Suppose owners in the NFL are considering a lockout

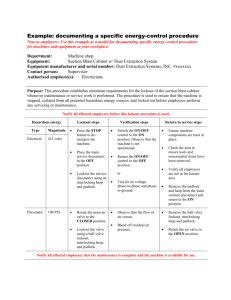

advertisement

Economics 345 Sports Economics Exam 2 Spring 2006 Name _____________________________ 1. Using the two-team model, explain both graphically and verbally the impact of each of the following on player pay, owner profits, and competitive balance in both the short term and the long term. (8 Points) a. fan willingness to pay decreases: b. a rival league is absorbed by the dominant league: 2. (6 Points) The NHL recently had a lockout that lasted one year. Players currently receive about 75% of the $1.9 billion in league revenues. The owners would like to reduce the players share to 60%. The following are the rough numbers for the NHL given what has been reported in the press. Owners usually make $500 million, net, in a given year, about 25% of the $1.9 Billion in annual revenues. If the lockout is successful, owners will make an additional $300 million the year after the lockout. The owners claim that they can make about $180 million during the lockout by renting their facilities for concerts, etc. If the lockout is not successful, owners will make $180 million during the lockout plus the usual $500 million the next year. It is estimated that the value of fan ire is ten percent of league revenues or about $200 million. If the probability of winning the lockout is 80 percent, what is the expected value of the lockout? Should they do it? (Since we are only dealing with one year there is no need to discount) EV = P(A - M + G - F) + (1-P)[A - (M + F)] Where: A is the value of the alternative to the owners. M is the upfront cost, i.e. the lost revenues to owners. G is the gain from the lock-out. F is the value of fan ire. Is there any probability under which the lock-out makes sense? Explain fully mathematically and verbally. What would happen to the present value if the owners overestimated their alternative? 3. (8 Points) Depict graphically a situation where an owner is currently losing money. On your graph above show that there does not exist an efficient subsidy for this team, explain your results verbally. (Even if your graph does not come out perfectly assume that there is an efficient subsidy.) 4. (8 Points) What is meant by external benefits? Graphically demonstrate the inefficiency that occurs when sports teams produce external benefits. What are the three important types of external benefits? 5. (10 Points) Based on our class discussion and the chapter from Baseball Between the Numbers, “Are New Stadiums a Good Deal?”, carefully describe the empirical evidence on the impact of new stadiums in terms of team records, revenues, profits, and economic impact. 6. Explain fully what would happen to the following if free agency were abolished and we went back to the reserve clause: (10 Points) a. Individual player salaries. b. Team profits. c. Competitive balance in the league. d. The length of player contracts. Explain the issues involved with long-term contracts. Be sure to discuss shirking, and strategic effort. 7. (10 Points) Suppose the Buffalo Bills are considering relocating the team to Portland, Oregon in 2008, if they do not receive a new stadium lease/deal that they like. The mayors and city governments in both cities believe that having an NFL team is important. The mayor of Buffalo believes that a new downtown stadium will cost $300 million and the assumed benefits to the city are $200. According to team officials without a team the expected economic impact is a loss of $200 in Buffalo. The mayor of Portland knows that they will have to offer a better package to get the Bills to move, therefore they will build a $500 million stadium, and the external benefits are believed to be $300 million. The loss to Portland of not having an NFL team is reported to be $300 million. Both cities have two choices, they can either choose to build a stadium for the Bills, or not. Fill in the payoff matrix below with both the strategies and payoffs for both cities. What is the Nash equilibrium? Is this an example of the “Prisoners Dilemma”? Explain. Portland Buffalo: Don’t Build Buffalo: Portland: Portland: Buffalo: Buffalo: Portland: Portland: Build Build Buffalo Don’t Build Based on a rational actor model explain why owners have been able to receive large stadium subsidies all across the country. What has been the role of politicians in the stadium mess? What is the bottom line, fundamental reason for the outcomes we see?