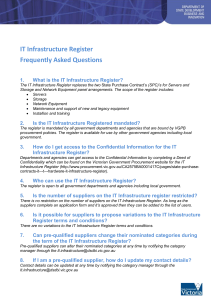

advertisement